Apps Like MyPayNow: Are you short on a budget and wanting to make ends meet before your next paycheck? If so, then a pay-on-demand or pay advance app like MyPayNow can help you with that. So, what is MyPayNow?

MyPayNow is a popular pay-on-demand service in Australia that lets you instantly access the money that you’ve already earned with no interest and hidden fees.

However, it’s not the only pay advance app out in the market, there are several other apps that offer the same service, so here is the curated list of the best MyPayNow alternatives that you can use.

List of Apps Like MyPayNow & MyPayNow Alternatives

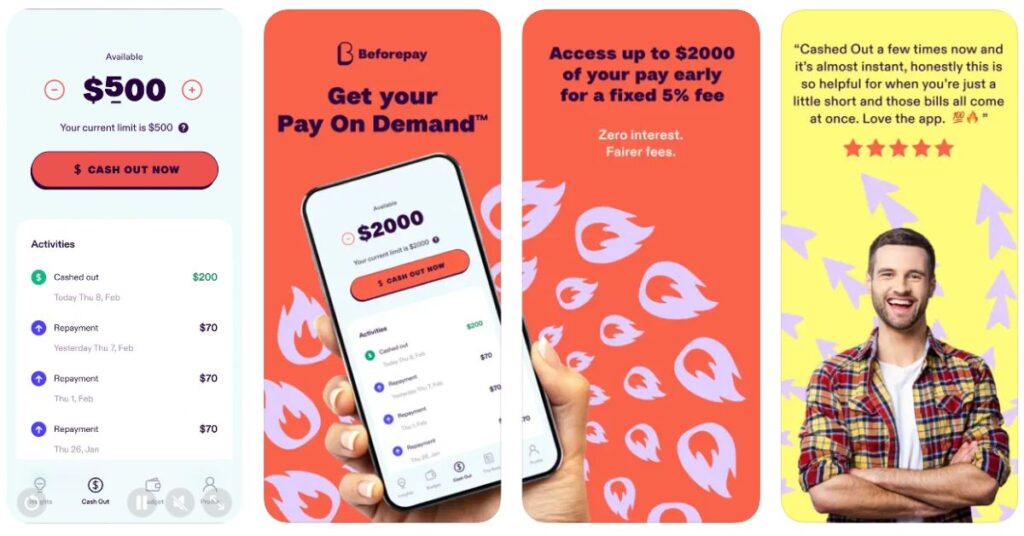

1. Beforepay

Before is one of the best apps like MyPayNow through which you can get instant access to a portion of your salary within 10 minutes. There are no additional fees, interest, or hidden fees except for the fixed transaction fee of 5%.

All you need to do is to download the app, meet the eligibility criteria, and connect to your bank. Then, it’ll confirm your pay and what you spend.

It’ll also help understand your income, and spending habits and ensure you budget better and plan smarter. And you’ll also get a budget plan exclusive to you.

Furthermore, if you are not able to make a repayment on time, you can simply select a ‘delay payment’ option which will automatically line up your next repayment with your next payment.

Key Highlights

| Loan Amount | Up to $2,000 per pay cycle |

| Fees | Fixed 5% transaction fee |

| Credit Check | No |

| Funding Time | 10 minutes but might take up to 12 hours based on your bank |

| Repayment | You can split your repayments into 4 installments |

2. Beforepay vs MyPayNow

Both Beforepay and MyPayNow are popular lending services that let you access a small portion of your salary before your payday. Although both charge the same 5% transaction fee, their maximum loan amount, eligibility, and repayment terms differ.

For instance, the maximum amount you can access through Beforepay is $2,000, whereas MyPayNow lets you access up to a quarter of your regular wage, up to $1,250.

And with Beforepay, you can split your repayments up to 4 installments, while you’ll have to repay in full on your next scheduled payday through MyPayNow. Nonetheless, you can request more flexible payment options.

Furthermore, one thing you must remember about both apps is that there is no credit check and to access your salary in advance, you’ll need to settle all your previous payments.

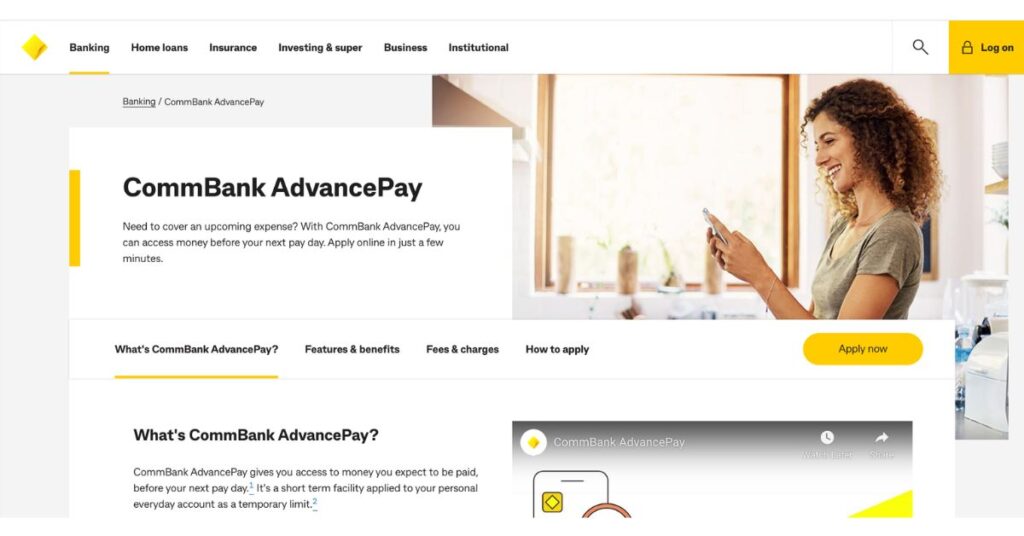

3. CommBank Advance Pay

CommBank Advance Pay is a short-term facility that lets you access your money before your next payday. Simply apply and answer a few questions, if you are eligible, you can apply for it within a few minutes.

It offers features like ‘spend tracker’ and ‘bill sense’ through which you can regulate your budget, expenses, upcoming bills, and a detailed breakdown of your expenses.

Moreover, to assist you to stay in control of your finances, it’ll limit the number of times you can access CommBank advance pay and will only let you have one payday advance at a time.

Key Highlights

| Loan Amount | Minimum amount of $300 and the maximum you can access will be available in your application form. |

| Fees | There is an upfront fee of $5 for every $500. |

| Credit Check | Yes |

| Funding Time | Usually within seconds but might take up to one business day. |

| Repayment | It automatically deducts the loan amount on your chosen payday. |

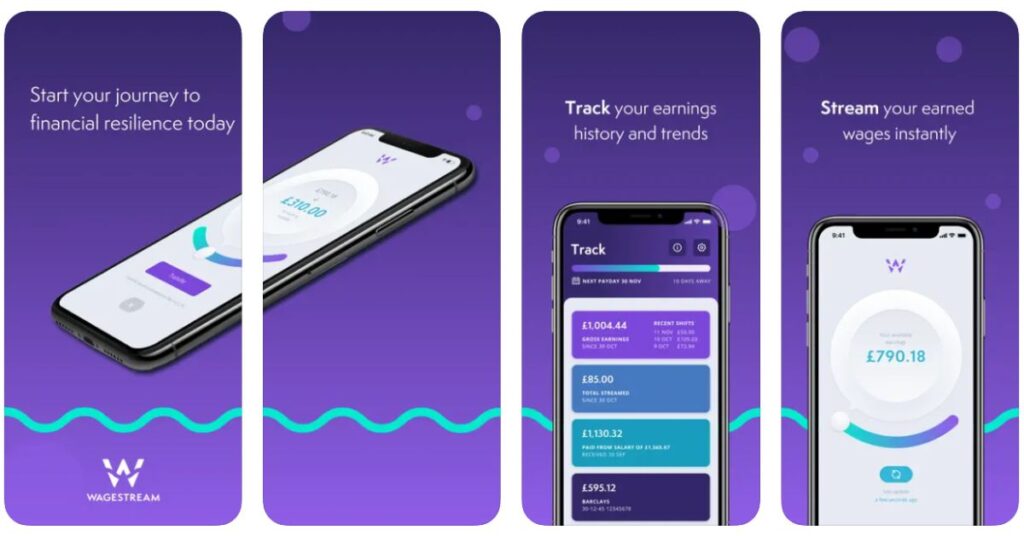

4. Wagestream

Wagestream is another site like MyPayNow through which you can access up to 50% of your earned income every hour of every day – at any point of your pay cycle. So, if you have any unexpected costs or want to cover any emergencies, just access Wagestream!

With just a few taps and a few seconds, access your income without any interest or late fees. Besides, it also offers tools to improve your financial health.

These tools include actionable tips and tricks to make the most of your pay and the facility to track and check your earnings in real-time and get exclusive insights.

Furthermore, you can also track your basic pay in real-time, review your history, and activity, and set monthly reminders to make sure you never miss a payment.

Key Highlights

| Loan Amount | Up to 50% of your wages |

| Fees | Fixed transaction fee of £1.75 |

| Credit Check | No |

| Funding Time | Within a few minutes but might take 1 to 2 business days. |

| Repayment | Automatically deducted from your next paycheck |

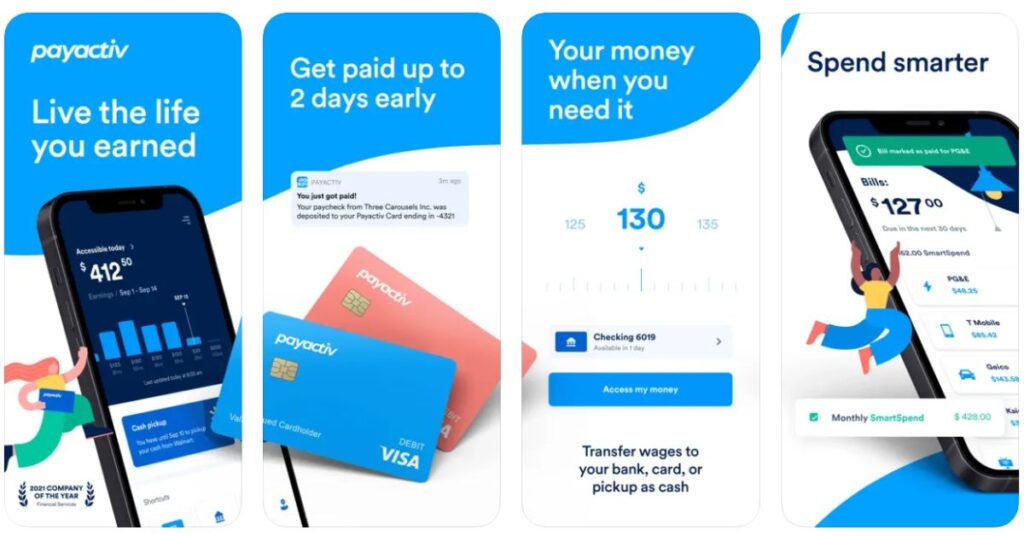

5. PayActiv

PayActiv is a financial service that offers cash advance services. You can get the wages directly into your bank account from hours you’ve already worked without any fees.

And like most of the apps like MyPayNow mentioned in this article, it does not require a credit check, and the amount you’d like to withdraw is based on the pay you’ve earned.

Moreover, if your employer is enrolled with PayActiv, you can easily take your cash advance at a Walmart Money Center and thus making it one of the few cash advance apps that don’t need a bank account.

Furthermore, it also offers other financial services like budgeting tools, savings, automated insights on what you can save, and financial health measurements.

Key Highlights

| Loan Amount | Up to 50% of what you have already earned |

| Fees | $1.99 processing fee for instant deposit to cards |

| Credit Check | No |

| Funding Time | Instantly but might take 1 to 2 business days. |

| Repayment | Funds are automatically deducted from your next paycheck |

6. WageTap

Are you short on money? Access WageTap! WageTap is a financial app similar to MyPayNow through which you can access your salary before your payday.

All you need to do is to download the app, sign up with your name, email, and contact counter, and connect your bank account into which your wage is paid. Easily access your salary with no hidden or late fees.

However, remember that you can only withdraw once for one pay cycle. And once you have successfully repaid your withdrawal, you can withdraw again.

Furthermore, it provides a ‘Bill Split’ feature to make paying bills easier by allowing you to split your bill payments into smaller repayments and pay them back over time.

Key Highlights

| Loan Amount | Up to $500 |

| Fees | Flat rate fee of 5% |

| Credit Check | No |

| Funding Time | Within three minutes but might take up to 24 hours |

| Repayment | Due next payday but the maximum is in 62 days. |

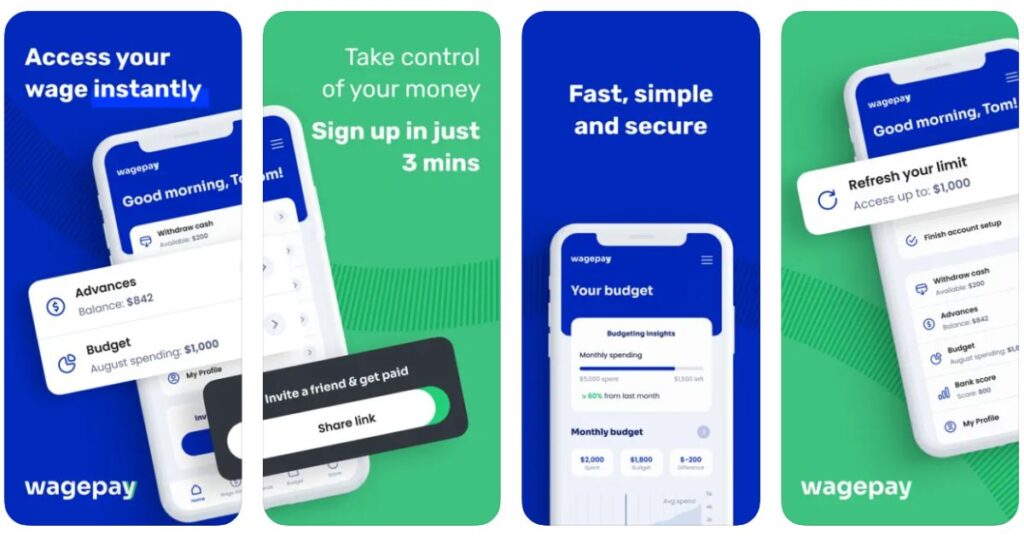

7. WagePay

With Wagepay, get real-time access to a portion of your wage. It transformed the way you access your pay by giving you the freedom to use your money faster whenever you need it with no extra or hidden fees.

Simply create an account by providing your personal details like name and contact number, link up your bank account in which you receive your wages, and then get paid within 60 seconds.

Since it is compatible with over 90% of the banks in Australia, you don’t have to worry about not having your bank.

Additionally, it mainly focuses on employed Australians and does not perform credit checks or look at your credit history or credit score during the sign-up process.

Key Highlights

| Loan Amount | Up to 25% of your wage to a maximum of $2,000 |

| Fees | Flat rate fee of 5% |

| Credit Check | No |

| Funding Time | Get paid in just 60 seconds |

| Repayment | Due next payday |

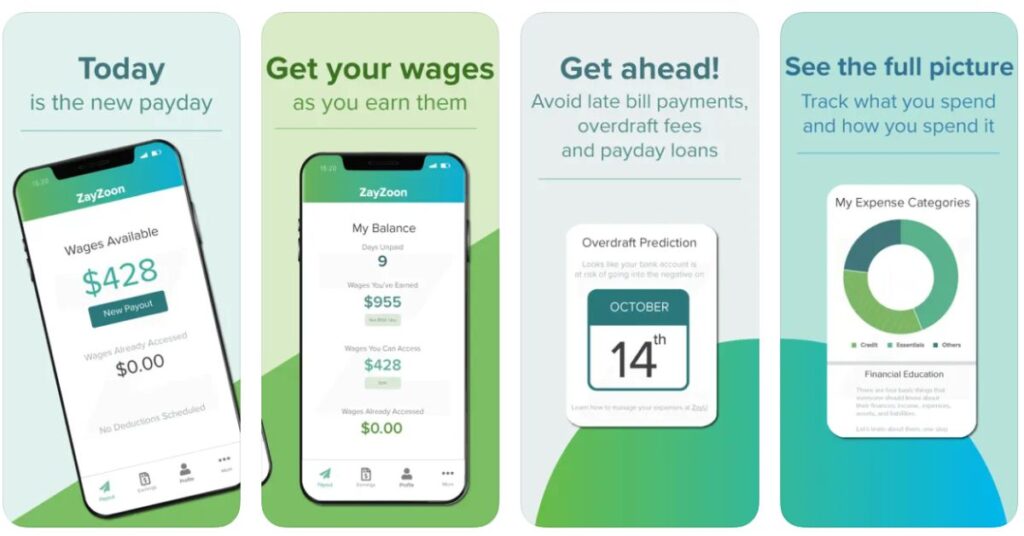

8. ZayZoon

ZayZoon is another site like MyPayNow that lets you access your already earned wages whenever you want. In this way, you can manage your cash flow and make up for any unforeseen expenses.

Simply create an account and request a loan and get paid either through direct deposit or through debit card or other supported pay card option.

It offers various financial wellness tools which provide financial tracking, low balance notifications, spending insights, overdraft prediction, and financial education. You can access these financial tools even though you do not choose to access wage funding.

Besides, note that, in order to use ZayZoon, your employer should have an existing agreement with ZayZoon, otherwise, you cannot access it and get your unpaid wages.

Key Highlights

| Loan Amount | Up to $200 |

| Fees | $5 flat fee per transaction |

| Credit Check | No |

| Funding Time | Instantly through debit card or other supported card but with direct deposit, it might take up to 1 to 2 business days. |

| Repayment | Due next payday |

9. PressPay

PressPay is a wages-on-demand service through which you can access your already earned income before your payday through a simple SMS.

Just create an account and send a text message to tell them how much of your earnings you wish to access. Once it is done, the amount will be immediately transferred to your account. And there will be no credit checks, sign up fees, ongoing fees, or any other hidden fees.

Besides, although it doesn’t need your employer to be partnered with them, you might get additional benefits like free withdrawals if your employer chooses to become a partner.

Key Highlights

| Loan Amount | Up to $1,00 of your earnings |

| Fees | Withdrawal fee of 5% of the money you have drawn |

| Credit Check | No |

| Funding Time | Instantly |

| Repayment | It’ll automatically deduct the amount on your next payday |

Apps Like MyPayNow & MyPayNow Alternatives: Final Words

All the apps like MyPayNow listed in this article let you access your salary before your payday. Each service has its own exclusive features and benefits and are specifically developed to help Australian citizens.

Before deciding on any app, check out main features like loan amount, fees, credit check, repayment, and funding time.

Though most of these apps are completely interest free, a few charge transaction fees. So, it’s important to decide on which platform suits your needs and requirements.

FAQs:

Which apps will let me borrow money instantly?

All the apps like MyPayNow mentioned in the article above will let you access a portion of your income before your payday.

What is MyPayNow limit?

Through MyPayNow, you can access up to 25% of your salary up to $1,250 and repay in full on your next scheduled payday.

Is there any app like BeforePay?

Some of the apps that offer pay day loans to cover unexpected expenses include MyPayNow, WagePay, PayActiv, WageTap, and all the other apps listed in this article.

Watch More BNPL & Pay Advance Apps Australia-

![9 Apps Like MyPayNow & MyPayNow Alternatives Australia [2024]](https://viraltalky.com/wp-content/uploads/2023/02/Apps-Like-MyPayNow.jpg)