Affirm vs Splitit – Affirm and Split are Buy Now, Pay Later apps that lets consumers divide their payments and pay less upfront.

This option will be provided during the checkout process or users can pay as they usually do by PayPal, debit card, or other preferred methods.

With both Affirm and Splitit, you can make your first payment one month after your purchase and the remaining amount can be paid in the following months on the same date.

Unlike Splitit, Affirm charges interest rates up to 30%. So, read on further to know more about Affirm vs Splitit comparison.

Affirm vs Splitit: Overview

Affirm: Affirm functions as a financial lender of installment loans for users to use at the point of sale to finance a purchase.

These loans have a fixed payment schedule which you can view before the completion of each purchase. Although it charges interest, a few retailers interest rates are as low as 0% on your purchases.

| Pros | Cons |

| No late fees or prepayment fees | Requires a soft credit check |

| Interests can be as low as 0% | Interests can range from 10% to 30% |

| Credit limit can be increased based on your credit history |

Splitit: Splitit is a payment solution that lets you pay for your purchases by using an existing credit card and then split the billing cost into interest and fee-free monthly payments.

Compared to other buy now, pay later services, you don’t have to pay extra interests or fees except what their credit card issuer may charge for missed payments or ongoing balances.

| Pros | Cons |

| Doesn’t charge any interest | Doesn’t improve your credit score |

| Doesn’t perform any credit check | Has only limited retailers |

| No application process | Retailers may place minimum or maximum buying values |

| Can make early payments |

Affirm vs Splitit: How Do They Stack Up!

Here is everything that you want to know about Affirm vs Splitit;

Features

Affirm:

- Checks your eligibility for a loan, verifies your details, and sets up your account.

- Make payments at your convenience by using the app.

- One-time-use virtual card permits you to purchase from any online seller.

- Access a list of partner sellers that can connect you directly to every seller’s site.

- Select the type of purchase that wish to repay.

- Offers a flexible repayment schedule to complete your payments.

- It offers a way to make every transaction secure.

Splitit:

- It is an interest-free payment solution.

- You can make purchases with a credit or debit card.

- Ability to choose how many installments you wish to use to repay for your purchase.

- Split installments over multiple cards if you don’t have a high enough balance on one card.

- It doesn’t require any application process.

- Installments are deducted directly from your existing debit or credit card.

- No late or hidden fees, and it doesn’t charge interest.

- Seamless integration with most e-commerce platforms like Shopify, WooCommerce, or Magento.

Requirements For Eligibility

Affirm:

- Must be 18 years or older (19 years or older in Alabama and Nebraska)

- Have a valid U.S. or APO/FPO/DPO home address

- Valid U.S. mobile or VoIP number that receives SMS texts

- Provide your full name, email address, date of birth

- Give the last 4 digits of your social security number to authenticate your identity

Splitit:

- Should be over 18 years old

- Have a valid email address

- Have a valid and verifiable US mobile number

How Do They Work?

Affirm: Once you open an account with Affirm, you will need to qualify some requirements and then, you’ll need a maximum purchase amount.

Although the spending limit varies by customer, the maximum spending limit that is allowed by Affirm is $17,500. And every time you try to purchase something, that transaction needs Affirm’s approval.

At the checkout, you can view the payment options, which you can select depending on your budget. However, note that Affirm’s loan terms differ by the merchant. That means your repayment options and APR will entirely depend on where you shop.

While most of the repayment plans come under three categories – 3, 6, and 12-month plans, some transactions may have even more time period to pay off the purchase.

After your purchase is processed, your first monthly payment is due, and the remaining payments are due each following month on the same day.

There is also a possibility that you might have to make an initial payment at checkout if you don’t qualify for the complete loan amount.

Remember that payments are automatically withdrawn from your bank account. And there is no limit to how many loans you can access with an Affirm account at a time.

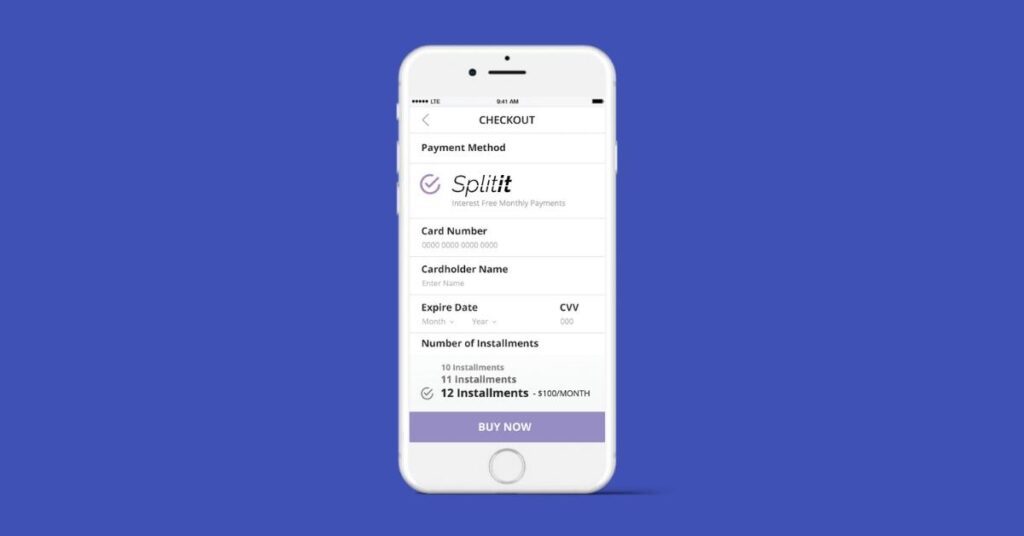

Splitit: Unlike Affirm, Splitit doesn’t have an application process. So, when you choose Splitit as your payment option, it’ll either create automatic installment payments or you can select the number of interest-free payments that you’d like to make.

These payments can be made over 3, 6, 12, or 24 months. But some sellers limit the number of possible payments. So, always check with your retailer to view what terms they allow.

Once it approves you, use Splitit to regulate your buying. When you complete the purchase and the seller approves your shipment, it ensures that you have the available credit for the complete purchase.

Then, you’ll have to pay for your first installment on the day of your purchase and then each month on the same day for a number of installments you’ve selected.

All required payments are automatically made and if you’ve used a credit card during the purchase, it will charge your card the installment amount on the same date every month.

If you’ve used a debit card, it’ll automatically withdraw the required amount from your checking account. Thus, ensure you have adequate funds in your checking account.

Note that Splitit asks you to provide your email to set up an account with the support portal on its website. You use this portal to check your installments and make payments.

Interest and Fees

Affirm: Usually, interest rates are based on the retailers you are shopping with, and in some cases, your personal credit history.

On Affirm’s website, you may even find several retailers like Casper, Mirror, Rings, and Dyson, with financing as low as 0%.

However, other purchases may charge interest rates may range from 10% to 30%, based on your credit history and on the retailer.

You should also note that Affirm doesn’t charge any fees on its loans or to create an account, and also there are no hidden fees.

Moreover, it doesn’t even charge late fees, but it is possible that your late payments may impact your credit score and credit history.

Splitit: Unlike Affirm, Splitit doesn’t charge any interest or fee to the buyers. However, it is important to note that fees and interest from your credit card may still apply.

It charges the retailer or merchant fee for every transaction. Even though it doesn’t charge any late fee, you should remember that it could hurt your credit score and even lead to a higher interest rate.

And since the purchase goes on your credit card, the payments may be reported to credit bureaus.

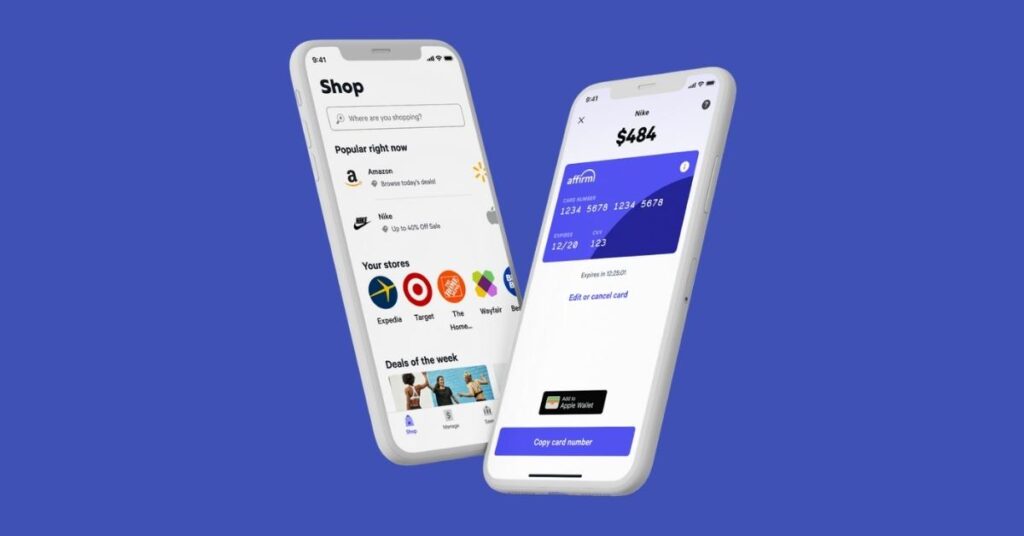

Mobile App

Affirm: You can access Affirm on both iOS and Android devices. After you install the app, you can access your account and shop stress-free at your favorite stores.

You can also view your transaction history, as well as pay your bills. It offers a personalized experience depending on your spending limit and shopping history.

You can complete your purchase online or in-store with Google Pay or Apple Pay. The app offers great deals on electronics, automobiles, apparel, appliances, and more.

Splitit: You can only use Splitit on the web, and it doesn’t have an app yet.

Customer Service

Affirm: If you need any help with Affirm, you can email their customer support at help@affirm.com or cares@affirm.com or call them at (855) 427-3729. Visit Affirm’s help centre for more information.

Splitit: If you need any help with Splitit, you can email their customer support at support@splitit.com or contact them at 1-844-775-4848.

Katapult vs Affirm: Complete Comparison [2022] Affirm vs PayPal: Complete Comparison [2022]

| Affirm | Splitit | |

| Application Process | Yes | No |

| Credit Limit | Varies | No credit limit |

| Repayment Terms | Varies by loan | Varies by loan |

| Amount Due at Purchase | As low as $0 | 25% |

| Interest | 0%, 10% to 30% | None |

| Credit Check | Soft credit check | No credit check |

| Minimum Credit Score | Not Available | Not Available |

| Late Fees | None | None |

| Prepayment Fees | None | None |

| Popular Brands | Walmart, Peloton, Pottery Barn, Expedia | GameStop, Public Rec, Umbro, Altitude Sports |

Final Words: Affirm vs Splitit!

Both Affirm and Splitit are amazing buy now, pay later services, thus, it can be quite difficult to choose a particular platform. Nevertheless, we can help you with it!

Affirm can be an appealing choice for those who would like to browse a wide variety of retailers. But it charges interest, so it cannot be ideal for everyone.

On the other hand, Splitit doesn’t charge any interest or late fees, but it has a limited number of retailers. Nonetheless, it is really easy to use and doesn’t even require an application process.

So, hopefully, the above article might have helped you to know everything about Affirm and Splitit and allows you to understand how Affirm vs Splitit compare!

8 Apps Like Splitit to “Buy Now Pay Later” [2022] Sezzle vs Affirm: Complete Comparison [2022] Affirm vs Shop Pay: Which one is Better for You? [2022]

FAQs

Can you split pay with Affirm?

Yes. With their split pay, you can make 4 interest-free payments for your purchases.

Does Splitit affect credit?

No, it doesn’t affect your credit score.

Does Affirm help you build credit?

Your positive payment history and credit use may be reported to the credit bureaus, which can help you build credit.

Is Splitit interest-free?

Yes, Splitit is completely interest-free and doesn’t charge any late or prepayment fees. Moreover, it doesn’t require any credit check and registration or application process.

Can I pay off my installments early?

Yes, you can. This option is available on your Splitit shopper portal, or you can contact our customer care at support@splitit.com.

From Australia? Try these Best Buy Now Pay Later Apps in Australia [2022]

![Affirm vs Splitit: Which Is Better For You? [2024]](https://viraltalky.com/wp-content/uploads/2021/12/Affirm-vs-Splitit.jpg)