Loans Like Safety Net Credit: Financial Crisis is very real when we talk about paying bills and no savings. In this era, everyone is struggling to meet a financial balance between life, earning, and health.

But most of the time, creating the balance is a stress in itself. Hence then we need financial help such as short-term loans, payday loans, overdrafts ect to keep ourselves moving. Safety Net Credit is a good payday loan alternative that provides loan offerings to its applicants.

In this article, we are going to talk about the best Loans like Safety Net Credit to try your luck getting financial help with easy transfer of funds and availability.

By the end of the article, you will get details such as eligibility criteria, borrowing limit, interest rate, etc of these Safety Net Credit Alternatives.

List of Loans Like Safety Net Credit

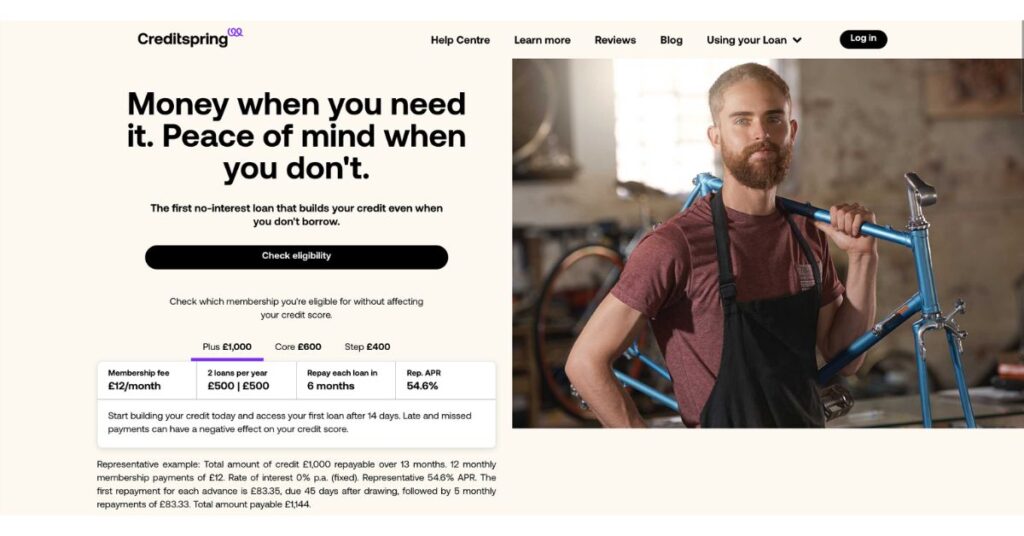

1. Credit Spring

Credit Spring is a service that offers you funding as interest-free loans but on monthly subscriptions. You need to pay 7 to 12 pounds every month as of insurance policy to get funds from Credit Spring.

Credit Spring let its customers borrow up to 200 pounds to 500 pounds twice per year and will get 6 months to repay the same with each advance they receive. Credit Spring can be a good alternative to loans like Safety Net Credit to get funds easily.

With Credit Spring, you can cancel the membership anytime. You can easily repay the first one and get a second advance immediately with other benefits of access to the Stability Hub etc.

Eligibility

- The borrower should be 18 years of age.

- You need to be a UK resident.

- Your per annum income should be a minimum of 14,000 pounds.

- Self-employed students are not given loans from Credit Spring.

Borrowing Limit

- Among up to $638 or $380 or $255 for 6 months.

- From 200 pounds to 1000 pounds for 12 months.

Interest Rate

- From 54.6% to 88.8%

Repayment

- Monthly Repayment through Online Payment Mode.

Funds Released

- Once you have signed up, you need to wait for 14 days before applying for a loan.

- After you have applied for a loan, on approval the transfer of funding is usually immediate within an hour or the same day.

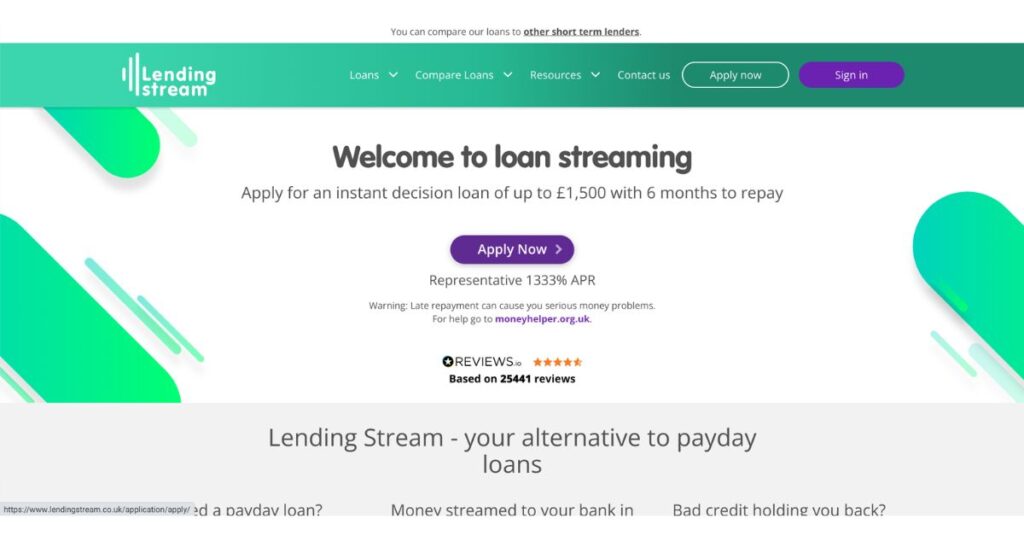

2. Lending Stream

Lending Stream is another close loan provider like Safety Net Credit to get easy funds with flexible repayment options. Lending Stream offers installment loans with a repayment facility of 6 months.

The user interface of Lending Stream is user-friendly and its services are quick and efficient. The website also has to Compare with other features to compare the loans provided by Lending Stream with other sites like Amigo, Bamboo, MyJar, etc to select the best out of them.

Lending Stream works by applying for a loan, and getting the approval on the same. Once approval is done, you get funds directly in your bank account and then you can take control of the repayments.

Eligibility

- You should be a UK resident and should be of 18 years of age.

- Your monthly income should be above $510 or 400 pounds minimum.

- The borrower must have an active debit card and bank account.

Borrowing Limit

- From $63.87 up to $1900 for 6 to 12 months.

Interest Rate

- 292% per annum fixed.

Repayment

- The repayment method with Lending Stream is on a monthly base.

- The repayment starts from $200 per month.

Funds Released

- The funds will be released within a few minutes of your loan applications with online payment mode, direct debit, or phone payment option.

- Lending Stream promises to lend money after approval within 90 seconds.

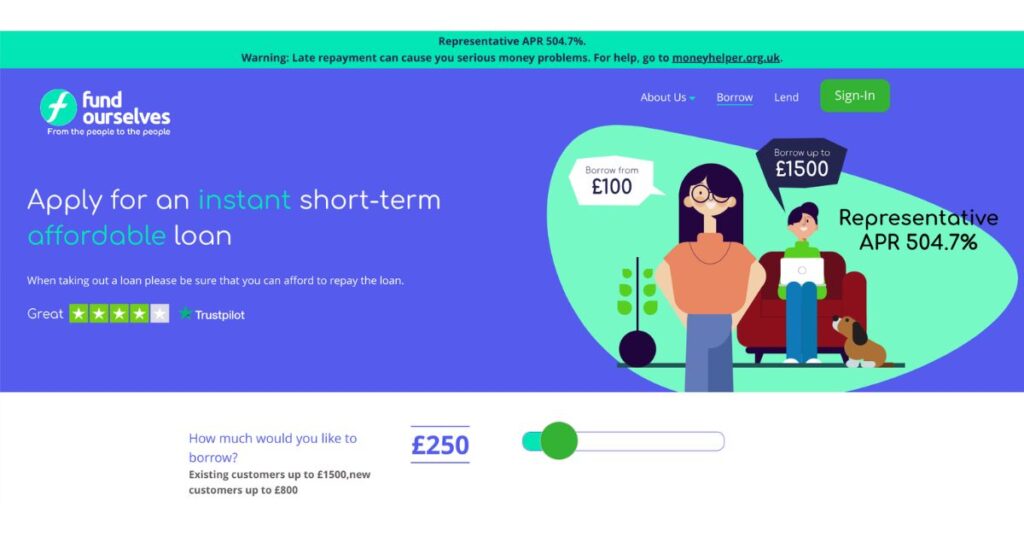

3. Fund Ourselves

Fund Ourselves is said to be a FinTech Company providing short terms loans for its customers with no-so-good or poor credit scores. It offers pay-back early repayment features without any penalty.

With Fund Ourselves offers 5 minutes of the application procedure, instant and quick decisions for easy loan approvals. Fast funding with flexible repayment options. Fund Ourselves works 24 hours online 7 days a week for best services.

The loan repayment usually works as equal installments depending upon the loan amount and loan term duration under Fund Ourselves. Though, Fund Ourselves is a good option for Loans like Safety Net Credit.

Eligibility

- You should be over 18 years of age.

- Full-time UK resident.

- You should be earning a regular income.

- You should have a valid UK Bank Account, mobile phone, and email address.

- No Guarantor Required.

- Bad credit is considered a big no for bankruptcy, CCJs, and IVAs.

Borrowing Limit

- From $127 to $1900.

Interest Rate

- 208% per annum which is fixed.

Repayment

- Flexible repayments option.

- No early repayment fees.

- No hidden costs.

Funds Released

- Instant loan decision with a 5-minute application process.

- Funds will be transferred on the same day of application and approval.

4. Drafty

Drafty is a good alternative for loans like safety net credit to borrow a line of credit. It offers no hidden fees, fast funding, and other exclusive features to its borrowers.

Borrowers only have to pay interest on the amount they have used, it is convenient and has more competitive rates than many other payday loans available in the UK. Borrowers can easily repay the whole loan amount early without paying any extra fees.

Drafty offers an option to change your repayment date at your convenience and also offers the feature of reducing the interest by paying the loan term amount early. To solve any queries you can call them on – 0203 808 4440.

Eligibility

- The borrower should be of 18 years of age.

- You need to be a permanent UK resident.

- You should have an active bank account and a valid debit card.

- You should have a monthly income of 1250 pounds as minimum income.

Borrowing Limit

- 3000 pounds or $3800 approximately.

Interest Rate

- The interest rate of Drafty is up to 96.2%

Repayment

- The repayment is carried out monthly with continuous payment authority.

- Additional repayment methods are available such as online payment with Drafty.

Funds Released

- The funds are released after approval within 90 seconds to the borrower’s bank account with Drafty.

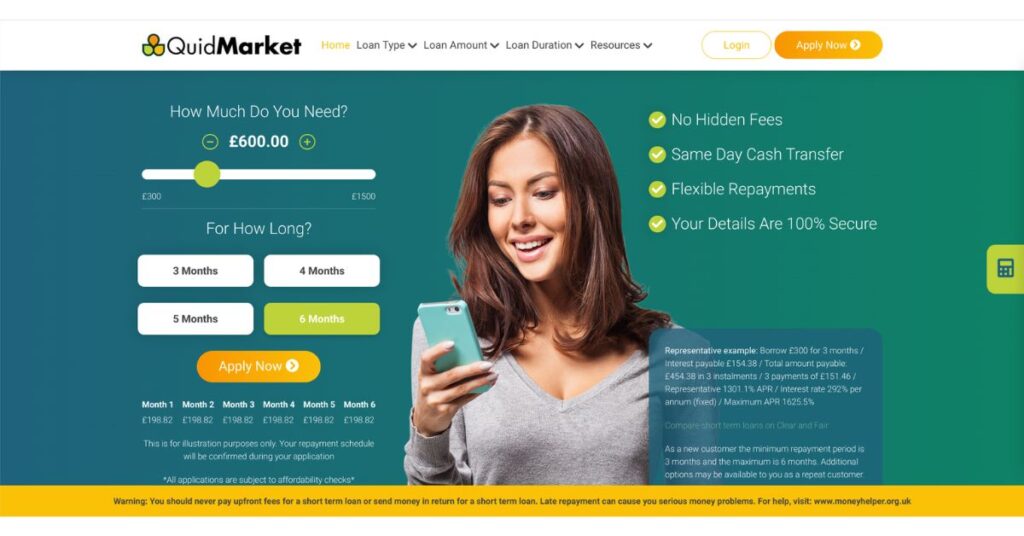

5. QuidMarket

QuidMarket is a direct lender under the authorized FCA list. It is one of the closest loans to safety net credit to borrow funds easily, quickly, and with many benefits. QuidMarket offers a same-day cash transfer feature for every applicant.

It is a great option if you have bad credit and find it difficult to get traditional loans from banks. QuidMarket promises more flexibility in repayment options than any other traditional payday lender.

QuidMarket doesn’t need a guarantor for applying for loans under them. No hidden fees are charged by QuidMarket from its borrowers.

Eligibility

- Should be between the age of 23 to 65.

- Should be a resident of the United Kingdom.

- Should have a valid mobile number with a current UK Bank Account.

- A valid debit card is a must.

- Must be employed or at least take home salary should be 1250 pounds per month.

Borrowing Limit

- 300 pounds to 1500 pounds for 3 to 6 months.

Interest Rate

- The interest rate of QuidMarket is charged 0.8% per day of the amount borrowed.

Repayment

- Flexible Repayment method between 3 to 6 months.

Funds Released

- QuidMarket offers same-day cash transfers whenever it's possible.

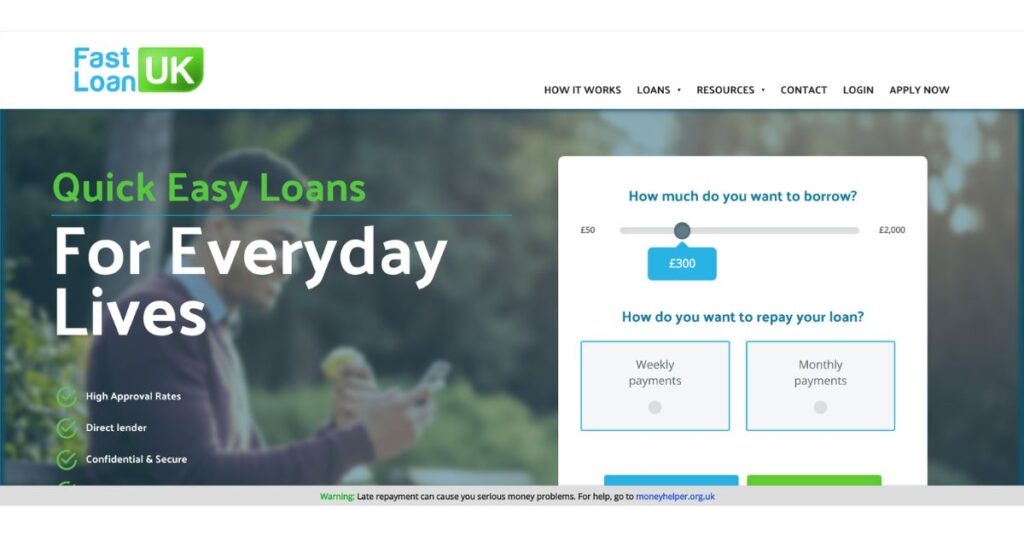

6. Fast Loan

Fast Loan UK is quite an effective loan alternative for Safetynet. It is very convenient to borrow money from Fast Loan as they provide loans from 7 days to 12 months criteria. It has no hidden costs, it is one of the direct lenders with high approval rates.

Fast Loan UK provides the benefits of repaying early. You can easily repay the loan term amount to avail the benefit of reduced interest. Borrowers only have to pay interest for the funds outstanding with Fast Loan.

To get more worthy insights about Fast Loan UK, you can check here.

Eligibility

- The borrower’s age should be of 18 years and above.

- You should be a current United Kingdom resident.

- You should receive a regular mode of income.

- Should possess a valid bank account with a debit card.

- You should be full-time, part-time, or self-employed.

Borrowing Limit

- From 50 pounds to 2000 pounds.

Interest Rate

- 130.21% per annum fixed.

Repayment

- The repayment is of two types under Fast laon: Weekly payments and Monthly payments.

Funds Released

- The funds are released within 15 minutes of signing the loan agreement with Fast Loan UK.

Conclusion

Here we come to the end of the article disclosing the best loans like safety net credit to get your financial aid from. In this article, we scrutinized every crucial piece of information one needs before selecting a lender to lend money from.

FAQs

Can I still borrow from Tappily?

It depends on whether you have revoked Tappily’s access to your bank account or not to borrow from Tappily.

Is SafetyNet still lending?

It has entered administration and has no information on lending received from 9th January 2024.

Is there anything similar to Credit Spring?

Yes. In this article, you can find many alternatives to Credit Spring and SafetyNet.

Try Alternative Loans in UK-

![7 Top Loans Like Safety Net Credit & Alternatives [2024]](https://viraltalky.com/wp-content/uploads/2023/08/Loans-Like-Safety-Net-Credit.jpg)