Are you looking for the best apps like MoneyLion? Wondering which app offers the best features? Don’t worry, we’ll help you with that. In this article, we’ll show you 8 best MoneyLion alternatives that are worth considering. It’s not always easy and simple to keep your financial health in perfect shape, especially when you have a lot of bills to pay.

One of the most challenging things to do as an adult is to handle personal finance. Even though there are several ways to get a loan, including going to your local bank or just simply downloading a mobile app, many people are still inexperienced in handling their finances appropriately.

Over the last few years, a lot of apps that mainly focus on money management and lending loans got released in the market, and one of the best financial apps among them is MoneyLion. It lets users to manage their own finances by linking their bank accounts, monitoring their credit scores and applying for loans.

List of Best Apps like MoneyLion

Apps like MoneyLion allow you to borrow money before your paycheck arrives swiftly. Also, some of these apps specialize in either giving out loans or offering users an understandable view of their personal finances.

Check out the guide below for more information on 8 best apps like MoneyLion.

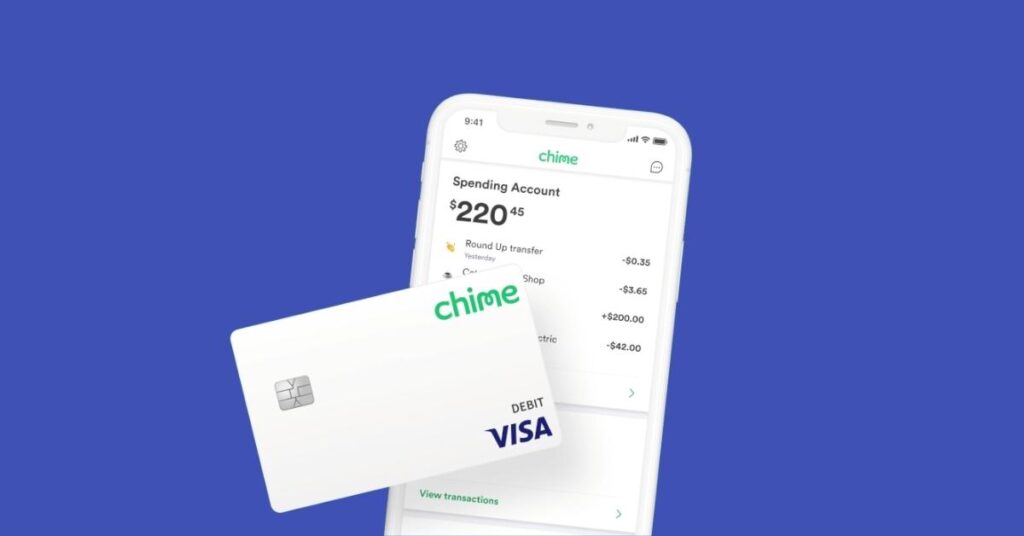

Chime

Chime is an American financial company that offers fee-free mobile banking services. Account-holders are issued Visa debit cards and can have access to an online banking system that is available through the company’s website or through its mobile apps. It earns the majority of its revenue from the collection of interchange.

Eligibility Criteria:

- Must be at least 18 years old

- Should be a citizen of the U.S.

- Your first and last name

- Social security number (SSN)

- Email and a password

Cash Advance: The cash advance limit through Chime is up to $200.

Repaying Advance: It’ll automatically withdraw your loan amount on your payday.

Fees: It doesn’t charge any monthly fee, and overdraft fee, or service fees. And Chime’s spending account is entirely free, and it charges a fee of $2.50 for every transaction at an out-of-network ATM.

Special Features

- There are no physical branches, and it does not charge any monthly or overdraft fees.

- Bank accounts offered through Chime’s partners are insured up to the standard maximum deposit insurance amount of $250,000.

- It offers several fee-free banking products like an automated savings feature, checking accounts with no minimum balance, and early wages access.

- Once you reach the overdraft limit, purchases will be declined, but no traditional negative balance fees will be charged.

- Automatic saving features assist you in saving money any time you spend or get paid.

Must Try these 7 Apps like Chime for Mobile Banking!

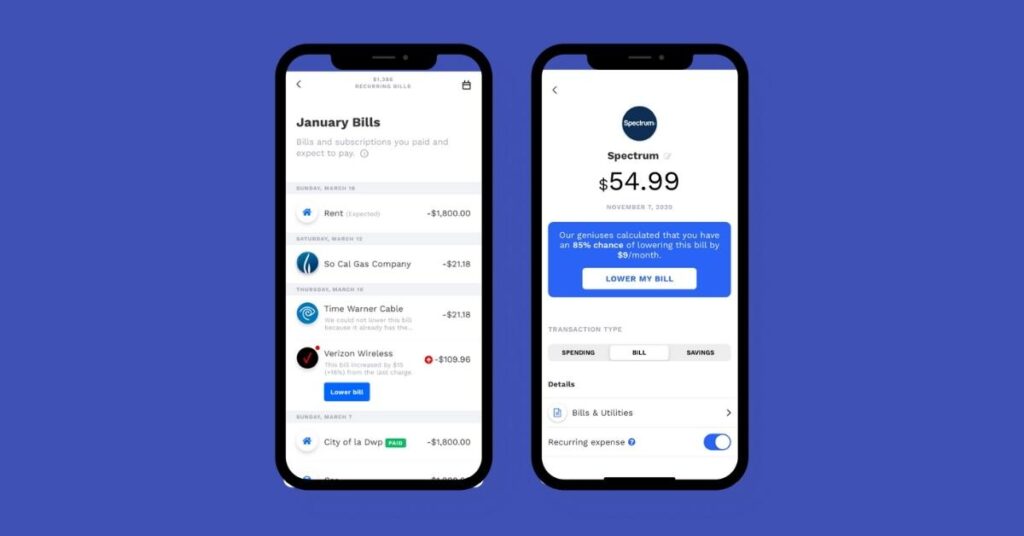

Cleo

With Celo, track your spending, save money, and achieve your goals! And when you use its A.I. chatbox to create personalized smart budgets, as well as improve your budgeting skills.

All you need to do is connect your banking information to Cleo to let the AI-powered chatbot analyze spending patterns and get to work.

Usually, almost all banks are supported by Cleo. But, if your bank is not supported, you can easily request Cleo with support.

Special Features

- Use its AI-powered service to create personalized smart budgets.

- Save money automatically based on what you can afford.

- You can set a limit on your spending.

- It helps you build up your own emergency fund.

- Cleo helps you build your credit score.

- It shows your spending per category over the last few weeks.

Eligibility Criteria:

- Should be at least 18 years old

- Must have regular income

Cash Advance: The maximum cash advance you can access through Cleo is $100.

Repaying Advance: You chance choose your repayment date, which is anywhere between 3 and 28 days.

Fees: Cleo has both free and paid versions. Its paid version-Cleo Plus, costs $5.99 per month.

Must Try these Apps like Cleo to Manage Finance [2022]

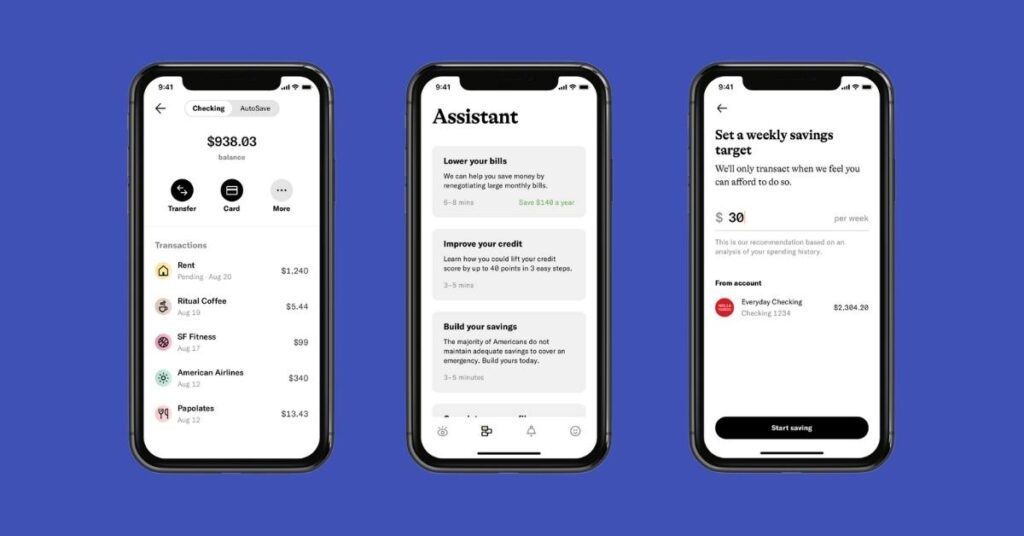

Albert

Albert offers better banking, saving, investing, and budgeting solution by giving you access to live human financial advisors through ‘Albert Genius’ who provide expert financial guidance.

These real financial advisors regularly work to review your bank fees, bills, unusual charges and send you alerts. Also, you will be provided useful financial topics, everything including from managing to paying off debt.

Special Features

- Albert tracks your income and spending habits and can save your spare money automatically.

- Get your paycheck up to 2 days early.

- No mandatory minimum or maximum repayment timeframe.

- Uses cutting-edge security technology to protect your sensitive information.

- Albert Cash and Albert Savings accounts are FDIC-insured.

Eligibility Criteria:

- Be a U.S. resident or citizen

- Be 18 years old or older

- Hold a bank account with a U.S. financial institution

- A mobile phone that supports the Albert app

- Make a qualifying direct deposit

Cash Advance: The maximum cash advance you can access through Albert is up to $250.

Repaying Advance: You can repay when you get your next paycheck or whenever you can afford it.

Fees: It doesn’t charge any interest or late fees.

7 Bank Apps like Albert to Smartly Manage Your Money [2021]

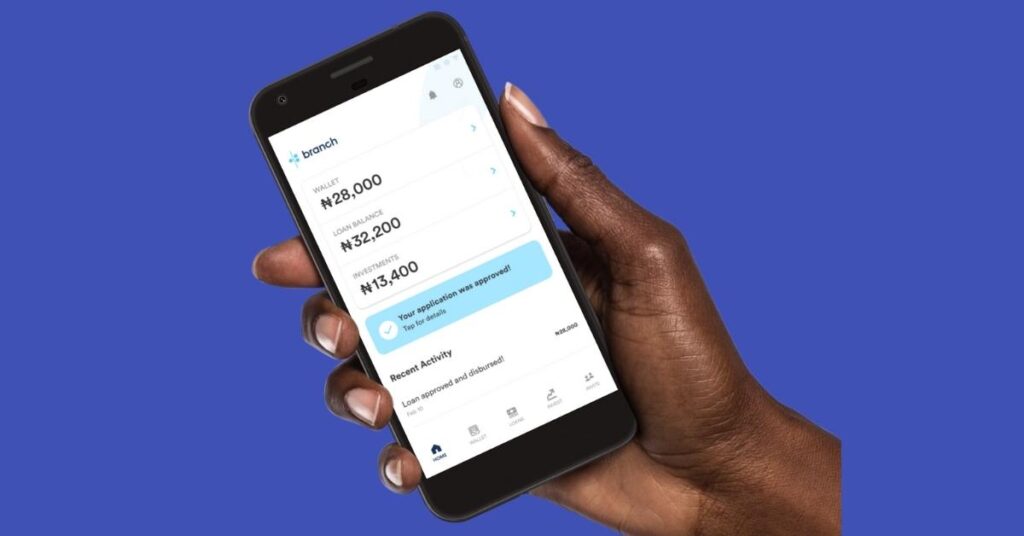

Branch

Branch states itself as ‘Banking for Working Americans,’ which offers cash advances, budgeting tools, and a checking account. Once your pay transfers to your checking account through direct deposit, you can receive cash advances up to $150 two days earlier.

All you need to do is to download the branch app and create an account, add your work location, debit card, or payroll information, employer name, as well as your bank data.

Special Features

- Let you apply for credit, save funds, or monitor your financial health.

- Offers free monthly CIBIL scores and personalized tips.

- There are no late charges or rollover fees on loans.

- Get money quickly if you’re willing to pay for quicker access.

Eligibility Criteria:

- Be at least 18 years old

- Must have a payroll card or debit card

- Provide bank account information

Cash Advance: The maximum amount you can through Branch is $150 and the maximum you can get per pay period is $500.

Repaying Advance: Branch will automatically withdraw the advance money from your checking account on your next payday.

Fees: It doesn’t charge any interest or late fee, or membership, however, you may ask to leave a tip for the service.

And depending on the amount you transfer, it charges $2.99 to $4.99 for an instant advance to your linked debit card or bank account.

Dave

Dave is like Moneylion that lets you access your salary earlier than the payday. It is partnered with LevelCredit to report your loan payments to major credit bureaus.

This means you can be able to build or enhance your credit score with Dave. You can get up to $100 advance from your upcoming paycheck.

Eligibility Criteria:

- Should be 18 years old

- Have a steady paycheck that you direct deposit into your checking account

- Show that your bills don’t consume your entire paycheck.

Cash Advance: The maximum payday advance you can receive is $100.

Repaying Advance: Users can pay the advance back manually or set up automatic payments from a bank account. And the automatic payment date is set to your next payday.

Fees: It charges a monthly fee of $1, and it will automatically deduct your fee from your connected bank account.

Special Features

- You can easily plan for your upcoming expenses, including your phone bill, rent, or even places you usually go to.

- You’ll get instant alerts for exceeding your planned budget.

- This app uses an algorithm to predict users’ capability to repay loans depending on their income history and checking account.

- It doesn’t charge any overdraft fees, rather it charges a monthly fee to access the app.

- It also offers an option to “tip” after getting a loan.

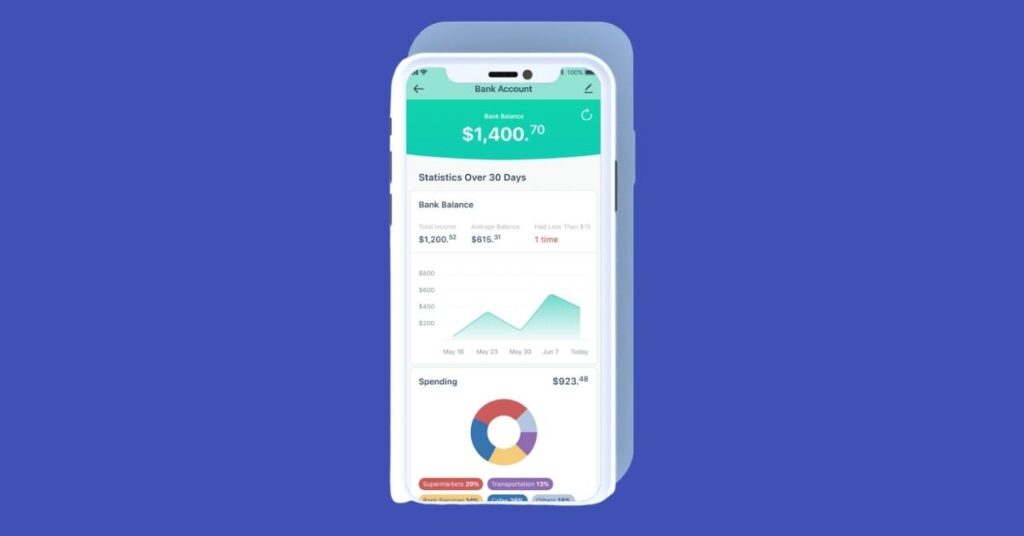

Empower

With Empower, get cash advances with no credit checks and no interest. All you need to do is to download the app on your device and provide them with your weekly savings target.

Then, it will check your income and expenses daily to find out when and how much money you can use. Since it works as a financial aggregator, you can link all your financial accounts on your device.

Special Features

- Set up paycheck deposit to Empower, and it’ll make that money available to you as soon as possible.

- Get cashback and save money on the places where you shop.

- Have convenient access to over 37,000 ATM locations across the U.S.

- Track and monitor your expenses.

- Has bank-grade security features and protections like AES 256-bit encryption, multi-factor authentication, Touch/Face ID.

Eligibility Criteria:

- Your account must be healthy for at least 60 days

- A minimum $500 average monthly income

- Have three recurring deposits of $200

- Account must average at least 2 transactions per day

- Current account balance must be healthy

Cash Advance: It gives you cash advances up to $250 for all eligible members with zero interest.

Repaying Advance: Once you’re approved and get your cash advance, you can pay it back on your next paycheck.

Fees: There are no overdraft fees, no maintenance fees, no insufficient fund fees, or hidden fees.

It charges $8 per month to access all the features like banking and budgeting tools. It also charges a 1% foreign exchange fee for the total transaction amount.

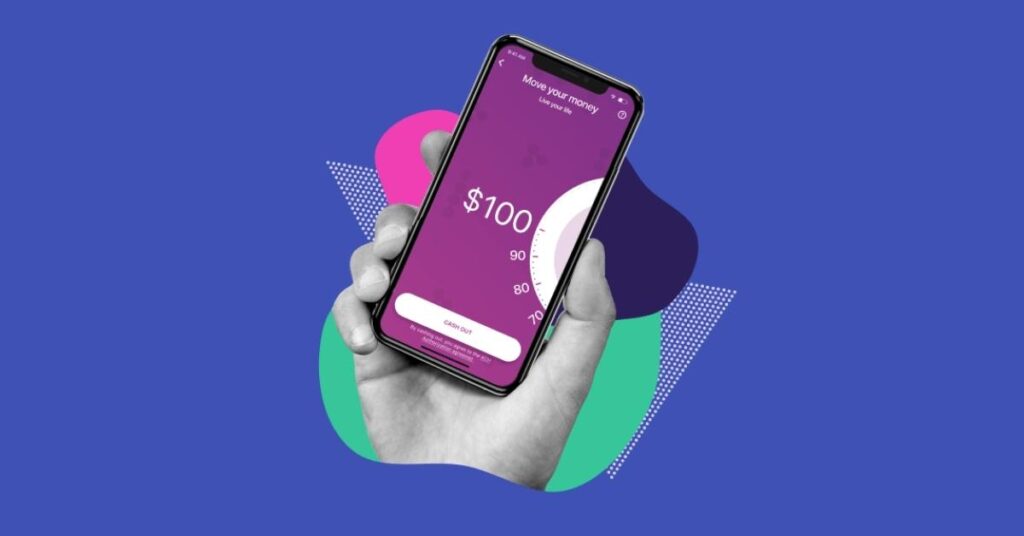

Klover

Get interest-free cash advances or paycheck advances with Klover and pay it back after your paycheck arrives. You can achieve this by creating a Klover account and providing your basic information.

It then uses the information you’ve provided to connect you with its financial products and services. And when you request a cash advance, it’ll take around 1 to 2 days to verify your account.

Special Features

- Improve your financial health and access cash whenever you need it.

- Ability to track your monthly spending by category.

- With its ‘money in-money out’ tool, check out your cash flow.

- Complete small tasks like answering questions to earn higher limits.

- It follows the highest bank-level standards for encrypting all your information.

Eligibility Criteria:

- All deposits should be from the same employer

- Bank statement’s paycheck description must match previously deposited paychecks

- Have a minimum of three consecutive direct deposits over the past 2 months

- Have a regular paycheck – weekly or bi-weekly. No semi-monthly or monthly deposits are accepted.

- Your account must have a positive balance

- Checking account should be active for the last 90 days.

Cash Advance: The maximum amount you can borrow is up to $100. And it uses a point system to increase the limit.

Repaying Advance: Your cash advance money will automatically deduct from your bank account on your next payday.

Fees: It doesn’t charge any interest or hidden fees. However, it takes out the same amount that you’ve borrowed.

And the standard deposit option is completely free, and it usually takes 1-2 business to process the money.

Whereas the immediate debit option charges a fee ranging from $1.99 to $14.99. You’ll receive the money in your account the same day you’ve requested.

10 Best Apps Like Klover [Best Alternatives]

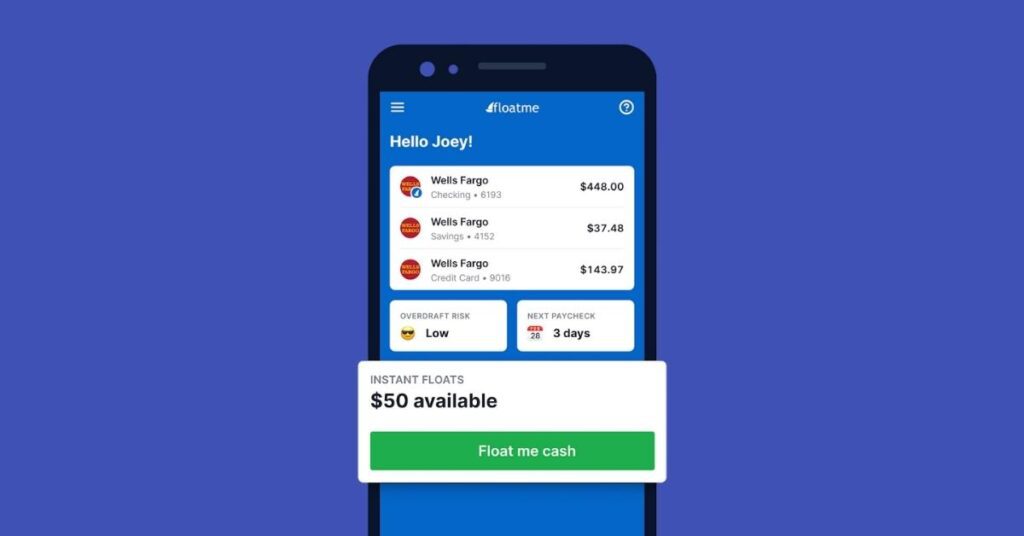

FloatMe

FloatMe helps employees to get ahead of their finances by offering cash advances and helps you to prevent overdraft, save money, meet bills, and manage finances.

Everyone can access their growing library of tools, articles, and other personal resources like budgeting, emergency funds, strategies, taxes, and many more.

Special Features

- It helps you save money, meet bills, prevent overdrafts, manages your finances, and access your wages early.

- Supports over 10,000 financial institutions, including Bank of America, Navy Federal Credit Union, Wells Fargo, Chase, and USAA.

- View any linked accounts and track your cash inflows and outflows.

- Access a growing library of articles, tools, and other personal finance resources.

- All your data is secured with 256-bit encryption.

Eligibility Criteria:

- Valid phone number and email address

- Debit card linking with an active checking account

- Direct deposits from an employer

- Must have an income of at least $200 per paycheck

- A smartphone capable of sending and receiving text messages

Cash Advance: You can borrow up to $50 before your next paycheck, and new users only have access to $10 to $30.

Repaying Advance: Your payback date is locked in once you take an advance.

Fees: It charges a monthly membership fee that costs $1.99 a month. You can also try its 30 days free trial and have full access to every feature it has to offer.

Must Try these 10 Apps Like FloatMe for Cash Advance [2021]

Vola

Vola Finance ensures you manage your money better. Simply download the Vola app on your device, create an account by providing your basic personal information.

Then, you can request an advance to your bank account, which usually reaches you in less than five business hours. And through its Vola Card, you can receive the advance to your card immediately.

Special Features

- Vola helps you track and manage expenses.

- Advance amount is not determined by previously worked hours.

- Its unique algorithm advances your paycheck.

- Offers overdraft protection.

Eligibility Criteria:

- Should be 18 years old

- Your account must be at least three months old

- Have a minimum balance of $150

Cash Advance: The maximum amount you can access through Vola Finance is up to $300 with zero interest.

Repaying Advance: Vola automatically deducts repayments from your bank account. And you can also make payment earlier with no prepayment penalties.

Fees: Vola is completely free to download, and it charges a monthly membership fee. The most basic membership plan starts from $4.99, and it states that the average subscription charge is $7.99.

5 Best Alternatives Apps like Vola to Try Out [2022]

Earnin

Earnin is a finance application that allows you to draw small amounts of your earned wages before the payday. Rather than charging interest, Earnin asks users to give an optional tip for their services, this service is similar to that of Brigit and Dave.

Eligibility Criteria:

- Have a consistent pay schedule–weekly, biweekly, semi-monthly, or monthly

- Over 50% of your direct deposit sent to a checking account

- Your salary must be at least $4 an hour

- A fixed work location and electronic timekeeping system at work

Repaying Advance: The repayment period depends on the total amount of money you can receive during each pay period.

Cash Advance: The maximum amount you can borrow through Earnin is $100. You might even be eligible for an advance up to $500 if you continue to use the app and pay all your advances successfully.

Fees: Earnin doesn’t charge compulsory fees, interest, or have any hidden costs. It also doesn’t charge any monthly fee and is entirely free to download.

Special Features

- Earnin has the ability to track the hours you work. You can be able to upload a photo of your daily timesheet or link the app to your company’s online timesheet system.

- Your pay period withdrawal limit is based on your earning, financial behavior, and several other factors.

- Based on the type of work you do and the way you get paid, you might not be able to use Earnin at all.

- Earnin uses a substantial encryption to keep user data safe.

- Its balance shield can help prevent overdrafts from your bank account.

- You are supposed to give your bank information to connect the app to your checking account.

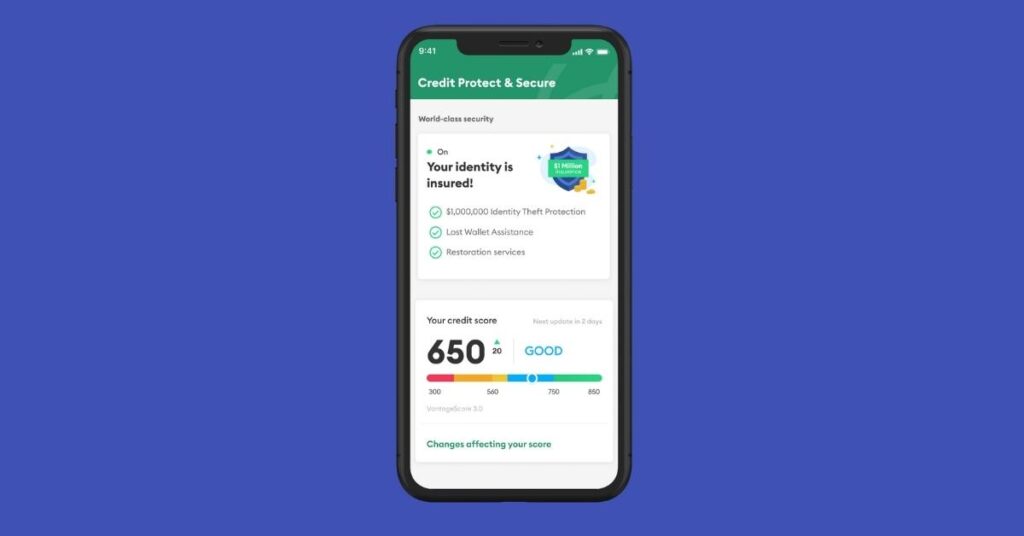

Brigit

Brigit is one of the best payday loan apps, chiefly known for its advanced payday. Nevertheless, it is more than just a paycheck advance app.

Furthermore, it offers many other features like overdraft fees and budgeting protection. Brigit app’s paycheck advance features let users to request a cash advance.

Eligibility Criteria:

- Must be 18 years old

- Average paycheck should be greater than $400

- Must have an active checking account

- Have a bank account balance greater than $0

- Money should be left in your bank account two days after you get paid.

- Must have at least three recurring direct deposits from your employer

Cash Advance: You can get a cash advance up to $250 if your credit card balance hits zero.

Repaying Advance: The repayment date will be given to you when you request your advances, and it can be accessible in the app. It’ll automatically withdraw the advance on your repayment date.

Fees: Brigit has both free and paid membership. Its paid membership – Brigit Plus, costs $9.99 per month. Its paid version offers instant deposits, auto advances, and credit protection & security. And its free version has very limited features when compared to the paid plan.

Special Features

- Brigit’s credit builder feature is a more affordable alternative to secure credit cards and is created to work whether you are new to credit or are rebuilding your credit.

- You can also be able to track and monitor your credit score as well as get your full credit report.

- When your balance is low, money can be automatically sent with auto advances get cash immediately in your account.

- They’ll notify you if your balance changes and if you have an upcoming bill.

- All your data is secured with the same 256-bit encryption that banks use.

If you want to read more about Brigit, make sure to follow here: Brigit Detailed Review

CashNetUSA

CashNetUSA is another app like MoneyLion that offers payday loans, installment loans, and lines of credit through the mobile platforms.

Simply download the CashNetUSA app on your device and fill out the online form by providing your basic information. For the approval process, it considers credit info and scores other than your FICO scores.

Special Features

- Review your payment details, including future and past payments.

- You can access its benefits like discount offers, coupons and free financial courses.

- Request a draw, view your available credit, and make payment.

- Loans and repayment terms depend on where you live.

- Offers interactive tools and educational resources on money management.

Eligibility Criteria:

- Should be a U.S. citizen

- Have a permanent resident with a verifiable income

- Must have an active checking account

- Be 18 years of age or older

- Have a steady source of income

Cash Advance: The maximum payday loan you can access through CashNetUSA is around $100 to $600, and installment loans range from $100 to $3,500

Repaying Advance: You must repay the loan within 8 to 35 days, depending on your next pay date.

Fees: The loan fees and the repayment terms will entirely depend on the place you live.

8 Best Sites Like CashNetUSA to Get Loan Easily [2022]

Wealthfront Cash Account

Wealthfront Cash Account is another service like MoneyLion that offers banking products and a cash account. One of the essential features of this account is that you can set up a direct deposit and get your money a bit earlier.

Eligibility Criteria:

- Any individual 18 years old or older

- Have a U.S. social security number

- A permanent U.S. residential address and currently lives in the U.S.

- Have a U.S. phone number can accept SMS text messages.

Cash Advance: Borrow up to 30% of your account whenever you need it, for whatever you need.

Repaying Advance: Payback what you borrow and the interest payment on your own schedule.

Fees: Depending on your account, interest rates can be as low as 2.40% – 3.65% and charge an annual advisory fee of $0.25% for investment accounts.

It doesn’t charge account-opening fees, trading & commission fees, withdrawal, or account-closing fees and account transfer fees.

Special Features

- No overdraft fees, no account fees, and no transfer fees.

- Wealthfront Cash Account has made managing your money simple, whether you’re planning on investing your extra cash, paying bills, or just simply saving money for a big purchase.

- You can create categories to save for things like an emergency fund or down payments, and they’ll automatically transfer your money to hit your goals.

- It has the ability to move your money from your cash account right into the market.

- Debit card allows purchased and fee-free cash withdrawals from over 19,000 ATMs.

- Self-driving and autopilot saving and investing tools.

PockBox

PockBox is one of the best apps like MoneyLion that offers a service that mainly aims to quickly connect customers with a lender which offers loans that might work for them.

All you have to do is fill out their short & secure online form to request funds online without visiting a store. Once you submit your information, they’ll try to connect you with a lender.

Eligibility Criteria:

- Be at least 18 years old.

- Should be a U.S. resident

- Must work or have a daily source of income with at least $800 per month

- Should be legally qualified to enter and form contracts under applicable law

Cash Advance: You can get over $2,500 in funding and even get more helpful options.

Fees: There is no monthly subscription fee, and the interest charges may vary.

Special Features

- Users have the ability to choose and connect with short-term moneylenders who could loan up to $2,500 immediately.

- You can easily get access to lenders who wish to provide loans, even to those with no or bad credit scores.

- The charges and interest loans you would incur when you get a loan based on the lender you select.

FlexWage

FlexWage is one of the best apps like MoneyLion that offers financial services, including earned wages access. Its chief product is WageBank that provides employees access to their earned wages prior to their next payday through a debit card.

Special Features

- It allows employees to access their paychecks whenever they need it.

- It gives reloadable payroll debit cards for employees who receive paper checks but are unbanked and could not receive direct deposits.

- You’ll be charged a fee when transferring the paycheck and using the debit card.

- You can notice that their charges are typically lower when compared to getting a payday loan.

InGo Money

InGo Money is another best app like MoneyLion that helps users cash their business checks, paychecks, and personal checks anytime. With InGo Money, you can get your money within a few minutes directly in your bank, PayPal account, or prepaid card.

Just create your InGo Money profile in the app and link your prepaid card, bank debit card, credit cards and PayPal account.

Eligibility Criteria:

- You are at least 18 years of age or higher based on the age of majority in your jurisdiction.

- Must be a U.S. citizen or legal alien residing in one of the 50 states

- All the information you provide should be in connection with each check submitted for approval is true, correct, and complete.

- All cards and Accounts to which you ask us to send funds are legally owned or controlled by you.

- You must have a verifiable address.

Cash Advance: You may use Ingo to money borrow up to $5 to $5,000. You may submit multiple checks with a total combined value of $5,000 per day and $10,000 per month. These limits may be increased to $15,000 per month for some accounts.

Fees: Money in 10 days is completely fee-free. But money in minutes charges a minimum fee of $5.

Special Features

- You can be able to choose to pay credit card bills, purchase an Amazon Gift Card or split a cheque to send money to different accounts.

- If your check is approved and your account is funded, or your bill is paid, the money is for sure.

- Its app may be used by identity-verified customers to cash checks issued on U.S. financial accounts to fund.

The Bottom Line

The above-mentioned list of apps like MoneyLion are quite different from MoneyLion as they offer different features like connecting with moneylenders or saving initiatives. So, we hope the above article on 8 best apps like MoneyLion has helped you to pick up the best option according to your needs and preferences.

Must Try these 12 Apps like Possible Finance for Instant Loans! [2021]

Try these 5 Apps Like Lenme to Borrow & Lend Money Easily! [2022]

![16 Best Apps Like MoneyLion to Manage Your Money [2024]](https://viraltalky.com/wp-content/uploads/2021/08/Apps-Like-MoneyLion-alternatives-2.jpg)