Loans Like Wonga: Payday loans in simpler terms are short-term loans or small-amount loans which are borrowed with a high rate of interest on the agreement of paying it in monthly installments or when the borrower gets his income in the upcoming month.

Wonga Loans were one of the payday loan providers in the United Kingdom. Wonga Loans became insolvent in the year 2018 because of the detailed scrutiny check carried out by FCA and the practices of Wonga became questionable.

Hence, in short, the conclusion was the collapse of Wonga Loans which was the biggest payday lender in the UK till the year 2018. In this article, we are going to talk about the best loans like Wonga as their alternatives.

By the end of the article, you will get to know about their key features, loan terms, loan amount, fees charged, interest rates, eligibility criteria, etc.

List of Loans Like Wonga

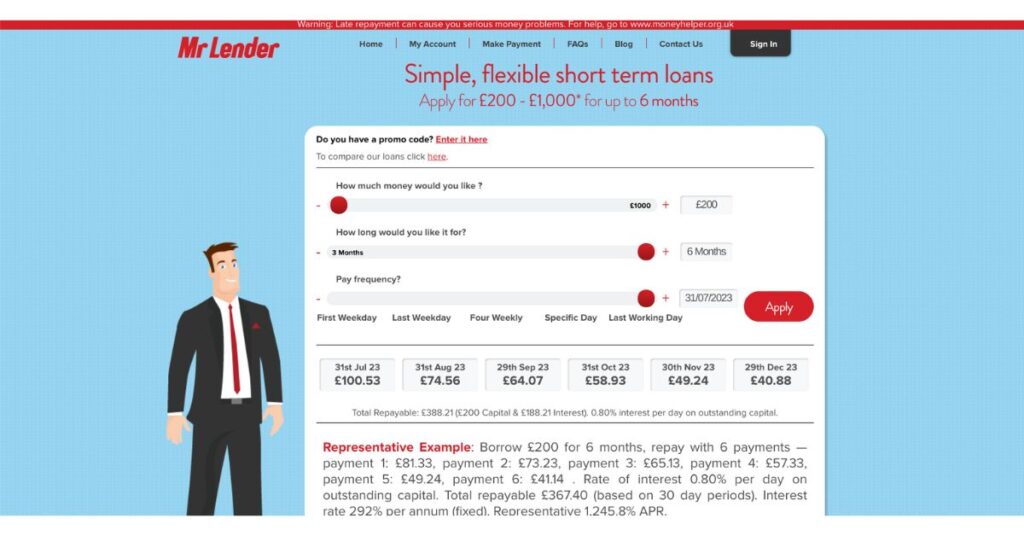

1. Mr. Lender

Mr. Lender is the closest loan provider for loans like Wonga to get easy loans in the United Kingdom. After Wonga, it is one of the leading short-term loan providers where you can borrow amounts and pay in 3 installments generally.

To know more in detail related to Mr.Lender, check here.

Key Features

- The funding with Mr. Lender will be made available to you within a very fast hour.

- Mr. Lender is a great option for emergency funding or short-term payday loans.

- Customers get an option to change their repayment date if they want.

- No late fees or monthly fees are fixed.

- Live chat and customer support are available for phone, post, and email address options.

- Customers can reduce their interest by repaying the loan amount early.

Maximum Loan Amount

- From $254 upto $1200

Interest Rate

- 292% fixed per annum.

Loan Term

- 3 to 6 months.

Eligibility

- You need to be 18+ of age and a resident of the UK.

- You must have a regular income of 600 pounds per month.

- No bankruptcy in the last 3 years with a good credit score.

- Must have a UK bank account and debit card.

Monthly Fee

- Not such a term, but a daily interest of 0.8% will be calculated for late fee payment.

2. Moneyboat

The second Wonga alternative is Moneyboat. Moneyboat Uk is said to be the direct lender which makes it a transparent connection between their loan applicants and them. They don’t work as brokers.

To know more about Moneyboat, enter here.

Key Features

- The interest rate per day is taken as 0.7%.

- No hidden fees are charged by Moneyboat.

- No promo codes are given by Moneyboat.

- Flexible scheduling for repayment options.

- Transparent and fast funding within one day of approval.

- No credit score is fixed, hence even if you have bad credit you can still apply for a loan with Moneyboat.

Maximum Loan Amount

- From $200 to $1900

Interest Rate

- 255.5% per annum

Loan Term

- 2 to 6 months

Eligibility

- Minimum 18 years of age.

- Your minimum income should at least be up to 1000 pounds per month.

- You must have employment be it full-time or part-time.

- You must have a UK bank account and debit card.

- Students' applications are not accepted.

Monthly Fee

- fixed fee is set for monthly payments. Repayment options can be chosen weekly or monthly as per customer.

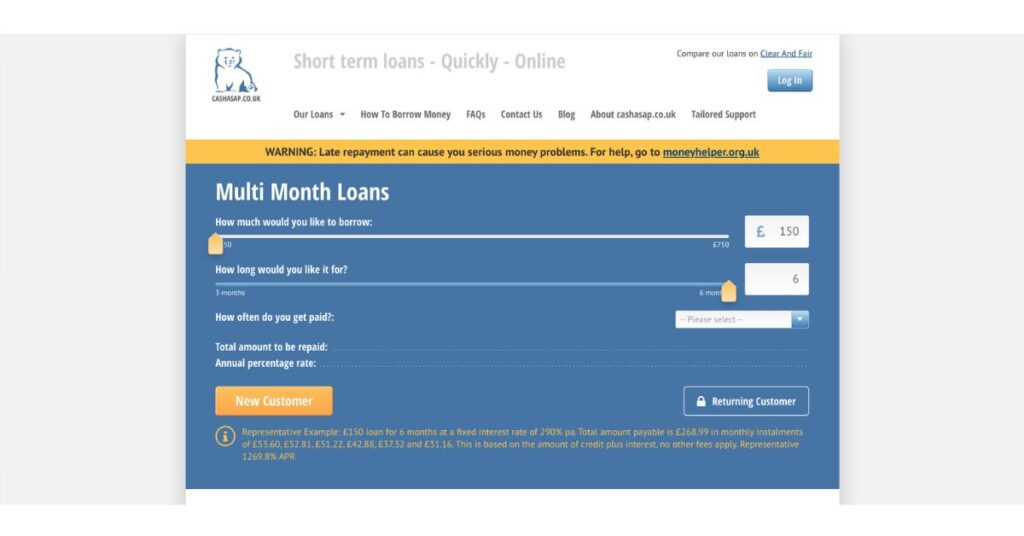

3. Cashasap UK

Cashasap UK is a short-term loan provider in the UK, and hence it is one of the loans like Wonga to get financial aid from. Cashasap UK offers multi-month loans as well as payday loans according to the applicant’s needs.

To get more insights about Cashasap UK, check here.

Key Features

- Cashasap UK promises its customers to provide easy application services for their clients to get loans easily.

- It has an application form that is 24×7 accessible and can be easily filled and submitted at any time.

- They carry ID verifications, and creditworthiness checks to provide clients with the best loan suggestions.

- You can get cash within a few minutes after the Loans approval.

- The loan amount will be directly transferred to your bank account.

Maximum Loan Amount

- From $100 to $890

Interest Rate

- More than 290% per annum.

Loan Term

- 3 months.

Eligibility

- A credit check is carried out on every applicant, no minimum credit score is set yet.

- Employment is necessary for the approval of a loan in a part-time or full-time course.

- You should be 18+ and a UK resident.

- You should have a debit card with a compulsory UK bank account.

Monthly Fee

- No monthly fees charged outside interest.

4. Drafty

Drafty is third in the list of loans like Wonga to checkout. Drafty is authorized under FCA for providing a line of credit with limits of up to 3000 pounds and is an easy use alternative for loans and overdraft facilities.

To get all the detailed insights about how Drafty works and your eligibility, click here.

Key Features

- Drafty Gives options to change your repayment date.

- With Drafty, you can repay the loan amount any time you want.

- No hidden fees or late fees are charged by Drafty from its customers.

- It offers the benefit of lowering the interest by repaying early.

- To contact the customer service of Drafty, you can always call on- 0203 808 4440.

- Borrowers only have to pay interest on the loan amount they have used.

Maximum Loan Amount

- Borrow upto $3800

Interest Rate

- 96.2% Representative APR

Loan Term

- Open-ended line of credit

Eligibility

- The borrower should be a UK resident with 18 years of age.

- Should have at least a minimum income of 1250 pounds a month.

- Should have an active debit card and active bank account.

Monthly Fee

- No hidden fees as such

5. Cashfloat

Cashfloat is the other closest alternative for Wonga Loans. It is said to be another leading direct lender in the United Kingdom for employees or monthly income earners. Cashfloat promises to deliver fast funding, flexible payday loans, personal loans, etc.

To check how you can avail of loans under Cashfloat, click here.

Key Features

- Cashfloat is a regulated and authorized lender as per the FCA.

- Under Cashloat, borrowers have fast application as well as fast approval procedures.

- You can get funding on the same day as per approval day.

- Cashfloat has a mobile app that keeps it easily accessible to borrowers for funding on the go.

- The unique feature of Cashfloat is that even if your application is rejected it has the option to connect to alternative lenders which can be a great help in an emergency.

- You can also get access to the loan calculator which offers transparent fees and rates to compare everything with other competitors of Cashfloat.

Maximum Loan Amount

- Upto $1900 approx.

Interest Rate

- Daily APR is around 0.5% which is the lowest.

Loan Term

- 1 to 4 months.

Eligibility

- Borrowers should have a regular income with secure employment.

- You should be 18 years old to borrow a loan from Cashfloat.

- The borrower should have an active UK Bank account.

- You must be a UK resident.

Monthly Fee

- No hidden fees.

6. Cashlady

Cashlady is not a money lender or direct lender. But can be seen as Wonga's alternative because it is a fully authorized and regulated broker which introduces its applicants to the borrowers to enter into short-term loan contracts.

To gain more knowledge about Cashlady, enter here.

Key Feature

- Cashlady is only a credit broker but no lender.

- You can have cash sent to you within minutes of approval of your application.

- It doesn’t charge any fees from its customers for using its brokerage services.

- Cashlady if fails to provide you a loan then they will directly connect you to their alternatives.

- The types of loans offered by Cashlady are- payday loans, short loans, lines of credit, or guarantor loans.

Maximum Loan Amount

- Upto $1500.

Interest Rate

- 49.9% APR

Loan Term

- 6 to 18 months.

Eligibility

- UK residents only.

Monthly Fee

- No fees are charged.

7. Swift Money

Swift Money is for sure a loan like Wonga to get yourself enrolled. In simple terms, Swift Money is a financial service provider which is an efficient loan providing services to transfer money within 10 minutes of your application’s approval.

To get details about Swift Money, check here.

Key Features

- The application process with Swift Money is quite simple, quick, and easy.

- · The application form hardly takes 15 minutes to be filled up.

- Swift Money doesn’t charge any setup or arrangement fees from the borrowers.

- Even with bad credit, you can still apply for loans with Swift Money.

- The funding speed of Swift Money is said to be 10 minutes after approval.

Maximum Loan Amount

- Upto $4400.

Interest Rate

- Representative APR to be 815.74%.

Loan Term

- 1 month to 24 months.

Eligibility

- The borrower should have received a regular income.

- Should be of 18 years of age.

- Must be a UK resident.

- Should have an active and working bank account with a valid debit card.

- Ability to meet repayments, missed payments may incur a charge.

Monthly Fee

- No hidden fees.

Conclusion

Here we come to the end of the article showcasing the best possible loans like Wonga for UK-based audiences to select the best payday loan lenders and brokers.

Students are not accepted for loans, with a basic requirement of employment and regular income is a must to borrow any amount in the UK. Repaying all the loans on time is necessary to avoid any further problems.

FAQs

What is similar to Wonga loans?

In this article, you will get a detailed answer about similar to wonga loans with their key features and other functionalities.

Is there anything like Wonga?

Fair Finance is something like Wonga which works best and closest in terms of Wonga loans.

Does Wonga Still exist?

No. Wonga does not exist today’s date.

Try Alternatives Loans UK-

![7 Top Loans Like Wonga: Best Payday Loans [2024]](https://viraltalky.com/wp-content/uploads/2023/08/Loans-Like-Wonga.jpg)