Loans like Bright Credit: Money is very complicated and no one can take the risk of that. But there are unfortunately some days when we cannot arrange money and when we need help from outside to keep us on track.

Hence, for keeping us on track, loans come in handy but traditional bank loans can take up much time and more interest compared to online payday loans or emergency loans which are available easily.

Bright Credit is one of the expensive loan lenders which help us in emergencies with easy and fast funding facilities. The loans of Bright Credit start from $300 to $1,000 and so on. In this article, we are going to talk about such 6 Loans like Bright Credit.

By the end of the article, you will get to know in detail about 6 Loans like Bright Credit which can save you from debts and non-recoverable situations.

List of Loans like Bright Credit

1. NetCredit

The number one hitting the list of Loans like Bright Credit is NetCredit. NetCredit is one type of online money lender which offers loans such as personal loans, instalment loans etc.

The good thing about NetCredit is the flexibility seen with repayment terms where you can change the payment dates according to the loan you have taken into consideration.

Key Notes

- No prepayment penalties.

- Flexible repayment terms.

- No application fees or charges.

- The APR rate of NetCredit is kept from 34% to 155% maximum.

- The late fee is charged for being 25 days late up to $25 with an origination fee depending on your location.

- The payment options are flexible with NetCredit.

- NetCredit offers a website with financial sources for educational purposes to borrowers.

Loan Amount

- From $1,000 to $10,500.

Loan Term

- 6 to 60 months.

Credit Check

- No

2. One Main Financial

The second one to hit the list of loans like Bright Credit is the One Main Financial Loans. It is the type of money lender who lends money for usually personal loans.

The best thing about One Main Financial loans is their mobile application. Their mobile application offers an easy user interface from where borrowers can manage their accounts with payment details, check their scores etc.

To know in detail about what One Main Financial has to offer, you can click here.

Key Notes

- The APR rates of One Main Financial Loans are said to be around 18% to 35.99%.

- The origination fee charged by One Main Financial Loans ranges from $25 to $500 or more.

- $5 to $30 is charged as a late fee if your payment is late.

- The prepayment penalties are not kept by One Main Financial Loans.

- There is a charge fee for no sufficient funds ranging from $10 to $50.

- The branch locations for personal loans are situated almost everywhere with most people living under 25 miles.

Loan Amount

- From $1,500 to $20,000

Loan Term

- 24 months, 36 months, 48 months or 60 months.

Credit Check

- No

3. Lending Club

Lending Club comes third when we talk about Loans like Bright Credit. It is a fintech company providing money lending facilities to its users.

Lending Club allows borrowers to use their funds for home improvement, credit card consolidations, balance transfers, medical bills etc. But it is against the use of their funds in activities such as cryptocurrencies, illegal activities, education etc.

The platform is now offering full banking services with personal loans and instalment loans. To know more about Lending Club, check here.

Key Notes

- The APR Rate of Lending Club is said to be from 9.57% to 36%.

- Lending Club offers the option of direct payment to third-party creditors.

- Joint applications for borrowing money from the lending club are accepted and available.

- It is a great platform to get easy funding for payment to third parties etc.

- Late fees and Origination Fees are charged by the lending Club.

- It does not charge any prepayment penalties to its borrowers.

Loan Amount

- $1,000 to $40,000

Loan Term

- 36 or 60 months.

Credit Check

- The minimum score is 600.

4. Upstart Personal Loans

Another loan Bright Credit is offered by Upstart Personal Loans. They have fixed-rate personal loans offered to their borrowers.

It also has a hardship program where borrowers can easily apply for suspended loan payments if they are having economic hardships or have no jobs. You can use their funds for credit card consolidation, weddings, moving loans, debt consolidation, medical loans, home improvement, refinancing student loans etc.

To know more interesting details about Upstart Personal Loans and their offerings, click here.

Key Notes

- Upstart does not have any option of co-signer yet.

- Loans are available with a fair credit score.

- Upstart Personal Loans offers borrowers to choose payment dates according to their will.

- The APR rates of Upstart Personal Loans are kept between 6.50% to 35.99%.

- The origination fees are kept between 0 to 8%.

- For the physical copies, Upstart charges you around $10 for paper copy fees.

Loan Amount

- $1,000 to $50,000.

Loan Term

- 3 to 5 years.

Credit Check

- Minimum Credit Score to be 600.

5. SoFi

The underrated star for loans like Bright Credit is SoFi. SoFi offers lending in personal loans. It is a great option for good credit scorekeepers because of soft credit checks.

The SoFi Loans permit the use of their funds for credit card consolidation, home improvements, relocation assistance, medical procedures etc. But their loans are not at all available for educational purposes, investments, real estate etc.

Key Notes

- No origination fees are charged by SoFi Personal Loans.

- Borrowers are not charged late fees on late repayments with SoFi Loans.

- The APR is between 8.99% to 23.43%.

- For the autopay enrollees, the APR rate is reduced by 0.25%.

- Borrowers can change their payment dates according to their capabilities.

- SoFi offers special unemployment protection to borrowers who are actively searching for employment opportunities.

Loan Amount

- From $5000 to $100,000

Loan Term

- 24 or 84 months or 2 to 7 years.

Credit Check

- Soft Check- minimum score to be 650.

6. Brigit

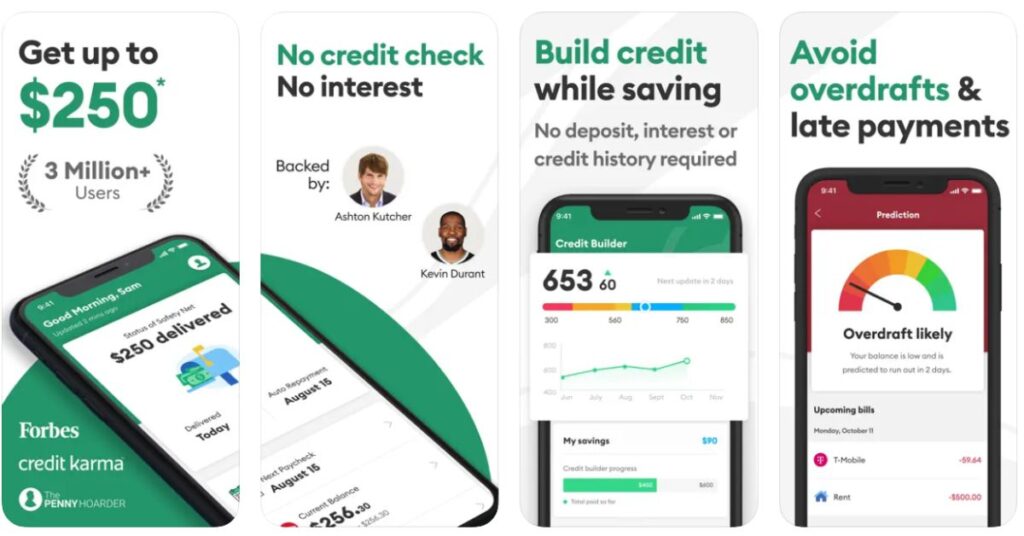

Brigit is quite different from other loan lenders but works similarly to a loan like Bright Credit. It is an application which provides instant cash advances for the shorter-term period with shorter amounts.

Users can easily monitor their credit score with Brigit and look for theft protection etc. No interest is charged for $250 which is a long-term solution for loans with interest.

To know more about Brigit, you can click here.

Key Notes

- It is a fast-funding app for low funds.

- Brigit offers credit-building features.

- It is a cash advance system usually smaller than competitors but worth it for one-day loans etc.

- Users must pay a monthly subscription of $9.99 to get advances.

- To be eligible for advances, accounts must be active for 60 days, balance greater than $0 with three recurring deposits.

- Users get access to credit-building tools.

Loan Amount

- From $20 to $250.

Loan Term

- 2-3 days as in payday.

Credit Check

- No

Conclusion

Here, we come to the end of the article for insights on Loans like Bright Credit. Hope you find this article helpful to make the right choices for getting your advances. Check twice the details before applying for loans and remember to read all the terms and conditions for your safety.

To know more about finances and much more content, keep reading articles and the latest trends on our page regularly.

FAQs

What is Bright Money's credit limit?

The credit limit of Bright Money is up to $10,000.

Is Bright credit card legit?

Yes. Bright Credit Card is legit and safe to use.

![6 Best Loans like Bright Credit to Check Out [2024]](https://viraltalky.com/wp-content/uploads/2023/06/Loans-like-Bright-Credit.jpg)