Are you looking for the best apps like Quadpay? Wondering what the fastest way to get money is? Want to get access to money quickly without the pain of these loans?

If you are searching for solutions to these questions, don’t worry! You’ve come to the right place! This article will discuss the best apps that are like Quadpay.

Quadpay is a Buy Now, Pay Later service which offers savvy buyers more freedom and flexibility to pay later anywhere at any time.

Customers are permitted to split any purchase into four installments for over six weeks without any hidden fees or zero interest. Quadpay’s chief purpose is to create a world where each person can access the products they desire.

Apps Like Quadpay: Best Alternatives!

With all the buy now, pay later apps, it has been pretty much easier to turn to online services for all your shopping requirements. Read on further to know more about the 8 best apps like Quadpay.

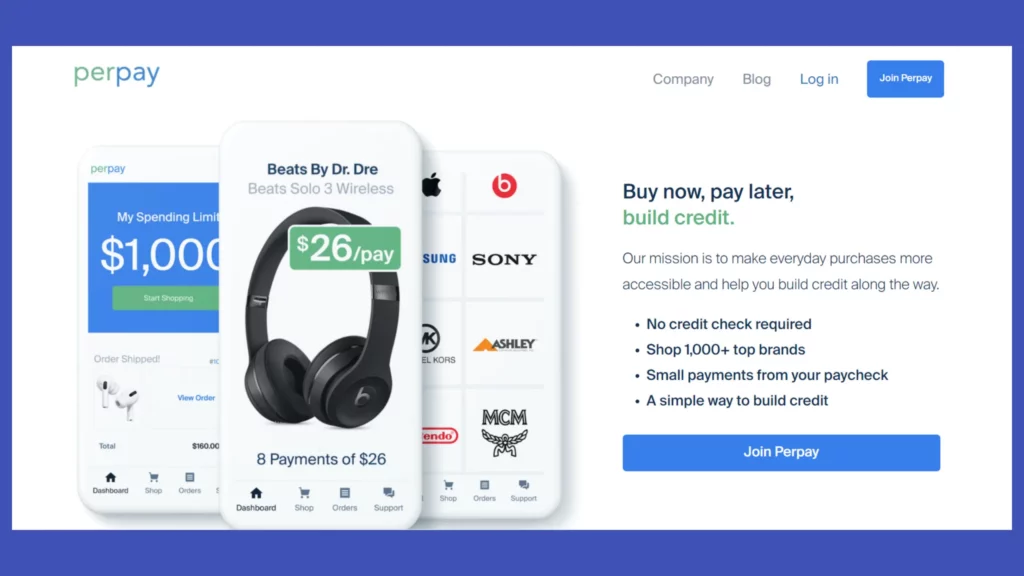

Perpay

Perpay is one of the best Buy now pay later service, in the list of best apps like Quadpay, Its main aim is to make every day buying more available and assist you build credit at the same time.

How Does Perpay Work?

Get started with Perpay by creating an account on the mobile app or the website. And give your personal information like your name, house address, telephone number, email address, Social Security Number.

As soon as they approve your application, you’ll receive an email with instructions on making payments and getting your products.

Perpay lets its users buy products and repay over time by a simple and easy scheduled payment, with no fees and no interest. Its eight-installment payment plan offers an easy way to make paying for large items within reach.

You can then explore your favorite products on the Perpay market, add them to your card, and then submit your application for a review.

Perpay will analyze your request, and it will offer an approved spending limit and a conclusion on your requested application. Once they receive your first payment, they will ship your products.

Requirements for Eligibility

- Actively maintain full-time employment

- Be in good standing with all financial requirements

- You must validate three months of employment history with your current company

- Ability to set up multiple direct deposits

- Have an active mobile phone

- No active bankruptcies

- Have access to a complete copy of a recent pay stub

- Minimum annual income should be $15,000.

Late Fees: If you miss a payment by any chance or if they don’t receive the payment within six days of the due date, Perpay will charge you a late fee of up to $35.

Shipping Policy: Once you make the first payment, you can expect your items to be shipped within 3 to 5 business days. Shipping time will vary depending on your products.

Return Policy: You can return a few products within 30 days of payment. But some brands will not allow you to return their products.

Customer Service: If you need any help with Perpay, you can email them at hello@perpay.com or call them at 215-834-4200.

8 Best Sites Like Perpay to Buy Now Pay Later [2021]

Key Features

- Use your personalized spending limit to shop for the products you desire.

- Automatically pay over time for your order with a small amount from every pay check.

- You can see your credit score increase after just 4 months.

- Perpay will continually apply your account history towards helping you build credit.

- Select your favorite product, fill the cart and choose Perpay as your payment option.

- It doesn’t charge any hidden free or interest or credit check.

| Pros | Cons |

| Interest-free payments | Charges a late fee of $35 |

| Low credit score won’t affect eligibility | |

| It doesn’t check your credit score or report to the credit bureau |

From UK? 5 Best Buy Now Pay Later Apps in UK [2022]

Klarna

Klarna, which is also referred to as Klarna Bank AB, is a Swedish company that offers online financial services, including direct payments and post-purchase payments and payments for online storefronts. Its point-of-sales loans for in-store and online let customers buy now and pay later.

How Does Klarna Work?

In order to use Klarna, download the app or sign in through the website to create an account. You’ll have to provide basic details like your email address, name, phone number, and bank information to withdraw your payments.

Klarna will perform a soft credit inquiry, your buying history, and your personal information to verify your identity, spending limit, and the ability to shop. This soft credit check will neither affect your credit score, nor it will appear on your credit report.

While purchasing, you can select one of three financing options- Pay in 4 or pay in 30 days or a 6 to 36-month loan.

The pay in four is a zero-interest option that requires a 25% down payment at the time of buying, then three equal, fortnightly payments for the remaining balance. You can view your purchase history, process returns, and track your shipments through the mobile app.

Requirements for Eligibility

- You need to be at least 18 in order to use Klarna’s payment options

- Have a positive credit history

- Don’t have a lot of debt. So, pay off your balances as soon as possible.

Late Fees: If you don’t pay your payment on time, you’ll be charged a late fee of $7, and the longer terms loans have a $35 late fee assessment.

Shipping Policy: Once you place an order, it may take a few days to process your order. After your order is processed, you’ll get an email with the tracking and shipping details.

Return Policy: You have 28 days from the date you receive your order to return it for a refund. It takes Klarna around 5-7 business days to process and post your refund to your original payment method. Visit here for more information on the return and refund policy.

Customer Service: If you need any help with Klarna, you can email their customer support at hello@klarna.com or call them at 844-552-7621. You can also send a message via the Klarna app or even online chat is available on the Klarna website.

Key Features

- It offers a payment solution for the e-commerce industry.

- Specially designed to make payments safe, simple and secure for purchasers and sellers by managing customer payments and store claims.

- Explore online stores, pin your favorites and share your saved items with your friends.

- You can pay in four installments for every two weeks, and these installments are interest fee.

- It may charge a late fee of up to $7 if the payment is failed after two tries and there is no consequence for early payment.

| Pros | Cons |

| Interest free on Pay in four financing | Charges late fees |

| Set price alerts on your saved items | Needs soft credit check |

| Offers different ways to finance purchases |

From UK? Try these 6 Apps Like Zilch to Buy Now Pay Later [2022]

Afterpay

Afterpay is another best apps like Quadpay that operates in Australia, Canada, New Zealand, the United Kingdom, and the United States. It is best known for its pay alter services which let in-store and online consumers buy a product instantly and pay it later.

How Does Afterpay Work?

Sign up for an After account by providing your name, phone number, email address, home address, date of birth, and the payment method. There will be no credit check, and you don’t need to provide your Social Security Number.

After you’ve created an account, you’ll be given a small spending limit to start with. Usually, new accounts start with a $500 limit, which eventually increases over time depending on how long you’ve been using Afterpay, purchase price and with on-time payments.

You can repay your loan in four equal installments, due every two weeks, with the first payment paid at checkout.

In other words, your purchase amount is broken down into four payments, with 25% paid during the checkout. And the other 75% is paid in equal installments every two weeks over the next six weeks.

Your first payment could be higher than the others for large purchases. However, the company will show how installments are split before you pay.

Requirements for Eligibility

- Should be a US resident and reside within one of the 50 states or the District of Columbia.

- Must be at least 18 years old or 19 years old in Alabama and Nebraska

- Capable of entering into a legally binding contract;

- Have a valid and verifiable email address and mobile number;

- Give a valid delivery address in the United States;

- Be authorized to use the US-issued credit or debit card to make the purchase

Late Fees: If you make any late payments, your late payments will be capped at 25% of the initial purchase and do not accumulate over time.

Shipping Policy: Once you make the first payment, you can expect your items to be shipped within a few business days.

Return Policy: Returns are always subject to the individual merchant’s policy. So, any information regarding your returns should be raised directly with the merchant, whose details will be available on their website.

Customer Service: If you need any help with Afterpay, you can email their customer support at info@afterpay.com.au or call them at 855-289-6014.

Key Features

- Customers can pay for their purchase in four installments over a six-week period.

- It doesn’t charge any interest, but it can charge late fees if you don’t make the payment on time.

- You can use it to view your current and past Afterpay orders, as well as your payment history.

- You can also change your payment card for future payments if you want to be more flexible with your finances.

- Use the app to shop and keep track of all your orders and your payment schedule.

| Pros | Cons |

| Zero interest on purchases | Charges late fees |

| No credit check | On-time payments are not reported to credit bureaus |

| Accepts applicants with little credit history | No other financial options |

| Ability to change your payment due date |

Afterpay vs Quadpay vs Klarna vs Sezzle: Grand Comparison!

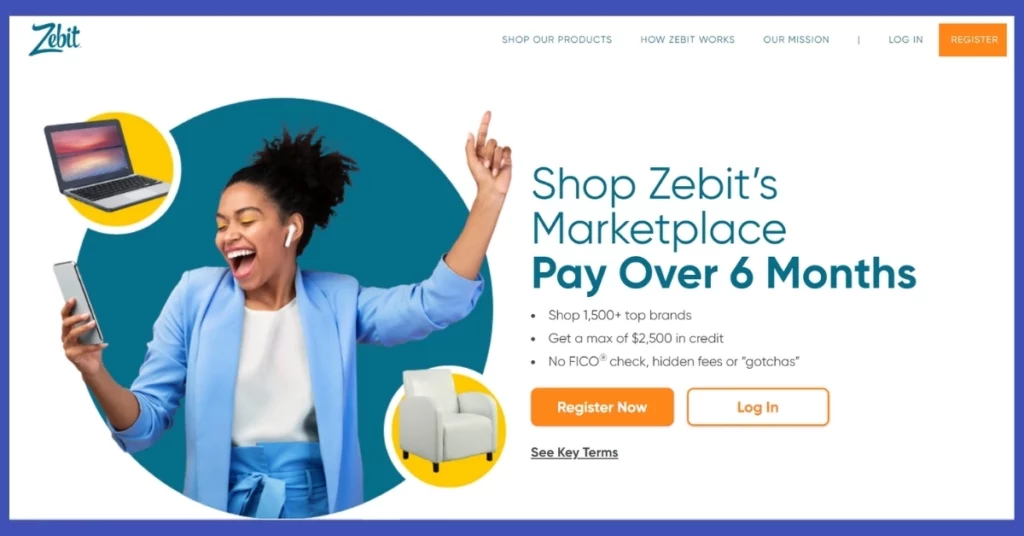

Zebit

With Zebit, you can get a max of $2,500 in credit to shop and spend on the products you want. All you have to do is join Zebit, shop & select the item you desire, and make a down payment if approved. Your item will ship, and you have to pay the remaining balance over 6 months.

How Does Zebit Work?

To create a Zebit account and access Zebit credit, you must be at least 18 years or older. And then, Zebit will verify your identity and your employment income to check if you are eligible.

Zebit offers customers up to $2,500 in credit, which can be used to buy products from the Zebit Market. Zebit Market is where you can purchase products ultimately interest-free. And the ZebitLine is the amount of credit that you have to finance these products.

You'll be given six months to pay for the products you buy. And these payments are divided across the six-month timeframe. You can also make a down payment at the time of purchase.

For instance, if you purchase a product for $1,000, you'll have to make a down payment of 25%, i.e., $250. And the remaining $750 is financed for the 6 months' timeframe.

ZebitLine is only valid with your current employer. So, if you leave your employer, your ZebitLine will be discontinued! Remember that your FICO score will not be affected and Zebit will determine how much credit you can receive. Also, you won't be able to make transactions until you pay off your payments in full.

Requirements for Eligibility

- Be over 18 years old

- Have a valid Email address

- Have a valid, verifiable US mobile number

- Might verify your identity and your employment or income

Late Fees: Zebit does not charge interest, late fees, application fees, or membership fees.

Shipping Policy: Orders for the physical products are usually shipped within 3-5 business from order placement. When your items ship, you'll receive an email with tracking information.

Return Policy: Zebit doesn't accept returns or exchanges on any of the products. Therefore, before going through checkout and placing your order, make sure you've selected the products you want.

Customer Service: If you need any help with Zebit, you can email their customer support at help@zebit.com or visit here for more information.

10 Best Sites Like Zebit to “Buy Now Pay Later” [2021]

Key Features

- Make a purchase and pay over in six months with no fees and interest.

- To access Zebit, you must be 18 years old and actively employed or retired with benefits.

- It verifies your identity with the help of credit reporting agencies.

- It equally divides payments into six months.

- Offers a variety of branded products.

| Pros | Cons |

| No late fees or any hidden fees | No return policy |

| Interest free | Few products can be overpriced |

| It won’t affect your credit score |

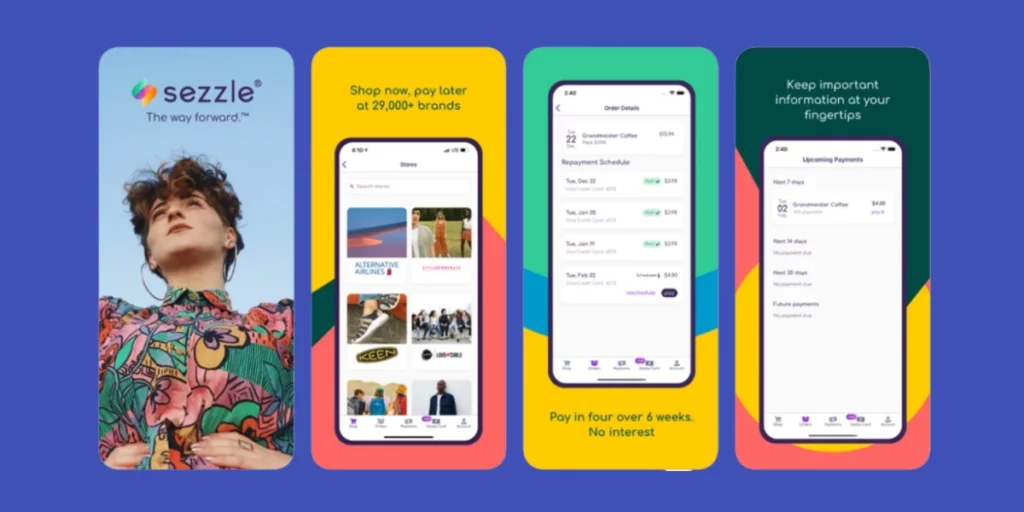

Sezzle

Sezzle is a financial company that offers an alternative payment platform provide interest-free instalments plans at certain online stores. Customers are permitted to split any buying into four interest free installments for over six weeks, without any hidden fees or zero interest.

How Does Sezzle Work?

First, download the Sezzle app and create an account using your credentials. An approval decision will be made immediately without performing any credit check.

So, when you place an order, their unique approval process reviews your account and decides what type of plan should be offered to you.

When you are approved, you’ll make the necessary down payment, and then three equal payments are scheduled in six months timeframe. In most cases, you’ll be asked to pay 25% upfront, and the remaining amount is divided into three installments.

Its three installments are due two weeks apart with no interest or any other hidden charges. After your order is placed, Sezzle will immediately pay the seller in full, so the seller has their funds and can process your order easily.

You can use Sezzle online with any of their lengthy list of affiliates—like Keen, Target, and GameStop. Or you can use the service in associated stores by using a virtual card through the app.

Requirements for Eligibility

- Should at least 18 years old (19 in Alabama)

- Have a valid email address and US or Canadian mobile number

- Must have a US or Canadian bank account, a debit card, or credit card—prepaid cards will not work for an initial purchase.

Late Fees: Sezzle doesn’t charge any late fee. But if you want to schedule your repayment, it charges a fee of $10. You can only get one free reschedule, and the next reschedule charged a fee of $5.

Shipping Policy: After you place an order, Sezzle will pay the merchant full funds. Then, your product will be shipped immediately.

Return Policy: Returns are always subject to the individual merchant’s policy. So, as soon as Sezzle gets a refund from the merchant, your payment will be automatically updated.

Customer Service: If you need any help with Sezzle, you can email their customer support at support@sezzle.com or call them at +1 (888) 540-1867 from 9 AM to 5 PM.

7 Apps like Sezzle to Buy Now Pay Later [2021]

Key Features

- It serves more than two million customers and thirty-four thousand traders.

- The first payment should be paid at the moment of purchase, while the remaining three are due at regular interval over the following six months.

- Customers who have paid off earlier purchases on time are permitted to finance the purchase of more expensive products.

- Users can shop and discover store via the Sezzle app or through its website.

| Pros | Cons |

| Interest free | Charges for a late or missed payment |

| No upfront or establishment fees | Sometimes it may decline your purchase |

| No credit limit is needed | |

| Can customize your repayment schedule |

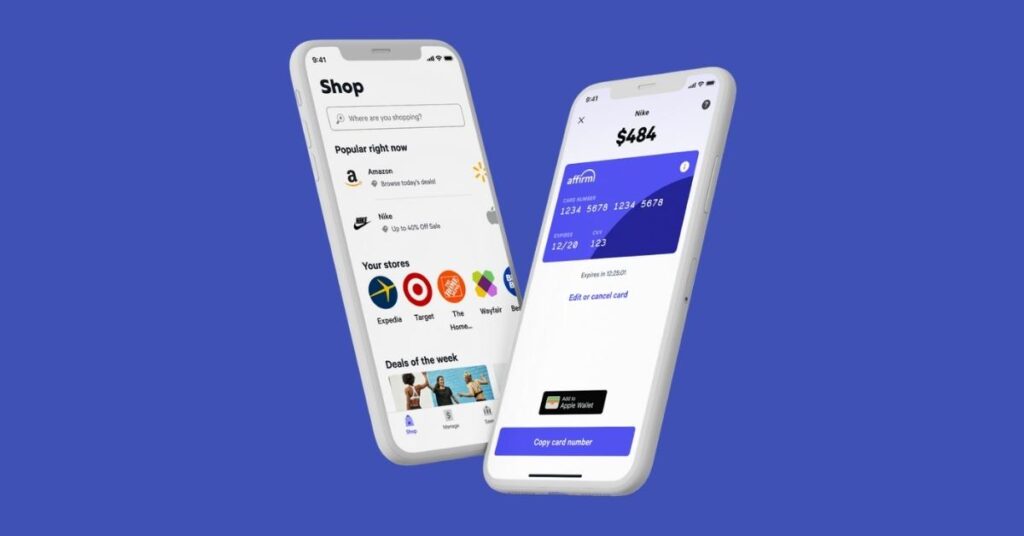

Affirm

How Does Affirm Work?

Download the Affirm app, shop your favorite stores, and choose Affirm at the checkout. Then, enter your information to find out whether you are authorized for a loan or not.

Although Affirm doesn't have a minimum credit score requirement, it'll still perform a soft credit check and also check your previous payment history, as well as how long you've had an Affirm account.

Once you are approved, you can select the payment schedule that will be suitable for you and then confirm your loan. Your credit limit is based on your credit history, payment history with Affirm, and your Affirm account's time length.

Factors like how you're managing your existing loans, paying bills on time, and reducing debt balances can help you get a higher credit limit.

To repay your loan, you can choose to split your purchases up to three or six or twelve payments. And if you want to pay off your loan early, you can pay without any prepayment penalty.

Requirements for Eligibility

- Must be 18 years or older (19 years or older in Alabama and Nebraska).

- Have a valid U.S. or APO/FPO/DPO home address.

- A valid U.S. mobile or VoIP number that should receive SMS texts.

- Give your full name, email address, date of birth.

- Provide the last 4 digits of your social security number to authenticate your identity

Late Fees: Affirm doesn't have any prepayment fees, late fees, service fees, or hidden fees.

Shipping Policy: Orders are usually shipped within two business days.

Return Policy: You can return your purchase and get a refund within 120 days from the date of purchase. To get a refund, you'll have to contact the store where you've purchased the product and request a refund.

Customer Service: If you need any help with Affirm, you can email their customer support at help@affirm.com or cares@affirm.com or call them at (855) 427-3729. Visit Affirm's help centre for more information.

| Pros | Cons |

| Interest free financing | Not available at all retailers |

| No upfront fees | Does not report on-time payments to the three credit bureaus |

| Don’t charge any late fees | Could receive a high interest rate |

Affirm vs Splitit: Complete Comparison [2022]

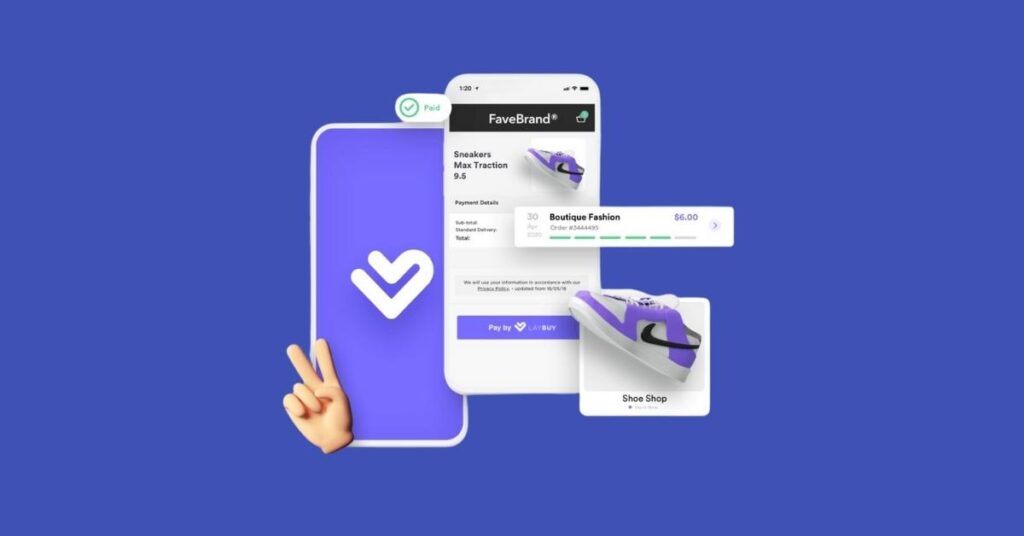

Laybuy

Laybuy is another Quadpay alternative, which is a buy now, pay later service. It lets you receive your purchase now, then you can pay over 6 weekly interest-free installments.

How Does Laybuy Work?

You can sign up for Laybuy either through Laybuy’s website or through its mobile application. After your account has been verified, Laybuy will assign your limit, then you can instantly start shopping.

Laybuy has a simple interest-free payment option that lets you secure your buying today and pay for it in total six equivalent payments, once a week for 6 weeks. Upon registration, it performs a credit check to get a credit score on all new users.

Once your order is finished, you can see the first payment, which is equal to one-sixth of the purchase price. The next following five payments are managed every week on the day of your original buying.

You can view all your account information as well as a payment schedule at any time by using your Laybuy account. After you select Pay by Laybuy at checkout and finish your buying, the retailer or merchant will ship your items at the delivery address that you have submitted.

Requirements for Eligibility

- Must be at least 18 years old.

- Have a valid and verifiable email address and mobile telephone number.

- Should have a valid debit or credit card.

- Have a valid license or passport

Late Fees: If you miss a payment, you’ll be notified instantly and a late payment fee of $8 USD or $10 NZD or £6 GBP or AUD might be charged.

Shipping Policy: Usually, the delivery time is mentioned either at checkout based on the delivery option or as a part of the order confirmation email they send out to you.

Return Policy: If you decide to return your purchase, your LayBuy payment plan is regulated once the retailer has accepted your returns.

Customer Service: If you need any help with Laybuy, you can email their customer support at help@laybuy.com, or visit here to submit your request, their team will get back to you as soon as possible.

Key Features

- It gives you access to thousands of retailers from all over the world.

- It provides faster way to pay, so you can complete your order within few seconds.

- You can check in to see how much credit you have, keep up-to-date with any upcoming payments and pay off your orders early.

- In-app personalized barcode makes paying in-store fast and easy.

- Discover the latest trends and check out the latest deals.

- Openpay

Openpay is an Australian company that functions as the “Buy Now, Pay Later” service and offers online financial services and post-purchase payments. It is mainly designed to let consumers to pay for items they brought by using interest-free installments.

How Does Openpay Work?

Download the Openpay app and create an account by providing your basic information. If you link your Openpay account to your Visa or Mastercard, it’ll give you an instant response to your application.

After filling out the application form, your account activation will occur within 48 hours. You can then use it at over a thousand active dealers around New Zealand and Australia, and this might comprise home delivery businesses, in-store or online stores.

You just have to select Openpay as your payment option and choose among multiple repayment options during your purchase.

Once you’ve selected your payment method, you’ll get instant approval. Then, you’ll have to repay your payment for every two weeks. They automatically deducted these repayments as scheduled from your connected Mastercard or Visa.

Requirements for Eligibility

- Be 18 years or older

- A valid email address and mobile number

- Have a valid Australian payment card, both credit and debit cards are acceptable

- Provide a valid Australian ID or New Zealand ID if a resident there

Late Fees: If a payment is not made by time, it will charge a late fee of $9.50. Before your plan is finalized, you might be subjected to management and establishment fees.

You can avoid this late fee by contacting Openpay before your due date.

Return Policy: It will cancel your future repayments if you return your complete order. And if you return only a part of your order, the value of these items will come off your remaining payments equally.

Customer Service: If you need any help with Openpay, you can email their customer support at info@openpay.com.au or call at 1300-168-359. You can also chat with one of their experienced agents.

Key Features

- It is easy to sign up, and offers longer payment plans and flexible plans.

- To access Openpay, you have to be 18 years old and provide your email address, phone number, and credit or debit card information.

- Explore several retailers in-app, and scan your exclusive code to shop in-store.

- You can monitor your plans and repayments.

- Schedule your purchases over fortnightly, or monthly payments with plans up to 24 hours.

| Pros | Cons |

| Provides full upfront payment to merchants | Charges late fee |

| Increase average transaction value | |

| Can schedule your repayment before the due date |

From Australia? Best Buy Now Pay Later Apps in Australia [2022]

The Bottom Line

With BNPL services, you can buy something now at a fraction of its price, and pay off the remaining amount in some time. Nevertheless, remember that the availability of “Buy Now Pay Later” services does not mean that you can be able to buy anything without limit.

So, we hope the above article on 8 best sites like Quadpay has helped you pick up the best option based on your requirements and preferences.

Must Try these 12 Apps like Possible Finance for Instant Loans! [2021] Best Alternatives Apps Like Deferit to Check Out [2022]

Try these 5 Apps Like Lenme to Borrow & Lend Money Easily! [2022]

![Must Try these Apps Like Quadpay to Buy Now Pay Later [2024]](https://viraltalky.com/wp-content/uploads/2021/08/apps-like-quadpay-alternatives.jpg)