Popmoney vs Zelle – are you wondering which one is best for you and your finances? Or thinking which one is safe to use? These might be the questions that kept you searching for Popmoney and Zelle. If you want to do online transaction and looking for the best option, this article will helps you right through it so that you can pick up the best choice based on your needs.

Popmoney and Zelle both are a payment service which transfers money electronically from one bank account to another. They were basically designed for payments among friends and family. These services are legitimate and permits you to send money to other people that are enrolled in the app but before sending money it is important to make sure that you’re not being scammed.

Popmoney vs Zelle: Comparison

Fees

- Popmoney: Requesting and sending money will be going to cost you a bit whereas, receiving money is completely free. It costs approximately $0.95 per transaction to request money from someone and for sending money to someone. Nevertheless, you will not be charged if the person you requested doesn’t pay it as the fee will be only deducted when you receive the money. You also have the option to transfer the fee to the person who sent you the cash.

- Zelle: On the other hand, you’ll not be charge any fee to use Zelle. It’ll mention you to check your bank to make sure that they didn’t charged any fee for transfers through the app.

Payment types

- Popmoney: You can easily send money to a family member or to a friend through their phone number, account number, bank routing, or email address. The person who receive the money will be informed about the money transfer and will be given instructions on how to obtain the cash. However, the procedure for sending money is different for people who have the Popmoney service offered through their bank.

You can start a money transfer from your online bank account via your bank’s website only if your bank participants with Popmoney. And you need to make a Popmoney profile on the website to transfer money with your bank account or debit card, if your bank doesn’t involve with Popmoney.

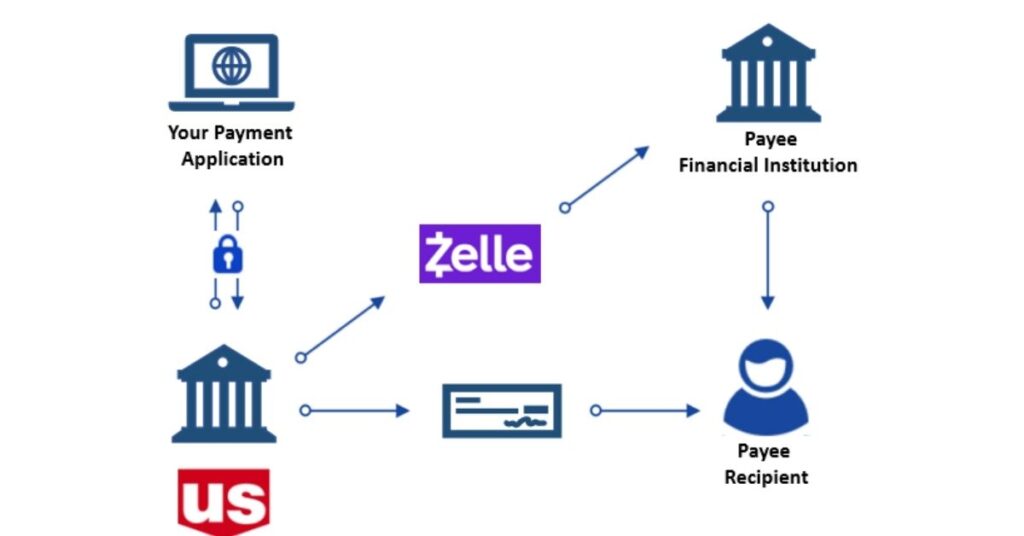

- Zelle: With Zelle, you can transfer money by means of someone’s email address or mobile number. Money goes directly from one back account to another account for the people who have the app in online banking. If one person doesn’t have a Zelle account via online banking, instead it is a transaction between a bank account and a Debit card or Mastercard or Visa card.

Speed

- Popmoney: It usually takes one to three business days or more depending on various factors such as how you send the money and when the recipient accepts the cash. As debit card transfers offer the fastest delivery i.e. if you send money at 5pm, the recipient gets it by 10pm and bank account transactions can take several days.

- Zelle: It is faster than Popmoney as the transaction can happen within minutes when both sender and receiver have Zelle. Whereas a transaction between someone with Zelle account and someone without Zelle can take one to three business days.

Network Reach:

- Popmoney: It has a wider range than Zelle and its service is offered by nearly 2,500 financial services including US Bank, MidCountry Bank, BBVA Compass, PNC Bank, Regions Bank, First Hawaiian Bank, Midwest Bank, Fifth Third Bank, Commerce Bank and more.

- Zelle: Like Popmoney, it can be opened with your online bank account. Currently, it participates with more than 100+ banks and quite less than 2,500 Popmoney’s financial institution network. It is allied with various banks like Bank of America, Wells Fargo, Ally Bank, Citibank and more. Along with this, if your bank or credit union doesn’t offer Zelle, you can be able to download the application to transfer money if the receiver also has Zelle.

Safety

- Popmoney: It has a verification process to make sure that the person you’re transferring money to own the email address or phone number. It also gives information to the receiver such as your phone number, name, and address to complete the payment request.

- Zelle: Just like Popmoney, it has some protections whenever someone starts a sham transaction from your account if you try to report it early. Nonetheless, Zelle’s terms and conditions clearly mentions that this is a service intend to transfer money bank and forth to people you want.

Popmoney vs Zelle: The End`

Popmoney and Zelle are inexpensive ways to transfer money. Requesting and sending money will be going to cost you a little bit, but receiving money is completely free. Whereas, you’ll not be charged any fee to use Zelle. I hope the above article on Popmoney vs Zelle has helped you solve your problem. Now, its up to you to decide which service to choose between them based on your needs, preference, and requirements.

Try Alternatives: 6 Must-Try Apps Like Zelle for Safe Transfers [2022]

Also Read: Best Apps like Possible Finance

![Popmoney vs Zelle: Which Is Better For You?[2024]](https://viraltalky.com/wp-content/uploads/2021/05/Popmoney-vs-Zelle-2.jpg)