YNAB vs Truebill: Everything is now digitally paid and everyone has UPI IDs, debit cards, and credit cards linked to many websites and sometimes we end up paying for the services we don’t even use anymore.

Many websites of entertainment and other sites which has monthly subscription plans use automatic deduction of fees on the monthly basis, and without our knowledge, it doesn’t get deducted, and to track our money exactly where it is, is tough.

Sometimes, we forget about what we have subscribed to, or they have forgotten the password of the site to cancel the subscription payments. Wondering how to do so? Some apps provide services to control what you subscribe to and where you pay your money to.

In this article, we are going to talk about the two best apps that let you know where your money goes namely YNAB and Truebill. YNAB stands for You Need A Budget. Hence YNAB and Truebill both are apps that provide financial services and tracking.

By the end of the article, you will get to know about YNAB vs Truebill, with their perk highlights, pros, cons, price and plans, and much more in detail.

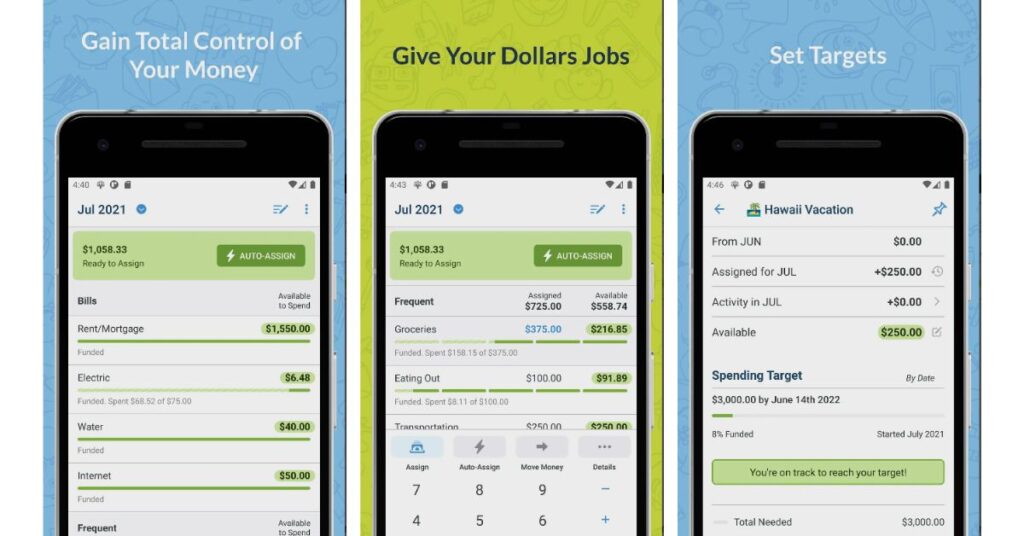

What is YNAB?

YNAB – You Need A Budget provides monitoring and controlling features on your finances and where it is being used. If you have heard about zero-based budgeting techniques for family and personal budgeting then YNAB will not disappoint you in any way.

It has techniques to prompt you the earmark all income and current positive account balances and also has ready to assign categories to fill amount in across all the accounts is zero. It is like taking fewer amounts and keeping them in envelopes one by one.

It has a customizable category feature, where you can customize folders and categories without your amounts ad labels to divide your money and income into savings categories, credit card payment categories, and much more.

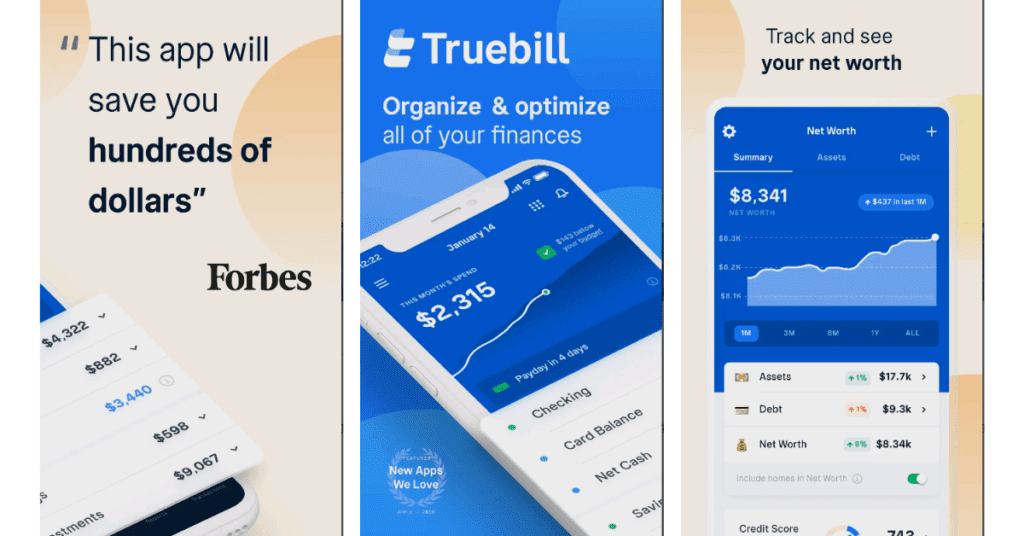

What is Truebill?

Truebill is a service provider which collects all the financial information and optimizes all your bills, subscriptions, and savings of the same.

It is a bill paying or budgeting software service available in-app versions in a desktop version that manages your bills, gives you cash advances without a paycheck, and helps you pay the lowest amount on bills.

It also offers you a savings account to collect your savings for a better future. It also provides other features like canceling unwanted subscriptions and much more. It also has outage management and energy bill savings.

How does YNAB work?

All you have to do is download the You Need A Budget app and create an account with it. After creating an account with YNAB, you have to link all your bank accounts with it and then it will start monitoring your incomes and expenses.

By default, it will have categories of debt payments, credit card payments, immediate obligations, true expenses, quality of life goals, fun, etc to divide your monthly income and expenses.

You have to divide your payment into categories so you know where what amount is being deducted and why. It has customizable category making with amounts of your wish. It also shows you subscriptions and offers to cancel the same if not in use.

It also shows the available balance to carry forward next month and shows where you are sending more and where you have forgotten to pay especially bills and all.

It also has auto subtraction of budget here it shows your balance remaining out of the limit set if you have stated $500 for bills and you have paid $100 as one bill, then it will show the remaining balance as $400 remaining in the bill category.

And when you go overboard in any category, it will show you the alerts of overspending in a particular category, which will make you realize where you need to save more than spend more.

It also offers auto-budgeting and auto-deduction methods, if you don’t have enough time to bifurcate all money into categories, once you have linked your bill details and all bank accounts, it will pay your transactions on monthly basis from your accounts as an auto-payment mode.

How does Truebill work?

To use Truebill, you have to first install the app from the website, apple app store, or google play store.

Once you have successfully installed the app, create an account with them providing your email address and mobile number. After providing personal information, link your bank account and credit and debit cards to monitor your bills and money.

After lining all your cards and accounts, it will deduct the subscription information from history and will monitor the same, after examing your spending it will show you which are unwanted subscriptions which you should immediately unsubscribe.

It also provides you the option to save money on bills paid by Truebill on your behalf where it then costs you around 30% annual of all the money you saved by choosing the lowest amount to pay for your bills with Truebill.

It also has a feature of checking the internet provider's outage and it also seeks a refund and credit of your cable account if there is an area outage, etc. It also has partnered with an energy provider named Arcadia Power to save some sort of amount by choosing to pay energy bills with Truebill.

Perk Highlights: YNAB vs Truebill

YNAB

- It provides zero-budgeting techniques.

- It helps you categorize your payment beforehand.

- It also has an automatic payment mode to pay bills before due dates.

- It also helps you divide your money as per your categories and as per your amount limits.

- You can learn a lot about how you are spending and where you need to stop over-spending.

- It also offers a budgeting blog, which gives all the education one needs to be aware of while making budgets and maintaining a good budget on the monthly basis.

- It also has superior customer care support which helps you solve any queries.

- It also offers 100+ free live and online workshops every week by expert teachers to improve your budgeting skills and maintain money at its best.

Truebill

- It offers subscription management where you can cancel unwanted subscriptions.

- It also has negotiating bills, so you can choose to pay the lowest prices of the same.

- It also provides budget planning.

- It has financial tools which analyze your payments and spending habits to improve.

- It also offers a savings account option where you can save your money for future benefits.

- It also offers cash advances to help you in a financial crisis.

Pricing and Plans: YNAB vs Truebill

YNAB

- It offers a free trial for 34 days straight.

- After that, on monthly basis, it will cost you around, $11.99/per month.

- If we talk about a yearly subscription then it will cost you around $84 per year which will save nearly $60 out of monthly subscribing to the same.

Truebill

- It has two pricing plans.

- The one is with free service with several features.

- Other has Premium version where it has a monthly cost of up to $12 to $13 for exclusive features like Balance syncing, premium chat, and much more.

Pros and Cons: YNAB vs Truebill

Pros of YNAB

- It is available o multiple platforms like websites, apple stores, and google play stores.

- It has both ways of promoting—with manual categorizing and energies and also with automatic entries and deductions.

- It also has multiple accounts linking to YNAB.

- It offers a free trial of 34 days.

- It offers easy tracking of transactions by two methods of automatic entries and manual entries.

- The personalization which YNAB gives, no one else can give.

- It has the active approach of dividing each dollar into different categories.

Cons of YNAB

- It has higher prices than other financial budgeting apps.

- It has no bill tracking feature and hence it requires more improvement in the billing category.

- It has a steep learning curve that is difficult to crack.

- It has few features than some free apps out there.

Pros of Truebill

- The app is free to use for basic services.

- The service of Truebill is very secure with 256-bit encryption.

- It provides budget maintenance, financial analysis, and cash advances all in one app.

- They provide cash advances without a paycheck.

- They also help you negotiate to pay the lowest amount of bills.

- It costs a premium version at $13 to 12 dollars which is cheaper.

- You can easily track your budget.

- It also helps you manage subscriptions.

- It also enables you to understand the credit score and report.

Cons of Truebill

- It charges you 30% of the annual savings which it negotiates when paying your bill.

- The rating given by Better Business Bureau is just 2.2 which is quite low.

Final Verdict: Which is Better YNAB or Truebill?

Overall if we look at YNAB vs Truebill, YNAB has limited features whereas Truebill has the maximum exclusive features for its users and customers.

YNAB does have any savings account option or cash advances option for its users whereas Truebill offers the savings account option with cash advances without waiting for paychecks.

Truebill also has payment security and security with the privacy of personal information. Truebillhass also partnered with high reputed energy providers, internet and cable outage management and so many more which YNAB fails to do so.

Hence, in conclusion, Truebill offers more services and more features whereas YNAB is limited to budgeting money. So if you are looking for only a budgeting app with no more features or complex user interface then YNAB is a great app for you.

If you are looking for one financial app to be at your service with savings, payments, and at times of financial crisis then Truebill is a great alternative for you.

Nerdwallet vs Mint: Which Is Better For You? [2022]

FAQs

Who owns Truebill?

Rocket Company has acquired Truebill at the cost of $1.3 billion.

Who owns You Need A Budget?

You Need A Budget App is owned by Jesse and Julie Mecham.

Is there any free version of Truebill?

No. Currently, Truebill doesn’t provide any free versions of Truebill.

![YNAB vs Truebill: Which Is Better For You? [2024]](https://viraltalky.com/wp-content/uploads/2022/06/Personal-finance-apps.jpg)