Best Buy Now Pay Later Apps in Australia – Are you searching for the best BNPL app? There are several BNPL apps like Afterpay, PayPal, Openpay, Zippay, Laybuy, Klarna, Splitit, Sezzle, Bundll, Humm, Brighte, and LatituePay available.

Wondering what’s the fastest way to get money, or what is the best “Buy Now, Pay Later” service?

If you are looking for solutions to these questions, don’t worry, we’ve got you covered! In this article, we will discuss the best buy now pay later services in Australia. In the recent times, Buy Now Pay Later services have gained immense popularity.

Also, several merchants or vendors have partnered with BNPL apps to make purchases easier. These BNPL platforms are almost similar to credit cards as they let you buy something now and then pay it later. One of the major differences is that, as long as you make your payment on time, many of BNPL services doesn’t charge any interest.

Best Buy Now Pay Later Apps in Australia

It’s quite hard to believe that purchasing products now and paying later will be regarded very easy. With buy now, pay later services, customers are able to buy products without having to pay the full amount upfront. Read on further to know more about Best Buy Now Pay Later Apps in Australia.

Here is the list of Best Buy Now Pay Later Apps in Australia that are worth considering:

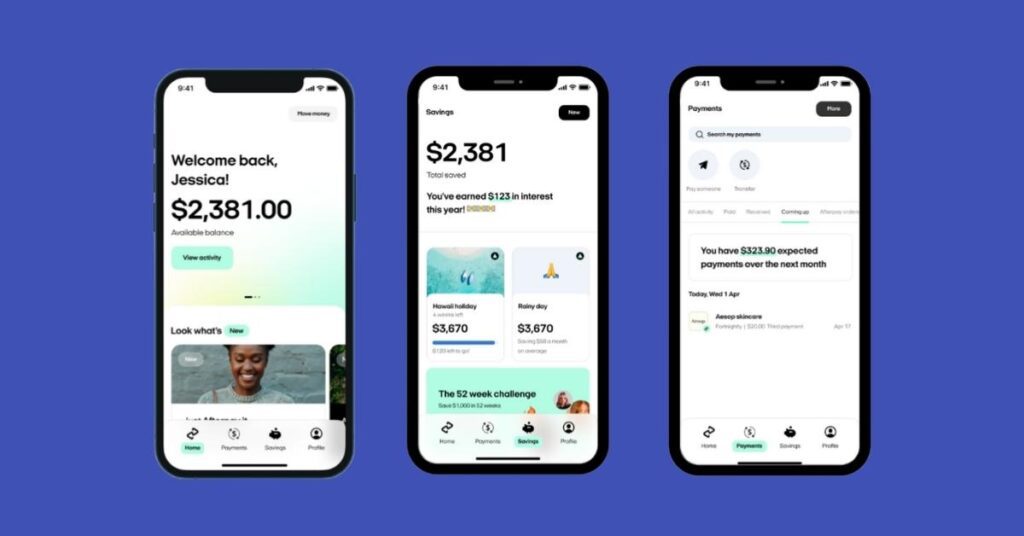

Afterpay

Afterpay is an Australian financial technology that provides short-term financing choices to fit shoppers at their desired sellers. It is one of the best buy now, pay later apps in Australia and also operates in New Zealand, Canada, the United States, the United Kingdom.

Users can shop through the Afterpay mobile app, available for both iOS and Android devices, or online via its website. There are over 23,00 sellers available in North America itself and a total of 85,000 vendors across the world.

It doesn’t charge any interest as long as you pay on time. However, if you don’t pay on time, you will not be able to make extra purchases till you bring it to current. Don’t worry, these late payments are never reported to the credit bureaus.

Afterpay Review

Afterpay helps you to free up your cash flow by dividing your purchase down into four installments. Here is everything that you want to know about Afterpay.

How does Afterpay work?

You can easily create the Afterpay account by providing your basic personal information, including your name, address, debit or credit card number, phone number, date of birth, and email address. There will be no credit check, and you don’t have to give your Social Security Number.

Once you’ve created your account, you’ll be given a small spending limit to start with. A lot of new accounts start with $500 limit, and the limit eventually increases over time depending on how you utilize it and with on-time payments.

Even though it doesn’t charge any interest, it charges a late fee, and your account will be frozen for new purchases till you pay your payments. Also, remember that on-time payments will not enhance your scores, and late payments will not make it bad.

Sign up Process

Sign up process is pretty simple, and it doesn’t require a credit check. You just have to provide your name, phone number, email address, date of birth and payment methods for the application. New users are authorized for lower limits, which will sooner or later increase over time.

Afterpay vs Quadpay vs Klarna vs Sezzle: Grand Comparison!

Key Features

- It is only meant for in-store and online shopping.

- Use the app to shop and keep track of all your orders and your payment schedule.

- Customers can pay for their purchase in four installments over a six-week period.

- You can also change your payment card for future payments if you want to be more flexible with your finances.

- It doesn’t charge any interest, but it can charge late fees if you don’t make the payment on time.

- You can use it to view your current and past Afterpay orders, as well as your payment history.

Fees & Interest

Afterpay doesn’t charge any interest and these loans are interest-free with 25% payments upfront and 25% payments every two weeks till the loan is paid incomplete. So, there are no fees on any loans as long as you make your payments in time, if you pay late, you are supposed to pay a $10 late fee, plus an extra $7 if the payment is not after seven days.

Ratings

- Google Play Store Ratings: 4.7/5

- Apple App Store Rating: 4.9/5

Afterpay Customer Service

Afterpay has both positive and negative reviews. Many of its negative reviews are regarding poor customer service, and other problems are regarding refunding issues. If you are facing any issue, you can email to their customer support at info@afterpay.com.au or call them at 855-289-6014.

| Pros | Cons |

| Doesn’t charge any interest on purchases | Charges late fees |

| No credit check is required | Afterpay may sometimes decline your purchase |

| Caps late fees at 25% of buying sum | It doesn’t offer other financial options |

| You have the ability to change your payment due date | It is not available with Capital One credit cards |

| Instant approval |

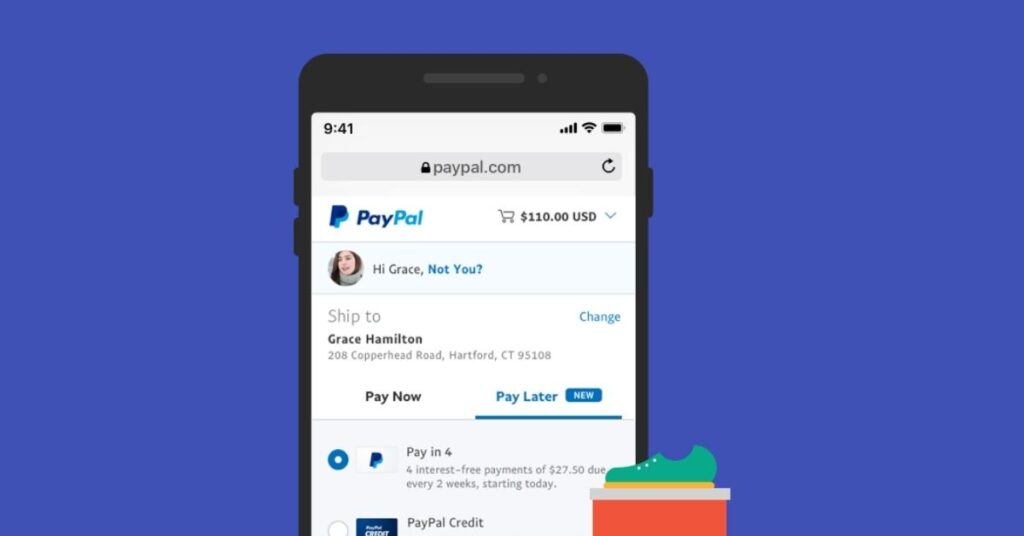

PayPal Pay in 4

PayPal Credit Pty Limited approves PayPal Pay in 4 to Australian customers and only appears as a choice at the point of sale for users who have a PayPal account in good position. If you have a negative balance in your PayPal account, there is a probability that PayPal “Pay in 4” option will not appear in the PayPal wallet.

It uses its own data and analytics to run credit checks with an external credit bureau to confirm whether users can afford the loan. Users have the ability to divide the cost of purchases between $30 and $1500 into four interest-free payments, which consist of an initial payment and three automatic installments. Its no-fee thing is only exclusive to Australia.

PayPal Review

PayPal’s Pay in 4 is another option that is added to the PayPal digital wallet. Here is everything that you want to know about PayPal Pay in 4.

How Does PayPal in 4 Work?

Pay in 4 will be available as a choice in the PayPal Wallet for users who have their accounts in better positions and people who have met the eligibility measures. All you have to do is use the standard PayPal button to pay for your buying, and you can see that Pay in 4 will appear at checkout.

PayPal Pay in 4 enables you to divide your purchase from $30 to $1500 over four equivalent interest-free installments. Nevertheless, the first payment should be made at the time of purchase, and the following three payments can be made with automatic repayments drawn every two weeks.

These repayments are made automatically through your PayPal account by using the payment options you’ve opted. Few other buy now, pay later services like Afterpay, Zippay, and Klarna are also set up this way, other services might work differently.

Key Features

- Its no-fee structure is exclusive to Australia, where PayPal has over nine million active users.

- It operates as a payment processor for online retailers, auction sites and many other commercial users.

- Its exclusive transaction dispute resolution mechanism protects both the seller and the buyer.

- You can access PayPal on both Android and iOS devices.

Fees & Interest

PayPal Pay in 4 doesn’t charge any fee or interest for your purchases, also there is no fee for late payments. As long as you see the option for Pay in 4 at the checkout, you can even have multiple Pay in 4 plans at the same time. The only fees PayPal charges are currency conversion fees on international purchases.

Ratings

- Google Play Store Ratings: 4.8/5

- Apple App Store Rating: 4.2/5

PayPal Pay in 4 Customer Service

Just like any other financing application, PayPal Pay in 4 also has both positive and negative reviews. If you have issues or queries regarding your account or payment, there are several ways to contact PayPal’s customer service. Online chat is available through PayPal Pay in 4 website, or you can fill up the community forum or even connect with them through call.

| Pros | Cons |

| Doesn’t charge any interest or late payments | Pay in 4 option will not appear if you have negative balance |

| Quick and easy-to-use | Might run soft credit check when you apply |

| Reports, analytics and other useful tools are easy to find | |

| One of the most trusted platforms |

Affirm vs PayPal: Complete Comparison [2022]

Openpay

Openpay is a financial company that operates as one of the best “Buy Now, Pay Later” services in Australia and gives online financial services like post-purchase payments. It is easy to sign up, and it also provides longer payment plans and other flexible plans.

It is mainly developed to let users pay for their purchases by using interest-free installments. Furthermore, it also offers SaaS – a Software as a service product for business-to-business clients like Woolworths to provide trade management and accounts.

Openpay Review

Open Pay is an innovative in-store and online payment solution that allows you to purchase now and pay in time. Here is everything that you want to know about Openpay.

How Does Openpay Work?

You can easily create Openpay account, you just have to download the app from Google Play Store or Apple App Store and then register by using basic information. You can also link your new Openpay account to your Mastercard or Visa, and it will give you an immediate response to your application.

Once your Openpay account has been approved, you can use it at over a thousand active dealers around New Zealand and Australia, this may include home delivery businesses, in-store or online stores. You just have to select Openpay as your payment option and choose among multiple repayment options during your purchase.

Once you’ve selected your payment method, you’ll get immediate approval, and you’ll be supposed to repay your payment every two weeks. These repayments are automatically deducted as scheduled from your connected Mastercard or Visa.

Key Features

- It is primarily developed to permit users to pay for items they brought through interest-free installments.

- To use Openpay, you have to be 18 years old and give your email address, phone number, and credit or debit card information.

- It sends out reminders before your scheduled repayments.

- Discover numerous retailers in-app, and scan your private code to shop in-store.

- Schedule your purchases over fortnightly, or monthly payments with plans up to 24 hours.

- You can also be able to monitor your plans and repayments.

Fees & Interest

Regardless of the type of Openpay plan you choose, remember that it will always be interest-free.

However, if you miss a payment, it might charge a late fee and some plans might also comprise a management fee. But you don’t need to worry about it because you’ll be told about this fee upfront if this applies to the plan you choose.

Its fee structure is like this:

For 20% deposit under $2,000

| 2 Months | $0 per fortnight |

| 3 Months | $1 per fortnight |

| 4 Months | $2 per fortnight |

| 6 Months | $3 per fortnight |

For 10% deposit over $2,000

| 6 Months | $3 per fortnight |

| 12 Months | $4 per fortnight |

| 18 Months | $5 per fortnight |

| 24 Months | $5 per fortnight |

Ratings

- Google Play Store Ratings: 3.8/5

- Apple App Store Rating: 4.6/5

Openpay Customer Service

Just like any other financing application, Openpay also has both positive and negative reviews. If you are facing any issue, you can email to their customer support at info@openpay.com.au or call at 1300-168-359. You can also chat with one of their experienced agents.

| Pros | Cons |

| Increase average transaction value | Charges late fee |

| Offers full upfront payment to merchants | |

| Offers fee refund on returns | |

| Flexible repayment options |

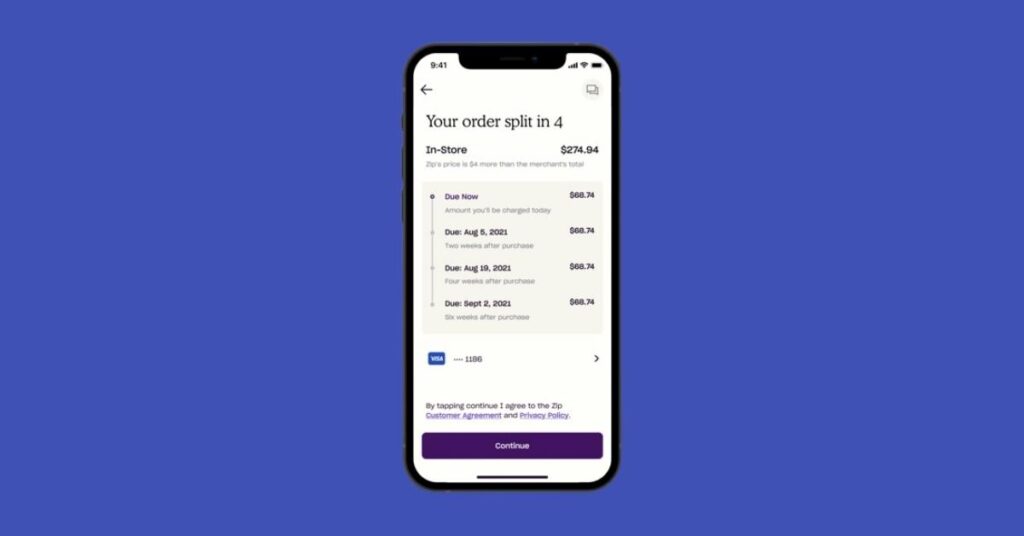

Zip

Zip Co Limited, earlier known as ZipMoney Limited is a financial company that operates in Australia, the United Kingdom, the United States, the Czech Republic, New Zealand, the United Arab Emirates, and South Africa.

Zip digital wallets have two interest-free accounts, Zip Money and Zip, which can be used with retail partners in-store and online, anywhere Zip is accepted. Zip offers an interest-free service until the end of each month, if the payment is not done by the due date, it charges $6. Accounts are available from $250 up to $1,500.

On the other hand, Zip Money offers 6 months interest free service, providing a reusable amount of up to $30,000. Zip is one of the best buy now, pay later apps in Australia. The company has also acquired the US-based Buy Now, Pay Later service – Quadpay.

Zip Review

Zippay is an interest free payment solution, which is approved by several stores across Australia. Here is everything that you want to know about Zippay.

How Does Zip Works?

You can easily create a Zip account by using your PayPal or Facebook account information. As soon as you’ve signed in and provided your basic information, you’ll be approved in seconds. Once you’re approved, you can make your purchase in two methods – online and in-store.

As soon as you have purchased something, you can choose how you wish to repay. You can select among weekly or monthly repayment schedules. A minimum monthly payment of $40 is needed. To avoid the late payment, you are advised to pay off your purchase by the end of the month.

All these payments are completely interest-free, and you can sign up for direct debit, so payments are made automatically from your bank account or credit card depending on the repayment schedule which you’ve selected.

Key Features

- It doesn’t charge any interest on your unpaid balance.

- It provides a credit limit between $350 and $1,500, which will be approved while applying.

- As soon as you have completed your sign-up process, you can use your Zippay account instantly.

- You have the ability to pay off your loan fortnightly, weekly or monthly for any amount you select.

- Zippay is available in thousands of stores around Australia.

- You can set up repayments as you like as long as you meet the minimum required $40 monthly repayment.

- You can also set up a direct debit to automatically deduct payments from your credit card or bank account.

- You can simply use your phone to tap and pay for your everyday expenses.

Fees & Interest

Zip doesn’t charge any interest, and there are no annual or establishment fees. The only fee it charges is $7.95 monthly account fee. But, if you pay your statement closing balance in full by the due date, it will waive this fee. Besides, if you don’t pay the minimum payment every month, it may apply a late fee of 1.5% after 21 days.

Ratings

- Google Play Store Ratings: 4.8/5

- Apple App Store Rating: 4.9/5

Zip Customer Service

Just like any other financing application, Zip also has both positive and negative reviews. If you are facing any issue, you can email to their customer support at complaints@care.zip.co or call them at (02) 8294 2345 between 9 AM to 6 PM, Monday to Saturday. You can also mail them at 14/10 Spring St, Sydney NSW 2000.

| Pros | Cons |

| Zip offers same day settlement | Zip has lower credit limit than Zip Money |

| Interest free payments | Charges for late payment |

| It doesn’t require card for transactions |

7 Apps Like Zip to “Buy Now Pay Later” [2022]

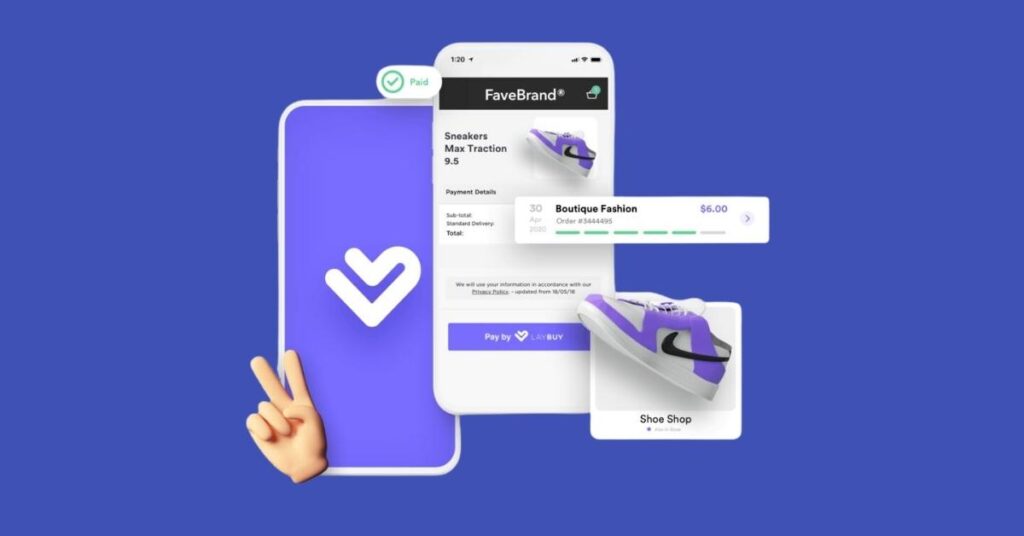

Laybuy

Laybuy is another buy now, pay later service with over 1,200 vendors and merchants. It permits you to get your purchase now; then, you can pay over 6 weekly interest-free installments. You can access Laybuy either from Laybuy’s app or via its website.

Laybuy is available for Australian, New Zealand, and UK residents who are at least 18 years old or above. In order to create a Laybuy account, you are supposed to provide your name, valid email address, residential address, valid passport or license, and your phone number for credit verification.

Laybuy Review

Laybuy enables you to buy products with selected retailers and divide the cost into six weekly interest-free payments. Here is everything that you want to know about Laybuy.

How Does Laybuy Work?

Laybuy offers a simple interest-free payment option that allows you to secure your buying today and pay for it in total six equivalent payments, once a week for 6 weeks. Upon registration, it executes a credit check to get a credit score on all new users.

As soon as your account has been verified and your credit score has been confirmed, Laybuy will assign your limit, and you can instantly start shopping. Once your order is finished, the first payment, which is equal to one sixth of the purchase price will appear. The next consecutive 5 payments are managed every week on the day of your original buying.

You can be able to view all your account information along with a payment schedule at any time by using your Laybuy account. Once you choose Pay by Laybuy at checkout and finish your buying, the retailer or merchant will ship your items at the delivery address that you have submitted.

Key Features

- It offers a faster way to pay so that you can finish your order within a few seconds.

- It provides you access to thousands of sellers from all over the world.

- Discover the latest trends and check out the latest deals.

- In-app personalized barcode makes paying in-store fast and easy.

- There are no upfront fees to pay on your account.

- Manage all your payments both in-store and online through your dashboard.

- You can check in to see how much credit you have, keep up-to-date with any upcoming payments and pay off your orders early.

- If you want, you can be able to overpay in advance of the six weeks.

Fees & Interest

Laybuy doesn’t charge you any upfront fees or any interest. However, if you miss a payment, you’ll be notified instantly and a late payment fee of $8 USD or £6 GBP or $10 NZD or AUD might be charged.

Ratings

- Google Play Store Ratings: 4.6/5

- Apple App Store Rating: 4.9/5

Laybuy Customer Service

Just like any other financing application, Laybuy also has both positive and negative reviews. If you are facing any issue, you can email their customer support at help@laybuy.com, or you can go to https://www.help.laybuy.com and submit your request, their team will get back to you as soon as possible.

| Pros | Cons |

| No upfront or establishment fees | Charges for late payment |

| Interest free | Sometimes it may decline your purchase |

| Automatic payment scheme of six qual installment | |

| No credit limit is needed |

Klarna

Klarna is a Swedish company, which operates in Australia, France, Germany, the United States, the Netherlands, the United Kingdom, and much more. It offers online financial services, including direct payments along with post-purchase payments and payments for online storefronts.

Its main aim is to offer payment solutions for e-commerce industry, and it is developed in way to make payments safe and secure for sellers and purchases by managing store claims and buyer payments.

Klarna enhances your checkout experience by offering Pay after delivery options, direct payments, and installment plans which let customers pay whenever they want. It recognizes the user and allows one-click repeat buying across Klarna’s merchant network, which results in increased conversion rates and average order value.

Klarna Review

Here is everything that you want to know about Klarna.

How Does Klarna Work?

You can be able to shop with Klarna via mobile app or through the website. Your spending limit and the capability to shop are determined by Klarna’s soft credit inquiry, your buying history, and your personal information. During your purchase, you can be able to select one of three financing options- Pay in four or pay in 30 days or a six- to 36-month loan.

The Pay in four is a 0% interest option which needs a 25% down payment at the time of buying, then three equal, biweekly payments for the remaining balance. Pay in 30 finances provide you time to try out your products, return what you don’t want, and pay for the rest in one big payment. The longer-term loans need monthly payments until the balance is paid incomplete.

You can view your purchase history, process returns, and track your shipments through the mobile app. Users can be able to create a wish list of items for future buying or to share with family and friends. If the price drops on any item on your wish list, it’ll give you a notification. Klarna is one of the few BNPL apps which provides a loyalty program that rewards users.

Key Features

- Its point-of-sales loans for in-store and online let customers to buy now and pay later.

- You can pay in four installments for every two weeks, and these installments are an interest fee.

- It might charge a late fee of up to $7 if the payment is failed after two tries, and there is no penalty for early payment.

- It gives a payment solution for the e-commerce industry.

- It is particularly created to make payments safe and secure for buyers and sellers by managing customer payments and store claims.

- Explore online stores, pin your favorites and share your saved items with your friends.

- Get information on your purchase and track them from store to door.

Fees & Interest

Its pay in 4 is no interest and doesn’t charge any fee if you pay on time. However, if you don’t pay on time, it might charge a fee. This late fee will be capped.

You will be charged a $1 late fee per late installment; this means the most you could be charged is $9.

Ratings

- Google Play Store Ratings: 4.6/5

- Apple App Store Rating: 4.8/5

Klarna Customer Service

Just like any other financing application, Klarna also has both positive and negative reviews. If you face any issue, you can email their customer support at hello@klarna.com or call them at 844-552-7621. You can also send a message via the Klarna app or even online chat available on the Klarna website.

| Pros | Cons |

| Provides several ways to finance purchases | Charges late fees |

| Set price alerts on your saved items | Needs soft credit check |

| Interest free on Pay in four financing | Sometimes it might report your missed payments to credit bureaus |

| Create virtual card numbers for other stores |

Splitit

Splitit is another Buy Now, Pay Later service that allows customers to use the credit they’ve received by breaking up purchases into monthly interest-free installments by using an existing credit card. It also lets merchants of all sizes to offer payment installments to their customers within a few minutes.

Furthermore, it partnered with sellers like SofaClub and James Avert to assist customers in choosing a payment plan for their finances and lifestyle. These equivalent payments can range from 3 to 24 months, with zero interest as long as you made your payment on time. Users can be able their existing debit or credit card.

It doesn’t require any registration, so you can easily access the payment option as you check out from the seller. Once your card is accepted, you can easily make a transaction as it entirely avoids separate credit checks and applications. These features make your shopping experience easy and simple.

Splitit Review

Here is everything that you want to know about Splitit.

How Does Splitit Work?

Once you choose Splitit as your payment option, you’ll first select the number of interest-free payments you wish to make. These payments can be made over 3, 6, 12, or 24 months, but some sellers limit the number of possible payments. Anyone whose payment process is approved at the checkout can use Splitit to manage their buying.

Once the seller approves your shipment, you’ll be charged for the first payment, and the remaining balance will be held on your credit or debit card till the final payment is made. When you purchase a product, Splitit asks you to give your email to set up an account with the support portal on its website. You can be able to use this portal to check your installments and make payments.

Key Features

- It is an option built directly into its partnered seller’s online checkout.

- It seamlessly integrates with most e-commerce platforms like WooCommerce, Shopify, or Magento.

- You can easily set up and start accepting installment payments in minutes.

- It abolishes the difficulty of integrating several accounts by withholding all charges upfront.

- It combines your Splitit account with card processing for installments, all managed through one account.

- There is no credit check, waiting for period, or application process for Splitit.

Fees & Interest

Paying with Splitit is always interest-free, and there is no fee for late payments.

8 Apps Like Splitit to “Buy Now Pay Later” [2022]

Splitit Customer Service

Just like any other financing application, Splitit also has both positive and negative reviews. If you are facing any issue, you can email their customer support at support@splitit.com or call them at +61-1800-957-440.

| Pros | Cons |

| It doesn’t need a credit check | Limited payment options |

| Doesn’t charge any interest or fees | Retailers might place minimum or maximum buying values |

| There is no application process to use Splitit | Has limited retailers |

| You can also make early payments | |

| You can continue earning points for using rewards credit card |

Affirm vs Splitit: Complete Comparison [2022]

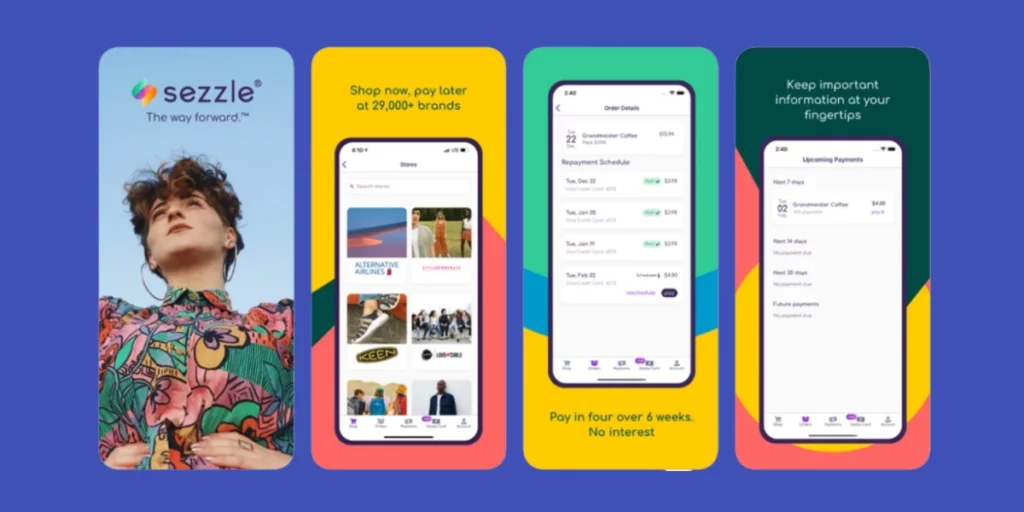

Sezzle

Sezzle is a financial company that offers an alternative payment platform providing interest-free installment plans at selected online stores. It has over 6.7 million active users and over 34,000 active merchants. It lets customers divide the payment for their purchase into four installments. Users can be able to shop and discover stores via the Sezzle website or its app.

Sezzle functions as an alternative payment option which the customer chooses during the checkout to allow payment with active retailers. The first payment should be paid at the time of purchase, while the remaining three payments should be paid at regular intervals over the following six weeks.

Sezzle Review

Sezzle is a payment method that provides you the ease to buy now and pay later without interest. Here is everything that you want to know about Sezzle.

How does Sezzle work?

To get started with Sezzle, you have to be at least 18 years or older and have a valid phone number, email address, and non-prepaid payment method.

When you place an order via Sezzle, their exclusive approval process review your account to decide what type pf repayment plan should be offered. In most cases, you are supposed to pay 25% upfront or the first installment or down payment of your purchase, and the remaining amount splits up across three more installments.

Each of your three installments is due two weeks apart with no interest or any other hidden interest. Once your order is placed, Sezzle instantly pays the seller in full, so the seller has their funds and has the ability to process your order easily.

7 Apps like Sezzle to Buy Now Pay Later [2021]

Key Features

- You can easily log in and use Sezzle as the selected payment method through its app or website.

- It offers over 29,000 brands and products, including clothes, jewelry, footwear, and much more.

- It offers a category of features stores from the home screen, these stores are selected depending on their offers, popularity, and product quality.

- It also allows you to reschedule your payment.

Fees & Interest

Although Sezzle is completely interest-free, the only fees you might face are failed payments fees or rescheduled payment fees. If your schedule payment fails to process, you’ll be charged a $10 fee, usually, this happens if the card has been cancelled or when there are not enough funds in the account.

They even send email and text reminders to prevent this from happening. You can only get one free reschedule and the next reschedule is charged a fee of $5.

Ratings

- Google Play Store: 4.8/5

- Apple App Store: 4.9/5

Sezzle Customer Service

Just like any other financing application, Sezzle also has both positive and negative reviews. If you are facing any issue, you can email to their customer support at support@sezzle.com or call them at +1 (888) 540-1867 from 9 AM to 5 PM.

| Pros | Cons |

| Push payments up to fourteen weeks later | Needs 25% down payment upon buying |

| Can reschedule following payments for free | Every extra reschedule is $5 |

| First reschedule per order is completely free | |

| Doesn’t charge any interest on purchase | |

| Fast checkout |

Bundll

Bundll is another best buy now, pay later app in Australia which is empowered by Mastercard. You can use it in-store as well as online or anywhere Mastercard is accepted. You can be able to buy anything you want, from clothes to eggs and fuel, and repay it later.

It doesn’t require credit checks for the standard users, but when you upgrade to SuperBundll, it’ll involve a credit check, and you’ll also get several advanced features.

Bundll Review

Here is everything that you want to know about Bundll.

How Does Bundll Work?

You just have to simply download the Bundll application from Google Play Store or Apple App Store and create an account. As soon as you’ve created an account, you can be able to add the Bundll digital card to your mobile phone and start shopping, both in-store and online. Firstly, all you have to do is to set a repay day.

This repay day will be the day of the week when repayments for your purchases will be made. Every week you make a new “Bundll” for that week’s buying, and you must pay every week’s buying on your selected repay day for up to 14 days later.

You’ll also have the ability to snooze payments for extra 14 days, either with a free snooze or by paying a fee of $5. However, you are supposed to meet additional eligibility measures in order to use this feature. You can use the “Card Reveal feature inside the app to shop online and swipe your digital wallet in your phone to shop in-store.

Key Features

- You can easily download the Bundll app from Apple App Store or Google Play Store.

- Log in to the app safely and securely by using thumbprint, a pin or face ID.

- You can shop at any place in-store or online, wherever Mastercard is accepted.

- View your transaction history, track your spending and see where you shop.

- Ability to snooze your repayment for another fortnight.

- Once you have used your account in Australia, you can use it overseas, wherever Mastercard is accepted.

Fees & Interest

Bundll doesn’t charge any interest, but if you miss a payment, you will be charged a late fee of $10. Before charging a late fee, they’ll even send you notification and then give you a 24-hour period to make your payment. It will also charge a fee of $5, if you snooze a payment. If you are using the upgraded version of Bundll – SuperBundll, you’ll have to pay 5% on your purchases.

Ratings

- Google Play Store: 3.8/5

- Apple App Store: 4.6/5

Bundll Customer Service

Just like any other financing application, Bundll also has both positive and negative reviews. If you are facing any issue, you can email to their customer support at hello@bundll.com.au. You can also chat with their live agents or fill the form from https://bundll.com/contact.us.

| Pros | Cons |

| Shop anywhere, where Mastercard is accepted | Requires Superbundll to use snooze feature |

| No account fee or interest | Charges late fee |

| Snooze feature lets you delay your repayment |

6 BNPL Apps like Bundll to Try Out [Australia 2022]

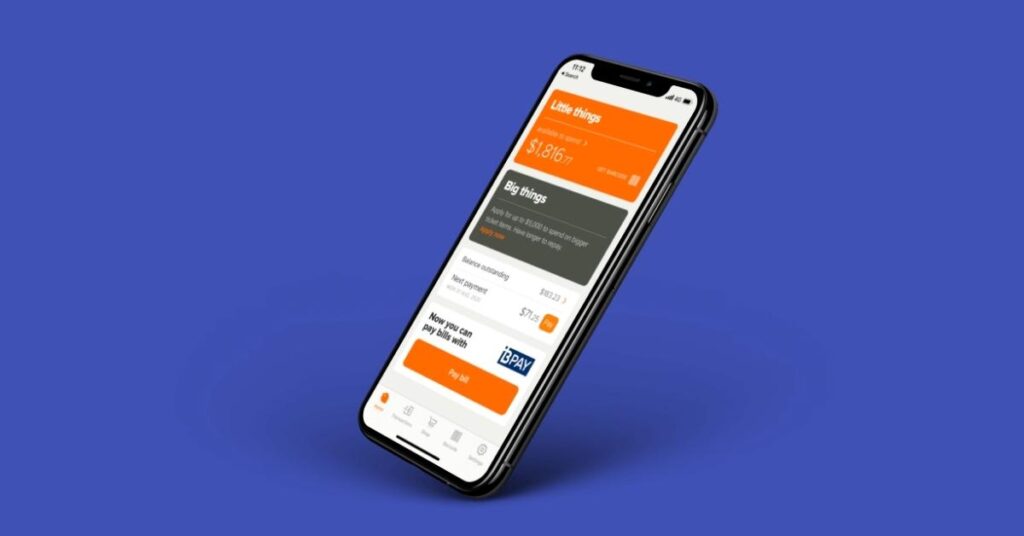

Humm

Humm is a buy now pay later service functioning in Australia. Just like other buy now pay later service like Afterpay, Klarna and Zippay, Humm also lets you to pay for your buying in overtime for completely interest free. It allows you to divide your buying price into smaller monthly or biweekly payments.

Nevertheless, unlike other services, which usually limit the amount you can spend to between $1,000 and $2,000, Humm provides you the possibility to take up to $30,000 by using two distinct digital wallets – Little Things and Big Things.

With Little Things, you can use up to $2,000, and you are supposed to repay in either five or ten biweekly repayments. With Big Things, you can spend up to $30,000, and repayments can be divided across monthly payments ranging from six months to five years, interest-free.

Humm Review

Here is everything that you want to know about Humm.

How Does Humm Work?

You can easily create a Humm account by downloading the Humm app or through its website. You’ll need to provide your personal information, including name, mobile number, residential address, diver’s license or your passport, and you should be at least 18 years old, a permanent resident of Australia, and a permanent job.

As soon as you have signed up and have been approved, Humm will provide you access to its “Little Things” wallet. The spending limit in your Little Things wallet depends on the information you’ve provided during the sign-up process. Your spending limit might increase once you’ve built up a good repayment history.

You have to receive prior approval to make any purchases through “Big Things.” For amounts up to $5,000 in advance, you can be pre-approved in-store or online. If the product you wish to buy costs more than this, the application process has to be completed in-store. As soon as you are approved, you’ll get a barcode on your app, which you can share with the seller.

Key Features

- Repayments plans are depended on whether you purchase a Big Thing or Little Thing.

- Your spending limit depends on the information you have provided during the sign-up process.

- It performs a credit check, and any repayments you miss can negatively affect your credit score in the future.

- You can shop several products both in-store and online, including beauty products, homeware, technology and much more.

Fees & Interest

Humm doesn’t charge interest on any of its purchases, but if you miss your payment, it charges a late fee of $6 for each missed payment. Also, there is a monthly fee for Big Things and Little Things plans which are on a five-month or more repayment plan. Thus, you are supposed to pay an establishment fee between $35 to $90 on Big Things.

Ratings

- Google Play Store: 4.7/5

- Apple App Store: 4.8/5

Humm Customer Service

Just like any other financing application, Humm also has both positive and negative reviews. If you are facing any issue, you can email their customer support at customer.experience@shophumm.com.au or call them at 1800-088-151 from Monday to Friday between 7:30 AM to 7:30 PM, and on Saturday between 7:30 AM to 5:30 PM. You can chat with their live agent during the support hours – Monday to Friday between 10:00 AM to 7:00 PM.

| Pros | Cons |

| Interest free | It charges monthly fees |

| Installment plans are quite flexible | Establishment fees on Big Things is quite expensive |

| You can shop for expensive products |

Brighte

With Brighte, you can get the latest upgrades to your home now and repay it later. Once you’re eligible, you can apply to get pre-approved on the Brighte website. As soon as you are approved, you can access the wide variety of Brighte sellers to purchase items with 0% interest.

When you have an active Brighte zero-interest payment plan, you can apply to reuse the amount that you’ve already repaid or simply improve the limit. The sellers that are available through Brighte offer a range of household requirements such as roofing, solar panels, and flooring.

Brighte Review

Here is everything that you want to know about Brighte.

How Does Brighte Works?

Sign up process is quite simple with Brighte. In order to be eligible for Brighte, you have to be a homeowner, aged over 18, have a valid driver’s license, passport, or Medicare card, have a bank account in your name, and should be an Australian permanent resident, employed for more than 25 hours per week and must have a good credit history.

Once you’ve submitted your application, Brighte will evaluate the application in order to its credit approval measures. As soon as your application is approved and installation has been completed, Brighte will settle your account with the seller, and your automatic biweekly repayments will start.

It offers various finance options based on the selected vendor. Its zero-interest choice usually ranges from $1,000 to $30,000 for owners with terms of 6 to 60 months. It also offers longer loan term options – Brighte Personal Loan and Brighte Green Loan.

Key Features

- As soon as you’re approved, you can have access to various home and energy improvement vendors.

- Its application and approval process are very easy and quick, and automated to make sure you get a response as fast as possible.

- As it offers several retailers to select from, the repayment terms for every service will have different terms, ranging from 6 to 60 months.

- You can make extra payments at no additional cost through the BrightePay app or by phone.

- It provides 0% interest payment plans for purchases from $1,000 to $30,000 for homeowners.

Fees & Interest

There is an account-keeping fee of $1.50 per week, which is included in biweekly payments. If you are not able to make a payment on time, a late payment fee of $4.99 may be charged. These late fees are capped at $49.99 per calendar year. No interest is added to the repayments, and no fees will be deducted till the work is finalized on your assets.

Ratings

- Google Play Store: 4.4/5

Brighte Customer Service

Just like any other financing application, Brighte also has both positive and negative reviews. If you are facing any issue, you can email to their customer support at info@brighte.com.au or call them at 1300-274-448, Monday to Friday between 9 AM to 9 PM, Saturday – 10 AM to 6 PM, Sunday – 10 AM to 6 PM.

| Pros | Cons |

| Interest free | Charges late fee and an account keeping fee |

| Have different repayment terms |

Latitude Pay

Latitude Pay is one of Australia's best buy now pay later apps that lets users spend up to $1,000 with their selected sellers. Users are supposed to pay 10% of the purchase price up-front and make the remaining payment over nine weeks.

In-store sellers create an exclusive Latitude Pay under your name, which they will authorize through email or text message. While shopping online, you just have to add a product to your cart and use Latitude Pay during your checkout. Once your order is approved, you'll receive an email explaining your plan.

Latitude Pay Review

Here is everything that you want to know about Latitude Pay.

How Does Latitude Pay Work?

To create a Latitude Pay account, you should be at least 18 years or older, have a reasonable credit rating, have a valid debit or credit card, and be an Australian citizen. Once your application is approved, you can simply choose Latitude Pay at the checkout from a wide variety of sellers – both online and in-store and get their products right away.

These approvals occur in real-time, and users can keep track of their outstanding and repayments through the Latitude Pay app. You can select to set up your account to make automatic deductions or make manual repayments.

Key Features

- Users can easily sign up to use Latitude Pay

- It offers several stores, and you make purchases up to $1,000.

- The repayment period can be over ten weeks, with the first payment being paid during the checkout.

- It sends notifications or SMS to inform your upcoming payments.

- Your spending limit depends on the real-time approval per purchase which can be increased by your reliable payment.

- It undergoes a soft credit check during the application process.

Fees & Interest

Latitude Pay doesn't charge interest on any of its purchases, and also there is no account fee. However, if you miss your payment, it charges a late fee of $10. If your automatic payment fails, SMS or an app notification will inform you of upcoming payments.

Also, customers are asked to pay $10% of the product's price during the time of purchase. If you miss more than three payments, your spending limit will decrease.

Ratings

- Google Play Store: 4.4/5

- Apple App Store: 4.7/5

Latitude Pay Customer Service

Just like any other financing application, Latitude Pay also has both positive and negative reviews. If you are facing any issue, you can email to their customer support at luke.simpson@latitudefinancial.com.

| Pros | Cons |

| Interest free | Charges late fee |

| Quick approval | 10% upfront |

| You can pay off your balance early |

Pay Day Apps:

Beforepay

Beforepay gives you access to credit based on a share of your salary before payday. Unlike another buy now, pay later apps like Zippay, Klarna, or Afterpay, which lets you borrow money for certain transactions, Beforepay offers you the amount as a total sum cash advance which directly goes into your bank account.

By using the Beforepay app, you can be able to track your expenses and income by linking it to your salary bank account. You also can view your income, upcoming bills, spending habits, and remaining balance and, based on your past spending, permit the app to create an automatic budget for you.

Beforepay Review

Here is everything that you want to know about Beforepay.

How does Beforepay Work?

In order to use Beforepay, you are supposed to download the app from Apple App Store or Google Play Store and register for an account by using your Facebook account or email address. You may also have to provide your personal information, including name, mobile number, age, and the state you are living in, then connect your bank account.

Once you have created your account, Beforepay will give you the amount you select – between $100 to $1,000, and allow you to repay it in four weeks. You can also repay the full amount when you get your wage or simply choose to pay it off in installments for up to four weeks.

Beforepay doesn’t run a credit check, but as a part of its valuation process, it does analyze the expenses and income connected with your bank account to make sure you are capable of making repayments.

Key Features

- Beforepay app directly connects to your bank account.

- It provides up to $1,000 in salary installments on your expected salary.

- You can easily make your repayments in four weekly installments.

- It doesn’t charge any fee for early payments.

- It automatically analyses your spending habits to offer you a customized budget.

- Uses bank-grade security to protect your data from scams.

- The Delay payment feature lets you automatically line up your next repayment with your next payday.

- Receive updates and notifications on your saving progress and spending.

Fees & Interest

Beforepay doesn’t charge interest on any of its purchases and also there is no administration fees or monthly fees. Nevertheless, you’ll be charged a 5% transaction fee, which is applied only if you borrow money in contradiction of your upcoming wages.

Ratings

- Google Play Store: 4.7/5

- Apple App Store: 4.9/5

Beforepay Customer Service

Just like any other financing application, Beforepay also has both positive and negative reviews. If you face any issue, you can email their customer support at support@beforepay.com, between 9 AM and 5 PM, 7 days a week.

| Pros | Cons |

| There are no late fees | You can only access limited amount of money |

| You can quickly access money | It is not a long-term finance solution |

| Less cost than traditional payday loans | |

| You can get access to tailored budget |

MyPayNow

MyPayNow is an on-demand pay service that lets you access up to 25% of your salary ahead of your payday. This can be pretty useful if you have an unexpected bill which you have to pay or simply require some extra money until the end of the month.

Once your request is approved, you can have money in your account within a few seconds. However, you can only access funds up to your limit per pay cycle. To get started with MyPayNow, you are supposed to provide a valid phone number, email address, Australian ID, amount of your salary, banking information.

MyPayNow Review

Here is everything that you want to know about MyPayNow.

How Does MyPayNow Work?

You can easily create a MyPayNow account by providing your details and answering some questions regarding your employment. Once you’ve completed creating an account, their artificial intelligence technology will do all the work in the background to evaluate how much of your salary you can get advance access to.

Once the advances have been processed, scheduled repayments are automatically set up to overlap with your pay cycle. You can make a unlimited number of requests and get what you require and whenever you require. The money you accessed is automatically deducted from your next Pay through direct debit. Once your MyPayNow balance resets, you can take another pay when you require.

Key Features

- You can easily download the MyPayNow app from Google Play Store or Apple App Store.

- You can only have access to multiple of 50 when accessing your wages.

- It provides up to 25% of your salary up to a limit of 1,250.

- You’ll be automatically debited from your account on your next payday.

- It uses bank-grade encryption to secure your data from scams.

- You don’t have the ability to repay early, and the funds which have been given to you will be only taken on our next payday.

- It doesn’t perform any credit checks.

- If you miss your payment, you’ll be able to pay in real-time by using your debit card.

Fees & Interest

MyPayNow doesn’t charge interest on any of its purchases and also there is no administration fee or monthly fees. Nevertheless, you’ll be charged a 5% transaction fee, which is applied only if you borrow money in contradiction of your upcoming wages. For example, if you have advanced $100, they’ll charge $5.

Ratings

- Google Play Store: 4.7/5

- Apple App Store: 4.9/5

MyPayNow Customer Service

Just like any other financing application, MyPayNow also has both positive and negative reviews. If you face any issue, you can email their customer support at customerservice@mypaynow.com.au.

| Pros | Cons |

| Less cost than traditional payday loans | You can only access small amount of money |

| Access your money immediately | |

| Interest free | |

| Doesn’t perform any credit checks |

6 Apps Like Beforepay & MyPayNow You Should Try! [2022]

The Bottom Line

With BNPL services, you can buy something easily and pay off the remaining amount later. Buy Now, Pay Later services are easy-to-use and charge low fees and low interest or zero interest. However, don't forget that the availability of “Buy Now Pay Later” services does not mean that you can buy anything without limit.

So, We hope the above article has helped you to know everything about best buy now pay later apps in Australia as well as the best alternatives to Afterpay, PayPal, Openpay, Zippay, Laybuy, Klarna, Splitit, Sezzle, Bundll, Beforepay, MyPayNow, Humm, Brighte, and Latitude Pay.

![Best Buy Now Pay Later Apps in Australia [2024]](https://viraltalky.com/wp-content/uploads/2021/12/Best-Buy-Now-Pay-Later-Apps-in-Australia.jpg)