Are you searching for the similar sites like Zebit or Zebit alternatives? Want to know which site offers you the best options? This article will show you a list of similar websites like Zebit to shop with Buy Now and Pay Later options. Zebit is one of the best platforms that offer interest-free credits.

Several sites offer BNPL (Buy Now, Pay Later) payment services, which permits you to pay for your purchase over time instead of paying them all at once. These options include rent-to-own, credit cards and lease-to-own programs and instalment plans.

One of the best features of Zebit is that it involves many interactive modules, a better encryption layer for safe usage, a newsletter feature and many more.

Even though it has several useful features, it might not be fit for you. So, it's always a good idea to look at some other alternatives.

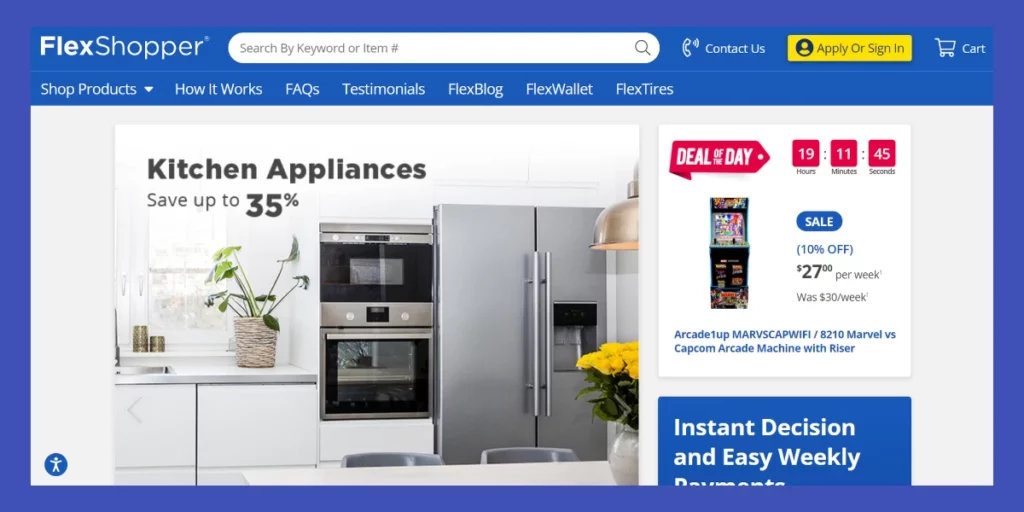

FlexShopper

FlexShopper is one of the best sites like Zebit. You can shop over 80,000 products, including top brand electronics, furniture, home appliances, mattresses, Televisions, video games, tablets, smart home, laptops, garden and tools, cameras, camcorders, tires, etc. much more.

The organization makes a majority of its income by leasing its products.

You can have the liberty to lease whatever you want from wherever you want.

All you need to do is to take a photo of the product you like and fill out a simple form. Products are delivered at your doorstep, or you can pick them up in stores.

Features

- It offers a wide range of products to select from.

- It leases you good under a rental-purchase agreement.

- There are over 1,40,000 new brand name items available with Flex Shoppers.

- The app has a direct deduction payment option.

- You can easily apply for FlexShopper by providing your name, age, date of birth, address, job details and other personal information.

- There is no advance payment and no hidden charges.

- It provides a detailed listing of every product with an overview, features, and fast response.

How Does it Work?

Download the FlexShopper app from Apple App Store or Google Play Store, or simply use FlexShopper on a web browser.

In order to get approved for a FlexShopper loan, you must be at least 18 years, needs to reside in the United States, valid checking account, valid SSN, phone number address and should have a source of income.

Even if you have a bad credit history, you’ll easily get an option of an instant spending limit of $2,500. Once you’re approved for a loan, you’ll have to choose the products you want to buy.

As you browse items in stores, click a photo of what you like to rent to own and then, they’ll process your request and send an electronic lease for you to sign.

Once you’ve selected the product or after it’s been delivered, your weekly payments will be automatically deducted.

How to Repay?

Weekly payments may vary by state but ranges from 7 days to 29 days. The Lease continues until you end it early or make all required payments for 52 weeks.

Under your lease, you make 52 weekly payments or access an Early Purchase Option to acquire the rented goods completely, or rent the goods for at least the starting term and terminate the lease whenever you want by making all needed payments and returning the products.

Also, you don’t have to pay any additional amount if you pay the full “Cash Price” of an item along with taxes within the first ninety days of your lease.

You can also be able to change your pay cycle by simply calling them at 855-353-9289 and providing your credit or debit card information.

Fees

Although it does not charge any interest rate for your purchases, late fees may apply if your payment is missed.

It charges a “Cash Price” for a cash sale of the product or $50 more charge than the cost of the merchant you’ve selected. Nonetheless, if you select various products simultaneously, they may reduce the Cash Price by $50.

Customer Support

If you face any issue with FlexShopper, you can email their customer support at resolutions@flexshopper.com or submit a request here.

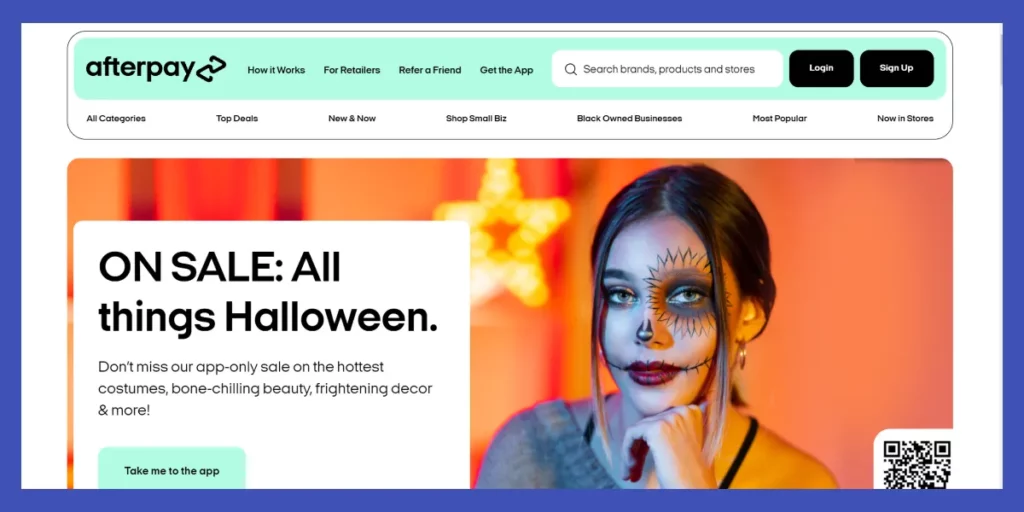

Afterpay

Afterpay is another Zebit alternative operating in the United Kingdom, the United States, Canada, Australia and New Zealand.

It is popularly known for its “pay later” service, which allows in-store and online consumers to buy a product immediately and pay for it later with four equal repayments without being charged.

It is fully integrated with your favourite stores. First-time users can provide payment details as usual, and then products will be delivered to you by the seller.

You can log in at any time to check your payment schedule and make the payment before the due date. Otherwise, they’ll automatically deduct money from your credit or debit card.

Features

- Payment for their purchase in four instalments over a six-week period.

- It doesn’t charge any interest, but it can charge late fees if you don’t make the payment on time.

- You can use it to view your current and past Afterpay orders, as well as your payment history.

- You can also change your payment card for future payments if you want to be more flexible with your finances.

- Use the app to shop and keep track of all your orders and your payment schedule.

Afterpay vs Quadpay vs Klarna vs Sezzle: Grand Comparison!

How Does it Work?

You can easily create an Afterpay account by providing your basic personal information, including your name, address, debit or credit card number, phone number, date of birth and email address.

There will be no credit check, and you don’t have to give your Social Security Number. Once you’ve created your account, you’ll be given a small spending limit to start with.

A lot of new accounts start with a $500 limit and the limit eventually increases over time depending on how you utilize it and with on-time payments.

Even though it doesn’t charge any interest, it charged a late fee and your account will be frozen for new purchases till you pay your payments.

Also, remember that on-time payments will not enhance your scores and late payments will not make it bad.

How to Repay?

You’ll have to pay in four instalments for over 6 weeks. Your first instalment should be paid at the time of purchase, and the remaining can be paid in the next 6 weeks.

Afterpay accepts domestic debit and credit cards. The easiest and simplest way to repay is its automatic payments system. You just have to open the app and enter the details of your selected payment card under the “Add a Payment Method.”

Fees

Afterpay doesn’t charge any interest and these loans are interest-free with 25% payments upfront and 25% payments every two weeks till the loan is paid incomplete.

So, there are no fees on any loans as long as you make your payments in time, if you pay late, you are supposed to pay a $10 late fee, plus an extra $7 if the payment is not after seven days.

Customer Support

If you face any issue with Afterpay, you can email their customer support at info@afterpay.com.au or call them at 855-289-6014.

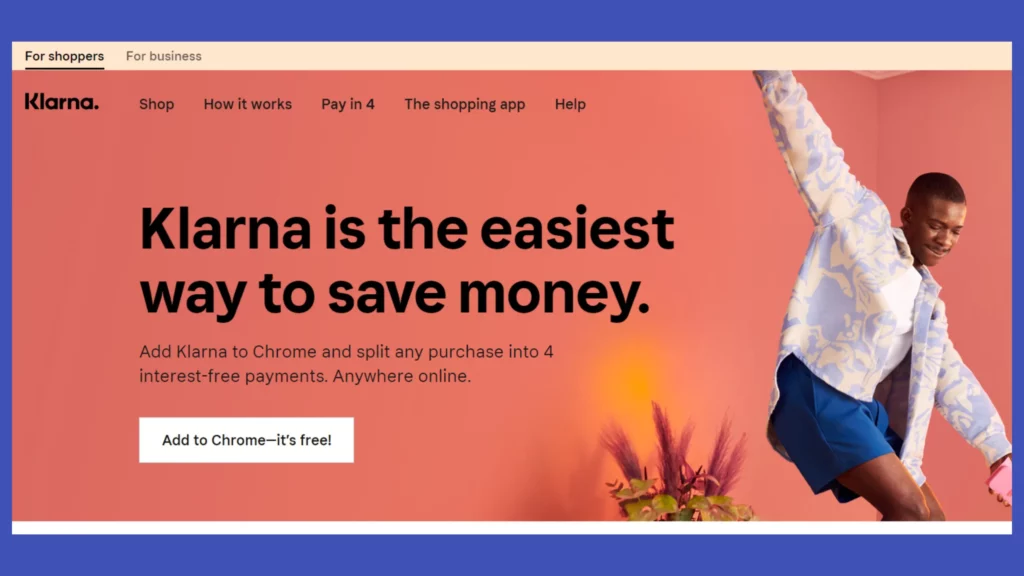

Klarna

Klarna is a Swedish company, which also operates in few other countries. It offers online financial services, including direct payments along with post-purchase payments and payments for online storefronts.

It mainly focuses on offering payment solutions for the e-commerce industry. It is developed to make payments safe and secure for sellers and buyers by managing store claims and buyer payments.

Klarna enhances your checkout experience by offering pay after delivery options, direct payments, and installment plans, letting customers pay whenever they want.

It identifies the user and permits one-click repeat buying across Klarna's merchant network, which results in improved conversion rates and average order value.

Features

- Its point-of-sales loans for in-store and online let consumers to buy now and pay later.

- You can pay in four installments for every two weeks and these installments are interest-free.

- It might charge a late fee of up to $7 if the payment is failed after two tries, and there is no penalty for early payment.

- It gives payment solutions for the e-commerce industry.

- It is particularly created to make payments safe and secure for buyers and sellers by managing customer payments and store claims.

- Explore online stores, pin your favorites and share your saved items with your friends.

- Get information on your purchase and track them from store to door.

How Does it Work?

Shop with Klarna via mobile app or through the website. Your spending limit and the capability to shop are determined by Klarna's soft credit inquiry, your buying history, and your personal information.

Select one of three financing options during your purchase- Pay in four or pay in 30 days or a six- to 36-month loan.

The pay in four is a 0% interest option which needs a 25% down payment at the time of buying, then three equal, biweekly payments for the remaining balance.

Pay in 30 finances provide you time to try out your products, return what you don't want, and pay for the rest in one big payment. The longer-term loans need monthly payments until the balance is paid in complete.

View your purchase history, process returns, and track your shipments through the mobile app. Users can be able to create a wish list of items for future buying or to share with family and friends.

If the price drops on any item on your wish list, it'll give you a notification. Klarna is one of the few BNPL apps which provides a loyalty program that rewards users.

How to Repay?

Fees

It doesn't charge any interest on its Pay in four finances. You'll never pay more than your initial purchase price, as long as you make your payments on time.

Nevertheless, it does charge a late fee. This means if you don't pay your payment on time, you'll be charged a fee of $7, and the longer terms loans have a $35 late fee assessment.

Customer Support

If you face any issue with Klarna, you can email their customer support at hello@klarna.com or call them at 844-552-7621. You can also send a message via the Klarna app, or even online chat on the Klarna website.

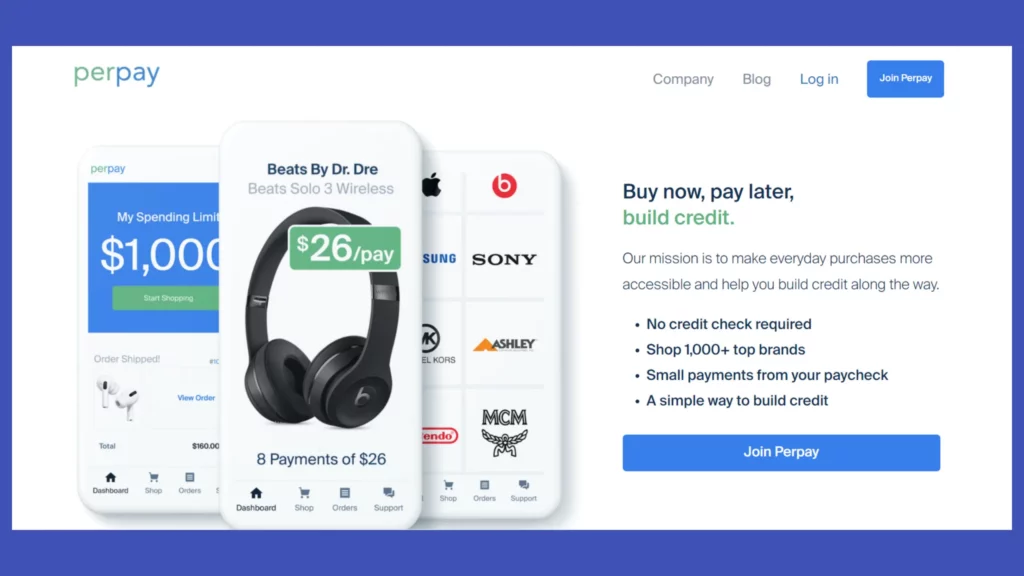

Perpay

Perpay is a website and an application that help you build credit through small payments. It doesn't perform any credit checks.

You'll get a customized spending limit when you provide your basic information, such as income and employment data.

After your order is approved, most products are shipped in the following three to five business days. However, delivery is typically made within 3- 4 weeks for larger products like furniture and other large appliances.

Features

- It doesn't charge any hidden fee or interest or credit check.

- Use your custom-made spending limit to shop for the products you desire.

- Perpay will repeatedly apply your account history towards helping you build credit.

- Select your favorite product, fill the cart and choose Perpay as your payment option.

- Automatically pay overtime for your order with a small amount from every paycheck.

- Every on-time payment helps you build your history, you can see your credit score increase after just 4 months.

7 Best Sites Like Perpay for Buy Now Pay Later [2021]

How Does it Work?

Perpay users can buy products and repay over time by a simple and easy scheduled payment, with no fees and no interest.

You might have to give your personally identifying information like your name, house address, email address, Social Security Number, telephone number, and financial information like income, employment, and bank account information.

You should actively have an active mobile phone, maintain full-time employment, have access to a complete copy of a recent pay stub, and your minimum annual income should be $15,000. Once your profile setup is completed, you'll get an estimated spending limit to use.

Find your favorite products on the Perpay market, add them to your card and submit your application for a review. It will analyze your request and offer a permitted spending limit and a conclusion on your requested application.

Once your application is accepted, you'll get an email with guidance on making payments and getting your products. Your products will be shipped after they receive your first payment.

How to Repay?

Payments are done through direct payroll deposit and are received according to your pay cycle, this included weekly, fortnightly or monthly.

Apart from payroll payments, additional payments can be done through card or authorized bank accounts. As soon as your order is approved, you'll get complete instructions on how to set up your payment.

Fees

Perpay doesn't charge any interest or hidden fee. It also doesn't charge any extra fee for late or missed payments.

Customer Support

If you're facing any issue with Perpay, you can email their customer support at hello@perpay.com or call them at 215-834-4200.

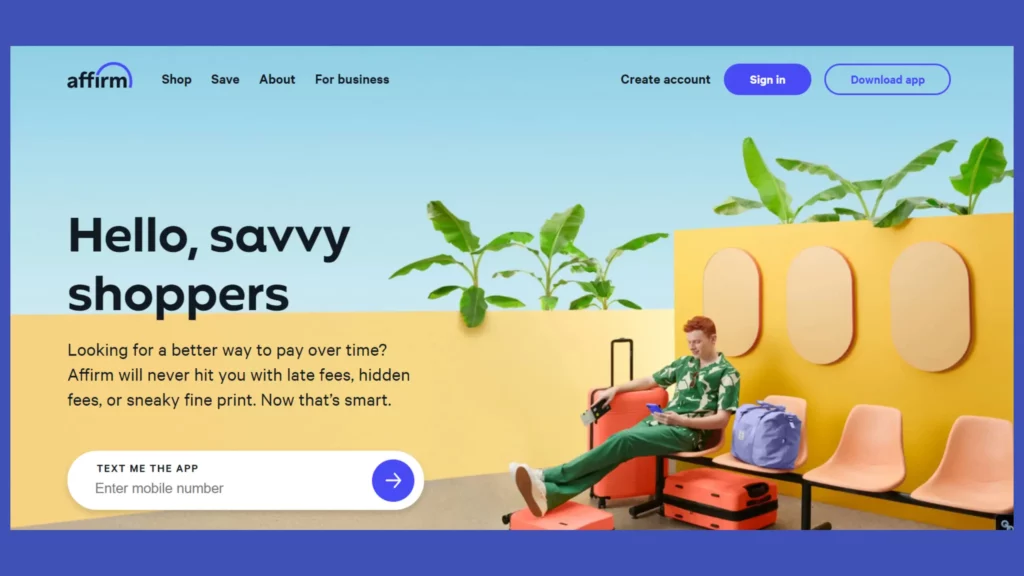

Affirm

Affirm operates as a financial lender of installment loans for customers to sue at the point of sale to finance a purchase.

It let you shop anytime at any store and pay over time with no penalties, no late fees, or hidden costs of any kind.

It doesn't charge hidden fees or any kind of fees like late fees. Nevertheless, your ability to shop may be prevented if you make on-time payments.

Payments will be automatically withdrawn from your debit card or bank account. Depending on your personal data and credit report, you'll be prequalified to make purchases on your spending.

Features

- No late fees, penalties, or hidden costs of any kind.

- Find your favorite store and complete your purchase at a physical store with Affirm app or from Affirm's official website.

- Open a high-yielding savings account with no minimums and no fees.

- Payment options are subjected to an eligibility check and might not be available in every state.

- AutoPay lets you to make automatic payments.

How Does it Work?

First, download the Affirm application from Apple App Store or Google Pal shop your favorite stores and then choose Affirm at the checkout and enter your information and find out whether you are approved for a loan or not.

Affirm checks out how you manage your existing loans when approving you for new buy now and pay later services.

Other factors like reducing debt balances, paying bills on time, and restricting how regularly you apply for new credit might also help you to get a higher credit limit.

If you are approved, choose the payment schedule which will fit you and then confirm your loan. Your credit limit is based on your credit history, payment history with Affirm, and your Affirm account's time length.

If you want for a credit limit, you'll have to pay off your current Affirm loan on schedule and should work on enhancing your credit score overall.

How to Repay?

Affirm lets you choose your payment option. This means you can choose to split your purchases up to three or six or twelve payments.

You can pay with your debit card or checking account on the Affirm site or through the Affirm application.

You can also make automatic payments by enabling the “AutoPay” feature. It'll automatically deduct your monthly payment from your bank account or debit card on every due date. Note that different purchases may have different AutoPay settings.

If you want to pay off your loan early, you can pay without any prepayment penalty.

Fees

It doesn't have any prepayment fees, late fees, service fees or hidden fees. Nevertheless, it doesn't guarantee that you'll be approved for zero-interest financing.

Your APR can range from 0% to 10% to 30%, depending on your credit and eligibility. For some purchases, you might be required to pay a down payment.

Customer Support

If you face any issue with Affirm, you can email their customer support at help@affirm.com or cares@affirm.com or call them at (855) 427-3729. Visit Affirm's help centre for more information.

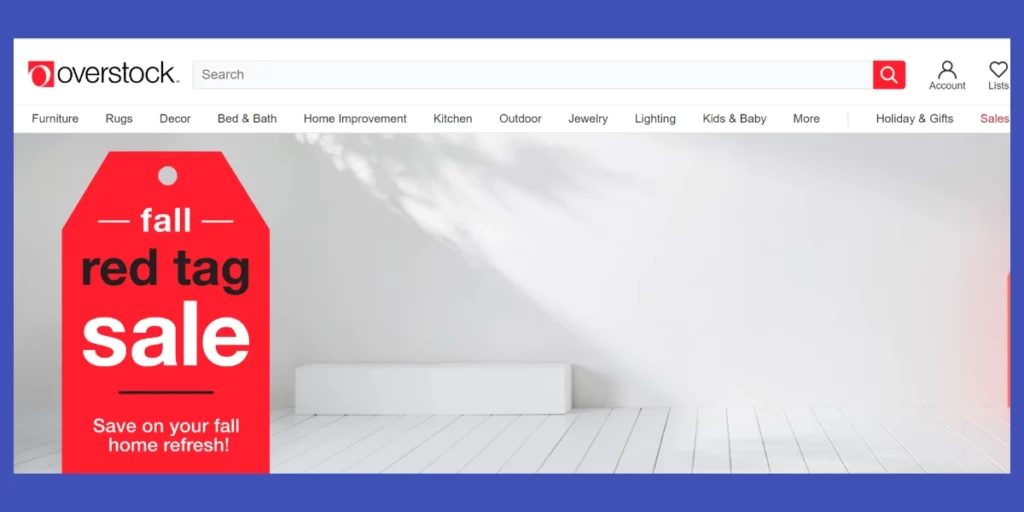

Overstock

Overstock is an American online retailer that primarily sells furniture. It is one of the best sites like Zebit, which help you find designer brands and home goods at the cheapest prices online.

The company continues to sell furniture, home decor, bedding, handmade goods and many other products that are closeout merchandise, nevertheless, it also sells new merchandise.

Overstock also manages the inventory supply for other vendors. The organization originally sold entirely surplus and returned products on an online e-commerce marketplace, settling the inventories of at least 18 failed dot-com companies at less than the wholesale prices.

7 Best Sites Like Overstock to Buy Furniture [2021]

Features

- You can shop for furniture, electronics, home décor and many more.

- Free shipping for US orders over $45.

- It can be your reliable store for furniture and other home enhancement products.

- You’ll have the ability to find liquidation and clearance products.

- If offers a large number of brands and manufacturers.

How Does it Work?

In order to access Overstock, you must be 18 years or older, have a routing and account number for an open and active checking account, a valid Social Security Number of ITIN, and a credit or debit card.

It offers two different financing options – Overstock Store Credit Card and Lease-To-Own. OverStock Credit Card lets consumers pay up to 24 months for zero interest.

It has a minimum purchase of $249 for 6 months term, $499 for 12 months term, $1499 for 18 months term and $1999 for 24 months term.

The lease-to-own option permits up to 90 days to pay off your lease in flexible weekly, fortnightly or monthly options. The initial payment is only $49 and it doesn’t charge an application or processing fee.

It doesn’t require any credit check, and Progressive Leasing gathers data from credit bureaus with no credit needed.

How to Repay?

Payments will be automatically deducted from your bank account or charged to your card. Charges will appear on your statement as Progressive Leasing or Prog Lease.

You can also make payments by visiting here or by calling them at 1-855-810-2546.

Fees

Overstock doesn’t charge any interest or application fees or processing fees.

Customer Support

If you face any issue with Overstock, you can email their customer support at customercare@overstock.com or call them at (800) 843-2446.

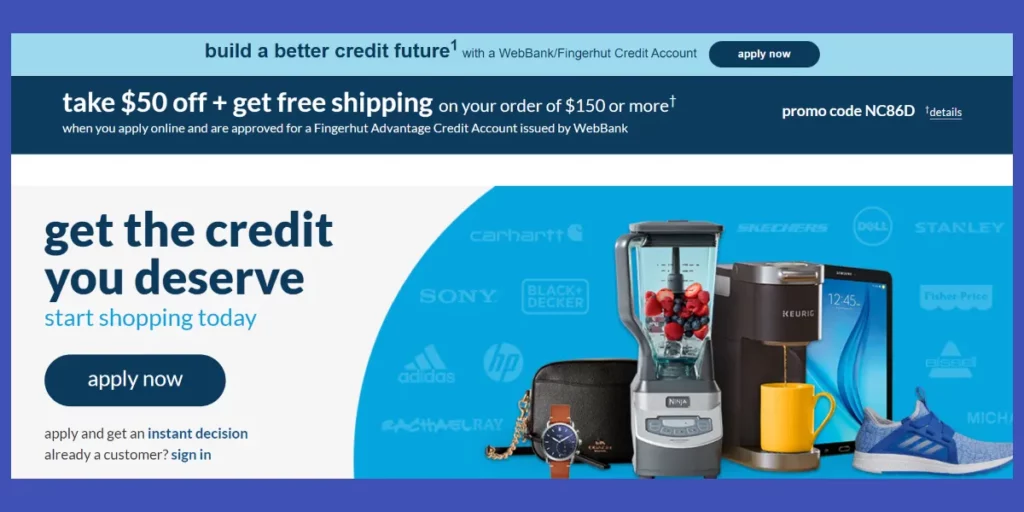

Fingerhut

Fingerhut is one of the finest Zebit alternatives. They initially used to sell automobiles seat covers, later, the business moved itself as a mail-order catalog corporation and expanded its products to include dishes, tools, towels and many more. It offers two types of accounts:

Fingerhut FreshStart Credit Account and the Fingerhut Advantage Revolving Credit Account.

Today, it is different from other online vendors in that consumers can pay with credit, and make monthly payments up until their orders are completely paid off.

It has passed through many ownerships during its existence, this includes one-time ownership by American Can Company, Petters Group Worldwide and Bain Capital Ventures.

Features

- It lets you find various clothing, health, electronics, toy and beauty items.

- Users can apply for a credit account that is issued by WebBank.

- It offers two types of accounts – the Fingerhut FreshStart Credit Account and Fingerhut Advantage Revolving Credit.

- Easy to get for people with limited or no credit history.

- No annual fee and 10% back through the payment rewards program.

How Does it Work?

Fingerhut provides two credit account – WebBank/Fingerhut Advantage Revolving Credit and Fingerhut FreshStart Credit Account. When you apply for a credit on Fingerhut,? you're actually applying for both of its credit accounts.

The Fingerhut Revolving account might or might not need a one-time down payment when you place your first order.

You'll be automatically considered for a Fingerhut FreshStart account if you aren't approved for the WebBank/Fingerhut Advantage Revolving Credit account.

Whereas, The Fingerhut FreshStart is a three-step instalment credit plan. If you are approved, you'll have to make a one-time purchase till your credit limit.

Then, make a down payment of $30, and your order will be shipped to the address you've provided. Later, pay off the remaining balance in numerous monthly payments.

If you make your payments on time and for the full amount, and you may be rewarded with a revolving WebBank/Fingerhut Credit Account.

Both lines of credit are issued by WebBank and are created to allow you to buy Fingerhut's wares and pay for them on a payment plan with an APR of 29.99%. Once you are approved for one of the credit loans, you can shop and place your order.

How to Repay?

WebBank/Fingerhut FreshStart Credit Account Agreement permits you to make your starting purchase by making a down payment of $30 to Fingerhut and 6 or 8 low monthly payments on your Loan.

The Annual Percentage Rate is 29.99%. Visit here for more information.

Your on-time payments will be reported to all the three major credit bureaus, which may help to increase your credit scores.

Fees

With a WebBank/Fingerhut Credit Account, there are NO annual fees, membership fees or over-limit fees.

The only extras are the interest you might be charged on your account, is late fees and/or any return payment fees. Return and late payment fees can be up to $40.

Customer Support

If you face any issue with Fingerhut, you can email their customer support at customerservice@fingerhut.com or call them at 1-800-208-2500 or 1-800-603-7052.

Visit its customer service page for more detailed information.

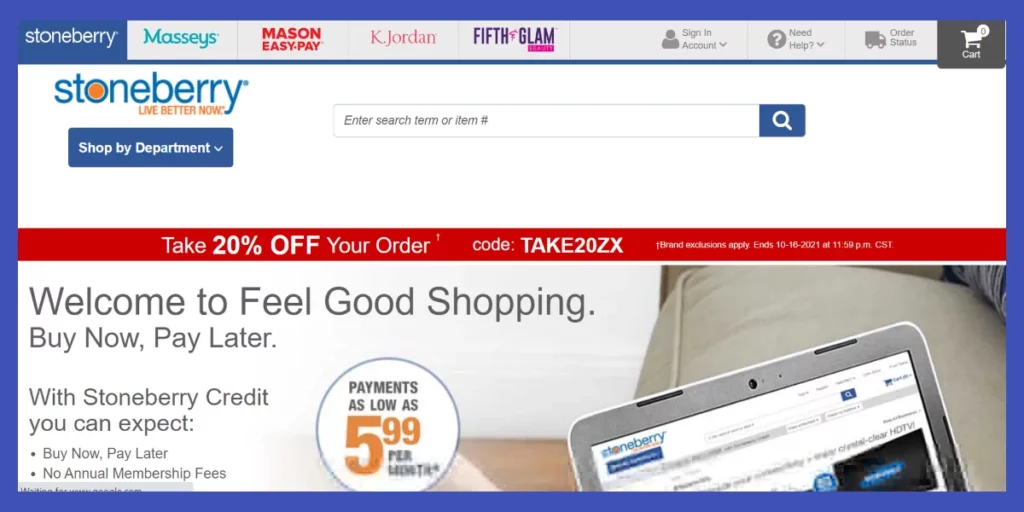

Stoneberry

Stoneberry is one of the prominent shopping retail web services which gives you the ability to purchase a product on a credit basis.

It comprises several features, and the users will not face any kind of problem while purchasing any product. This site is limited to certain regions of the world, and it is not available everywhere.

Stoneberry provides good merchandise with assurance and accepts credit and debit cards.

It also offers promo code, sales and a contact support feature that lets a live agent communicate with the consumer directly and solve any issue.

Features

- You can be able to apply for a special kind of credit to use.

- It comprises several features, and the customers don't face any issue while buying anything.

- It also has a mobile application for both iOS and Android devices.

- It offers free shipping and a good return policy.

- Pay in monthly instalments for the products you've purchased.

- You don't have to provide your credit card details unless you make a purchase.

- No additional fees for shopping.

How Does it Work?

Rather than offering a BNPL service for an extensive list of online sellers, Stoneberry Credit only works with the seller's own online products.

Customers shopping online with Stoneberry or one of its brands can access Stoneberry Credit. These brands comprise Mason Easy-Pay, K. Jordan, Masseys, and Fifth & Glam.

You'll have to fill out a prequalification form before you start shopping. Once you're approved, you can add the things you desire to your cart and place your order.

Since it doesn't have a minimum purchase size, you can use its credit to buy any product through Stoneberry or one of its brands.

Furthermore, it also doesn't have a maximum purchase amount. However, new users might be restricted to a credit line of $1,000. Down payments should be made if your order exceeds your eligible price.

How to Repay?

Every month by the due date on your monthly statement, you'll have to pay at least the ‘Minimum Monthly Payment' with any past due amounts.

It offers three suitable ways to make your payments – Mailing your payment, making payment online using a credit or debit card and by calling their customer service at 1-800-704-5480.

If the company has received your payments before 5 PM, it is considered an “On-Time” payment. Based on your ‘Highest Net Purchase Balance', your minimum monthly payment is calculated.

If you've accidentally paid in excess of your minimum monthly payment, it'll reduce your balance and finance charges.

Paid over monthly will not prepay or be approved against future Minimum Monthly Payments.

Fees

It doesn't charge any over the limit or annual fee, and if you pay your complete balance by the due date every month, you'll not be charged interest on your purchase. Your due date is a minimum of 25 days after the close of every billing cycle.

However, if you fail to make the minimum monthly payment by the due date, you'll be charged a late fee of up to $15 and your late fees and annual percentage rates depend on the state you live.

It boasts itself as it offers payments as little as $5.99 every month. Visit here for more information.

Customer Support

If you face any issue with Stoneberry, you can email their customer support at service@stoneberrry.com or call them at 1-800-704-5480.

Try these Sites Like Stoneberry for Online Shopping [2022]

Midnight Velvet

Midnight Velvet is one of the sites like Zebit. It is an American online store that is dedicated to offering a clothing line for women.

The basic operating of a site contains a store-like interface that gives distinct feminine products, and it is available in major regions of Canada and the United States.

One of the best features of Midnight Velvet is that it lets you purchase products on a credit basis, and it lets you rent a product and pay it per month based on its requirement.

Once you’ve ordered any product, you can be able to track the product and also, it lets you put your credit card information on its website.

Features

- It lets you track your order.

- It is available in major regions of Canada and the United States.

- Its dropdown menu assists you to get to the certain brand that is present on the website.

- You can enter your payment details during the time of purchase.

- It lets you purchase items on a credit basis and permits you to rent an item and pay for it later.

How Does it Work?

Just like other store-branded credit services, Midnight Velvet Credit works in the same way, but there are some differences that make it different from others.

Midnight Velvet credit is not issued through any national or state-chartered bank, and it provides credit directly to you.

This means there are no third-party fees. It mainly offers credit to those who might not qualify for traditional banks or store credit cards.

Your available credit increases and decreases based on how much you have purchased, your credit limit, and how much you have paid.

It regularly checks in-company payment, active accounts and external credit history to decide who can qualify for a credit limit increase.

Don’t forget that on-time payments can be the main key to qualify for a limit increase.

Once you are approved for a loan, it permits you to buy now and pay your balance in up to 47 months with low monthly payments.

If there’s any issue with your previous credit performance or your order is large enough, then you might have to pay some portion of your order total prior to shipment.

How to Repay?

As soon as you have received your first billing statement, payments can be completed on account in different ways – online, by mail and by phone.

If you want to make a payment online, navigate to “My Account” and log in to regulate your account. T

Check your account balance & credit limit, navigate to make a payment, and enable automatic payment service.

Call 800-648-0566 to make a payment using its automated voice-response system or mail a payment envelop.

Within five days of shipping your order, your first monthly billing statement is sent. By the date of your first billing statement, your account due date is created.

Your payment will be due on the same date each month, starting around 30 days after your first statement is produced.

Fees

It doesn’t charge any annual fee and has a fixed purchase APR of 5.75% to 25.99%.

However, if you fail to make the minimum monthly payment by the due date, you’ll be charged a late fee of up to $15 and your late fees depending on the state you live.

Based on the size of your balance and the number of payments you’re going to make, your monthly payments depend. The lowest monthly payment you can get can be as low as $20.

Customer Support

If you face any issue with Midnight Velvet, you can email their customer support from here or call them at 1-800-549-0367 on Monday to Friday between 8 Am and 12 Am.

Seventh Avenue

Seventh Avenue is another best site like Zebit that lets you purchase and view each & every type of product available on this site.

It offers home décor and most basic household products, which you can find under various exclusive offers and discounts.

It is only available in the United States and few parts of Canada. Likewise, it protects your transaction details from any third-party access during the purchase.

Furthermore, it offers a live agent who guides you through every issue you face.

Features

- Available in the United States and few parts of Canada.

- Protects your transaction details during the purchase.

- Offers home decor and most basic household items.

- You can get about 2,400 dollars credit for shopping.

- Mainly recognized for its home furniture and décor products.

How Does it Work?

Like other store-branded credit services, Seventh Avenue Credit works in the same way, but some differences make it different from others.

Seventh Avenue credit is not issued through any national or state-chartered bank, and it provides credit directly to you.

This means there are no third-party fees. It mainly offers credit to those who might not qualify for traditional banks or store credit cards.

Your available credit increases and decreases based on how much you have purchased, your credit limit, and how much you have paid.

It regularly checks in-company payment, active accounts and external credit history to decide who can qualify for a credit limit increase. Don’t forget that on-time payments can be the main key to qualify for a limit increase.

Once you are approved for a loan, you can buy now and pay your balance in up to 12 to 47 months with low monthly payments.

If there’s any issue with your previous credit performance or your order is large enough, then you might have to pay some portion of your order total prior to shipment.

How to Repay?

As soon as you have received your first billing statement, payments can be completed on account in different ways – online, by mail and by phone.

If you want to make a payment online, navigate to “My Account” and log in to regulate your account.

Then, check your account balance & credit limit and navigate to make a payment and enable automatic payment service.

Call 800-810-7064 to make a payment using its automated voice-response system or mail a payment envelop.

Within five days of shipping your order, your first monthly billing statement is sent. By the date of your first billing statement, your account due date is created.

Your payment will be due on the same date each month, starting around 30 days after your first statement is produced. Pay off your purchase in 12 to 47 months.

Fees

It doesn’t charge any annual fee and has a fixed purchase APR of 5.75% to 25.99%.

Based on the size of your balance and the number of payments you’re going to make, your monthly payments depend, which can be as low as $20 for products priced up to $2,000.

Customer Support

If you face any issue with Seventh Avenue, you can email their customer support from here or call them at 1-800-218-3945 on Monday to Friday between 8 am and 12 Am.

Ashro

Ashro is a place for women’s shopping and clothing lines. It integrates several small brands to work as a united store and service provider under a single place.

The basic function of the site is that it is a web-based service, and all the elements are combined effortlessly on the web-based service. It lets you choose products and deliver them at your doorstep.

Its monthly payments can be as low as $20 per month, based on how your application is viewed.

Once you’ve finished shopping and started the checkout process, the application process will be started. Just like Midnight Velvet, Ashro also offers both men’s and women’s clothing.

Features

- Once you select your desired products, it’ll deliver them right to your doorstep.

- Products are displayed with descriptions.

- Various ways to guide the user in locating each product.

- Offers you a promo code and several schemes for buying an item on the site.

- It doesn’t charge any interest or additional fees.

- Minimum EMI cost.

How Does it Work?

Just like other store-branded credit services, Ashro Credit works in the same way, but there are some differences that make it different from others.

Ashro credit is not issued through any national or state-chartered bank and it provides credit directly to you. This means there are no third-party fees. It mainly offers credit to those who might not qualify for traditional banks or store credit cards.

Your available credit increases and decreases based on how much you have purchased, your credit limit, and how much you have paid.

It regularly checks in-company payment, active accounts, and external credit history to decide who can qualify for a credit limit increase.

Don’t forget that on-time payments can be the main key to qualify for a limit increase.

If there’s any issue with your previous credit performance or your order is large enough, then you might have to pay some portion of your order total before shipping.

How to Repay?

Payments can be completed on account in different ways – online, by mail, and by phone. If you want to make a payment online, navigate to “My Account” and log in to regulate your account.

Then, check your account balance & credit limit, navigate to make a payment, and enable automatic payment service. Payments submitted online must be a minimum of $5.00.

Call 866-243-3114 to make a payment or mail a payment envelop to Ashro, Credit Dept. PO Box 2826. Monroe, WI 53566-8026.

The monthly payment price is based on the product price with shipping and processing charges and any applicable size/wt. Charges. Visit here for more information.

Fees

It doesn’t charge any annual fees; the interest rate varies from state to state (between $0 to $1.00), and it has a fixed purchase APR of 5.75% to 25.99%.

Your due date is at least 25 days after the close of each billing cycle. If you fail to make the minimum monthly payment by the due date, you’ll be charged a late fee of up to $15 and your late fees depending on the state you live.

Visit billing page for more information on Ashro’s fees.

Customer Support

If you face any issue with Ashro, you can email their customer support at https://www.ashro.com/cm/email-us/ or call them at 866-243-3114.

From Australia? Best Buy Now Pay Later Apps in Australia [2022]

Emporium

Emporium is one of the best sites like Zebit. It can be the solution for all your requirements and it is a direct seller where you can easily purchase products at affordable prices on low monthly installments.

You’ll have the ability to select from tens of thousands of products. It offers a wide variety of shopping categories like clothing, appliances, electronics, home goods, and many more.

Features

- Immediate approval of the account.

- There is no additional fee or any hidden charges.

- It gives you a limit of up to $5000 credit.

- It doesn’t require any credit card or credit statement.

Emporium is one of the similar sites to Zebit, which offers the BNPL option. It can be the solution for all your requirements, and it is a direct seller where you can easily purchase products at affordable prices on low monthly installments.

You'll have the ability to select from tens of thousands of products. It offers a wide variety of shopping categories like clothing, appliances, electronics, home goods, and many more.

Features

- Immediate approval of the account.

- There is no additional fee or any hidden charges.

- It gives you a limit of up to $5000 credit.

- It doesn't require any credit card or credit statement.

How Does it Work?

To be approved for Buy Now Pay Later services through Emporium, you should be 18 years and a legal resident of the United States of America.

Regardless of your payment status, it can limit the amount you may accrue in Buy Now Pay Later service.

You can purchase the products you want through an installment plan of various payments. The exact number this installment plan will be notified to you during the time of purchase.

The initial payment consists of the upfront price of your order along with all applicable taxes and non-refundable shipping charges.

The remaining payments will be charged to the original method of payment at 30-days intervals after your purchase. You can request for a written record of your payments any time.

You have the ability to pay by debit card, credit card or PayPal. If you wish to pay the complete balance of your BNPL amount, you can do it any time by contacting their customer service.

Buy Today Pay Later will not be available as a payment method if you have any previous unpaid monthly installments.

How to Repay?

An appropriate number of installments will be charged every 30 days until the item's price is paid incomplete.

Five payments are automatically deducted monthly from your debit card, credit card or PayPal. You'll receive the “Closure” of a full upfront payment, but with the cash-flow benefit of spreading the cost.

If you paid for the entire purchase upfront, the total amount charged to your card is no greater.

Customer Support

If you face any issue with Emporium, you can email their customer service at sales@emporium20.com or call them at 1-833-367-7620 from Monday to Friday between 10 Am to 6 Pm.

The Bottom Line

What did you choose? Well, let me make it easier for you! before picking up any Buy now, Pay Later services, it is important to be aware of things like interest rates, late fees and to be sure that you can be able to pay off the total purchase at least later.

So, I hope the above article has helped you to pick up the best buy now, pay later service from the above-mentioned list on best sites like Zebit.

You may like:

- 10 Best Sites Like ASOS for Shopholics [2021]

- 8 Best Apps Like Quadpay to Buy Now Pay Later [2021]

- Best Alternatives Apps Like Deferit to Check Out [2022]

![10 Best Sites Like Zebit to “Buy Now Pay Later” [2024]](https://viraltalky.com/wp-content/uploads/2021/07/sites-like-zebit-alternatives.webp)