Apps like Zip/ Zip Alternatives: Buy Now Pay Later or widely known as BNPL services are significant installment payment services that let you purchase something at a fraction of its price, and pay off the remaining price over time.

In other words, when you choose this kind of payment at your point of sale, the cost for the item that you’ve purchased is divided into four or more equal installments.

Zip Pay is such a popular BNPL service that is used by a large number of consumers. Its service is divided into two – Zip Pay and Zip Money.

You can choose between these services depending on your spending limit. That means if you usually spend less than $1,000 then Zip Pay is perfect for you.

While Zip Money can be a good option for those who spend over $1000. With Zip, you can buy gift cards as well as pay off your bills

Apps Like Zip: Best Zip Alternatives!

All Zip Pay loans are interest-free and payments in the Zip Money plan are only interest-free for the first three months of every purchase.

Even though it is an incredible buy now pay later service, it might not be right for you. Moreover, it also charges convenience fees as well as late fees.

Thus, check out the below post for information regarding the best Zip alternatives!

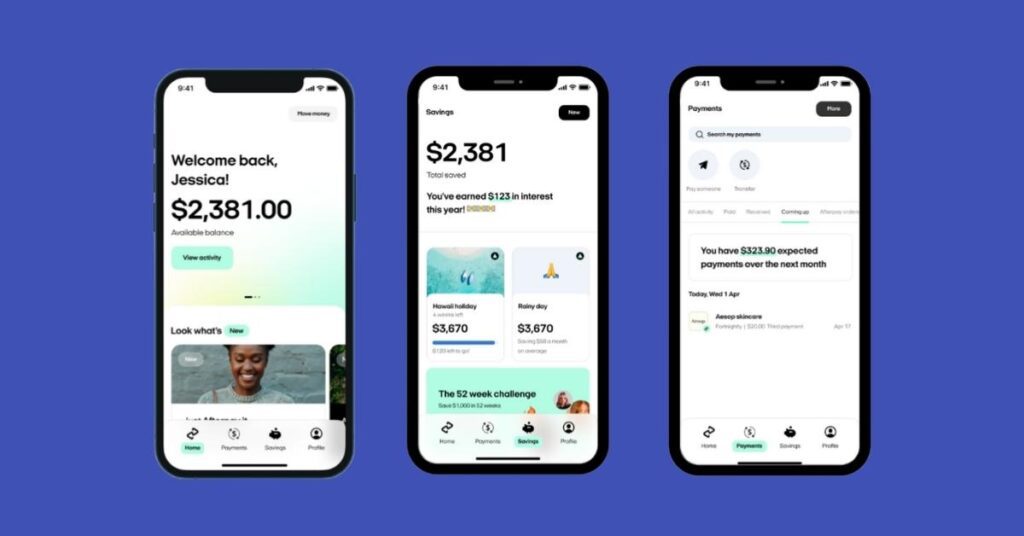

Afterpay

Afterpay is one of the popular BNPL services, as well as the best app like Zip. Afterpay is an Australian fintech that operates in the United Kingdom, the United States, Canada, and New Zealand.

It is partnered with over 50,000 in-store and online retailers to offer you an easy and simple buy now, pay later experience. All you need to do is to select Afterpay as your payment method.

You can divide your installments, and payback what every fortnight. All these installments are interest-free, so you don’t have to worry about paying anything extra.

Therefore, enjoy more convenience when buying your favorite item and the best part is that you can easily sign up for an account.

Requirements for Eligibility

- Must be a US resident and live within one of the 50 states or the District of Columbia.

- Be at least 18 years old (19 years old in Alabama and Nebraska)

- Can enter a legally binding contract

- Have a working email address

- Have a valid mobile number

- Valid delivery address in the United States

- Must be authorized to use the US-issued credit or debit card to make the purchase.

How Does Afterpay Work?

Once you’ve created an account, you’ll be given a small spending limit to start with. All you need to do is to select Afterpay during the checkout process and complete your purchase using their payment method.

Then, you’ll have to pay 25% as a down payment for your purchase and the remaining 75% should be paid over the next six weeks.

And Afterpay will never report your account to the credit bureaus, so late payments will not hurt your score and on-time payments will not build your credit score.

Spend Limit: Typically, new accounts start with a $500 limit, which eventually increases over time depending on how long you’ve been using Afterpay, purchase price, and on-time payments.

Repayment Terms: You get to repay your loan in four equal installments, due every two weeks with the first payment paid at checkout.

In other words, your purchase amount is broken down into four payments, with 25% paid during the checkout. And the other 75% is paid in equal installments every two weeks over the next six weeks.

Payment Methods: Afterpay currently accepts Mastercard, and Visa credit and debit cards issued in the United States.

Interest & Fees: All the Afterpay loans are interest-free and there are no hidden fees as well. Nonetheless, the only fee it charges is a late fee, which will be capped at 25% of the initial purchase and does not accumulate.

| Pros | Cons |

| Doesn’t charge any interest on purchases | Charges late fees |

| No credit check is required | It doesn’t offer other financial options |

| You have the ability to change your payment due date |

Afterpay vs Quadpay vs Klarna vs Sezzle: Grand Comparison!

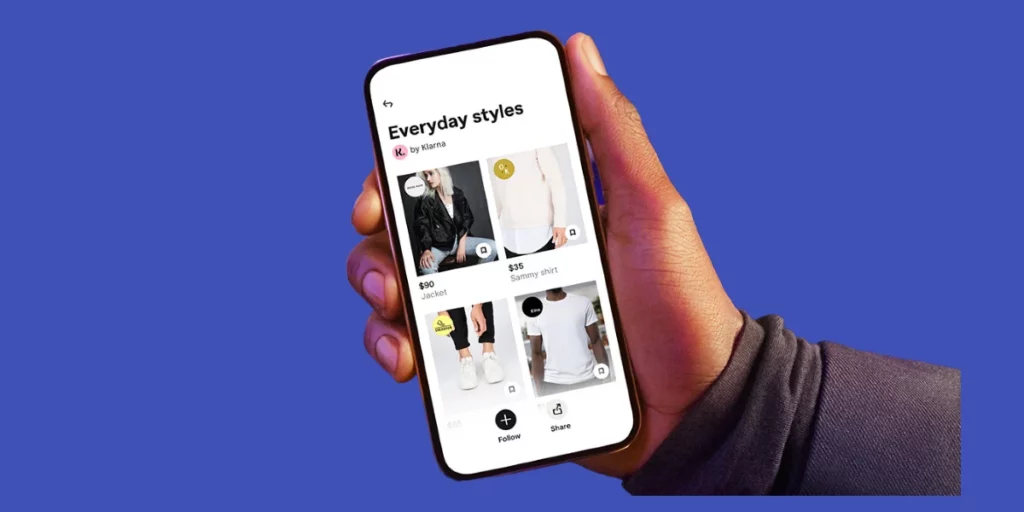

Klarna

Next on our list of the best apps like Zip Pay, we have Klarna. It provides online financial services like payments for online storefronts and direct payments with post-purchase payments.

With its BNPL service, it offers customers credit on their purchases as part of the checkout process. It is one of the largest services.

Unlike other apps that are listed in this article, through Klarna, you can make purchases at any US or Europe-based retailer that accepts debit and credit cards as it is partnered with over 200,000 retailers and merchants.

Moreover, you can enjoy its flexible payment schedules and plans!

Requirements for Eligibility

- You need to be at least 18 in order to use Klarna’s payment options

- Have a positive credit history

- Have a valid and verifiable email address and mobile number

- Don’t have a lot of debt

How Does Klarna Work?

Download the Klarna app on your device and give your personal information to create an account.

Then, it will determine your spending limit by performing a soft credit inquiry, your Klarna purchase history, and your personal information.

Since it performs a soft credit check, it will neither affect your credit score nor it’ll appear on your credit report.

And when you make a purchase, you can select from one of the three financing options – Pay in 4 or pay in 30 days or a 6 to 36-month loan.

You’ll also have the ability to view your process returns, purchase history, and even track your shipments.

Spend Limit: Although it doesn't specify any pre-set credit or spending limit.

You should remember that your spending limit and the ability to shop are based on Klarna’s soft credit inquiry, the information you give, and your buying history.

Repayment Terms: When you make a purchase, you can select from one of the three financing options – Pay in 4 or pay in 30 days or a 6 to 36-month loan.

Payment Methods: Currently, Klarna accepts all major debit and credit cards, such as Mastercard, Visa, AMEX, Discover, and prepaid cards are not accepted. Also, AMEX cards are not accepted when creating a One-time card.

Interest & Fees:

| Loan Type | Terms | Interest |

| Pay in 4 | Pay four equal installments with due every two weeks | Interest Free |

| Pay in 30 | Pay nothing for 30 days and then pay the complete balance | Interest Free |

| Longer Term Loans | Pay with a loan up to 36 months | 0% – 24%; 19.99% for standard purchases |

If you don’t pay your payment on time, you’ll have to pay a late fee of $7 for pay in 4 loans and the longer terms loans have a $35 late fee assessment.

| Pros | Cons |

| Different ways to finance purchases | Charges late fees |

| Set price alerts on your saved items | Needs soft credit check |

| Interest free on Pay in 4 financing | Sometimes it might report your missed payments to credit bureaus |

| Create virtual card numbers for other stores |

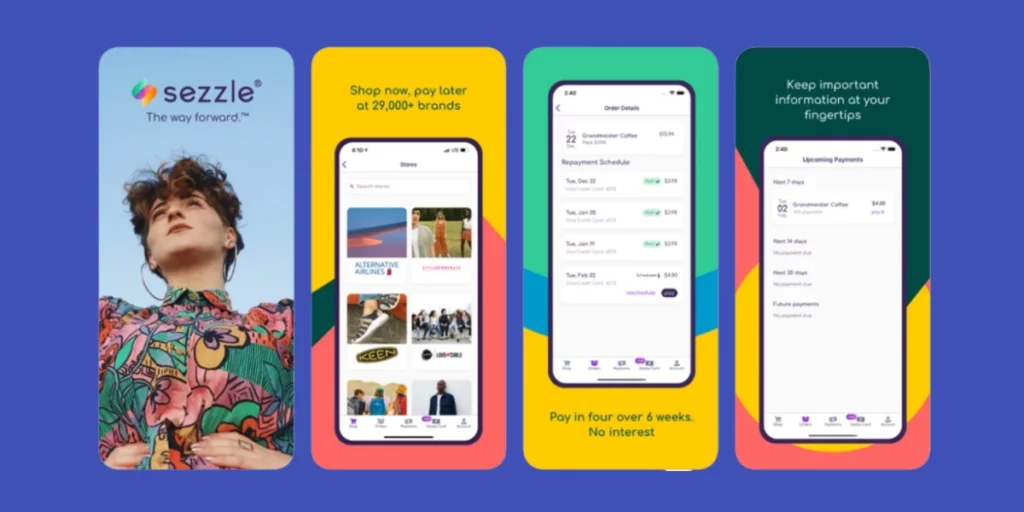

Sezzle

Sezzle is a digital payment platform that allows everyone to take control of their financial futures, spend responsibly and achieve financial freedom.

It operates as an alternative payment method that you can choose at checkout to enable payment with participating retailers.

You can purchase the most trending products in different categories as it is partnered with over 40,000 retailers. It even offers special perks program called Sezzle Up.

Through this program, you can access a wide variety of benefits like exclusive access to numerous stores and even boost your credit score.

Requirements for Eligibility

- Should at least 18 years old (19 in Alabama)

- Have a working email address and US or Canadian mobile number

- Must have a US or Canadian bank account, a debit card, or credit card—prepaid cards will not work for an initial purchase

How Does Sezzle Work?

As soon as you place an order, its exclusive approval process will examine your account and determine the type of plan you are eligible for.

And instead of relying solely on a customer’s FICO score for credit risk evaluation, Sezzle’s underwriting system assesses each order individually and takes into account multiple factors.

These factors include performing a soft credit score check, the customer’s order history with Sezzle, and the total purchase amount.

If you have paid off previous purchases on time are allowed to finance the purchase of more expensive products.

Spend Limit: The maximum amount you can borrow through Sezzle is $2,500 but not everyone will be approved for the full $2,500.

Yet, remember that your limit might increase if you make on-time payments and use Sezzle regularly.

Repayment Terms: The first installment is paid at the moment of purchase while the other three are due at regular intervals over the following six weeks.

Payment Methods: You can pay through your debit card, credit card, and bank account.

Interest & Fees: Sezzle doesn’t charge any interest or hidden fees. But the only fee they charge is a failed payment fee, which is $10 or reschedule fee.

That reschedule fee means, if you want to adjust the date of your payments more than once per order, you’ll need to pay $5 extra.

| Pros | Cons |

| No interest on purchases | Needs 25% down payment upon buying |

| Ability to reschedule following payments | Every extra reschedule is $5 |

| First reschedule is completely free |

7 Apps like Sezzle to Buy Now Pay Later [2022]

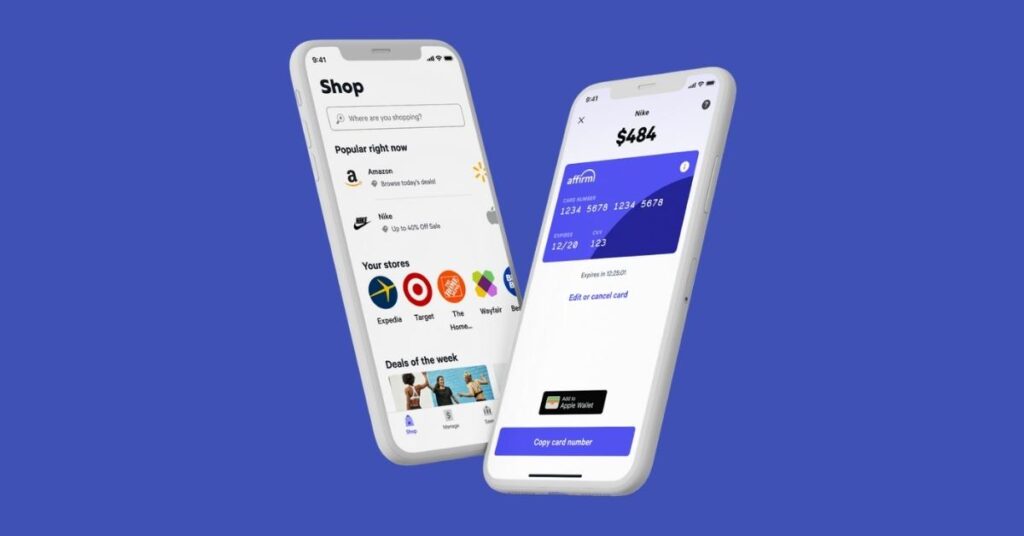

Affirm

Affirm is another Zip alternative that functions as a financial lender of installment loans for customers to use at the point of sale to finance a purchase.

Unlike a credit card, Affirm loans have a fixed payment schedule that you can view before the completion of each purchase.

Its main aim is to offer premium and client-oriented services, helping its users to have control over their finances.

Besides, it will also notify you earlier through text or email to make sure you don’t miss a payment. And even though it charges interest, a few retailer’s interest rates are as low as 0% on your purchases.

Requirements for Eligibility

- Must be 18 years or older (19 years or older in Alabama and Nebraska)

- Have a valid U.S. or APO/FPO/DPO home address

- Valid U.S. mobile or VoIP number that receives SMS texts

- Provide your full name, email address, date of birth

- Give the last 4 digits of your social security number to authenticate your identity

How Does Affirm Work?

Once you open an account with Affirm, you will have to qualify some requirements and then, you’ll get a maximum purchase amount.

After you enter the authorization code that you’ve received to your mobile, it’ll notify you of the loan amount you’re approved for, the number of months you’ll have to pay off your loan, and the interest rate.

And every time you try to purchase something, that transaction needs Affirm’s approval. At the checkout, you can view the payment options, which you can select depending on your budget.

You can choose the payment schedule that will be perfect for you and then confirm your loan.

Spend Limit: Mostly, the maximum amount you can access through Affirm is $17,000.

Your spending limit is based on your payment history, credit history with Affirm, and how long you have the Affirm account for.

Still, your credit limit can be increased by some factors, such as how you’re managing your existing loans, paying bills on time, and reducing debt balances.

Repayment Terms: You get to split your purchases up to three or six- or twelve-month payments to repay your loan. You can even pay off your loan early without any prepayment penalty.

Payment Methods: You can pay with your debit card or checking account. For some purchases, you can also pay by credit card for the down payment and installments. You can also pay by making a payment page.

Interest & Fees: Its interest rates are based on the retailers you are shopping with, and in some cases, your personal credit history.

Even though its interest rates may range from 10% to 30%, you may even find several retailers with financing as low as 0%.

Besides this, it doesn’t charge any fees on its loans or to create an account, and also there are no prepayment fees, late fees, service fees, or hidden fees.

| Pros | Cons |

| No late fees or prepayment fees | Requires a soft credit check |

| Interests can be as low as 0% | Interests can range from 10% to 30% |

| Credit limit can be increased based on your credit history |

Affirm vs Splitit: Complete Comparison [2022]

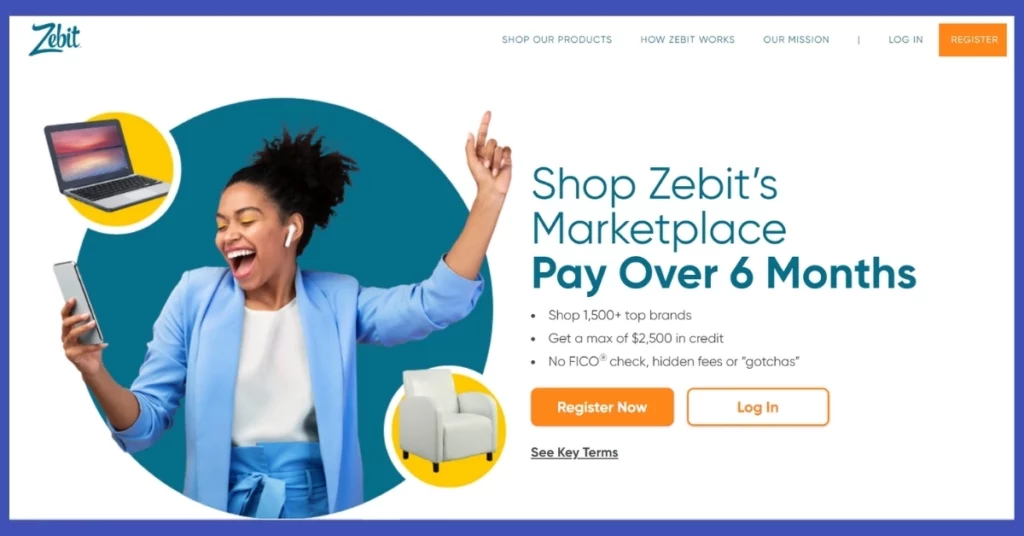

Zebit

Zebit is a convenient way to divide your item payment and pay over six months for 0% APR. It is one of the best apps like Zip that lets you browse the site and give you the chance to use a credit account.

You can access a wide range of products under popular categories like electronics, home décor, furniture, and many more.

It offers two products – Zebit Market and ZebitLine. Zebit Market is where you can purchase products completely interest-free. While ZebitLine is the amount of credit that you have to finance these products.

Requirements for Eligibility

- Be over 18 years old

- Have a valid Email address

- Have a valid, verifiable US mobile number

- Might verify your identity and your employment or income

How Does Zebit Work?

To get started with Zebit, you’ll need to fill out its application form and wait for their approval. It will verify your identity to check if you are eligible for its loan.

Within Zebit Market, you can purchase products completely interest-free and through the ZebitLine, you will have to finance these products.

More importantly, ZebitLine is only valid with your current employer, so you cannot leave your employer because ZebitLine will be discontinued.

Spend Limit: The maximum amount you can access through Zebit is $2,500.

Repayment Terms: You’ll have to make a down payment at the time of purchase and pay the remaining balance for the next six months.

Payment Methods: Zebit accepts credit and debit cards.

Interest & Fees: It does not charge interest, late fees, application fees, or membership fees.

| Pros | Cons |

| No late fees or any hidden fees | No return policy |

| Interest free | Few products can be overpriced |

| It won’t affect your credit score |

10 Best Sites Like Zebit to “Buy Now Pay Later” [2022]

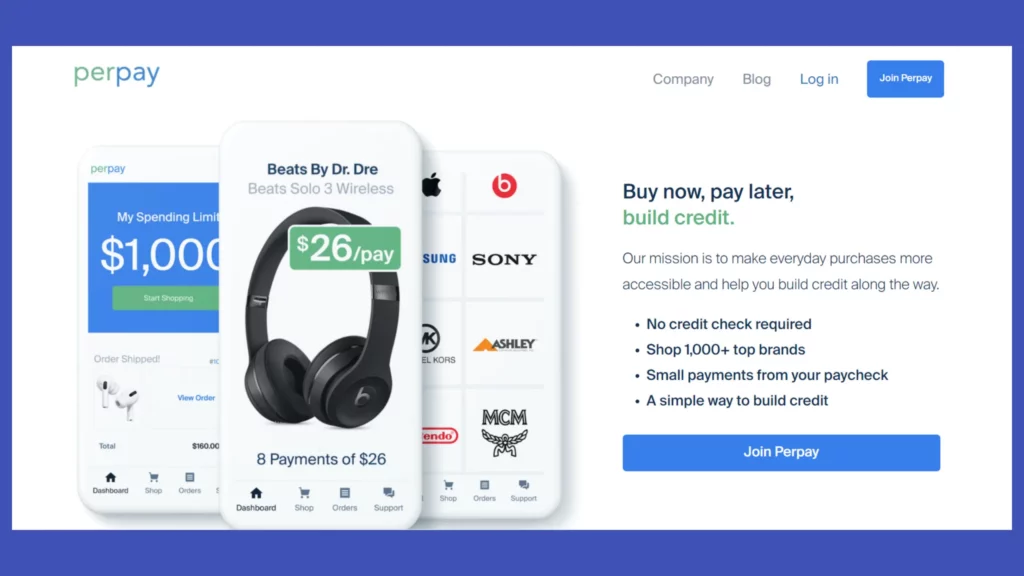

Perpay

The next Zip alternative we have is Perpay. Its main mission is to make everyday purchases more accessible and help out build credit along the way.

You can use your personalized Spending Limit to shop for things you want and need from their online marketplace

If you make on-time payments, you’ll get qualified for credit building. Unlike other apps like Zip that we have mentioned in this article, Perpay can help increase your credit score by reporting your on-time payments to Equifax and Experian credit bureaus.

Requirements for Eligibility

- Actively maintain full-time employment

- Be in good standing with all financial requirements

- A validated three months of employment history with your current company

- Ability to set up multiple direct deposits

- An active mobile phone

- No active bankruptcies

- Access to a complete copy of a recent pay stub

How Does Perpay Work?

In order to use Prepay, you’ll have to create an account by providing your personal information like phone number, email address, name, resident address, and Social Security Number.

Then discover your favorite products on the Perpay market, add them to your cart, and then apply for a review.

Once you submit the request, Perpay will examine your request. You’ll get an email with information regarding a suitable spending limit, how to make payment for your purchase, and get your product.

As soon as they receive your first payment, they will ship your products. You can then repay over time with an easy repayment schedule with no interest or any other fee.

Perpay states that you can view that your credit score increases after 4 months if you pay on time.

Spend Limit: The maximum amount you can access through Perpay is around $500 to $2500. Depending on how you use this service and your positive payment history, your spending limit might increase.

Repayment Terms: You can make payments in eight equal installments through a regular direct deposit. Note that these installments are directly deducted from your future paychecks.

Payment Methods: Perpay payments are made through payroll direct deposit & are received under your employer pay cycle.

Interest & Fees: Although it doesn’t charge any interest, you might have to pay a late fee of up to $35 if you miss a payment or if Perpay doesn’t the payment within six days of your due date.

| Pros | Cons |

| Interest-free payments | Charges a late fee of $35 |

| Low credit score won’t affect eligibility | |

| It doesn’t check your credit score or report to the credit bureau |

8 Best Sites Like Perpay to Buy Now Pay Later [2022]

PayPal Pay in 4

Everyone has probably used PayPal at one point or another

to send or receive payments. Pay in 4 is a PayPal’s new service that only

appears as a choice at the point of sale for users who have a PayPal account in

a good position.

So, if you have a negative balance in your PayPal account,

there is a probability that PayPal “Pay in 4” option will not appear in the

PayPal wallet.

Users can divide the cost of purchases between $30 and $1500

into four payments, which comprise an initial payment and three automatic

installments. These payments are interest free.

Requirements for Eligibility

- At least 18 years old

- Live within an eligible state within the United States

- Have a valid PayPal account connected to your credit or debit card

- Agree to have a soft credit check completed

- Complete a transaction valued between $30 and $1,500

How Does PayPal Pay in 4 Work?

All you need to do is to create a PayPal account by providing your basic information, and if you already have an account, you must ensure that it is in good standing.

When you are ready to make your purchase, you can choose the ‘Pay in 4’ option as a payment method during your check-out process. Remember that Pay in 4 option is only available if you are qualified.

Once they approve you, your purchase amount is divided into four equal installments, with the first payment paid at the time of your purchase and the three subsequent payments are paid in bi-weekly installments.

These payments are automatically deducted from your linked credit card, debit card, or bank account. That means you cannot use your PayPal balance to make payments.

Spend Limit: You can be eligible for purchases ranging from $30 to $1,500 that you make using your PayPal account.

Repayment Terms: The first payment is supposed to be made during the time of purchase. These repayments are deducted automatically from your PayPal account depending on the payment method you’ve selected.

Interest & Fees: It doesn’t charge any interest and there is no late fee as well. So, as long as you see the option for Pay in 4 at the checkout, you can even have multiple Pay in 4 plans at the same time.

However, the only fees PayPal charges are currency conversion fees on international purchases.

|

Pros |

Cons |

|

· No interest or any late fees |

· Pay in 4 option doesn’t appear if you have a negative balance. |

|

· Soft credit check doesn’t hurt your credit scores. |

· |

|

· Offers reports, analytics, and other useful tools that are easy to find |

· |

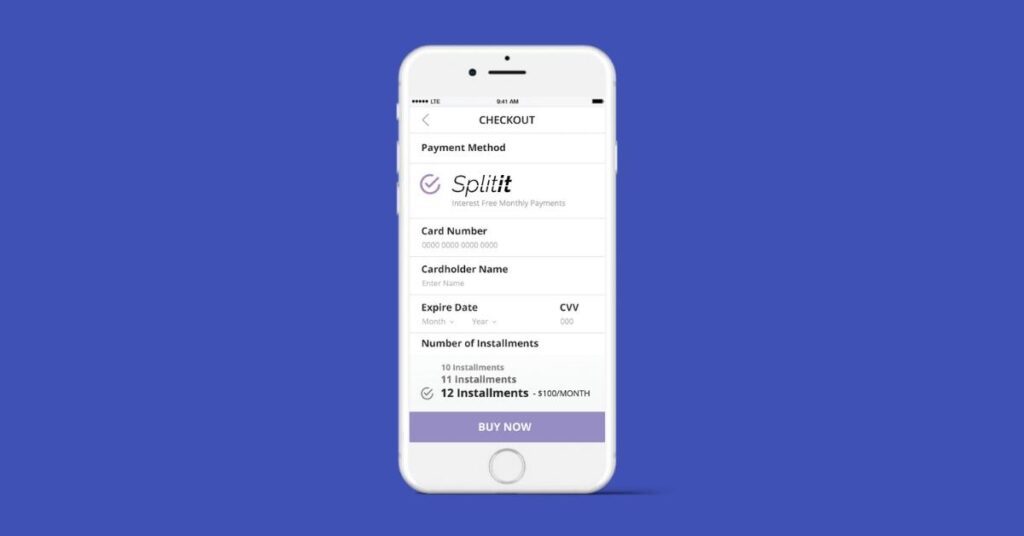

Splitit

Lastly, we have Splitit on our list of the best apps like Zip Pay. Splitit is a payment solution that lets you pay for your purchases by using an existing credit card and then split the billing cost into interest and fee-free monthly payments.

It is partnered with some famous sellers like James Avert and SofaClub to help you to choose a payment plan for your finances and lifestyle.

Unlike other services, you don’t need to be approved for a line of credit, and you can use your existing Mastercard or Visa debit or credit card.

Requirements for Eligibility

- Should be over 18 years old

- Have a valid email address

- Have a valid and verifiable US mobile number

How Does Splitit Work?

Unlike other Zip alternatives that we have listed in this article, Splitit doesn’t have an application process.

That means when you select Splitit as your payment option, either it will create automatic installment payments or you get to choose the number of interest-free payments that you’d like to make.

If Splitit approves you, you can use this payment method to manage your purchases. Before purchasing anything, it’ll make sure that you’ve available credit to complete the purchase.

You’ll then have to pay for your first installment on the day of your purchase and then each month on the same day for a number of installments you’ve selected.

And you’ll need to provide your email at the point of sale, and then you will be given login details for the Splitit consumer portal so that you can track your installments.

Spend Limit: Credit limits for debit cards are limited to $400 with a term of three months.

Repayment Terms: Its payments can be made over 3, 6, 12, or 24 months. You’ll have to pay for your first installment on the day of your purchase and then each month on the same day for a number of installments you’ve selected.

If you’ve used a debit card, it’ll automatically withdraw the required amount from your checking account. Thus, ensure you have adequate funds in your checking account.

Payment Methods: It supported Visa and Mastercard credit cards.

Interest & Fees: Splitit doesn’t charge any interest or fee to the buyers. However, it is important to note that fees and interest from your credit card may still apply.

And since the purchase goes on your credit card, the payments may be reported to credit bureaus.

| Pros | Cons |

| Doesn’t charge any interest | Retailers may place minimum or maximum buying values |

| Doesn’t perform any credit check | Has only limited retailers |

| No application process | |

| Can make early payments |

8 Apps Like Splitit to “Buy Now Pay Later” [2022]

Final Verdict: The Best Apps Like Zip!

With these Zip Pay alternatives, you can buy anything easily and pay off the remaining money later. Most of the apps are easy to use, interest-free, or have low fees.

Moreover, each of the apps mentioned above is trustworthy and reliable, so don’t hesitate to create an account with any of them.

Hopefully, the above article has helped you to find the best Zip alternative!

Compare The Best Apps Like Zip Pay

| Name of the App | Credit Limit | Interest | Credit Check | Minimum Credit Score | Late Fees | Term Length & Installments |

| Afterpay | $500 | None | None | None | 25% of the purchase amount | 6 weeks |

| Klarna | No specific pre-set credit or spending limit | None | Soft credit check | None | $7 for pay in 4 and $35 for longer term loans | Pay in 4 or pay in 30 days or 6-36-month loan |

| Sezzle | $2500 | None | None | None | $5 | 3 installments, due every two weeks |

| Affirm | $17,000 | 0% – 30% | Soft credit check | 550 | No | three or six or twelve months |

| Zebit | $2500 | None | Credit check with a third party | None | None | 6 months |

| Perpay | $500-$2500 | None | None | None | Up to 35 | Eight equal installments |

| Splitit | $400 | None | None | None | None | 3 to 24 months |

Shopping Tips

As there are several BNPL apps, it might be difficult to choose the perfect service when buying goods and services. Yet, sometimes we overlook a few things.

So, here is a small guide on how to choose the perfect best buy, now later service.

- Credit Score: If you have a bad credit score, it can be the best option to choose the BNPL service, which doesn’t check your credit score.

- Building Credit Score: If you want to build your credit score and want to have a good credit score, it makes sense to use apps that report your on-time payments to the major credit bureaus.

- Numerous Retailers: You may look for an app that is partnered with a wide range of retailers and is accepted at many stores. This will keep you from opening numerous accounts on different apps.

- Credit Limit: The spending limit or credit limit differs from company to company. So, based on the size of your purchase, search for the app that lets you complete your transaction easily.

- Fees: Fees makes an essential role to choose the perfect buy now, pay later service. Therefore, don’t overlook the fees or interest that the service may charge. Also, check whether you’ll be charged for late payments and early payments.

BNPL vs Credit Card

BNPL services are booming in growth, as they are an incredible alternative to credit cards. However, you should note that the availability of BNPL services does not mean that you can buy anything you want without limit.

Similar to BNPL loans, credit cards can also be used at retailers. Nevertheless, they charge a lot of fees, such as an annual fee, balance transfer fee, cash advance fee, foreign transaction fee, late payment fee, and more.

Here are some pros and cons that will help you understand why to use and why not to use these services.

Buy Now Pay Later

| Pros | Cons |

| You can apply online and get approved almost immediately | Payment plans are not always interest-free |

| Pay off purchases in installments, usually interest-free | Not all sellers accept buy now pay later services |

| Get approved without a hard credit check that can lower your credit score | Missing a payment or late payments can hurt your credit score |

| Choose a payment frequency that perfectly fits with your budget | Since you don’t have to pay in full right away, it is easy to overspend |

Credit Card

| Pros | Cons |

| Can be used at a wide range of retailers and for other purposes | if you carry a balance from month to month, interest charges can add up quickly |

| Potential to earn cashback, miles, or point on purchases | late payments could damage your credit score |

| Pay off purchases overtime at your own pace, without fixed installment payments | A hard credit check it usually required to qualify |

| Cards might offer other perks like rental car and travel insurance | Credit cards can change several fees that will be added up to your overall cost |

Lastly, we would to mention that it entirely depends on what kind of flexibility you need with your financing, and how much either option will cost you.

How to Delete Zip Account [Complete Guide] Best Alternatives Apps Like Deferit to Check Out

From UK? Try these 6 Apps Like Zilch to Buy Now Pay Later [2022]

![Top 7 Apps Like Zip to “Buy Now Pay Later” [2024]](https://viraltalky.com/wp-content/uploads/2022/01/apps-like-zip-alternatives.jpg)