Loans like Lending Stream: Lending Stream is offers short-term loans great for paying for short-term cash flow problems or unplanned necessities like auto repairs. If you have been looking for an alternative to loans like Lending Stream, you are at the right place.

We offer as much information about loan providers as possible to help you decide which would be best for you. On this page, we will cover loans like Lending Stream, its features, eligibility and the details of their terms.

We hope that this will assist you in choosing a loan that has the same or better attributes as Lending Stream for you.

List of Loans like Lending Stream

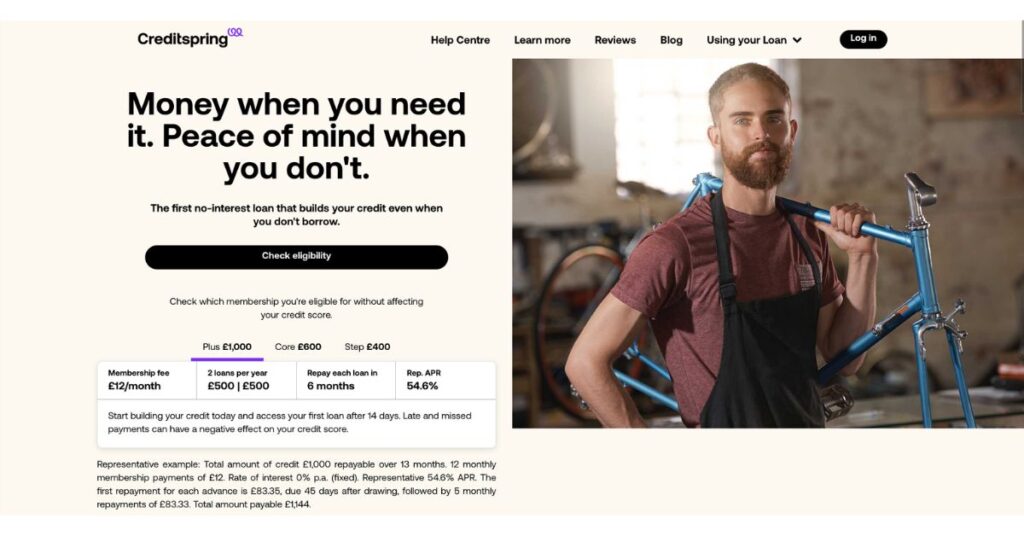

1. Credit Spring

You can borrow money more easily and affordably with Credit Spring membership loans. It was developed to help you avoid unexpected costs.

It offers a variety of membership tiers that can help you rebuild your credit or even receive the money you need to cover an unexpected expense. You can check your stability score as a member of Credit Spring to learn more about your financial situation and credit eligibility.

Feature

- Your membership is always refundable.

- You are not penalized if you pay back your loan early in part or in full at any time.

- Your credit score can be improved through loan repayments and membership dues.

- When a financial shortfall strikes, you won’t lose time searching for and applying for credit.

Maximum loan amount

£1,000

Interest rate

0% interest

Loan term

12 months

Eligibility

- The age must be over 18.

- Have a home in the UK permanently.

- Do not currently have any CCJs, IVAs, bankruptcies, or debts.

- Pass affordability checks, which include giving proof of income, and submit to credit file checks by a credit reference agency.

- Be employed full-time and make at least £20,000 annually.

Monthly fee

£7, £10 or £12

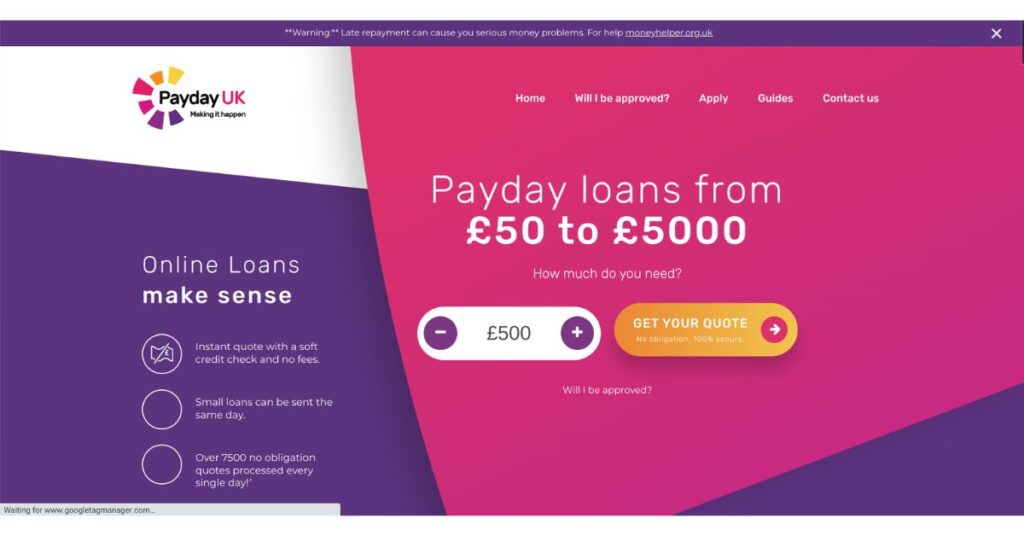

2. PaydayUK

It is a reputable service that assists you daily in finding modest loans for a various purposes. In actuality, it aids more than 4000 people daily on average. With its straightforward application process, you may quickly find a loan from an elite group of lenders, saving you time and simplifying your life.

According to Payday UK, in most circumstances, no credit check is necessary for the application, and fees are only assessed for approved loans. According to the website, the money can be deposited into your account in less than 10 minutes.

Features

- Quick quote with no fees and a gentle credit check.

- Small loans may be paid on the same day.

- Every day, more than 7500 free quotes are processed.

Maximum loan amount

£5000

Interest rate

91%

Loan term

Over 3 months to 36 months

Eligibility

- Being over 18 years old

- Being in a position of permanent employment, getting a pension, a disability benefit, or a living allowance

- Earning more than £417 after taxes each month

- Have a working debit card and a bank account process a working cell phone and email address.

Monthly fee

No fees

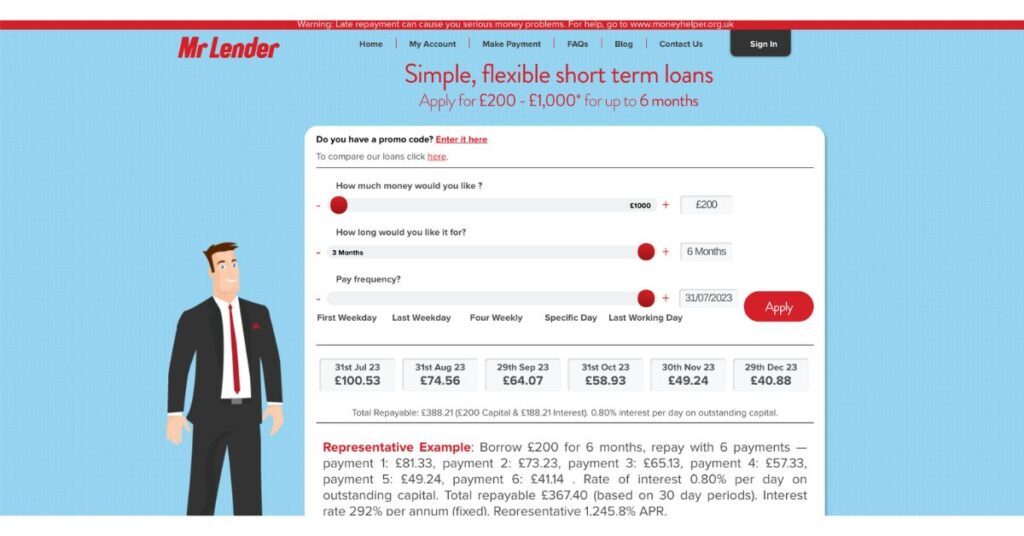

3. Mr Lender

Mr Lender, a short-term loan company established in the UK, provides you with quick and simple access to small amounts of cash. It accepts all applicants, including those with poor credit, but only those who can repay the loans are approved.

There are no up-front costs associated with borrowing money from Mr Lender, and there are no late penalties associated with missed payments. The fact that Mr Lender lowers the monthly payment, which distinguishes this loan provider. As a result, you only pay interest on the balance that is now due, making the loan more manageable and affordable.

Features

- It offers installment loans, short-term loans, and loans for people with bad credit.

- They have an APR that varies depending on the situation from 1,242.3% to 1,4623%.

- Online loan applications can be submitted, and if approved, monies are typically received the following day.

- It allows online account management.

Maximum loan amount

£1000

Interest rate

292%

Loan term

3 to 6 months

Eligibility

- You are over the age of 18.

- You have to be a UK resident.

- You have a job (whether it be full- or part-time).

- Your monthly take-home pay is at least £600 (net).

- You are using a legitimate debit card connected to the designated bank account.

- Your mobile phone number and email address are both active.

- You have not entered into an Individual Voluntary Agreement (IVA), a County Court Judgement (CCJ), or a Bankruptcy in the past three years.

Monthly fee

No fees

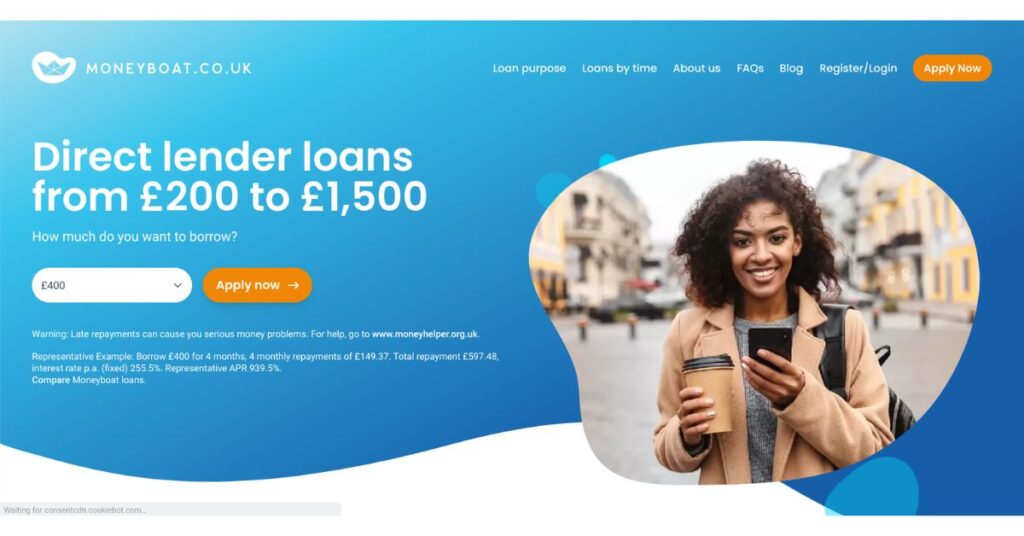

4. Moneyboat

Moneyboat is a transparent and flexible provider of high-cost short-term loans with its headquarters in London and affiliation with Evergreen Finance London Limited. Its lending process is efficient, and its fees and repayments are simple to grasp.

Being a direct lender, it has control over the entire financing process to ensure that it benefits you. Its goal is to provide you with easy access to financing that meets your needs. It offers consumer lending focused on the customer’s needs using the most cutting-edge and creative technology.

Features

- There are no fees or additional charges if you refund early.

- Detailed information regarding their fees.

- Repeat clients are permitted to borrow up to £1,500.

- Regular installments for payback

Maximum loan amount

£1500

Interest rate

0.7% per day

Loan term

Up to 6 months

Eligibility

You must be at least 18 years old and employed full- or part-time. You must make a minimum net monthly salary of £1,000, and you must have an email address.

Monthly fee

Late payment fees of £15

5. Fund Overselves

A short-term consumer peer-to-peer loan platform called Fund Ourselves is fully authorized by the FCA and subject to its regulation. Its mission is to offer better, more flexible and more affordable short-term loans for you.

It is known for its relaxed eligibility criteria, instant loan decisions and flexible repayment terms. It gives you up to a 12 months extension without applying any late fees. Its interest rates are competitive, and you can repay your loan early without incurring any penalty.

Features

- Flexible payment dates are available.

- Money can arrive in your account on the day of application.

- New customers can borrow up to £800.

- Convenient repayment terms.

Maximum loan amount

£1500

Interest rate

0.8% per day

Loan term

Over 4 to 6 months

Eligibility

Participation requires a bank account, mobile phone, and email address. You must also be a resident of the UK and at least 18 years old.

If the firm is confident that you can afford to repay your loan, Fund Ourselves will consider applicants with a poor credit history. It will not, however, accept those subject to bankruptcy, IVAs, or County Court Judgements (CCJs).

Monthly fee

No fees

6. Cashfloat

CashFloat is an online payday loans company that provides loans. It aims to make your loan more manageable by encouraging early repayments and introducing a unique Easy Start Technology, which allows you to pay less on the first installment.

It gives you more time to get a handle on your financial situation—an invaluable feature, especially if this is the first time you are taking out a payday loan. It also has a state-of-the-art ‘Money on Demand’ app so you can manage your money and repayments on the go.

Features

- With each funded payday loan, a free online loan calculator is provided.

- Your unique situation will determine how much you qualify to borrow.

- If rejected, it will transfer you to a different lender.

- You won't pay any further costs if you pay off your loan early.

Maximum loan amount

£2500

Interest rate

226%

Loan term

3 to 9 months

Eligibility

- You must have a mobile phone

- UK bank account with a debit card

- Be over 23 years old, and be a resident of the country.

Monthly fee

Late payment fees of £15

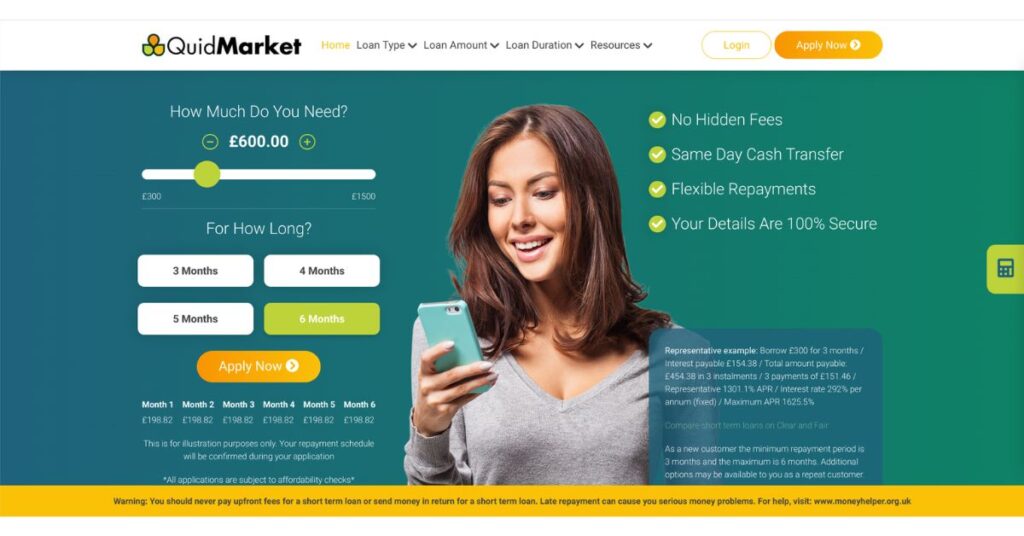

7. QuidMarket

QuidMarket provides a range of short-term loans, but it focuses on giving personal loans to applicants with poor credit or those who have previously been turned down for payday loans. It is a direct lender of short-term loans that serve as payday loan substitutes.

QuidMarket assesses your current financial situation in addition to your credit score, unlike other payday lenders in the UK, to determine whether you can afford to repay the loan. You have longer to repay them in equal monthly installments, and it's simpler to manage.

Features

- No additional costs for direct lenders’ loans.

- Greater manageability compared to usual payday loans.

- No collateral or guarantor is necessary.

- There are no applications or late fees.

Maximum loan amount

£1500

Interest rate

292%

Loan term

Over 3 to 6 months

Eligibility

You must be a resident of the UK, be at least 23 years old, have a mobile phone (the company will provide you with a four-digit SMS number as part of the application process), have a UK bank account with a working debit card, and make at least £1,300 per month to qualify.

Monthly fee

No fees

Final Words

We sincerely hope that this post will help you choose the best when applying for loans. Your loan approval is delivered promptly, effectively, and easily with this loan platform.

FAQs

What are the benefits of the Lending Stream?

With Lending Stream, you can repay it within 6 months and that too in 6 easy installments. But the plus part of having a loan with it is that it even allows early repayment without charging any extra fees. Its loans are charged at a daily interest rate and by making early repayments you can save money.

How long is the Lending Stream?

It offers 6 or 12-month loans. The maximum repayment period is 12 months. Since you can always repay early and save on interest, it doesn't have a set minimum repayment period.

Are there any other loans like Lending Stream?

Yes, mentioned all the loans are similar to Lending Stream which are legit and safe for use.

![7 Top Loans like Lending Stream & Alternatives [2024]](https://viraltalky.com/wp-content/uploads/2023/06/Loans-like-Lending-Stream.jpg)