Rocket Money vs YNAB: Our life revolves around money. When we don’t have it we worry about it and when we have it we worry about it. The world’s biggest problem with Money is how to use it and how to save.

The balance creation between saving money and using the money mindfully is tedious. Hence because of technology, now many applications offer you customized tips and tricks to manage, use, and professionally save your money.

In this article, we are going to talk about two such apps which help you in saving and using money namely- Rocket money and YNAB.

By the end of the article, you will get to know about Rocket Money vs YNAB with their key features, pros and cons, and the conclusion of which one is better than the two.

Rocket Money vs YNAB: Overview

Rocket Money

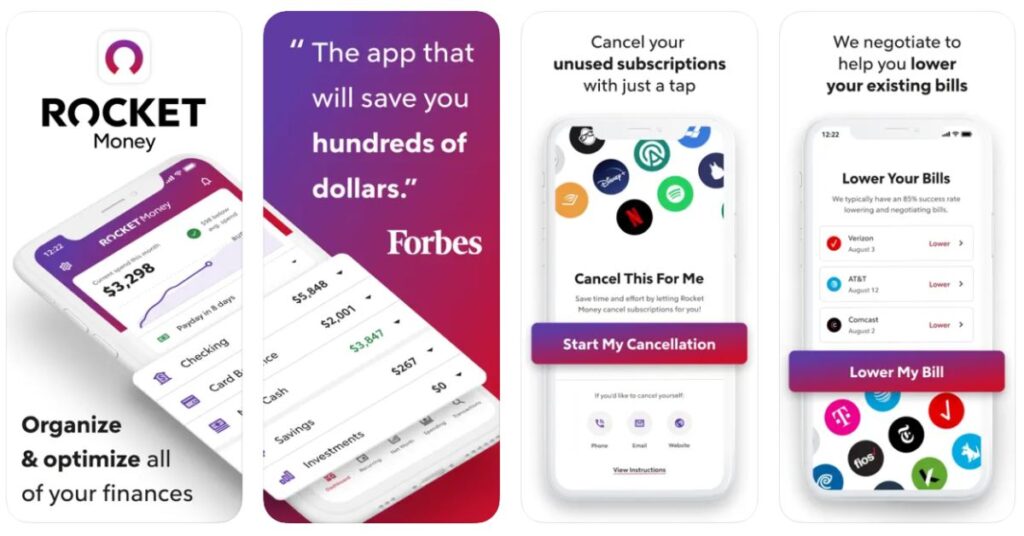

Rocket Money is a finance software like YNAB which offers you the services to manage finance correctly. In simpler terms, Rokcet Money is an app that suggests you have to save money. It is a great app to start your journey of savings.

To get more insights on Rocket money, you can check here.

YNAB

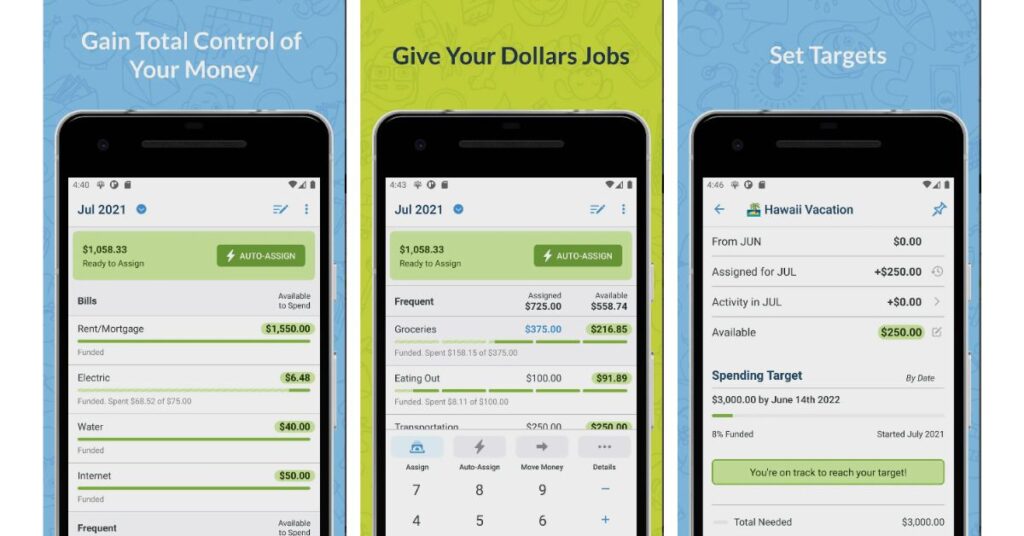

YNAB stands for You Need A Budget. YNAB fulfills its title by suggesting you the best budget as per tips to allocate your funding well. YNAB is a great software if you're looking for a partner who can help you make good financial decisions overall.

To know more insights about YNAB, you can click here.

Rocket Money vs YNAB: How Do They Work?

Rocket Money

For the very first, you need to set up your account with Rocket Money and connect all your financial accounts with it. And it simply divides all your payments into categories such as transaction registers, recurring payments, etc to make it easy to track your transaction and save on them.

YNAB

On the Working front, YNAB helps you manage your money by giving you advice on decisions to allocate every dollar you have to the expected expenses or for the savings as per your budget. Pretty simple to understand and does a great job in terms of managing the finance with YNAB.

Rocket Money vs YNAB: Key Features

Rocket Money

- Rocket Money is a great fit for the high level of customization.

- Rocket Money offers to seek a straightforward interface for its users.

- It has flexible settings and is user-friendly.

YNAB

- It is a beginner-friendly app.

- YNAB provides great finance education to its users.

- YNAB works well with merging financial accounts with a one-stop solution.

Rocket Money vs YNAB: Pricing

Rocket Money

- Rocket Money starts at $36 per year for the premium plan.

- Rocket Money also has a free version to use.

YNAB

- A free trial period is available.

- After the free trial, YNAB costs you around $14.99/per month or $99/per year with a money-back guarantee.

Ease of Use: Rocket Money vs YNAB

Rocket Money

Rocket Money is the simplest finance app till now. There are plenty of apps in finance management but they never work that easily like Rocket Money. It offers a clear set of icons, buttons, links, and the simplest menu to use.

YNAB

When we talk about Ease of Use, YNAB is very user-friendly. The account setup procedure is very quick and simple. Learning about the monthly budget with YNAB can be a bit of a slow procedure but it encourages the customers to take better decisions.

Rocket Money vs YNAB: Pros & Cons

Pros of Rocket Money

- Comes with free and premium plans.

- 7 days free trial of the premium plan.

- You can monitor your credit score with Rocket Money.

- You can have bill negotiation and monthly budget planning with Rocket Money.

- Custom categories are available with unlimited creation of budgets.

Cons of Rocket Money

- A subscription fee is charged to use all the features available with Rocket Money.

- The investment tracking of Rocket Money is not up to the mark.

- There have been some issues with Rocket Money with bank connections.

Pros of YNAB

- You can easily sync YNAB to multiple devices and have access fast and quickly.

- The spendings are trackable easily and efficiently.

- The user interface is smooth and clean.

- It is free for 34 days.

- YNAB comes with customizable categories.

Cons of YNAB

- The bill-tracking feature is yet to be introduced.

- There is a lack of reporting found in YNAB.

- YNAB cannot show you your overall financial condition.

Rocket Money vs YNAB: Which is the Right Budgeting App For Me?

The ultimate difference between Rocket Money vs YNAB is their purpose of application. Rocket Money in general focuses on providing you with solutions for how to save money according to your expenses and regulating them.

Whereas, YNAB stands for helping you make the right or better choices of how to invest your money wisely rather than giving solutions to save it in general.

Hence, in conclusion, if you are looking for software that can help you reduce your expenses and give solutions to save money then Rocket Money is a good option for you. But if you are looking for software that provides you with better choices to use your money well then YNAB is a great fit for you.

In short, both apps are must-try finance management apps. Rocket Money and YNAB both can be a good foundation for the user to start saving money, managing money, and budget making as a beginner.

FAQs

Rocket Money vs YNAB: Who wins?

Both of them are great options for choosing a finance app. But if you are looking for a savings option then Rocket Money wins but if you are looking for an app that shows you ways to use and manage your finance then YNAB wins.

Is YNAB worth the money?

Yes. The way it teaches you to learn budgeting is worth the money.

Can I trust Rocket Money?

Yes, you can surely trust Rocket Money because it has 256-bit encryption to store and secure your data.

![Rocket Money vs YNAB: Which is Better? [2024]](https://viraltalky.com/wp-content/uploads/2023/08/Rocket-Money-vs-YNAB.jpg)