Apps Like Lenme – Choosing the best peer-to-peer lending apps is important if you want to invest your money or want to borrow money for your needs.

The best Lenme alternatives listed in this article generally connect borrowers to lenders (investors), who solely loan money to qualified applicants.

Based on the investors or the app, they have different rates, terms, interest, and fees. However, they come with a limit, you can only loan a maximum amount set by the app. So, we can consider them as an alternative to borrowing money from a traditional online lender or a bank.

List of Apps Like Lenme/ Lenme Alternatives

Lenme is a peer-to-peer lending app that directly connects borrowers and investors. Although it is an amazing app, it charges an origination fee for borrowers, you cannot improve your credit score and sometimes, there is no guarantee that your loan will be funded.

Keep on reading to find the best peer-to-peer lending app for both investors and borrowers!

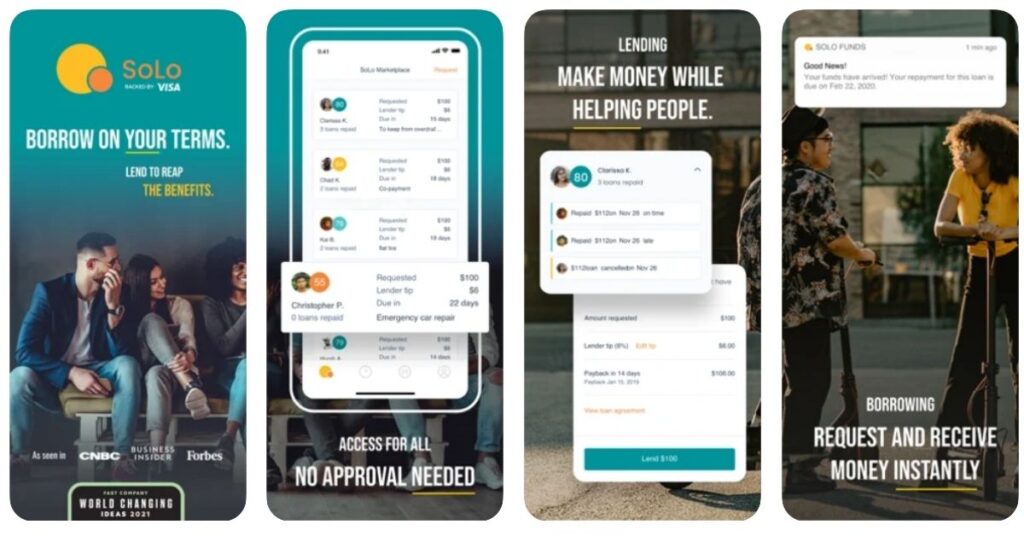

Solo Funds

Firstly, we have Solo Funds in our list of apps like Lenme. Solo funds is a microloan service that let users to easily access and provide funds for immediate needs.

As a borrower, you can set your own terms, choose the repayment date, give tips, and select the reason why you want the loan.

Generally, after you take a loan, the payback period is 30 days or less. Also, remember that one cannot be both a borrower and lender at the same time.

How Do Solo Funds Work?

Unlike other cash advance apps, it is not tied to your paydays and doesn’t provide the loan by itself. Rather, it offers a platform that let investors fund and borrowers loan money for their immediate use.

These loans can be as small as $50 and can up to $500, but the only catch is that as a new borrower you cannot request whenever you want.

Besides, if you don’t pay back your loan on time, it charges a late fee of 15% along with the $5 administrative fee. Other than this, it doesn’t charge interest or any other fee.

Borrowers can choose to pay their lender tips of up to 10% of the original loan value, with the same amount being set by borrowers in advance.

For instance, as a borrower, if you request a $100 loan, you can include up to a $10 (10%) tip to your lender as an encouragement to choose your loan over others.

What You Need to Know

Loan Amount & Interest: You can borrow up to $1000 without paying interest or any other fees to take out a loan. Rather, you can choose to pay your lender an optional tip.

It charges a late fee of 15% of your loan amount and $5 if you miss your due date. This means if you forget to pay on time on a loan of $150, you’ll have to pay a late fee of $27.50.

Monthly Fee: It doesn’t charge any monthly fee.

Credit Check: Although it doesn’t run a traditional credit check, it does analyze the information you provide and gives you a rating that let lenders see when viewing your application.

7 Must-Try Apps Like SoLo Funds That Let You Borrow Money! [2022]

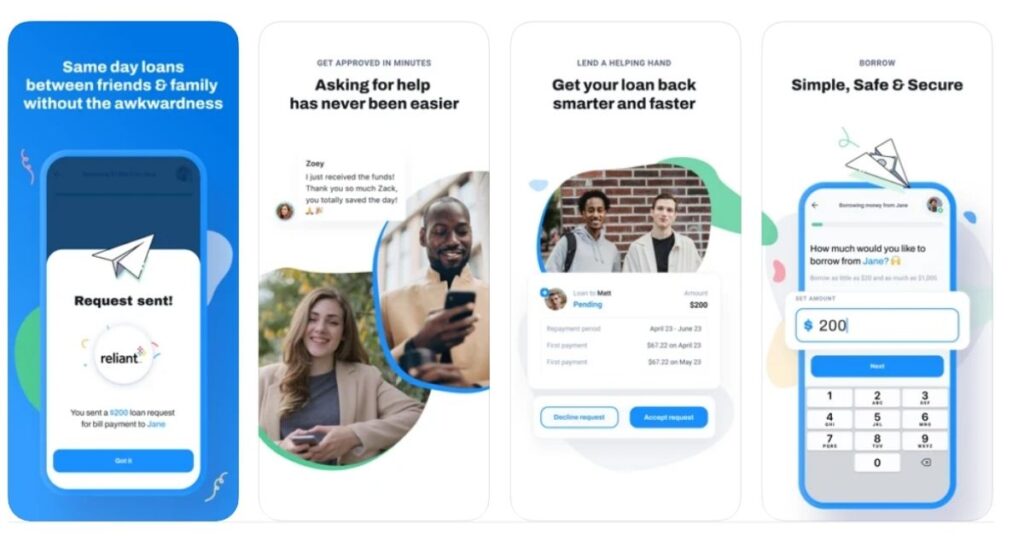

Zirtue

Zirute operates by providing a platform for friends and family to invest and borrow funds from one another in an official way. You just simply set the loan amount and let the lender make the repayment terms.

Once both parties approve the terms and conditions, borrowers’ loan requests will be serviced by Zirtue. And users can keep tabs on their loan amount, payments, and anything that Zirture has to offer.

Unlike other P2P services, Zirtue loans are funded by the one whom you already know rather than a group of anonymous lenders or investors.

Essentially, Zirtue itself doesn’t directly provide you a loan, it only lets users lend and borrow money from your friends and family.

How Do Zirtue Work?

To get a Zirtue loan, all you need to do is to open a free digital Zirtue account and get it verified with its secure and encrypted process.

Once it is done, you can set a custom loan amount or choose Direct-Bill pay, which sends funds straight to the provider. Then, you can send the request to your contacts.

After you get the loan, you can choose the repayment date which works for you the best and see how much interest will be applied to the loan. Generally, it allows a payback period from 3 to 36 months.

Nonetheless, you can pay for the loans monthly or pay all at once. Typically for monthly loans, Zirtue will automatically withdraw the repayment amount after the lender approves your loan.

What You Need to Know

Loan Amount & Interest: The maximum amount you can borrow through Zirtue is $1,000. However, Zirtue loans might not be for everyone, because all loans come with a 5% interest rate.

Besides this, there are no other fees associated with Zirtue loans. And you can repay your loan by bank transfer or by using a debit card.

Monthly Fee: As a borrower, you are supposed to sign up for a subscription plan, which you can cancel at any time. It ranges from $5.99 a month to $15.99 for six months, to $49.99 for a year.

Credit Check: Zirtue doesn’t perform any credit checks.

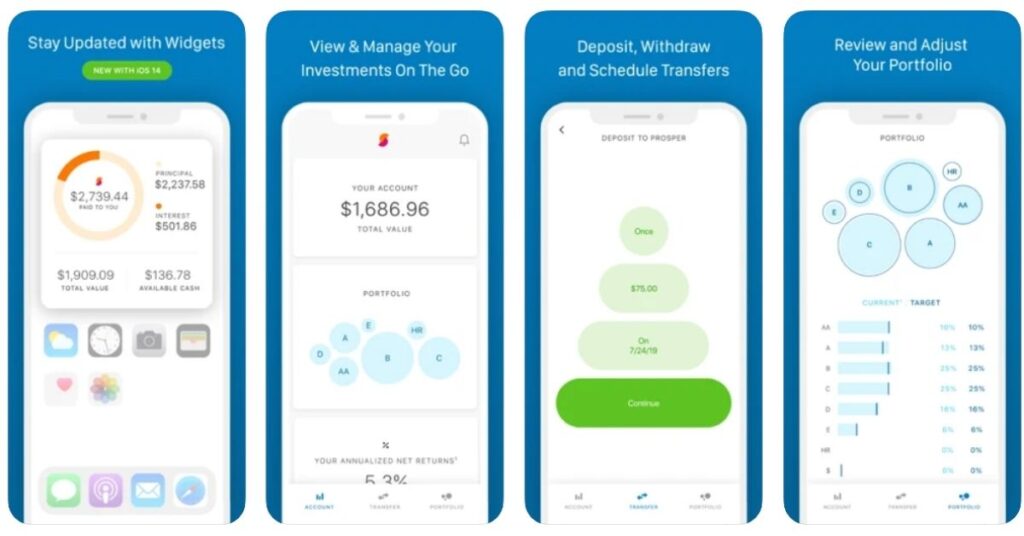

Prosper

Prosper is another peer-to-peer lending app that connects borrowers and investors. And it offers personal loans to borrowers with a good credit score.

It uses a unique rating system that checks data points like debt-to-income ratio and credit history to approve applicants.

As soon as you qualify for a loan, accept a loan offer, and get approved for the loan, funds may be deposited into your bank account as soon as the next business day.

How Do Prosper Work?

If you want to pay for a large expense, you can consider Prosper. All you need to do is to create an account and enter your details.

To create an account with Prosper, you’ll need to be at least 18 years old, have a checking account, social security number, a credit score of 640, and have a better income.

Then, you can enter the loan amount you want. Once you select your loan amount and answer a few questions, you’ll get the loan amount in your bank account one day, and based on your bank, it can take up to three business days.

However, for you to receive your money, a Prosper investor must choose to fund your loan. Generally, investors will agree to offer to fund before the approval process is completed, and they’ll have up to two weeks to fund your loan request.

What You Need to Know

Loan Amount & Interest: The loan amount you can borrow from Prosper ranges from $2,000 to $40,000 and you get 3-5 years to repay it.

Typically, Prosper’s annual percentage rate ranges from 6.95% to 35.99%. There is also an origination fee between 2.4% and 5% taken off the top of the loan. So, the amount you receive is the amount requested minus the origination fee.

Besides, you may also have to pay multiple types of fees with a Prosper loan, including a check payment fee, a late fee ($15), an insufficient funds fee ($15) and a payment by mail fee of $5.

Monthly Fee: It doesn’t charge any monthly fee.

Credit Check: To qualify for a Prosper personal loan, you’ll need a minimum credit score of at least 640. Note that if you have a higher credit score, you’ll get a better APR.

It performs a soft credit check and reports your on-time or late payments to the three bureaus.

Hundy

If you want to be an investor and provide financial support to those in need? Hundy can be an excellent choice for you!

If you are looking for someone to fund your loan requests for whatever reason, such as rent, groceries, or utilities, Hundy is a perfect choice for you to lean on.

Hundy is a mobile-only, no-fee deposit advance app that let users can get a deposit advance in just a few minutes from investors across you. Once you get approved as a Hundy member and start receiving advances, you’ll start earning points.

How Do Hundy Work?

All you need to do is to download the Hundy app and create an account by using your Apple ID or Facebook, enter your zip code, and simply link your bank account.

Once it is done, you can request an advance in less than 5 minutes and receive funds within one business day.

If you can show enough deposits coming into your bank account monthly and are good about paying your advances off on time, you can get advances up to $250 from the people around you. Most of the capital in the Hundy deposit advance is generally sourced by crowd investors.

You can easily prepay or extend your advance within a 61-day period at any time. And if you are unable to pay off your advance within the first 61 days, you can simply convert the advance into a no-penalty or no-fee 60-day installment plan.

What You Need to Know

Loan Amount & Interest: The loan amount you can borrow from Hundy ranges from $20 to $250.

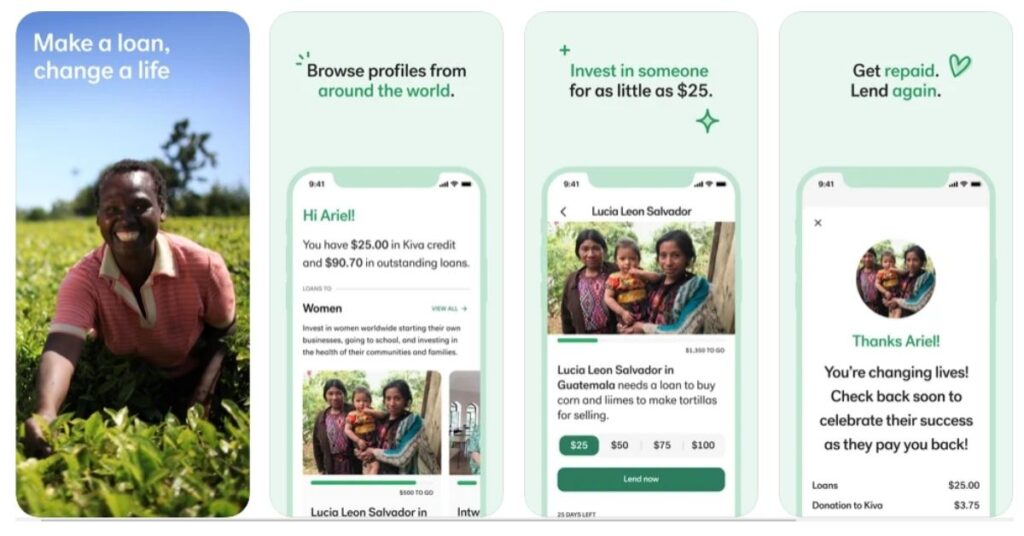

Kiva

You might have heard about a lot of apps that offer loans, but Kiva is different. Although Kiva is a lending app, it is quite different from others.

Kiva let people lend money through the internet to low-income entrepreneurs and students in over 77 countries. Its main is to expand financial access to help people succeed.

It generally comprises the personal stories of each person who applies for a loan so in this way lenders can connect with the borrowers easily.

Kiva works with over 300 microfinance institutions, schools & non-profit organizations, and social impact businesses across the world.

How Do Kiva Work?

Lenders can browse profiles on Kiva and choose an entrepreneur that they wish to fund. And as a lender, you can transfer your funds through PayPal (which waived its transaction fee in this case) or credit card processing.

When Kiva receives the lender’s money, it aggregates loan capital from the individual lender and transfers it to the appropriate Field Partners.

As a borrower, you must be at least 18 years old, live in the United States, and should use the borrowed money for businesses and not for any other personal reason.

You’ll also need to answer some basic questions and write detailed info about yourself, your business, and the reason why you need a microloan.

What You Need to Know

Loan Amount & Interest: The maximum amount you can borrow through Kiva is $5,000. It doesn’t charge any interest on the capital sent to Field Partners, but usually, Field Partners do charge some interest to borrowers to cover administration costs.

Usually, interest is higher on loans from microfinance institutions because of the administrative costs of overseeing many tiny loans and the increased risk.

Monthly Fee: It doesn’t charge any monthly fee.

Credit Check: It doesn’t perform any credit checks and doesn’t provide loans based on your credit score.

Quick Comparison: Apps like Lenme

| Apps Like Lenme | Maximum Loan Amount | Interest Charged | Monthly Fee | Credit Check |

| Solo Funds | $1000 | 0% | 0 | No |

| Zirtue | $1,000 | 5% | $5.99 a month, $15.99 for six months, or $49.99 for a year | No |

| Prosper | $40,000 | APR can be 6.95% to 35.99% | 0 | Soft Credit Check |

| Hundy | $250 | 0% | 0 | No |

| Kiva | $5,000 | 0% | 0 | No |

Final Words: Apps Like Lenme!

What did you choose? Yes, with a lot of choices out there, it can be a little hard to find the best peer-to-peer lending app.

Although the apps that lend money are getting popular, they do come with some high levels of risk. However, these can be great instead of going for traditional bank loans.

Moreover, a perfect peer-to-peer app can help you make difference with your investment while helping other by funding their regular needs or businesses.

Hopefully, the above article may help you to find the best app like Lenme that meets your requirements.

![5 Apps Like Lenme to Borrow & Lend Money Easily! [2024]](https://viraltalky.com/wp-content/uploads/2022/04/Apps-Like-Lenme.jpg)