Finding the similar apps like Splitit? Look no further! In this article, we have mentioned the 8 best Splitit alternatives that you can use for payment installments.

Whether you are looking for top electrical products, children’s toys, new furniture, apparel, or whatever, these apps make a great way to buy an expensive item without getting charged high interest!

Now the question comes, why not Splitit and whether Splitit is legit or not? Well, Splitit is an amazing online tool that makes installments of payments to make shopping easier and better.

And doesn’t even require an application process. Moreover, it has the highest ratio of approving transactions and is seamlessly integrated with Big Commerce, Shopify, and more.

However, what makes it less interesting is its limited payment options availability, the limited amount of retail traders and some retailers doesn’t accept debit cards.

Thus, check out Splitit alternatives to enhance your options and make sure you are getting the best deal from different retailers.

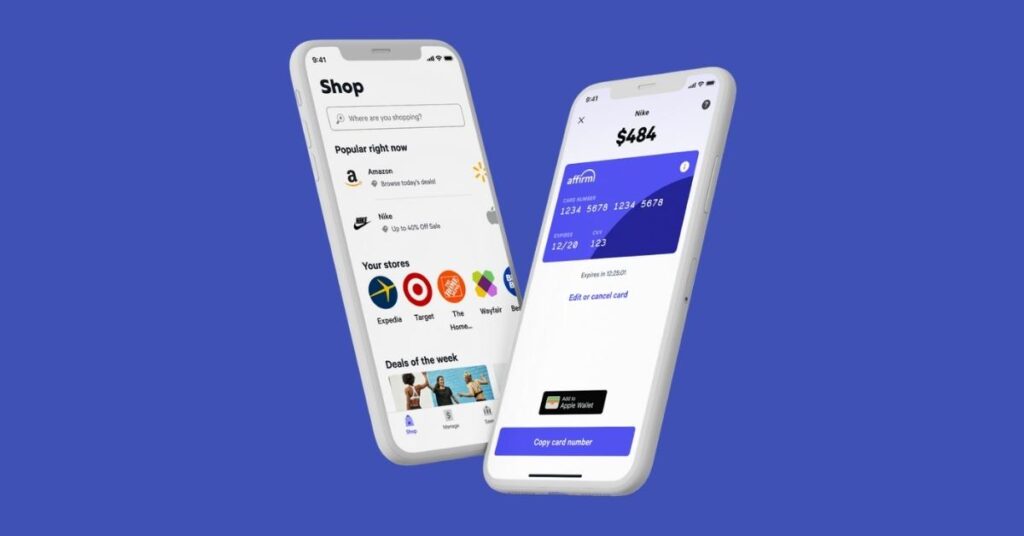

Affirm

In the first place, we have Affirm on our list of apps like Splitit. It is an online service that makes your shopping simple by making transactions easier.

After purchasing, you might have seen Affirm at a few popular stores like Wayfair, Walmart, Casper, and more. It is partnered with thousands of online and offline retailers.

Unlike a credit card, Affirm loans have a fixed payment schedule which you can view before the completion of each purchase.

And when you shop with affirm, a few retailers offer rates as low as 0% on your purchases. While some may have 30% rates, depending on your score.

Features

- Make payments at your convenience by using the app.

- Access a list of partner sellers that can connect you directly to every seller’s site.

- It offers a way to make every transaction secure.

- Offers a flexible repayment schedule to complete your payments.

- One-time-use virtual card permits you to purchase from any online seller.

Requirements For Eligibility

- Should be 18 years or older (19 years or older in Alabama and Nebraska)

- Have a valid U.S. or APO/FPO/DPO home address

- Valid U.S. mobile or VoIP number that receives SMS texts

- Give your full name, email address, date of birth

- Provide the last 4 digits of your social security number to authenticate your identity

How Does Affirm Work?

Whenever you want to purchase something, Affirm examines your account to approve that transaction.

And during the checkout, you’ll be given different payment options from which you can choose depending on your limit.

Your credit limit is based on your payment history, credit history with Affirm, and how long you have the Affirm account for.

Yet your credit limit can be increased by some factors like how you’re managing your existing loans, paying bills on time, and reducing debt balances.

Maximum Limit: Maximum purchase amount one is allowed by Affirm is around $17,500.

Repayments: You can choose to split your purchases up to three or six- or twelve-month payments to repay your loan. You can even pay off your loan early without any prepayment penalty.

Payment Methods: You can pay with your debit card or checking account. For some purchases, you can also pay by credit card for the down payment and installments. You can also pay by making a payment page.

Interest and Fees: Your purchases may charge interest rates may range from 10% to 30%, based on your credit history and on the retailer.

And it doesn’t have any prepayment fees, late fees, service fees, or hidden fees.

Afterpay

Afterpay offers access to hundreds of apparel stores, just like Splitit, and lets you pay for your purchases in four equal installments.

It is an Australian financial technology that also functions in the United States, New Zealand, the United Kingdom, and Canada.

You can easily sign up for an account without giving your social security number. What makes it more interesting is its partnership with over 23,000 sellers.

However, it is significant to note that getting approved or rejected is entirely based on a per-purchase basis.

Features

- Operates as an alternate payment option during the checkout process online or in-store.

- View your upcoming payments, orders, and account information.

- Get notified of an upcoming payment.

- Ability to change your payment card for future payments

- Users can pay for this purchase in biweekly installments with no interest.

- It helps you to free up your cash flow by sharing your purchase down into four installments.

Requirements For Eligibility

- Must be a US resident and reside within one of the 50 states or the District of Columbia.

- At least 18 years old or 19 years old in Alabama and Nebraska

- Can enter a legally binding contract

- A valid and verifiable email address and mobile number

- Valid delivery address in the United States

- Ability to use the US-issued credit or debit card to make the purchase.

How Does Afterpay Work?

First, you’ll be given a small spending limit to start with Afterpay. You’ll have to pay the first payment during the checkout and the remaining at the next installments.

For example, if your purchase amount is $100, you’ll have to pay $25 during the checkout. And the other $75 is paid in equal installments every two weeks over the next six weeks.

It doesn’t have any effect on your credit score because it’ll not report your on-time payments to the credit bureaus.

Maximum Limit: There is no usual limit on how much you can borrow through Afterpay. But several new accounts are limited to start with $500.

This limit eventually increases over time depending on on-time payments, how you use Afterpay, and the frequency of late payments.

Repayments: You can repay your loan in four equal installments, due every two weeks with the first payment paid at checkout.

For example, your every purchase is divided into four payments, with 25% paid during the checkout. And you’ll have to pay the other 75% in equal installments every two weeks over the next six weeks.

Payment Methods: Afterpay currently accepts Mastercard, and Visa credit and debit cards issued in the United States.

Interest and Fees: It doesn’t charge any interest. The only fee it charges is a late fee, which will be capped at 25% of the initial purchase and does not accumulate.

Afterpay vs Quadpay vs Klarna vs Sezzle: Grand Comparison!

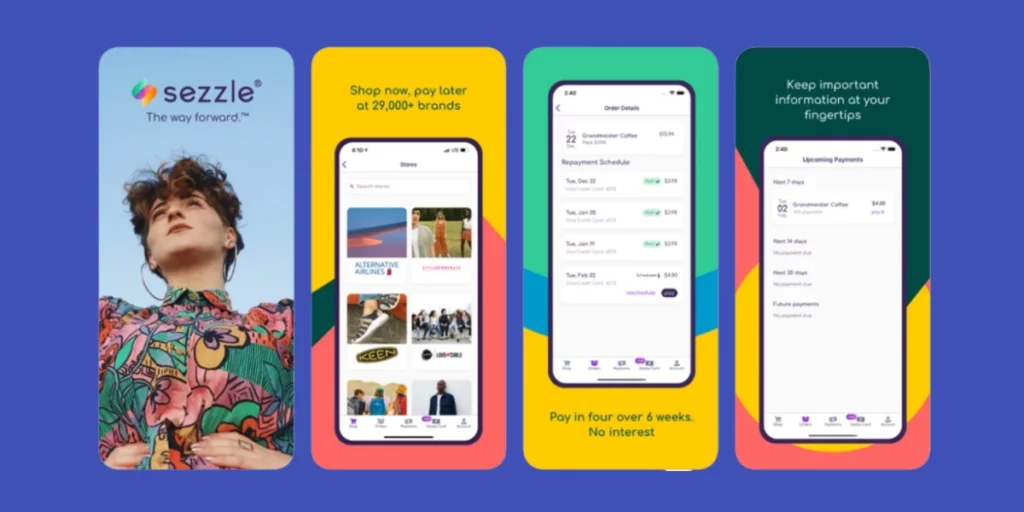

Sezzle

Sezzle is another Splitit alternative that you can use to make your shopping easier. What makes it popular is its fast approval process, which includes performing soft credit checks.

Its collection of brands is really amazing, you can buy almost everything related to fashion, baby care, health, sports, garments, and many more.

All you have to do is to shop and buy whatever you want, Sezzle will automatically divide your payment into four interest-free payments for over six weeks, without impacting your credit score.

Features

- Use Sezzle as the selected payment method through its app or website.

- Offers a wide range of products, including jewelry, footwear, clothes, and more.

- Users can pay the price of a product in four interest-free payments.

- Functions as an alternate payment option during the checkout process.

- Allow you to reschedule your payment.

- Featured stores are shortlisted based on their offers, popularity, and product quality.

Requirements For Eligibility

- Should at least 18 years old (19 in Alabama)

- A valid email address and US or Canadian mobile number

- Must have a US or Canadian bank account, a debit card, or credit card—prepaid cards will not work for an initial purchase

How Does Sezzle Work?

When you place an order, their unique approval process reviews your account and decides what type of plan should be offered to you.

After they approve you, you’ll make the necessary down payment and then three equal payments are scheduled in six months timeframe.

When your order is placed, Sezzle will instantly pay the seller in full, so the seller has their funds and can process your order easily.

A standard Sezzle account doesn’t report to the credit bureaus, so your late payments or missed payments have no impact on your FICO score.

Maximum Limit: The maximum amount you can borrow through Sezzle is $2,500 but not everyone will be approved for the full $2,500.

However, you should note that your limit might increase if you make on-time payments and use Sezzle regularly.

Repayments: Each of your three installments is due two weeks apart with no interest or any other hidden interest.

Payment Methods: You can pay through your debit card, credit card, and bank account.

Interest and Fees: It doesn’t charge any interest. However, the only fees you might be charged are the failed payments or reschedule payment fees, which are $10 and $5 respectively.

7 Apps like Sezzle to Buy Now Pay Later [2021]

Perpay

Perpay is another buy now, pay later service whose main aim is to make every day buying more available and assist you to build credit at the same time.

You can use your personalized spending limit to shop for the products that you want. After you make on-time payments for four months, you’ll qualify for credit building.

That means unlike most of the Splitit alternatives, Perpay can help increase your credit score, as it reports your direct deposit payments to Equifax and Experian credit bureaus.

Features

- Use your personalized spending limit to shop for the products you desire.

- Pay over time for your order with a small amount from every paycheck.

- You can see your credit score increase after just 4 months.

- Choose your favorite product, fill the cart and choose Perpay as your payment option.

- Perpay will continually apply your account history towards helping you build credit.

Requirements For Eligibility

- Actively maintain full-time employment

- Be in good standing with all financial requirements

- A validate three months of employment history with your current company

- Ability to set up multiple direct deposits

- An active mobile phone

- No active bankruptcies

- Access to a complete copy of a recent pay stub

- Minimum annual income should be $15,000.

How Does Perpay Work?

Once you create an account, your favorite products on the Perpay market and add them to your cart, and then apply for a review.

Perpay will examine your request, and it will offer an appropriate spending limit and a conclusion on your requested application.

When they approve your application, you’ll get an email with information on how to make payment for your purchase and get your product.

After they receive your first payment, they will ship your products. You can then repay over time with an easy repayment schedule with no interest or any other fee.

Maximum Limit: The spending limit ranges from $500 to $2500, but it’s limited for new users. Your spending limit might increase based on how you use the platform and your positive payment history.

Repayments: You can make payments in eight equal installments through a regular direct deposit. These installments are directly deducted from your future paychecks.

Payment Methods: Perpay payments are made through payroll direct deposit & are received under your employer pay cycle.

Interest and Fees: It doesn’t charge any interest. If you miss a payment by any chance or if they don’t receive the payment within six days of the due date, Perpay will charge you a late fee of up to $35.

8 Best Sites Like Perpay to Buy Now Pay Later [2021]

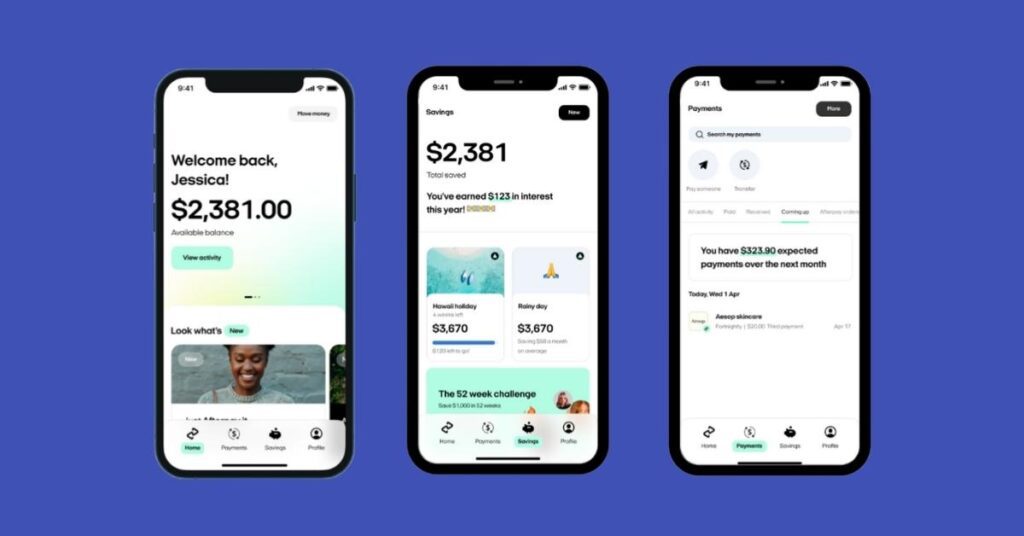

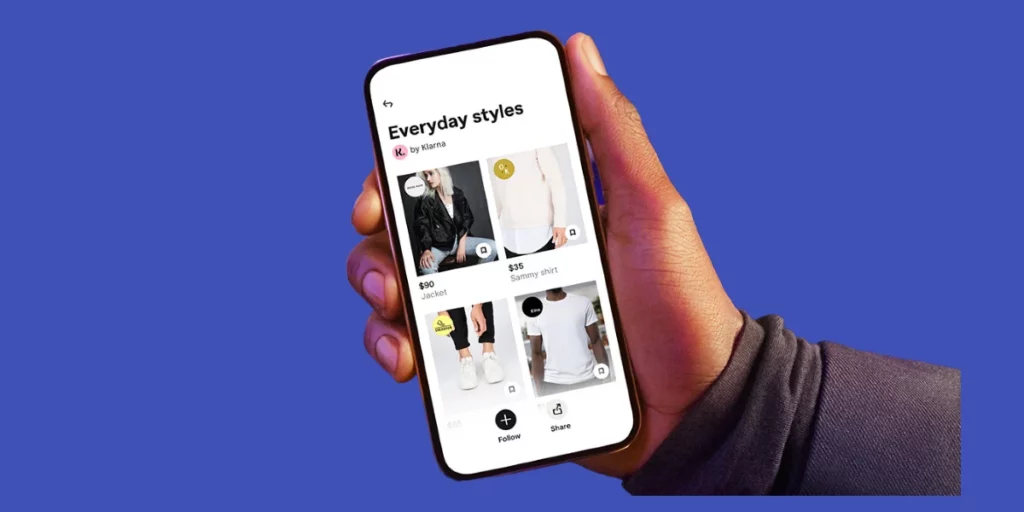

Klarna

Klarna is another app like Splitit that offers online financial services, including direct payments along with post-purchase payments and payments for online storefronts.

Its main is to offer payment solutions for the e-commerce industry and to make safe and secure payments for sellers and buyers.

Moreover, it enhances your checkout experience by offering direct payments, pay after delivery options, and installment plans that permit you to pay whenever you want.

Features

- Pay for your purchase in four installments every two weeks.

- Access over 250,000 retail partners, including IKEA, Samsung, H&M, and more.

- Online financial facilities, including direct payments, post-purchase payments, and payments for online shopfronts.

- Get live updates with delivery times, pickup codes, and even photos of a pickup point.

Requirements For Eligibility

- Must be at least 18 in order to use Klarna’s payment options

- Have a positive credit history

- Don’t have a lot of debt.

- Have a valid and verifiable email address and mobile number

How Does Klarna Work?

To approve your credit, Klarna will determine your spending limit by performing a soft credit inquiry, your Klarna purchase history, and your personal information.

When you make a purchase, you can select from one of the three financing options – Pay in 4 or pay in 30 days or a 6 to 36-month loan.

Even though Klarna performs a credit check, it’ll not affect your credit score and will not be visible to other lenders while deciding to pay in four interest-free installments.

Maximum Limit: Klarna doesn’t specify any pre-set credit or spending limit. Rather, your spending limit and the ability to shop are based on Klarna’s soft credit inquiry, the information you give, and your buying history.

Repayments: During your purchase, you can select one of three financing options- Pay in 4 or pay in 30 days or a 6 to 36-month loan.

Payment Methods: Klarna currently accepts all major debit and credit cards, such as Mastercard, Visa, AMEX, Discover, and prepaid cards are not accepted. Also, AMEX cards are not accepted when creating a One-time card.

Interest and Fees: It doesn’t charge any interest on its pay in 4 loans. But if you don’t pay your payment on time, you’ll be charged a late fee of $7, and the longer-term loans have a $35 late fee assessment.

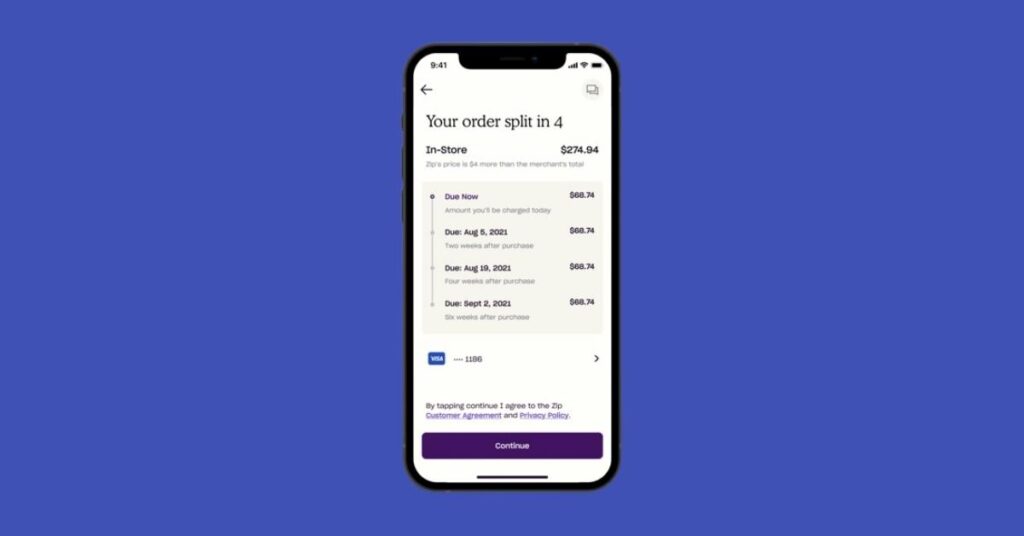

Zip

ZipPay is a fintech that aims at serving people with buying now and paying overtime. It has now acquired Quadpay and operates in Australia, the Czech Republic, the United States, New Zealand, the United Arab Emirates, the United Kingdom, and South Africa.

Zip digital wallets have two types of interest-free accounts – Zip Money and Zip Pay. These can be used with retail partners in-store and online, wherever Zip is accepted.

Zip Pay offers an interest-free service until the end of each month. And if the payment is not done by the due date, it charges $6. These accounts are available from $250 up to $1,500.

Features

- Browse more than 26,000 retailers in our Store Directory with ease and convenience.

- Browse and buy from online stores everywhere directly from the app.

- Find all the things you love and discover great new ones.

- Manage your account and shop just about everywhere in-store or online.

- Pay all your personal bills and household bills.

Requirements For Eligibility

- Be at least 18 years old.

- Have a verified PayPal, Facebook, or online banking account in your own name

- A good credit history

- Earn over $300 of primary income per week

- A valid email address and phone number

- Have a valid debit or credit card (Mastercard or Visa card)

How Does Zip Work?

Create a Zippay account and apply for a loan. Once they approve you, make your purchase either in-store or online.

Once you have decided on your purchase, you’ll have to pay $25 upfront or as a down payment, which can be paid through credit or debit card.

After that, you can view your repayment schedule, which needs three further 25% payments over six weeks. All these payments are entirely interest-free.

If you don’t pay your bills on time, it will affect your credit score. Also, it’ll check your credit score when you apply for the service, therefore, it is important to make on-time payments.

Maximum Limit: The maximum amount you can access through Zip Pay is $350 to $1,000.

Repayments: You’ll pay only the first 25% of your purchase amount and the other 75% will be divided equally and paid over the next six weeks.

Payment Methods: It will automatically debit your repayments from the payment method that is linked to your account.

Interest and Fees: It doesn’t charge any interest or any other hidden fees. However, if you don’t pay your balance in full, they may charge you a $7 fee on the first of every month.

7 Apps Like Zip to “Buy Now Pay Later” [2022]

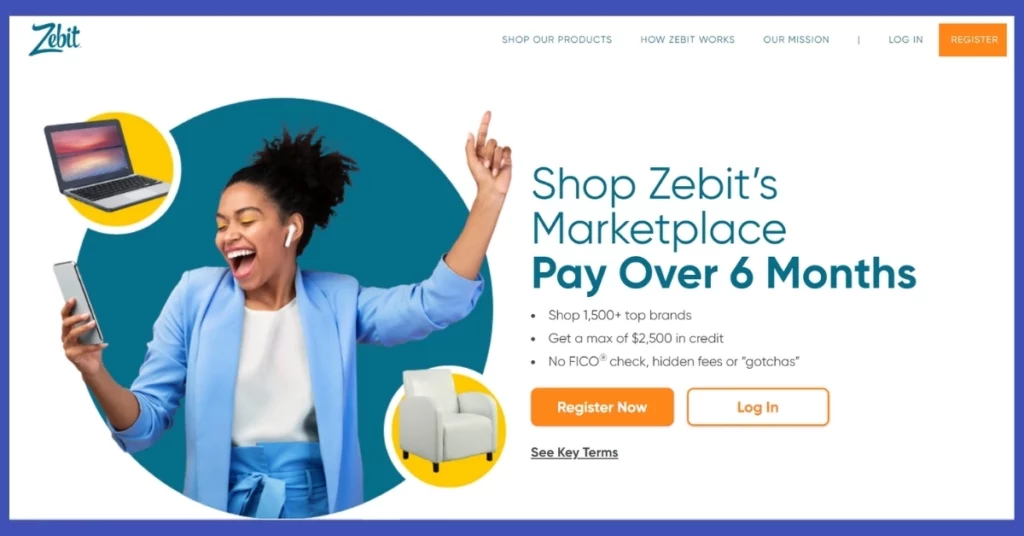

Zebit

Zebit lets you browse the site and offer you the chance to be able to use a credit account without having to worry about the interest rates.

It offers a wide variety of products with popular categories like home décor, electronics, furniture, other utilities, and many more.

It gives its users a credit line of $2500, and they have a Zebitscore, which will determine your ability to use the app.

Features

- Get interest-free store credit or ZebitLine up to $2,500.

- Zebit will determine how much credit you’re eligible to receive through the application process.

- Offers a variety of branded products.

- Browse and check what products are available through the Zebit Market.

- Make a 25% down payment now and the remaining 75% over the next 6 months.

- Does not report your payments to any credit bureaus.

Requirements For Eligibility

- Be over 18 years old

- Have a valid Email address

- Have a valid, verifiable US mobile number

- Might verify your identity and your employment or income

How Does Zebit Work?

Zebit offers users up to $2,500 in credit that can be used to buy products from the Zebit Market.

From the Zebit Market, you can purchase products completely interest-free and through the ZebitLine, you will have to finance these products.

You’ll have to make a down payment at the time of purchase and pay the remaining balance for the next six months.

For example, if you are purchasing a product for $1,000, you’ll have to make a down payment of 25%, i.e., $250, and the remaining $750 is financed for the 6 months timeframe.

As ZebitLine is only valid with your current employer, you cannot leave your employer because ZebitLine will be discontinued.

Maximum Limit: The maximum amount you can access through Zebit is $2,500.

Repayments: You’ll be given six months to repay for the products you buy, and these payments are divided across the six-month timeframe.

Payment Methods: Zebit accepts credit and debit cards.

Interest and Fees: It does not charge interest, late fees, application fees, or membership fees.

10 Best Sites Like Zebit to “Buy Now Pay Later” [2021]

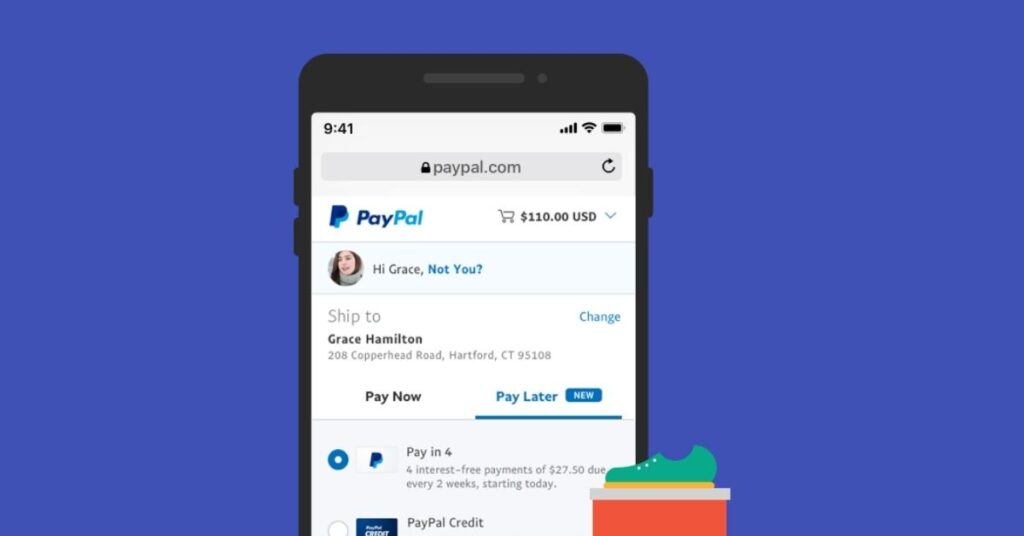

PayPal Pay in 4

Lastly, we have PayPal Pay in 4 in our list of the best sites like Splitit. You’ve probably used PayPal at one point or another to send or receive payments.

PayPal Pay in 4 is a new service that only appears as a choice at the point of sale for users who have a PayPal account in a splendid position.

That means if you have a negative balance in your PayPal account, there is a probability that PayPal “Pay in 4” option will not appear in the PayPal wallet.

Users can divide the cost of purchases between $30 and $1500 into four interest-free payments, which comprise an initial payment and three automatic installments.

Features

- Operates as a payment processor for online retailers, auction sites, and many other commercial users.

- Exclusive transaction dispute resolution mechanism protects both the seller and the buyer.

Requirements For Eligibility

- At least 18 years old

- Live within an eligible state within the United States

- Have a valid PayPal account connected to your credit or debit card

- Agree to have a soft credit check completed

- Complete a transaction valued between $30 and $600

How Does PayPal Pay in 4 Work?

Create a PayPal account and give your basic information, such as your card info and home address and also link your bank account directly.

If you are qualified, you get to view the Pay in 4 option in the PayPal wallet. You just have to click on the standard PayPal button to pay for your purchases.

The first payment should be made during the time of purchase and these repayments are deducted automatically from your PayPal account based on the payment method you’ve selected.

Note that missing payments can negatively affect your credit score if you leave it unpaid for 30 days or longer.

Maximum Limit: You can be eligible for purchases ranging from $30 to $1,500 that you make using your PayPal account.

Repayments: The three installments are automatically scheduled biweekly over six weeks to be paid through your PayPal account.

Interest and Fees: It doesn’t charge any interest or any other fee like late fees. However, the only fees PayPal charges are currency conversion fees on international purchases.

| Name of the App | Credit Limit | Interest | Credit Check | Minimum Credit Score | Late Fees | Term Length & Installments |

| Affirm | $17,000 | 0% – 30% | Soft credit check | 550 | No | three or six or twelve months |

| Afterpay | $500 | None | None | None | 25% of the purchase amount | 6 weeks |

| Sezzle | $2500 | None | None | None | $5 | 3 installments, due every two weeks |

| Perpay | $500-$2500 | None | None | None | Up to 35 | Eight equal installments |

| Klarna | No specific pre-set credit or spending limit | None | Soft credit check | None | $7 for pay in 4 and $35 for longer term loans | Pay in 4 or pay in 30 days or 6-36-month loan |

| Zip | $350 to $1,000 | None | None | None | $7 | 6 weeks |

| Zebit | $2500 | None | Credit check with a third party | None | None | 6 months |

| PayPal Pay in 4 | $30 to $1,500 | None | Soft credit check | None | None | 4 installments, every two weeks |

Final Words: 8 Best Apps Like Splitit!

With the apps like Splitit, you can buy something now, and pay off the remaining amount over time. Most of these apps are interest-free and don’t charge any kind of fee.

These buy now, pay later apps have become incredibly popular to help customers pay off their purchases over a longer time.

Nevertheless, remember that having access to these services doesn’t mean that you can purchase anything without limit.

Hopefully, the above article has helped you to select the perfect Splitit alternative!

From Australia? Best Buy Now Pay Later Apps in Australia [2022] Best Alternatives Apps Like Deferit to Check Out

![8 Apps Like Splitit to “Buy Now Pay Later” [2024]](https://viraltalky.com/wp-content/uploads/2021/12/Apps-Like-Splitit-alternatives.jpg)