Affirm vs Shop Pay: More individuals are using the internet to perform the majority of their shopping than ever before, which has increased the popularity of buy now pay later services.

Affirm and Shop Pay are two of your payment options if you're thinking about opening an online business or store. Both options enable your consumers to make periodic payments rather than a single cash payment for their purchases.

Though both may seem to be the same, they operate somewhat differently. So, to help you in making the best choice for your website and business objectives, we compare Affirm vs Shop pay in this article so that you’ll know what they are, their features, and the advantages.

Affirm vs Shop Pay: Overview

Affirm

Affirm is a stand-alone financial services provider that gives clients access to its own loan solutions. With no fees, it offers consumers a better option to pay over time. As a seller, you may grow your customer base and raise the average purchase value by using Affirm's diverse payment options.

For a seamless customer experience, you can provide the most flexible and pertinent payment alternatives in one display. And it allows customers to select between longer installments of up to 36 months, 4 interest-free payments every 2 weeks, or both.

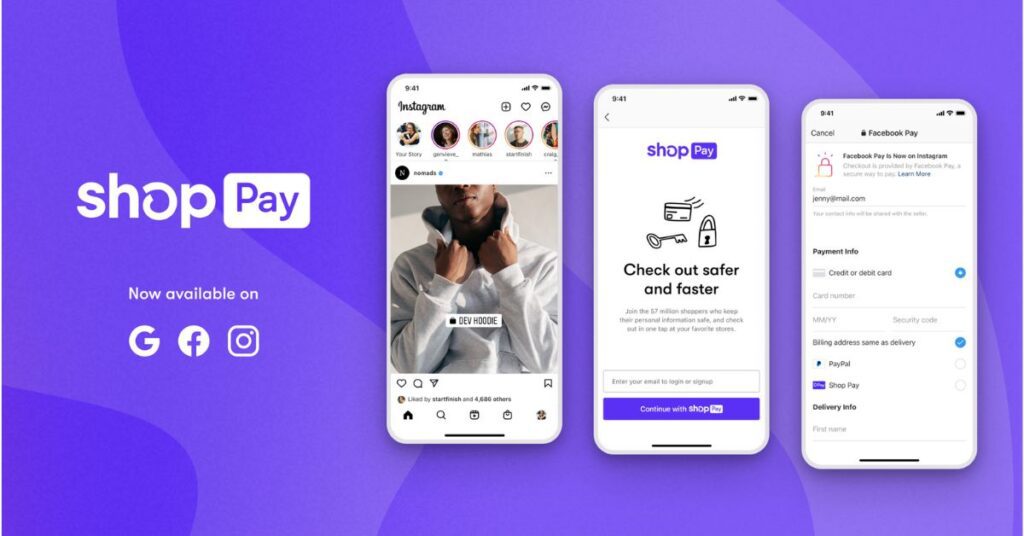

Shop Pay

Shop Pay is another method of payment offered by Shopify, which lets shoppers save shipping, billing, and credit card information to expedite the checkout process. It is in direct competition with other payment processors such as PayPal, Amazon Pay, Google Pay, and Apple Pay.

You can save up to five shipping addresses and credit cards, and you can feel confident knowing that your information is protected because it uses SMS text verification using a mobile device.

And as a seller, you get paid up front for the entire transaction even though your customers have the choice of breaking it into four equal payments with no interest or fees or paying in full.

What’s the difference between Affirm and Shop Pay?

For sellers: How do they work?

Affirm

When you offer your customers the appropriate offer, you can close every possible transaction. You can offer a variety of term length choices available for purchases between $50 and $17,500.

Giving customers the ease of flexible payments through Affirm, provides your business a competitive edge and boosts customer retention.

And for a seamless customer experience, you may provide the most adaptable and applicable payment options in one view using Adaptive Checkout.

Shop Pay

Shop Pay is very easy to use and understand. After selecting Shop Pay at checkout, your customers will need to input their billing, shipping, and credit card information.

The opportunity to save the information for a quicker checkout the next time they visit, is what makes it intriguing.

Keep in mind that Shop Pay has built-in security features to protect your customers' information by delivering a Shop Pay code straight to their registered mobile number.

This technique may seem pretty difficult to you, but it's not! You'll discover that adding the Shop Pay button to your checkout is incredibly simple and quick.

When do you get paid?

Affirm

Consumers that use Affirm pay either 0% APR or 10-36% APR for each transaction, depending on their credit history and the financing option they select.

As a buyer, you’ll never pay more than you agreed to on day one, regardless of your payment plan, as Affirm never assesses late fees or any other form of costs.

Shop Pay

Within 1-3 business days, you’ll receive the entire amount due for the order without having to wait for payment from the buyers. The types of payments accepted by Shopify differ depending on the providers used to handle the transactions.

Affirm vs Shop Pay: Requirements

Affirm

- Be at least 18 years old

- Give a true U.S. or APO/FPO/DPO residential address.

- You are required to consent to SMS text message delivery and give a functional VoIP or U.S. mobile phone.

- The phone account needs to be set up under your name.

- To confirm your identification, you need to provide your full name, email address, birth date, and the last four digits of your social security number.

Shop Pay

- Age requirement of at least 18 years

- Billing details must coincide with the registered bank account.

- Installment agreements are available for orders between $50 and $3,000 that include discounts, taxes, and shipping.

- Customers have two payment options: they can pay in whole at the register or divide the cost into four equal, interest-free installments.

Affirm vs Shop Pay: Fees

Affirm

Affirm charges you a percentage fee for each transaction, just like any other lending company, plus your discount rate (MDR), which might change based on the type and size of your business. Although the fees are not made public, the majority of estimates place them at roughly $0.30 per sale.

Shop Pay

Different transaction fees can apply to online purchases. Though the issuer and credit card company charge a nominal fee for credit card transactions, you won't pay any transaction fees for orders placed with Shopify Payments in the majority of countries.

You might just pay a credit card processing cost, depending on your membership package with Shopify. And there is a charge for each transaction made with them if you use a third-party payment provider.

Final Words

Hopefully, the above article might have helped you to know everything about Shop Pay and Affirm which allows you to understand Affirm vs Shop Pay compare!

READ BELOW MORE COMPARISON: Affirm vs PayPal: Which Is Better For You? [2022] Sezzle vs Affirm: The Only Guide You Need [2022] Katapult vs Affirm: Which Is Better For You? [2022] Affirm vs Splitit: Which Is Better For You? [2022] Afterpay vs Shop Pay: Which Is Better For You? [2022]

FAQs

Is Affirm the same as shop pay?

Affirm is the originator and servicer of Shop Pay installments, but payments are managed in your Shop Pay account.

Is Shop Pay only for Shopify?

Shop Pay is the fastest, easiest way to pay on Shopify. Plus, it's built on the same security infrastructure as Apple Pay and Google Pay, so you can rest assured that your payment information is safe and secure.

Can you pay off an Affirm loan early?

Yes — consumers can pay off their Affirm loans early without paying any prepayment penalties or fees. In fact, paying off your loan early can even save you money by avoiding interest.

![Affirm vs Shop Pay: Which one is Better for You? [2024]](https://viraltalky.com/wp-content/uploads/2022/12/Affirm-vs-Shop-Pay.jpg)