Loans Like Oakam: Loans are a very crucial part of anyone’s life. Finance is a thing no one can get help on time from humans. It is the part where we have to find a solution ourselves. Hence some direct lenders and brokers help us in emergencies.

Loan providers are of two typer brokers or direct lenders. They work as banks to provide you with money but are not real banks. They can be a fintech company or broker making their lending services available to you.

Oakam Loans was an easy solution for UK residents to get easy and flexible loans. But unfortunately, they are not presently lending. Hence in this article, we are going to talk about Loans like Oakam discussing their eligibility criteria, credit score requirements, loan term limit, funds released, etc.

By the end of the article, you will get to know about the best Oakam alternatives to get a loan easily, and quickly with flexible features in the United Kingdom.

List of Loans Like Oakam

1. Everyday Loans

To top the list of Loans like Oakam, Everyday Loans wins. It is one of the leading loan providers in the United Kingdom. It is a direct lender and doesn’t charge any fees for its services.

Everyday Loans offer loans for any purpose from 1000 pounds to 15000 pounds over the term of 18 to 60 months as well. It also provides loans to poor credit applicants and helps them out.

Even if your application is rejected, Everyday Loans won't let their decision affect your credit score. The result of the loan application is kept only between them and their applicants. To know more about them, check here.

Eligibility

- To avail loan from Everyday Loans you need to be of 18 years old and a UK Resident.

- And you can afford the repayments from time to time.

Minimum Credit Score Requirement

- Soft Check provides loans to poor credit people as well.

Borrowing Limit

- 1000 pounds to 10,000 pounds.

Interest Rate

- The representative APR of Everyday Loans is 58.4% to 71.3% per annum fixed.

Repayment

- The repayment procedure is carried out as monthly or weekly repayment options.

Funds Released

- The funds are released within a few minutes to the linked bank account after approval of the loan.

2. Payday UK

Payday UK is a direct lender for getting short-term loans from the United Kingdom. It is one of the best loans like Oakam to get short-term loans easily with flexible repayment options.

Payday UK offers loans for multiple purposes such as short-term cash, car loan, debt consolidation, paying bills, home improvements, and others with durations as per the applicant’s choice.

To know more insights about Payday Uk, you can check here.

Eligibility

- The borrower should be of 18 years of age.

- Must be a UK resident with a steady form of income.

- Should have a valid bank account.

Minimum Credit Score Requirement

- No minimum credit score requirement with Payday UK.

Borrowing Limit

- From 50 pounds to 5000 pounds, from 3 to 36 months.

Interest Rate

- 65% per annum.

Repayment

- The repayment method is monthly with Payday UK.

Funds Released

- Payday UK has funds released within the same day for short-term loans.

3. Zopa

Zopa is a very good alternative option for loans like Oakam because of its fast and easy funding facilities for its borrowers. It also has an application that gives easy access on the go anytime and anywhere.

For customer support, Zopa offers to solve queries with the use of a phone, live chat feature, mobile app, and also through social media. Hence the customer service of Zopa is appreciable.

The types of loans available with Zopa are usually personal loans and unsecured loans. The best part about Zopa is you can have access to your loan very easily after the approval. To get more information about Zopa, enter here.

Eligibility

- You need to be around 20 years of age.

- You should be living in the United Kingdom.

- You should at least earn 12000 pounds per year.

- Should have a good credit history of repayment of debts.

Minimum Credit Score Requirement

- No minimum credit score requirement is with Zopa.

Borrowing Limit

- 1000 pounds to 35000 pounds within 1 to 7 years.

Interest Rate

- The interest rate of Zopa is 22.9% APR.

Repayment

- The repayments with Zopa are flexible.

- Borrowers can set the repayment date as per their will.

Funds Released

- The funds are released within 2 hours with Zopa Personal Loans.

6. Bamboo Loans

Bamboo loans are a product of Bamboo Ltd which is a good loan like Oakam being a direct lender in the United Kingdom. The best part about the bamboo loan is it also considers the application with a poor credit score of Country Court Judgment.

The only catch here is you should be able to afford to repay the loan amount on time, if you are capable of that, then your loans will be easily approved. The repayments are made through Continuous Payment Authority with Bamboo Loans.

The key highlight of Bamboo Loans is you can get your funding on the same day of approval with a flexible option to change your repayment date according to your will. The only con is no joint loans are given. To check their loans, in detail, click here.

Eligibility

- The borrower must be of 18 years or more.

- You should be living currently in the United Kingdom.

- Must be affordable for repayments on time.

- You should not be bankrupt.

- Valid UK Debit Card with mobile number and email address.

Minimum Credit Score Requirement

- No particular limit is set for the credit score.

Borrowing Limit

- From 2000 pounds to 8000 pounds for 1 to 5 years.

Interest Rate

- The APR with Bamboo loans is usually about 69.9%.

Repayment

- The repayment procedure follows monthly repayments with Bamboo Loans.

Funds Released

- The funds are released on the same day of approval with Bamboo Loans.

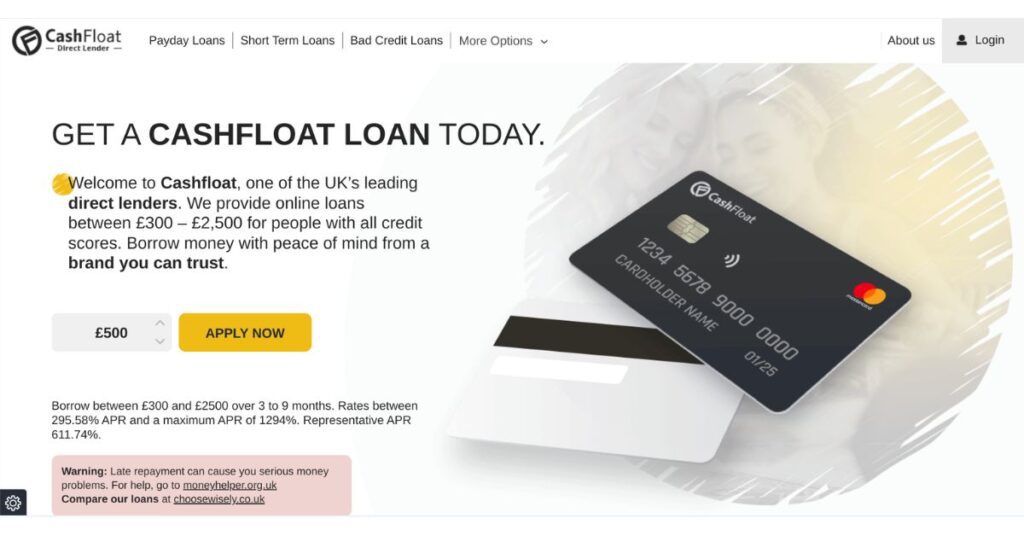

7. Cashfloat

Cashfloat stands for Cashfloat UK. It is a leading direct lender available in the United Kingdom for loans like Oakam to avail. The top two tier loans they offer are payday loans and personal loans.

The lending decision of Cashfloat usually takes up to 4 hours of receiving the application and hence it is a great feature that if you apply within a day and it gets approved then your funds will be made available within the next hour hence in the same day.

To solve any queries you have with cashfloat you can contact them on- 0203 757 1933. You can even drop them an email at client-service@cashfloat.co.uk.They are available 24×7 for your service. To know in detail about Cashfloat, you can check here.

Eligibility

- Have a steady income.

- Hold a UK bank account with a valid Debit card

- Should be of at least 18 years of age.

- Must be a UK citizen.

Minimum Credit Score Requirement

- No credit score minimum requirement with cash float. If you are eligible to afford repayments, then your loan will be approved.

Borrowing Limit

- From 300 pounds to 2500 pounds for 3 to 9 months.

Interest Rate

- The Interest Rate of Cashfloat is between 295.58% APR to 1294%.

- The fixed rate is 185.39% per annum.

Repayment

- The repayment method is basically on a monthly basis.

Funds Released

- The funds from Cashfloat are released within 1 hour from approval directly to your bank account.

Conclusion

Here we come to the end of the article, disclosing the best options for loans like Oakam to get short-term as well as long-term loans. We have observed their insights in detail regarding when funds are released, how much you can borrow, up to what limit, etc.

Hence, select the best option according to you and make sure repayments of loans are carried from time to time to avoid ending up in difficult situations while dealing with such loan providers.

Students and people who are bankrupt are not allowed to apply for such loans from lenders. Due to the inconsistency of the credit history, it is a pure risk to provide loans to them and hence usually CFA does not allow lending them money in any scenario.

FAQs

Is Oakam still lending?

Oakam is working with loan agreements till now but now they are not issuing new loans to the customers.

Which loan is easiest to get?

The easiest loans to get are payday loans, pawnshop loans, car title loans, etc.

What happened to Oakam?

It stopped issuing new loans to the customer in February 2022.

What is the interest rate of Oakam loans?

The Minium APR of Oakam is said to be 223% and the maximum APR of Oakam is said to be 1427.25%.

Try Alternative Loans in UK-

![7 Top Loans Like Oakam To Get Short-Term Loans From! [2024]](https://viraltalky.com/wp-content/uploads/2023/08/Loans-Like-Oakam.jpg)