Afterpay vs Quadpay vs Klarna vs Sezzle – Installment plans with services like Afterpay, Quadpay, Klarna, and Sezzle have become popular in recent years.

You may have heard of many payment solutions popping up everywhere recently. Therefore, you might be wondering, is there any good reason for the popularity?

And whether this payment method is worth trying or not? Or is this safe? In this article, we will examine Afterpay, Quadpay, Klarna, and Sezzle, covering everything from comparing, features, pros, and cons so that you can make a choice.

Afterpay vs Quadpay vs Klarna vs Sezzle: What are they?

Buy Now Pay Later (BNPL) services make it easy to shop, whether online shopping or in-store shopping, without the fees associated with credit cards. It is the fastest and most convenient form of financing, and the registration is pretty simple and straightforward.

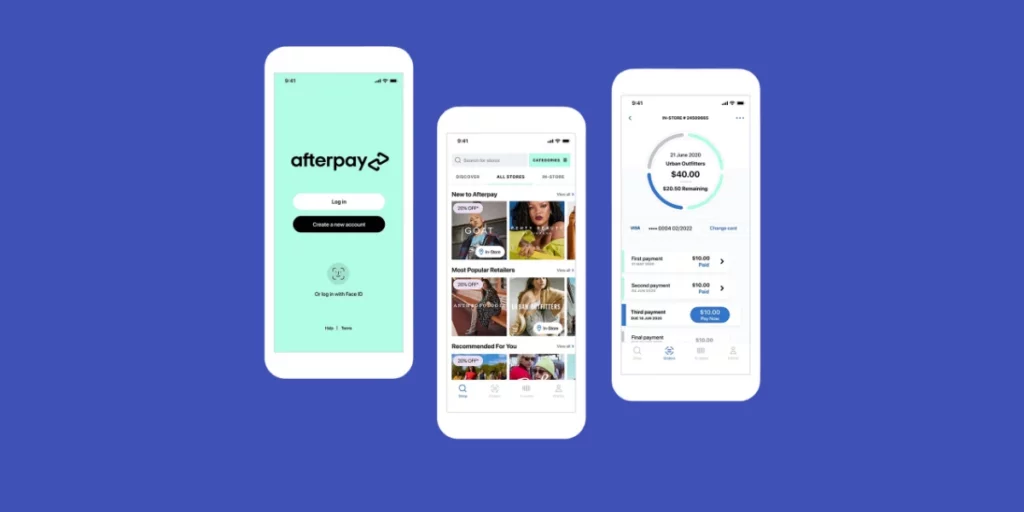

Afterpay

It is a buy now and pay later instant lender, which divides your total purchase amount into four weekly payments.

It allows its users to shop at places they like and get things they want or require, all while helping them stay within a budget.

So, basically, it is a budgeting tool and not a credit card or loan service. One of the most important features of Afterpay is its non-credit-based approval process which gives a huge advantage over traditional credit cards.

It doesn't charge any interest or upfront fees, and you won't be penalized for reaching your maximum limit.

Afterpay's requirement is, your order must be more than $35. Also, you have to be over 18 and have a credit or debit card to qualify.

You are also supposed to make a free account online through its application if you use it in stores and give your payment information and other information like your phone number and email address.

How does Afterpay work?

It allows retailers to offer installment plans for online purchasers and allowing a purchase to be paid in for installment for every two weeks.

First-time users are supposed to provide information such as their phone number and email address.

Whereas, usual shoppers may simply log in to make their purchase.

They’ll consider a different number of factors before approving any order, for example, if you have been an Afterpay shopper for a long time and if you have successfully repaid all your orders, you are more likely to be able to spend more.

They’ll also consider whether there are sufficient funds on your card or not, how long you have been using Afterpay, and the amount you have to repay.

The value of the order you’re trying to place amy help to reduce the value of your shopping cart.

Loan Amount: There is no usual limit on how much you can borrow through Afterpay. Bur, several new accounts are limited to start with $500. And the limit eventually increases over time depending on on-time payments, how you use Afterpay, and the frequency of late payments.

Loan Terms: You can repay your loan in four equal installments, due every two weeks, with the first payment paid at checkout.

For instance, it divides your purchase into four payments, with 25% paid during the checkout. And you'll have to pay the other 75% in equal installments every two weeks over the next six weeks.

Payment Methods: Afterpay currently accepts Mastercard and Visa credit and debit cards issued in the United States.

Interest Rates: It doesn't charge any interest.

Fees: The only fee it charges is a late fee, capped at 25% of the initial purchase, and does not accumulate.

Impact on Credit Score: It doesn't have any effect on your credit score because it'll not report your on-time payments to the credit bureaus.

Returns: Returns are always subject to the individual merchant's policy. So, any information regarding your returns should be raised directly by the merchant, whose details will be available on their website.

Afterpay Key Features

- Interface is easy to use.

- You can be able to see the various orders you have and how much you're approved for or have left in your dashboard.

- You'll be able to purchase new inventory without paying the full total at once.

- It divides your total purchase amount into four weekly payments.

- It allows customers to get their products immediately.

Pros

- User-friendly

- You can shop even when cash flow is less.

Cons

- No online customer service feature

- Refund and return process is quite tedious

Afterpay vs Shop Pay: Complete Comparison [2022]

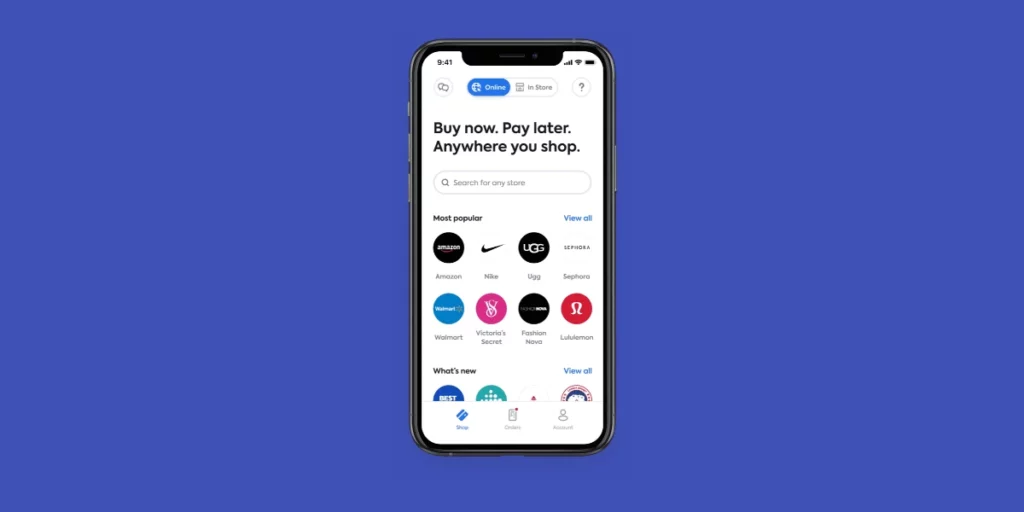

Quadpay/ Zip

Zip or Quadpay is another “Buy now and Pay later” platform that provides savvy shoppers more flexibility and freedom to pay later anywhere.

Customers can split their purchase into four installments for over six weeks. In return, Quadpay's partner merchants enjoy higher AOV and conversion, immediate payment, and more repeat purchases.

Quadpay's main goal is to empower modern consumers with transparent, simple, and financially responsible payment tools.

Their ultimate goal is to create a place where everyone can access the things they need, require, and want from life.

Along with Zip Co., it serves over 4.5 million customers and 30,000 merchants, with $3 billion in annual payment globally.

How does Quadpay work?

To get access for a Quadpay account, you should meet a few basic requirements such as you should live in the U.S., you must be at least 18 years old, have a valid and authentic mobile number, and must have a U.S. issued debit or credit card.

You can be able to pay off the larger purchases over six weeks with just twenty-five percentage down and no interest.

Remember that Quadpay doesn't pull your credit report when you make a purchase request; in this way, you won't be dinged for a hard inquiry. Furthermore, always pay on time to avoid late payment fees.

Loan Amount: Since Quadpay has become a part of Zippay, the maximum amount you can access through Zip Pay is $350 to $1,000. And through Zip money, you can access $1,000.

Loan Terms: You'll pay only the first 25% of your purchase amount. The other 75% will be divided equally and paid over the next six weeks.

Payment Methods: Zippay automatically debits your repayments from the payment method attached to your account.

Interest Rates: It doesn't charge any interest or any other hidden fees.

Fees: If you don't pay your balance in full, they can charge you a $6 fee on the first of every month when you have an unpaid balance.

If you've made no repayments for over 21 days after the fee-free period, it might charge a late fee of $5.

Impact on Credit Score: If you don't pay your bills on time, it will affect your credit score. Also, it'll check your credit score when you apply for the service. Therefore, it is essential to make on-time payments.

Returns: Returns are always subject to the individual merchant's policy. If you return goods to a retailer and agree to a refund, your Zip account will be credited with the agreed refund amount.

8 Best Apps Like Quadpay to Buy Now Pay Later [2021]

Quadpay Key Features:

- Easy to integrate.

- This payment platform is seamless and integrates easily into your system.

- It allows customers to increase AOV without damaging their purchasing power down the road.

- It has the ability to allow customers to buy more today, and merchants get their earnings faster.

- You can pay installments ahead of time or pay multiple installments at once, at no extra cost.

Pros

- Easy to use

- User-friendly and straightforward

- No extra costs or penalties as long as you pay on time

Cons

- It has only one payment plan.

8 Best Apps Like Quadpay to Buy Now Pay Later [2021]

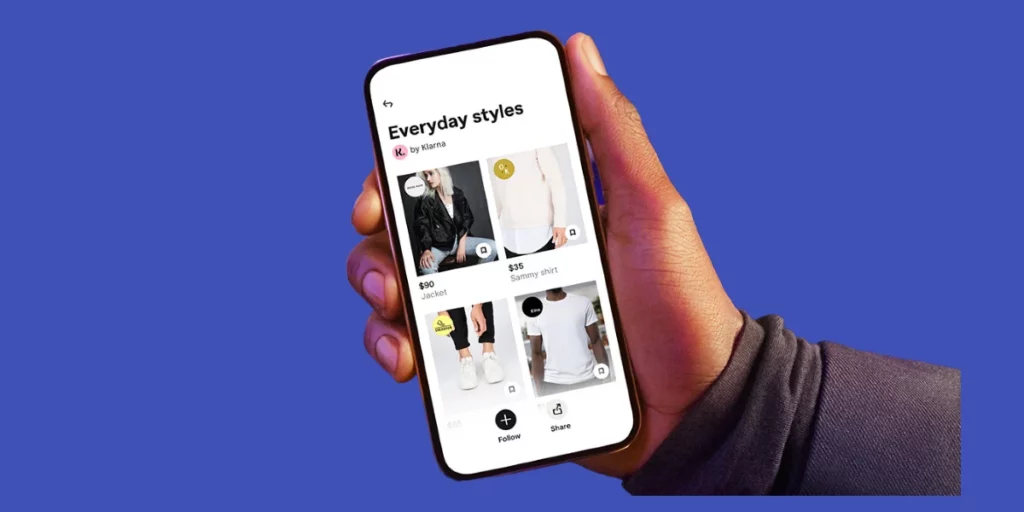

Klarna

Klarna is a multi-payment solution that offers a unique payment and offers various payment plans, which can be incredibly valuable for shoppers looking to pay off huge purchases.

It also allows shoppers to pay off their purchases in four installments for no interest, delay purchase payments for 30 days, or apply for thirty-six-month financing plans with competitive interest rates.

However, these offerings vary according to the merchants, but it doesn't matter which of these payments plans is available, they all provide a new level of flexibility to online shopping.

Furthermore, it allows users to purchase with any online retailer and take advantage of an interest-free installment plan, further allowing users to test products without worrying about the cost upfront.

Klarna is available in more countries than Afterpay, available in U.S., U.K., Denmark, Australia, Austria, Belgium, Finland, Germany, Norway, Sweden, Switzerland. Afterpay, on the other hand, is available in Australia, United States, United Kingdom, and New Zealand, and Quadpay is only available in the United States.

How does Klarna work?

Klarna allows you to pay in four equal installments for every two weeks. These installments are interest-free, but the company charges a late if the payment is unsuccessful after two tries.

However, there will be no penalty for early payment or paying off your balance in full before the final due date.

Loan Amount: Klarna doesn't specify any pre-set credit or spending limit. Instead, your spending limit and the ability to shop are determined by Klarna's soft credit inquiry, your buying history, and the information you provide.

Loan Terms: You can select one of three financing options- Pay in 4 or pay in 30 days or a 6 to 36-month loan during your purchasing.

Interest Rates: The pay in four is a zero-interest option that requires a 25% down payment at the time of buying.

Fees: If you don't pay your payment on time, you'll be charged a late fee of $7, and the longer terms loans have a $35 late fee assessment.

Impact on Credit Score: Even though Klarna performs a credit check, it'll not affect your credit score and will not be visible to other lenders while deciding to pay in four interest-free installments.

Returns: You get 28 days from the date you receive your order to return it for a refund. It takes Klarna around 5-7 business days to process and post your refund to your original payment method. Visit here for more information on the return and refund policy.

Klarna Features

- It offers a fee for different types of payment solutions with their own functionality.

- It is partnered with several online retailers, each offering one or more of three klarna solutions.

- It allows customers to shop with any of the online retailers they think they can pay with an installment plan.

- Every Klarna plan is approved on a case-by-case basis, and you'll get a spending limit based on various criteria, such as your Klarna account and your purchase history.

Pros:

- It accepts Discover Cards and American Express

- Can pay any major purchases over time by purchasing through the Klarna application

Cons:

- Can't customize your payment due dates

- Pay-later payment options are limited

From UK? Try these 5 Best Buy Now Pay Later Apps in UK [2022] 6 Apps Like Zilch to Buy Now Pay Later [2022]

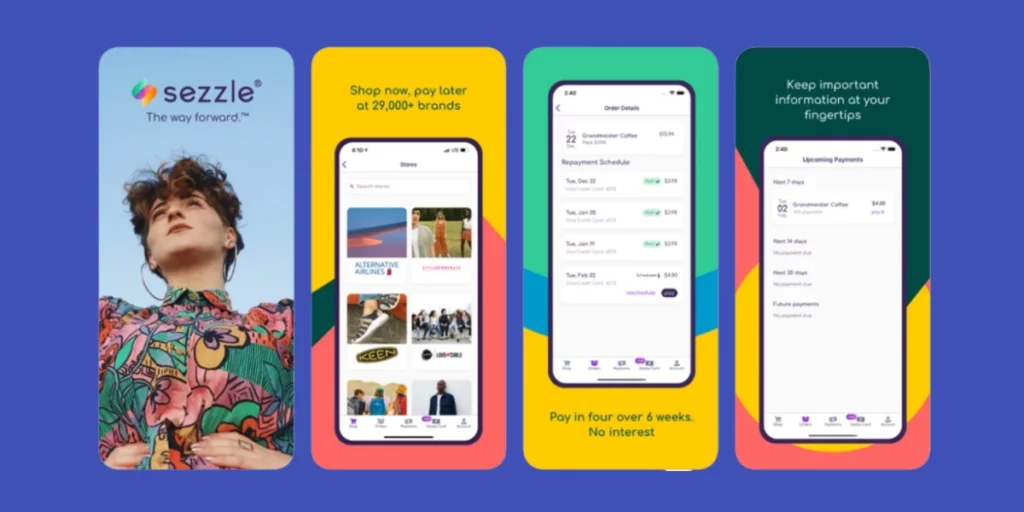

Sezzle

It is a public-benefit corporation that is on a mission to empower the next generation financially.

It is easy to integrate with any website and provides a great choice for customers who want an alternative payment method for their purchase that doesn't involve credit.

It enables millions of customers across Canada and United States to control their spending, be more responsible, and have access to financial freedom.

Furthermore, It is serving more than 29,000 merchants with over 2.4 million shoppers. Sezzle is the financially responsible solution to “Buy now and pay later.”

It lets shoppers to make their purchase today with four payments over the following 6 weeks with interest-free. Likewise, it also offers customers the option to reschedule their payment once for free, and the max fee for late payment is $10.

How does Sezzle work?

After you make an order through Sezzle, their unique approval system will review your account to determine what sort of repayment plan they can offer.

As long as you pay your installments on time, there will be no fees.

When you place an order, Sezzle will pay the merchant in full for the order immediately, in this way merchant will have their funds and is able to process your order.

Loan Amount: The maximum amount you can borrow through Sezzle is $2,500. But, not everyone will be approved for the full $2,500. If you make on-time payments and use Sezzle regularly, your limit might increase.

Loan Terms: Each of your three installments is due two weeks apart with no interest or any other hidden interest.

Interest Rates: It doesn't charge any interest.

Fees: The only fees you might be charged are the failed payments or reschedule payment fees. When your payments fail, it charges a fee of $10, and the rescheduling fee is $5.

Impact on Credit Score: A standard Sezzle account doesn't report to the credit bureaus, so your late payments or missed payments have no impact on your FICO score.

Returns: Returns are always subject to the individual merchant's policy. So, as soon as Sezzle gets a refund from the merchant, your payment will be automatically updated.

Sezzle Features:

- The interface is easy to use.

- You can be able to add graphics to your email marketing content, Social media, website, and many more.

- It allows you to withdraw your funds after on business day, unlike any other competitors.

- It verifies customer data, which heavily reduces the merchant's fraud chances, thus making it impossible for a fraud transaction to take place.

- They provide several ads and pages to link to your store to advertise acceptance of Sezzle payments for account holders.

Pros:

- Easy to use.

- Easy installation

- Good customer service

Cons:

- No significant cons

7 Apps like Sezzle to Buy Now Pay Later [2021] Sezzle vs Affirm: Complete Comparison [2022]

Summary: Afterpay vs Quadpay vs Klarna vs Sezzle

| FEATURES | AFTERPAY | QUADPAY | KLARNA | SEZZLE |

| Repayment | Six weeks/ Eight weeks | Six weeks | Six weeks | Six weeks |

| Type | In-store/ Online store | In-store/ Online store | online | In-store/ Online store |

| Platform | SaaS, iPhone, iPad, Android | SaaS | SaaS, iPhone, iPad, Android | SaaS |

| Installment payment and Payment processing | Only installment payment | Yes | Yes | Only installment payment |

| Integrations | Spree Commerce, Adyen, BigCommerce, Ecwid and other integrations | Salesforce, Shopify, WooCommerce, Magento, BigCOmmerce, Oracle Commerce, Workarea | Spree Commerce, Billbee, Centra, Checkout X, Consignor, Craft CMS, Desktop.com, and other integrations | CommentSold, Shopify, WooCommerce, Magneto, BigCommerce, 3dcart, CyberSource, Salesforce Commerce Cloud |

| TERMS | AMOUNT DUE | INTEREST | LATE FEE | |

| PAY IN 4 | Pay in four installments for every two weeks | First installment and your balance divided by four | 0 interest | Up to $7 |

| PAY IN 30 | Pay full balance after 30-days | $0 | 0 interest | None, only if you make the full payment |

| PAY NOW | Pay with your credit or debit cars via Klarna app | Full balance | 0 interest | N/A |

| FINANCING | Pay from 6-36 months | $0 | 0%-9.99%; 19.99% for standard purchase | Up to $35 |

Bottom line

I hope the above article on Afterpay vs Quadpay vs Klarna vs Sezzle comparison has helped you pick the best option based on your needs and requirements.

Also Read:

10 Best Sites Like Zebit for Buy Now Pay Later [2021]