Loans like Credit Spring: Credit Spring is a UK-based lending company that offers a unique credit service to you. You must pay a monthly fee to Credit Spring to use their revolving credit facility. You can use its credit facility to borrow up to £1,000, which can be paid back over four months.

It is best for receiving credit facilities but if you are looking for Credit Spring alternatives, you are in the right place! We have given a list of the best services like Credit Spring you must check out.

We have several services that provide loans like Credit Spring. So, to find out which one is the most effective Credit Spring alternative read the article below.

List of Loans like Credit Spring

1. Zopa

British financial services provider Zopa Ltd. provides credit cards, personal loans, and deposit accounts. In 2005, it launched as the first peer-to-peer lending business in the world, and since then, it has lent UK borrowers more than £2 billion.

They recently expanded their product offering to include business loans. 5% to 6% APR (annual percentage rate) is the range of their most popular personal loan rates. Businesses are eligible to borrow up to £750,000 at an APR of 8% to 10%.

Eligibility

- Be at least 20 years old

- UK citizen having a history of at least one year's addresses

- Employed, self-employed or retired with a pension

- Have an income of at least £12,000 per year (before tax)

- Have a credit history that we can see, and a good track record of repaying debt, e.g. utility bills, credit cards

- Be able to pay back the loan given your income and expenses.

| Amount borrowable | £1,000 to £25,000 |

| Term length | 1 to 5 years |

| Time to receive funds | Within two hours |

| Need to have an account with the provider | No |

2. Lending Stream

Lending Stream is a respectable substitute for Credit Spring as a short-term lender, and finding out if you qualify just necessitates a little credit check. Payments are quick, and there are no prepayment fees if you pay off your loan early.

You can set up a monthly withdrawal from your bank account to pay Lending Stream, or you can use your account to make one-time payments. You will receive an immediate response to your loan application from Lending Stream based on your creditworthiness, financial situation, and affordability.

Eligibility

- Residing in the UK.

- Age of 18 or older.

- In steady work with a salary of at least £400 each month.

| Amount borrowable | £50 to £1,500 |

| Term length | 6 to 12 month |

| Time to receive funds | Under 90 seconds |

| Need to have an account with the provider | Yes |

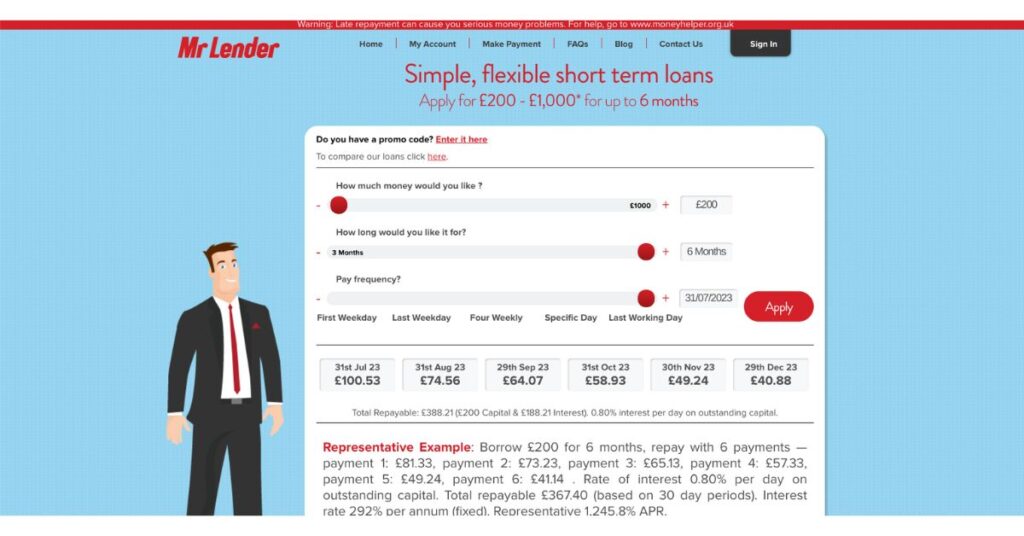

3. Mr Lender

Mr Lender provides straightforward short-term loans to provide a rapid, responsible, and flexible borrowing solution to you with unforeseen financial obligations.

It makes it simple for you to choose an appropriate loan using its calculator, and you can see how much the loan will cost you overall as well as the number of your monthly installments. Both when you apply for a loan using it and if you ever miss a payment, there are no upfront fees.

Eligibility

- You must be a resident of the UK.

- Age of at least eighteen

- You must have a consistent income of at least £800 (net) each month from employment, whether full- or part-time.

- It will not lend to anyone who has evidence of County Court Judgements (CCJs) within the last three years, Individual Voluntary Arrangements (IVAs), or Bankruptcy.

- You must have a valid debit card connected to the bank account you'd like us to transfer your money.

| Amount borrowable | £200 to £1,000 |

| Term length | 3 and 6 month |

| Time to receive funds | Within one hour of approval |

| Need to have an account with the provider | Yes |

4. Fund Overselves

Fund Ourselves is a peer-to-peer platform that allows you to request funding for your projects. For your participation, you will receive tokens that can be swapped for money or used as the site's currency.

There are no unforeseen costs, and funds can be deposited into your account right away. Your investments could yield profits of up to 15% annually. With investments starting at £1,000, you may take advantage of flexible periods and provision fund protection.

Eligibility

- Minimum age of 18

- As a resident of the UK

- Earning a consistent income

- Valid email address and mobile number

- No recent IVAs, CCJs, or bankruptcies

- A favorable or fair credit rating

| Amount borrowable | £100 to £1,500 |

| Term length | 21 days |

| Time to receive funds | Within one day |

| Need to have an account with the provider | Yes |

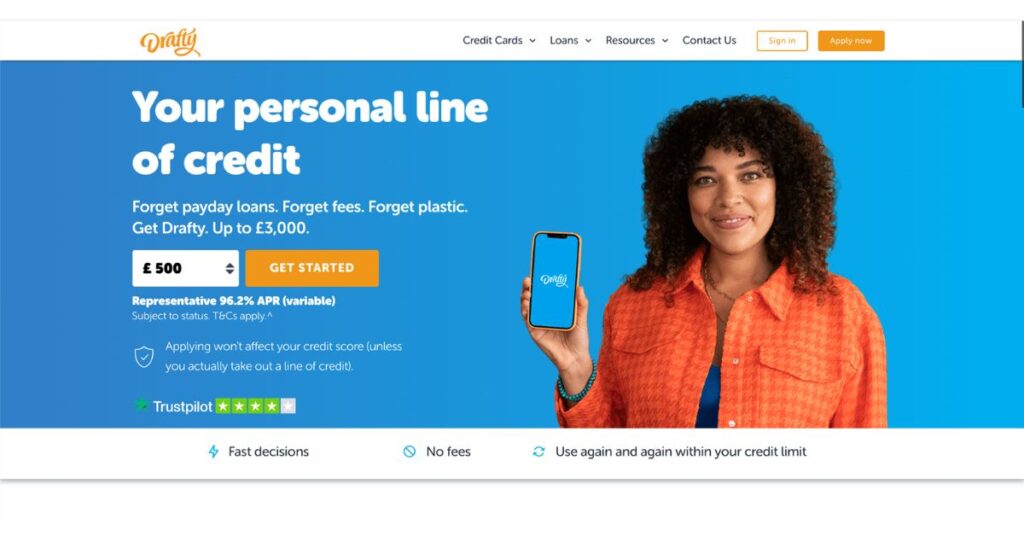

5. Drafty

Drafty is a UK-based peer-to-peer lending platform that offers personal loans to UK residents. They offer you a line of credit with a limit of up to £3,000 and you only pay interest on the amount you use. You may borrow up to your credit limit whenever you like, provided your account is in good standing.

Your eligibility will be determined by Draughty depending on your credit score and other considerations. As long as you pay your monthly minimum, the amount of time you borrow is up to you. Both late fees and penalties for early prepayment are absent.

You will have a year to repay the loan plus interest after it has been approved. The interest rate will vary depending on the type of loan that you take out, but it is typically between 5% and 10%.

Eligibility

- 18 or over and employed

- Earning at least £1,250 a month

- A citizen of the UK with a functioning bank account and debit card

| Amount borrowable | Up to £3,000 |

| Term length | Within one year |

| Time to receive funds | Under 90 seconds |

| Need to have an account with the provider | Yes |

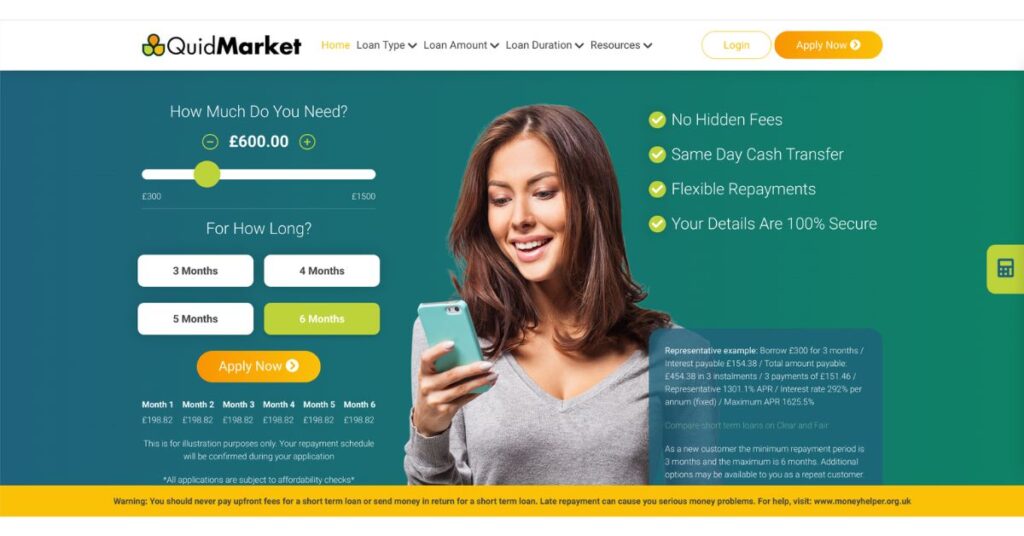

6. QuidMarket

QuidMarket is a direct lender of short-term loans, which are an alternative to payday loans. They’re easier to manage, and you have longer to pay them back with equal monthly installments.

If you require a short-term cash loan and your credit rating is low, you’ll want to find a loan provider that can help in your situation. If you have never borrowed from them before, it can help you get the cash you need with a short application form and a quick approval process.

Eligibility

- Live in the UK

- Being beyond the age of 65 and 23

- Have a mobile phone – it sends a 4-digit SMS code during your application process

- Hold a UK bank account with a valid debit card – it runs a verification check that takes 1p which is refunded

- Be employed and earn a minimum of £1,300 per month.

| Amount borrowable | £300 to £1,500 |

| Term length | 3 to 6 months |

| Time to receive funds | Within minutes of the transfer |

| Need to have an account with the provider | Yes |

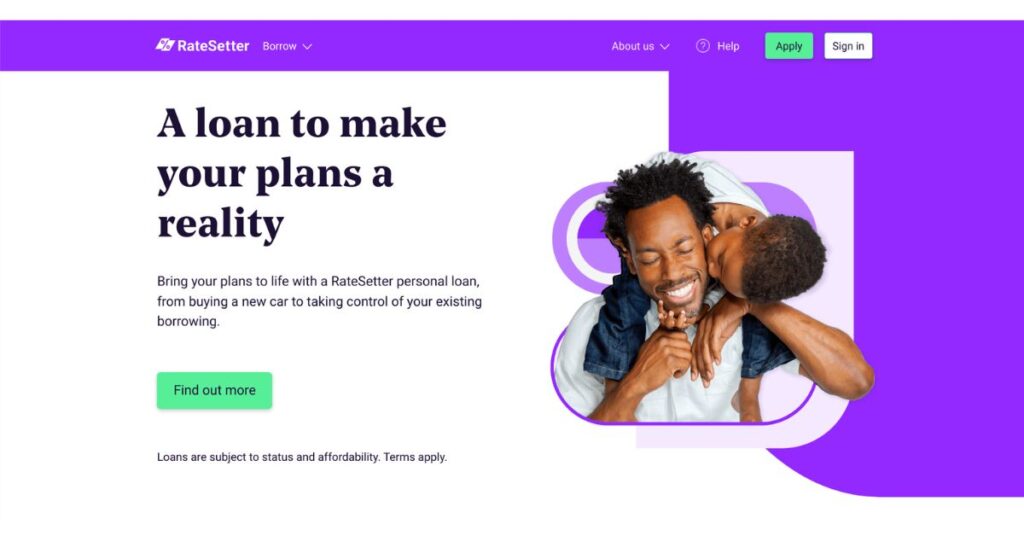

7. Rate Setter

Rate Setter is a peer-to-peer lender operating in the UK. It was founded in 2010 and has financed over £3 billion worth of loans so far. It is a peer-to-peer lending platform that brings together investors who want to make money by lending money to borrowers and borrowers looking for funding.

They offer fast and flexible personal loans at competitive prices, which can be used for various purposes, including buying a new car, making home improvements and consolidating your debts. It only charges an annual fee of 0.5% on investments made under £250k or 1% for larger investments with no other fees charged at all.

Eligibility

- You are 21 or over

- You hold an account with a UK bank or building society

- You've lived in the UK for at least three years

- You receive consistent monthly money from a reliable source

- You have a solid credit history and your credit report shows no County Court verdicts, bankruptcies, or debt relief orders

| Amount borrowable | £1,000 to £35,000 |

| Term length | 1 and 5 years |

| Time to receive funds | Within 5 working days |

| Need to have an account with the provider | Yes |

Final Words

We have concluded this article regarding Credit Spring loans. With these, we have done our best to give you information on the platforms that offer loans. We hope that our information will aid in your search for the best loan.

FAQs

What is Credit Spring?

A subscription service called Credit Spring provides loans with no interest. As with an insurance policy, you pay a fixed membership cost of £7, £10, or £12 each month based on your subscription in place of paying interest on money borrowed.

Are there any other safe loans like Credit Spring?

Yes, the Platforms mentioned in the above article are loans like Credit Spring which are safe for receiving loans.

![7 Best Loans like Credit Spring & Alternatives [2024]](https://viraltalky.com/wp-content/uploads/2023/06/Loans-like-Credit-Spring.jpg)