SoLo Funds is an app to borrow and lend money with no credit checks, interest, hidden fees, transactions fees, minimum balance and overdraft fees.

It is not the only peer-to-peer money lending app that is available in the market, there are a lot of apps that let you borrow from your peers.

So, to know more about the apps like SoLo Funds, keep on reading the article! Before that, let's understand what is peer-to-peer lending.

What is Peer-to-Peer Lending?

P2P lending or peer-to-peer lending services are those services that lend money to businesses or individuals through online service. It is also called as ‘Crowd Lending’ or ‘Social Lending’, which connected borrowers directly to the lenders, which are generally known as investors.

P2P lending businesses typically offer their services online and tend to function with lower charges and offer their services more inexpensively than the regular financial institutions. Now, keep on reading to know about SoLo Funds alternatives.

1. Prosper

Prosper is a peer-to-peer lending app like Solo Funds that offers personal loans to borrowers with a good credit score.

It uses an exclusive rating system that deliberates data points like debt-to-income ratio and credit history to approve applicants.

People who borrow money might charge an origination fee of around 2.41% to 5%. Online lenders can change the origination fees once they approve a loan.

Also, late fee of $15 will be charged to you if you forgot to repay your loan over 15 days past the due date.

How Does Prosper Work?

Similar to LendingClub, Prosper cannot be a better option for those who have bad credit scores. In other words, Prosper credit score minimum standard is 640, and its average is 710.

Once you enter your desired loan, you’ll receive the loan amount in your bank account in 1-3 business days after you are approved.

Borrowers can make fixed monthly payments throughout the duration of your 3- or 5-year term. Note that each payment comprises principal, interest, and any other applicable fees.

Typically, Prosper’s annual percentage rate ranges from 6.95% to 35.99%. There is also an origination fee between 2.4% and 5% taken off the top of the loan.

That means the amount you receive is the amount requested minus the origination fee.

Key Features

- Offers access to loan amounts from $2,000 to $40,000.

- Two borrowers can apply for a loan together as joint applicants.

- Use its ‘Auto Invest’ tool to set up, review, and adjust your target portfolio allocations.

- Provides access to a home equity line of credit for borrowers in states like New Mexico, Alabama, California, Colorado, Florida, Arizona, and Texas.

- You can choose a three- or five-year loan repayment term.

| Pros | Cons |

| No early repayment penalty | Charges origination fee of 2.5 to 5% |

| You can get funds as soon as three days | APR rates are quite high (7%-35%) |

| Users can invest with as low as $25 | |

| Maximum potential returns |

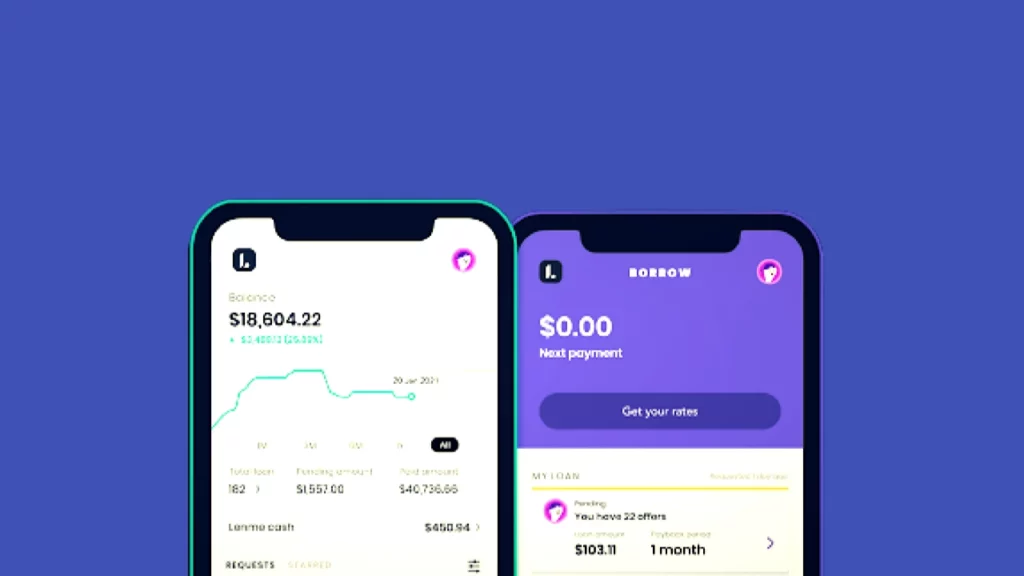

2. Lenme

Lenme is another app like SoLo Funds that allows borrowers to borrow money and lenders to lend money without the high costs required to maintain staff, manage loans, staff, and verify and qualify borrowers.

All you have to do is request a loan, and the investors will contest to provide you with the best interest rate that matches your profile.

How Does Lenme Work?

Download the app and create an account to request the loan. While requesting the loan, you’ll need to include your personal information along with the payment period you want.

You can borrow up to $5,000. And every borrower gets a credit risk score, such as green (strong credit background), orange (moderate risk), red (high risk), or blue (friend or family member sing your Facebook profile).

Once you choose a loan of your needs, you can then offer an interest rate and payback period. To be an investor, you’ll have to fund the entire loan, and as a requester, you get to choose to accept or decline your loan offer.

Although Lenme doesn’t charge investor’s fees, it charges a borrower a 1% origination fee.

Key Features

- Borrowers can borrow for a low origination fee, and investors can easily fund loans online directly with borrowers.

- You’ll receive your money directly in your bank account within a week.

- You can easily download the Lenme app from the Google Play Store or Google Play Store.

- They charge a 1% origination fee from the fund investors give while funding the loan.

- You can be able to manage your repayments through the Lenme mobile app.

- It removes all the needless costs by using technology to provide borrowers instant and transparent access to capital.

| Pros | Cons |

| No hidden charges | Limited information about security and cost |

| Borrowers can request loans for a less interest rate | Origination fee of 1% of the loan amount |

| Larger loan limit | |

| Low origination fee | |

| Borrow as little as $50 |

5 Apps Like Lenme to Borrow & Lend Money Easily!

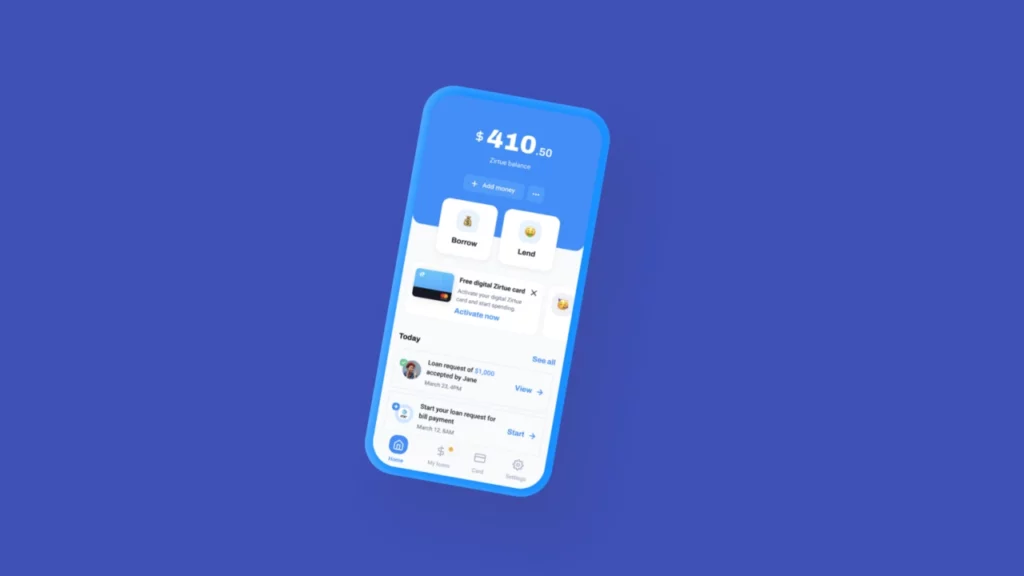

3. Zirtue

Zirtue functions by giving a platform for family and friends to lend and borrow funds from one another in an official way.

All you have to do is, set the loan amount, and the lender establishes the repayment terms.

Once both parties agree to the terms, the loan request will be serviced by Zirtue. These loan payments start on the agreed date by using the Automated Clearing House Network.

You can even get to keep tabs on your loan amount, payments, or anything that Zirtue offers all in one place. Basically, Zirtue itself doesn’t directly give you a loan, it only enables you to lend and borrow money from your peers.

How Does Zirtue Work?

Open a free digital Zirtue account and get it verified with its secure and encrypted process. Now, you can set a custom loan amount or choose Direct-Bill. With Direct-Bill Pay, funds will go straight to a provider.

Then, send the request to one of your contacts, or simply select a new contact by entering a phone number.

Once you get a loan, you get to choose a repayment date that will be suitable for you and view how much interest applies to the loan. Usually, Zirtue permits payback period from 3 to 36 months.

However, loans can be paid monthly or all at once. For monthly loans, Zirtue will automatically begin withdrawals for repayment 30 days after the lender approves and funds the loan request.

Key Features

- You can set a custom amount you wish to borrow and decide on the repayment details with your lender.

- Set your payback terms and allow automatic payments do the remaining process.

- You can track your payments and loans all in one place.

- They use patent-pending technology to make sure your financial and personal information is completely encrypted and safely stored.

- The borrower can set the loan details and while the lender creates the repayment terms.

| Pros | Cons |

| Automatic recurring payments | Charges monthly fees for Borrowers |

| Peer-to-peer lend and borrow | |

| Doesn’t charge anything for the lenders | |

| You can cancel the loan request if not accepted |

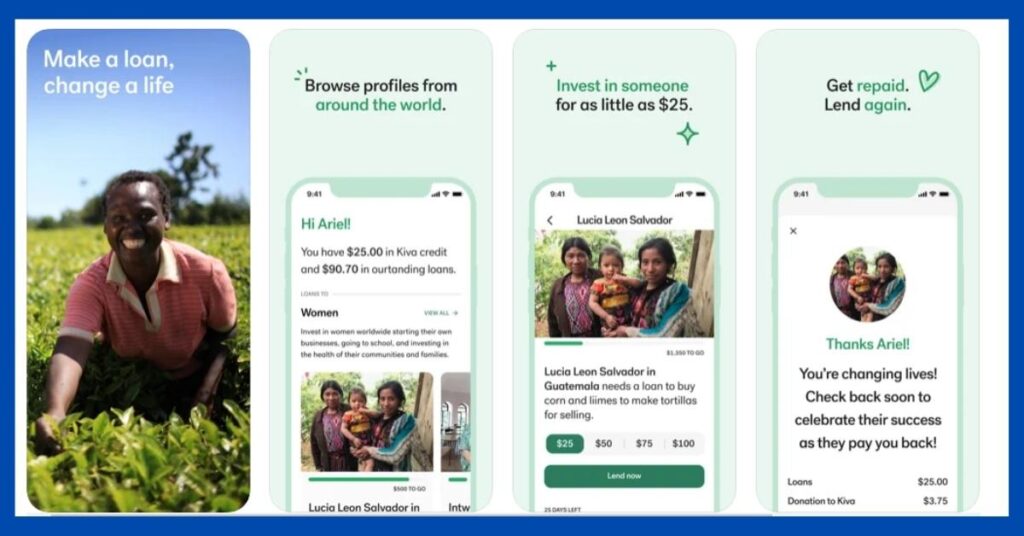

4. Kiva

You might have definitely heard about a lot of apps that offer loans, but Kiva is different. Although Kiva is a lending app, it is quite different from others.

Kiva allows people to lend money through the internet to low-income entrepreneurs and students in over 77 countries.

It usually includes personal stories of each person who applies for a loan so that lenders can connect with the borrowers easily.

Kiva works with over 300 microfinance institutions, schools & non-profit organizations, and social impact businesses across the world.

How Does Kiva Work?

As a lender, you can browse profiles on Kiva and choose an entrepreneur that you wish to fund. You can transfer your funds through PayPal (which waived its transaction fee in this case) or credit card processing.

When Kiva receives the lender’s money, it aggregates loan capital from the individual lender and transfers it to the appropriate Field Partners.

It doesn’t charge any interest on the capital sent to Field Partners, but usually, Field Partners do charge some interest to borrowers to cover administration costs.

Typically, interest is higher on loans from microfinance institutions because of the administrative costs of overseeing many tiny loans and the increased risk.

Key Features

- You can lend as little as $25 and make a big change in someone's life.

- Kiva is free of charge to use for both borrowers and lenders.

- Works with over 300 microfinance institutions, schools & non-profit organizations, and social impact businesses.

- You can also sort loans based on geographic region.

- Kiva is exceptionally simple to navigate, without compromising detail.

| Pros | Cons |

| No credit check and no origination fee | Long application process |

| 0% APR for United States borrowers | Offers loans only for small start-ups |

| Flexible payments |

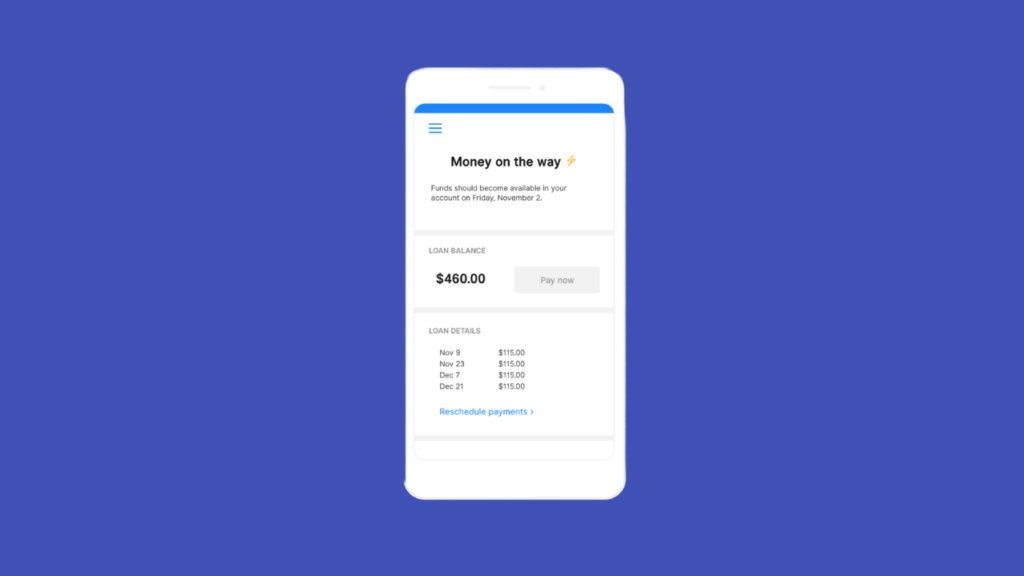

5. Possible Finance

Possible Finance is an online lender, which makes small installment loans through its app. It gives you eight weeks to repay the loan in two-week intervals, rather than to need full payment on your next date.

You can easily apply for a loan in just a few simple steps. It is one of the best apps like SoLo Funds.

It states itself as an alternative to regular short-term loans which are quite costly and are supposed to be repaid completely on your paydays.

Since it doesn’t perform any credit check, people with bad credits or no credit history can borrow. However, you should remember that all cannot access Possible Finance because it is only available in a limited number of states.

How Does Possible Finance Work?

Once you meet the requirements, check if the Possible Finance is compatible with your current bank or your credit union as it doesn’t work with all banks.

After you apply for the loan, you’ll get a notification within 24 hours regarding the status of your application and when you are approved, you can accept your loan within three days.

People with no credit history or bad credit can get up to $500, and should have an online checking account with a minimum monthly income of $750.

You can then repay your loan in biweekly intervals for eight weeks or two months rather than paying the full repayment on your next pay date.

If you want to change your repayment date, you can easily change up to 29 days past your due date without any extra fees or interest charges.

Key Features

- Money can be sent directly to your debit card so that you have instant access to your loan.

- It offers more adoptable cash options than other payday advances or loan alternatives.

- It is available in numerous places like Florida, Ohio, Missouri, Oklahoma, Indiana, Washington, California, etc.

- You don’t have to worry about no credit or bad credit as they don’t check your Vantage score or FICO score.

- You can be able to repay in installments to rebuild credit and increase financial health.

| Pros | Cons |

| Reports payments to all main credit bureaus | Available only in a limited number of states |

| You can delay your payment | Short repayment terms |

| Help you build credit |

12 Loan Apps like Possible Finance [PayDay, Cash Advance]

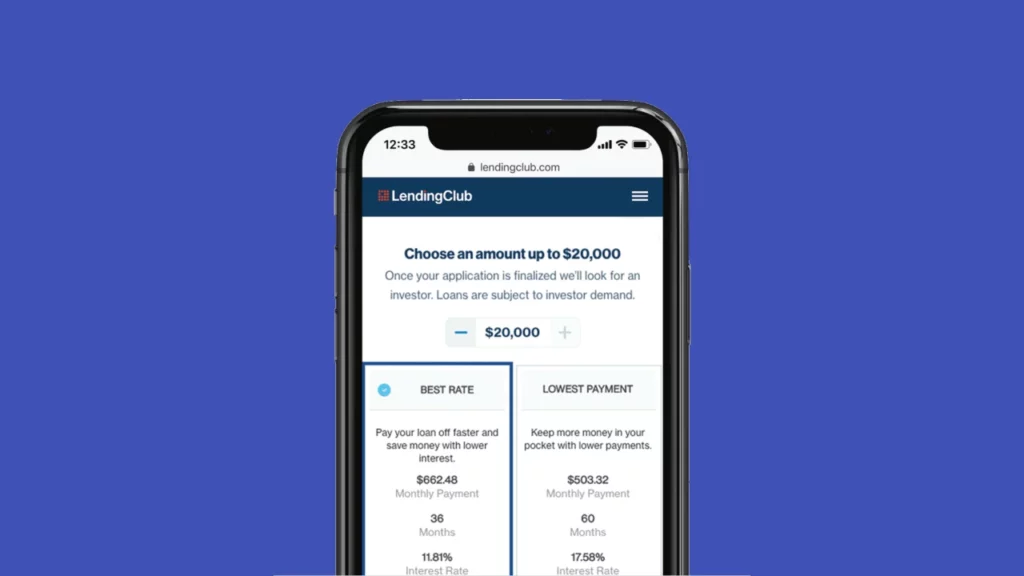

6. LendingClub

Lending Club is one of the best SoLo Funds alternatives, which offers a variety of financial products and services.

The first peer-to-peer lender to register its offerings as securities with the SEC (Securities and Exchange Commission).

It allows borrowers to create unsecured personal loan between $1,000 and $40,000.

How Does LendingClub Work?

In order to become a borrower, you’ll need to have a minimum credit score of 600 with a minimum credit history of three years.

You’ll then have to mention the loan amount you want, a reason for borrowing, your personal information like phone number, email address, home address, and personal information of co-applicants.

Once you are approved, LendingClub screens potential borrowers and services the loans. That means LendingClub makes the final decision whether give the money or not.

Usually, LendingCLub’s typical annual percentage rate ranges from 5.99% to 35.89%. It also charges an origination fee of 1% to 6% taken off the top of the loan.

So, we can say that LendingClub is only for those who have good credit and low debt.

Key Features

- LendingClub generates income by charging borrowers an origination fee and investors a service fee.

- You can quickly get started by entering your Online Banking username and password.

- It makes traditional direct-to-customer loans, including automobile refinance transactions by WebBank.

- You can check your account balances and view transactions for personal and small business saving accounts.

- You can also create a budget and track your spending or automate your savings.

| Pros | Cons |

| Ability to stretch the repayment terms of 3 and five years | Requires a minimum credit score of 600 |

| No hard credit inquiry | Charges an origination fee |

| Co-borrowers are allowed |

7. MoneyLion

MoneyLion is another financing app that offers numerous features, including cash advances, checking accounts, credit score tracking, credit builder loans, personal loans, a loan marketplace, and managed investing.

MoneyLion prides itself as an “All-in-one mobile banking membership” as they offer several products.

Its machine learning technology offers personalized advice to users depending on their spending habits. Similarly, you can also access small loans to help you handle your monthly income and expenses.

It also offers cash back from shopping at major stores.

How Does MoneyLion Work?

After you create an account, you can choose to add free services like Credit Builder Plus or Instacash advances. When you are approved, you can get a loan of up to $1,000.

Your payment can be higher depending on the amount you’ve borrowed and the APR you’ve provided. Usually, the APR ranges from 5.99% to 29.99%.

And with the ‘Monthly Repayment Calculator’, you can predict the possible cost of your loan and your monthly repayment.

You’ll get a 12-month term to repay, and the payments are deducted from your bank account each month on your pay date.

If you want to repay your loan sooner, you can access your Credit Reserve Account. You’ll also can change your payment due date or reschedule it by contacting MoneyLion.

Key Features

- You can easily create a MoneyLion account for completely free, this will give you access to an investment account and a zero-fee checking account.

- It allows tips on cash advances and has a 5.99% APR credit building loans available for a membership plan, which costs $19.99 per month.

- Although a membership fee is pretty high, it does approve you for some advanced products.

- You can be able to invest your additional change from your buying into your investment account.

- It doesn’t perform any credit check; it just analyzes your primary checking account, which should meet a few measures to get approved.

- You can also be able to pay off your loan early with no early payoff consequence fee.

| Pros | Cons |

| No hard credit checks | It charges a monthly membership fee |

| There is no monthly fee | It is not available in all states |

| No overdraft or service fees | |

| You can build credits as it reports your monthly payments to the credit bureaus |

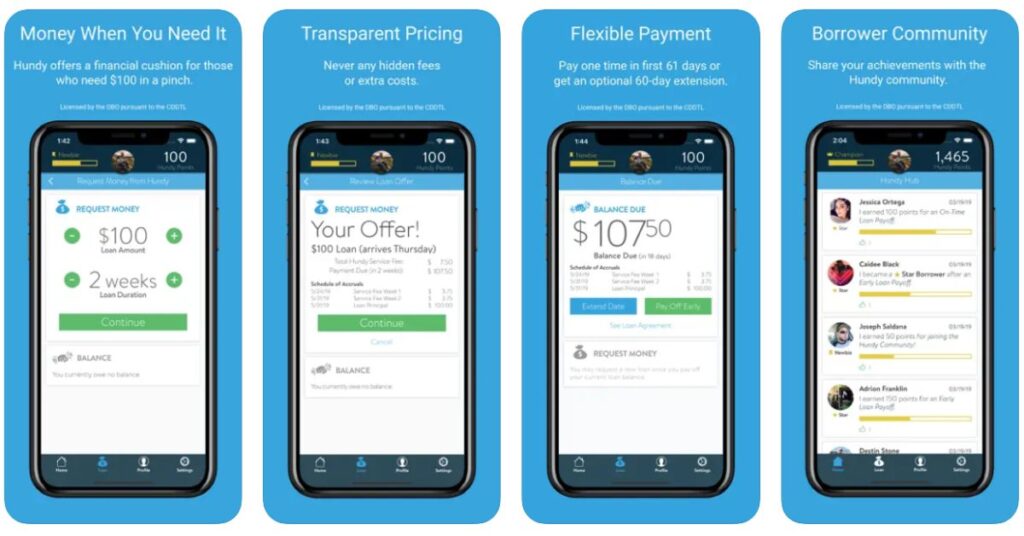

8. Hundy

Want to become an investor and give financial support to those in need? Hundy can be a perfect choice for you!

If you need money for whatever reason, such as rent, groceries, or utilities, Hundy is there for you to lean on. It is a mobile app for money where users can get a deposit advance in just a few minutes from investors across you.

Once they approve as a Hundy member and start receiving advances, you’ll start earning points and leveling up through five status levels.

How Does Hundy Work?

All you need to do is to download the Hundy app and create an account by using your Apple ID or Facebook and simply link your bank account.

Once you set up an account, you can request an advance in less than 5 minutes and get funds within one business day.

You can get advances up to $250 from the surrounding people. Most of the capital in the Hundy deposit advance is generally sourced by crowd investors.

You can easily prepay or extend your advance within a 61-day period at any time. And if you are unable to pay off your advance within the first 61 days, you can simply convert the advance into a no-penalty or no-fee 60-day installment plan.

Key Features

- You may request your first $25, $50, $75 or $100 advance based on your bank transaction history.

- Get a deposit advance in minutes from the people around you.

- Funds will be deposited into your bank account by the next business day.

- Advance repayment will be withdrawn on the date you select up to 61 days later.

- You can extend your advance for an additional 60 days after the installment plan.

| Pros | Cons |

| Easy to use | Sometimes it may block you from making payments |

| No early repayment penalty | Sufficient deposits should come into your account on a monthly basis |

| Easily convert the advance into a no-penalty or no-fee installment plan |

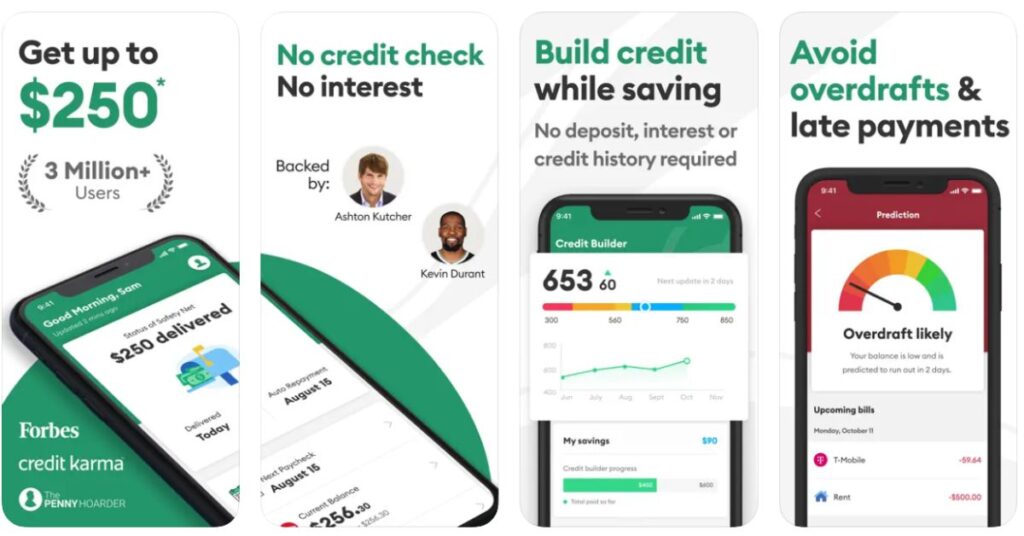

9. Brigit

Brigit is an app that provides small paycheck advances and credit-building tools. You can get up to $250 cash advances, gig work, personal finance and many more.

With the free version where you can get budgeting tools, alerts, and financial insights. It also offers a Plus plan for $9.99 a month where you get quick cash and the ability to build your credit along with all the features in the free plan.

Key Features

- It offers tools and complete credit reports to help you understand your credit.

- Ability to track how much you’ve saved by avoiding late fees, overdrafts, and more.

- Know your bank balance with real-time updates.

- No security deposit and credit check are required.

- Analyze your spending and earning trends over time.

- Get cash advance with no transfer fees, interest, late payment, and processing fees.

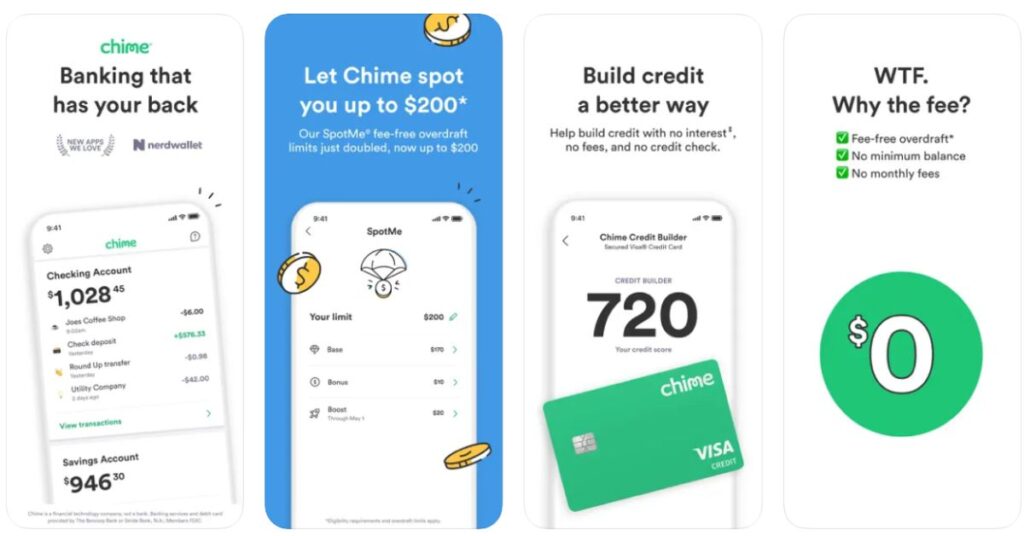

10. Chime

Chime is a financial technology that offers a fee-free online banking system through its website and app. It doesn’t have any physical branches and does not charge any overdraft fee or monthly fee.

Moreover, it doesn’t need a minimum balance or opening deposit to open a free checking account. You can overdraw up to $200 without incurring an overdraft fee. Nonetheless, once the overdraft limit is reached, your purchases will be declined.

Key Features

- Ability to set up a direct deposit and receive your paycheck up to 2 days earlier.

- Offers various banking products like automated savings feature, checking account and early wage access.

- There is no minimum balance required, no overdraft, and no monthly fees.

- Stay in control of your money with daily balance alerts, and instant transactions.

- It also offers the facility to send money to friends and family.

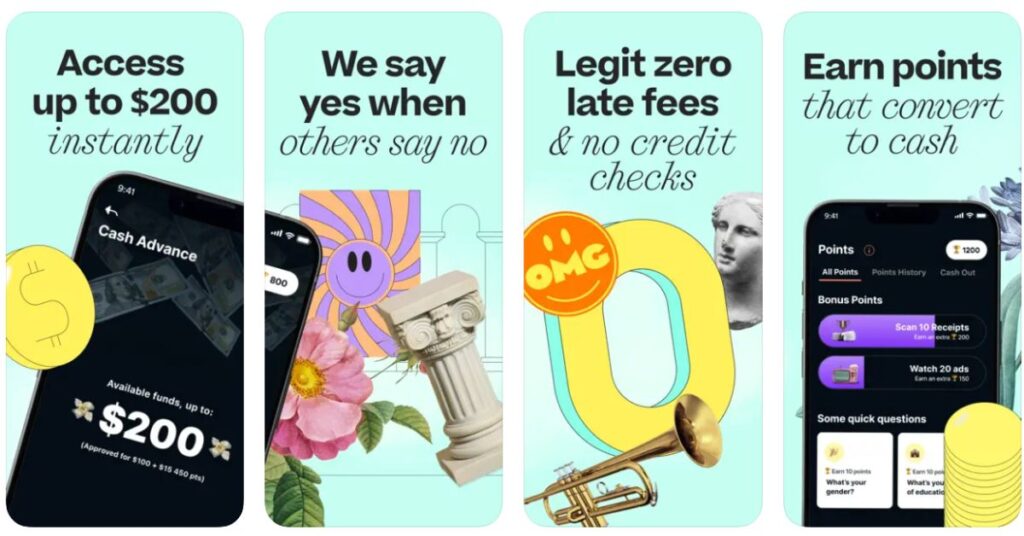

11. Klover

With Klover, you can get cash advances up to $200 with no credit checks, late fees, and interest charges. All you need to do is to create an account by entering your name, phone number, and email. Then, connect your bank account to receive the money.

However, in order to receive the money, you’ll have to wait for up to three business days. So, to get the money in less than 24 hours, pay for an express fee based on your cash advance money.

Key Features

- Ability to earn points for taking surveys and watching ads,

- You can borrow up to $100.

- Its financial dashboard assists you to keep tabs on your spending habits.

- You can track your credit scores and earn additional points when you reach your savings targets.

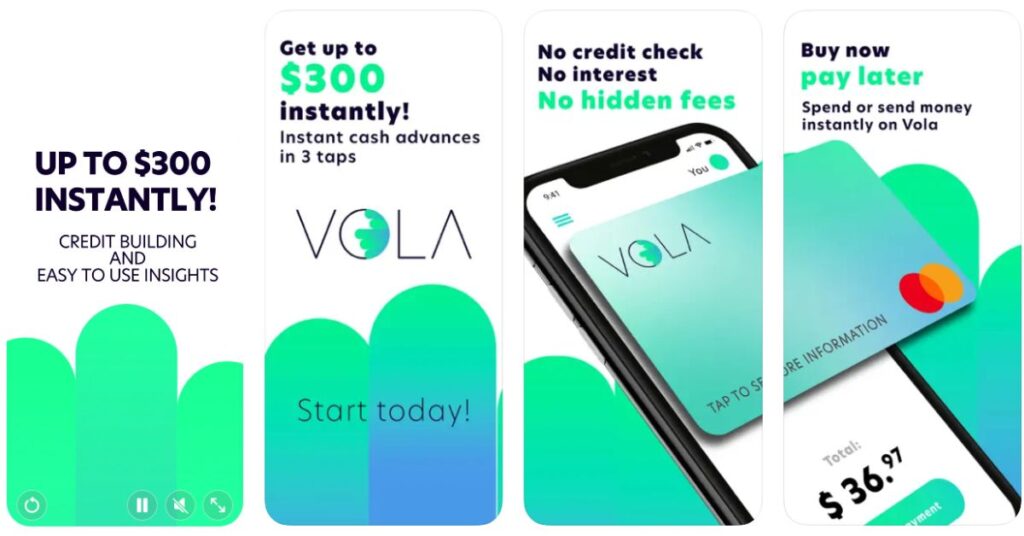

12. Vola Finance

Vola finance is another app similar to Solo Funds that offers up to $300 as a cash advance and lets you build up your score as you pay back your paycheck advances.

Simply connect your bank account, and choose the advance amount without incurring any overdraft fee. Further, it’ll break down your spending pattern to help you budget your upcoming expenses and find ways for you to save.

Key Features

- Track and manage your expenses.

- No interest and credit checks.

- Get alerts when your balance is low to avoid paying an overdraft fee.

- Cash advance goes directly to your checking account.

- Build your Vola score to get access to bigger advances.

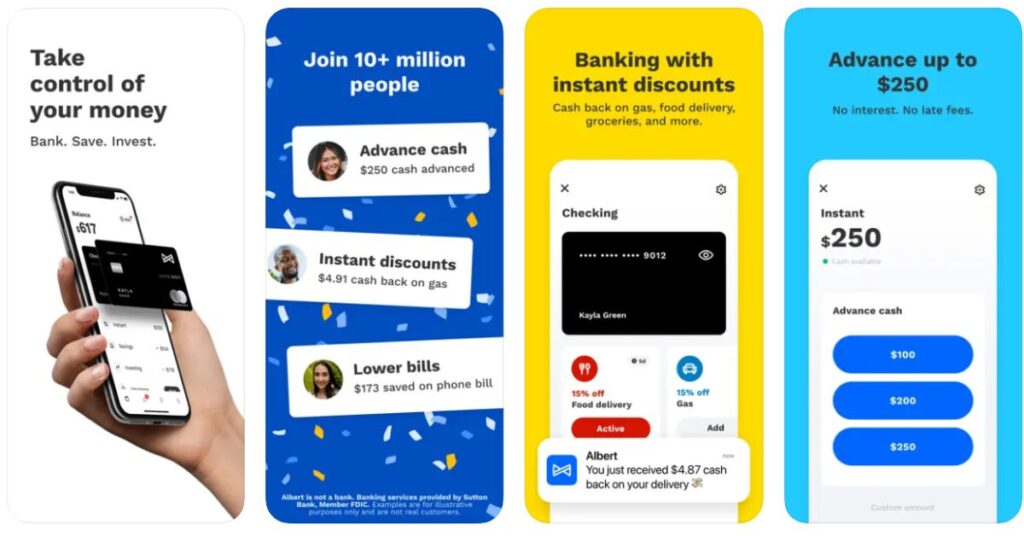

13. Albert

Albert is another type of financial service that automates your finances by using powerful technology. You can get paid early with cash advances up to $250.

Just set up a direct deposit and get the paycheck 2 days before your payday. Since there is no minimum and maximum repayment time, you can repay when are able to. Besides cash advances, it also offers better saving, budgeting, banking, and investing solutions.

Key Features

- Cash advances against your next paycheck.

- There is no minimum balance required, no overdraft, and no interest charged.

- It tracks your income and spending to save automatically.

- Can manage your budget and set up a custom investment portfolio with just $1.

What is SoLo Funds?

SoLo Funds is peer-to-peer lending and borrow app, which lets you borrow & lend money from other people for instant needs, rather than typical finance organizations like banks.

It is specially developed to cover your emergency expense without charging any interest or fees.

However, SoLo Funds charge a high late fee for smaller loans. Thus, it never hurts to check out SoLo Funds alternatives. All the apps mentioned in this article are available on Google Play Store or Apple App Store.

| Pros | Cons |

| No background checks | SoLo score goes down if you fail to pay on time |

| Loans are not based on credit scores or other factors | Higher fees for smaller loans |

| Maximum term of 15 days | |

| Most loans are funded within an hour | No guarantee that you’ll find a lender to finance your loan |

Final Words:

As there are a lot of options available out there, the best SoLo Funds alternative really depends on your needs and preferences. If you have any other queries regarding apps like Solo Funds, feel free to write in the comment section below.

![13 Loan Apps Like SoLo Funds to Borrow & Lend [2024]](https://viraltalky.com/wp-content/uploads/2021/09/apps-like-solo-funds-alternatives-1.webp)