Apps Like Zelle – Gone are the days when we used to wait for hours to receive funds into our bank accounts. Fortunately, we have a lot of options now!

Money transfer apps, which are also called peer-to-peer (P2P) apps that allow you to transfer cash from one person to another person easily and swiftly.

Zelle is such money transfer app that offers a unique way to pay family or friends directly from your bank. All you need to do is to download the app and link your bank account.

If you have an account at a participating bank, such as Bank of America, Wells Fargo, Citi, and so on, you can easily send cash with a same-day transfer to anyone with an account at a participating bank.

Additionally, it supports all kinds of payment methods, this includes a bank account, credit card, and debit card.

Yet, the only downside is that it is limited to the U.S. and it doesn’t have a few significant features that might help you enhance your P2P money transferring apps experience.

List of Apps like Zelle/ Best Zelle Alternatives!

Thus, in this article, we have listed the 7 best apps like Zelle that will spice up your experience with money transferring services.

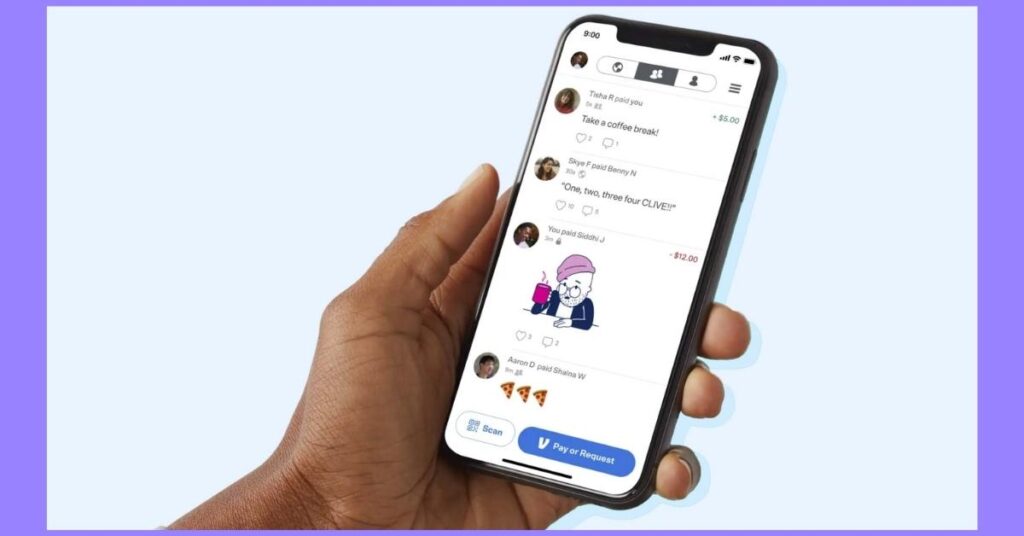

Venmo

Venmo is the best app like Zelle that offers a quick and easy way to send and receive money. You can seamlessly send, spend, or transfer Venmo money to your bank account.

It mainly aims for family or friends who wish to split their bills or borrow and pay back the money with a few taps on their smartphone.

Moreover, you can also use this app to shop or order food online with selected merchants as there are millions of websites or stores that let you choose Venmo as a payment option.

Typically, Venmo uses encryption to keep information secure, and you can also add additional layers of security to your Venmo account by adding a PIN and multi-factor authentication.

On top of instant payments and secure payments, it offers On-Sleazy tools that wisely manage your accounts.

Features

- Offers a way to spend how you want, where you want— all from one easy-to-use app.

- Pay and get paid for anything from your share of rent to a birthday gift.

- Use your unique business QR code for safe in-person payments.

- Stand out on the feed, connect with customers, and get paid with ease.

- Venmo makes settling up feel like catching up, from monthly bills to special celebrations.

- Spend your money in Venmo everywhere Mastercard is accepted in the U.S.

Requirements:

- Be at least 18 years old

- Must be physically located in the United States

- Have a U.S. cell phone that can send/receive text messages

- Should use the latest version of the Venmo app

- Need to add a U.S. bank account, credit card, or debit card

How Does Venmo Work?

All you need to do is to download the Venmo app and link your bank account, debit card, or credit card to the Venmo app. Now, you can send funds to pay a bill or receive money by requesting it.

You can easily send payments to others by searching their email, name, phone, or even with a personal QR code. SO, just your recipient, type in the amount, provide the reason and send money.

Although the reason for the payment is displayed on the timeline, you can choose to make the reason private and hide it from their timeline.

Furthermore, to ensure that you’re paying the correct person for your purchase, you can add friends to your Venmo app.

Fees: It doesn’t charge any monthly fee or to set up an account. However, if you want to send money by using a credit card, it charges a standard 3% fee.

Customer Service: If you need any help with Venmo, you can contact their customer support though the chat with us option from the app for the fastest service.

Or call them at (855) 812-4430 or send them a message by submitting a request here.

Cash App

Cash App is a mobile payment service that lets users transfer money to one another by using a mobile phone application and is only available in the UK and the US.

Similar to apps like Zelle, users can send, receive, and store money! You can only send and receive up to $1,000 instantly within any 30-day period. This limit can be increased after verifying your identity.

Even though the Cash App has direct-deposit functionality, the banking features are limited, and your money is not FDIC insured.

Yet, your payment information is encrypted and sent through secure servers. And you must always take few extra steps to make sure no one can send money using your phone.

Furthermore, it offers a customizable debit card – the Cash Card, which lets users spend their money at different retailers and withdraw cash from an ATM.

Features

- Offers the easiest way to send, spend, save, and invest your money.

- Protect all of your payments and investments with a passcode, Touch ID, or Face ID.

- Transfer money from Cash App to another bank account instantly instead of waiting days.

- Pause spending on your Cash Card with one tap if you misplace it.

- Receive deposits up to two days earlier than is standard with most other banks.

Requirements:

- Be at least 18 years old

- Must be a resident of the United States

- Should register for an account

- Have a valid email address, text-enabled phone number, street address.

- Provide your Social Security Number and a government-issued form of identification

How Does Cash App Work?

Cash App has four main functions – sending money, receiving money, investing, and mobile banking. If you want to send money, you just need the recipient’s phone number, email address, or $Cashtag. You can then either make the payment from your linked bank account, Cash App balance, or credit card.

And when you receive money, it will directly go into your Cash App account, which you can withdraw to a debit card or connected bank account.

When you don’t want to transfer money out to a bank account, you can request a Cash Card, which is basically a Visa debit card that allows you to use Cash App funds to buy products online or in retail stores.

Finally, the Cash App’s investing feature allows you to invest in stocks and exchange-traded funds as low as $1 with zero commission fees.

Fees: Cash App offers Instant Deposits to your linked debit card and Standard deposits to your bank account.

Instant Deposits are subjected to a 1.5% fee and will instantly arrive on your debit card. Whereas Standard deposits are entirely free, but it takes 1-3 business days to arrive in your account.

Also, it will charge you a 3% fee each time you use your credit card to send money. For instance, if you send $200 with the Cash App via your linked credit card, you’ll have to pay $206.

Fortunately, it doesn’t charge any fee to make payments with your bank account or debit card.

Customer Service: If you need any help with Cash App, you can get help through Cash App or visit here, or call them at 1 (800) 969-1940.

You can also visit this page to get more information on how to contact Cash App Support.

PayPal

Let’s not forget one of the earliest apps in the world of mobile payments – PayPal. PayPal is an American fintech company operating an online payment system in the majority of countries.

It serves as a payment processor for online retailers, auction sites, and several other commercial users that lets you transfer and receive money through its mobile app.

All it takes is just a few minutes to set up an account and send money to up to 20 people at a time. And for added security, you can show your name, username, photo, mobile number, and email on your account.

PayPal’s Money Pools provide an easy and simple way for groups of people to contribute to a group collection. Moreover, its invoice creation feature lets you customize and track every invoice you send.

Although you can send up to $60,000, PayPal might limit the transaction to $10,000 based on the currency you use.

Features

- PayPal account lets you check out safer, faster, and easier.

- Easily shop online with PayPal or pay other PayPal users for goods and services.

- Track and monitor every PayPal transaction you make.

- PayPal mobile app makes it easy to send money around the world.

- Manage your bill payments and get paid up to two days earlier with the new Direct Deposit feature

Requirements:

- At least 18 years old

- Have a complete legal capacity to enter into a contract to use PayPal and its services

- Have a valid phone number and email address

- Need to connect your account to your debit card, credit card, or bank account

- Sometimes ask you for proof of ID

How Does PayPal Work?

First, download the PayPal on your device, enter your mobile number to get a confirmation text, and link a credit card or debit card as a selected payment method.

As it offers both personal and business accounts, you can choose what you need. So, once the account is set up, you can make a payment through a mobile number or email address of another PayPal user.

Moreover, you can pay for your online purchase by using PayPal, as it offers a secure transaction through the retailer’s checkout cart.

And with its PayPal Credit option, it offers users to shop for a product now and pay it later or over time. However, to qualify for PayPal Credit and to create a business account as a merchant, you’ll need to provide some additional information.

Fees: PayPal charges different transaction fees;

For sending domestic personal transactions:

| Payment Method | Fee |

| PayPal balance or a bank account | Fee is waived |

| Cards | 2.90% + fixed fee |

| Amex Send Account | Fee is waived |

For sending international personal transactions:

| Payment Method | Fee |

| PayPal balance or a bank account | 5.00% A min. international fee of 0.99 USD A max. international fee of 4.99 USD |

| Cards | 5.00% A min. international fee of 0.99 USD A max. international fee of 4.99 USD |

| Amex Send Account | 5.00% A min. international fee of 0.99 USD A max. international fee of 4.99 USD |

For receiving money, it doesn’t charge any fee if no currency conversion is involved.

Customer Service: If you need any help with PayPal, you can contact their customer support by contacting them at 888-883-9970 from Monday-Friday between 8 am to 8 pm.

Or send a direct message through Twitter at @AskPayPal with your registered email address.

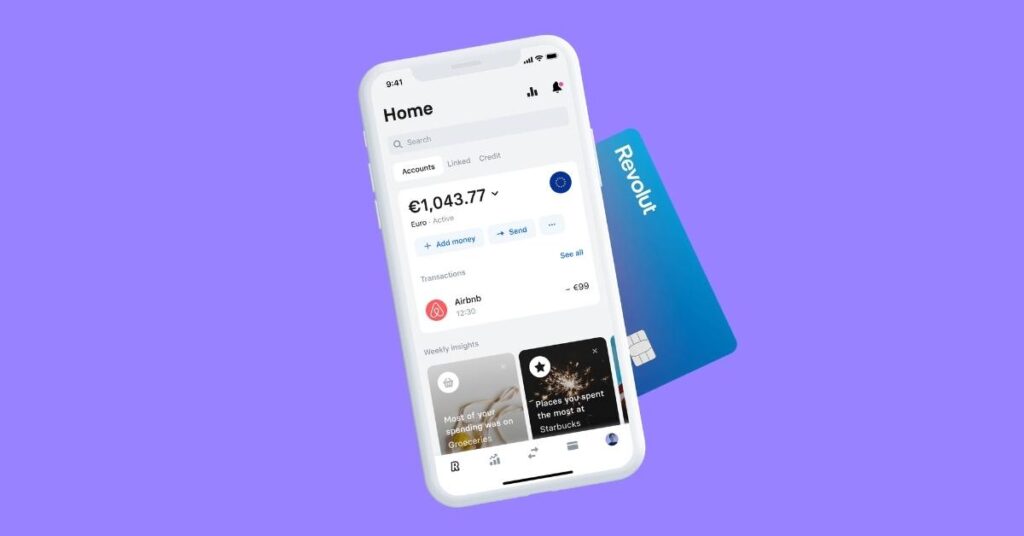

Revolut

Revolut is another app like Zelle that aims at making online money transfers easy and simple. It offers accounts featuring debit cards, Apple Pay, currency exchange, virtual cards, crypto, commodities, and more.

Its mobile app supports spending and ATM withdrawals in 120 currencies and transfers in 29 currencies directly from the app.

Besides, it assists users in saving on fees for both domestic and international transactions and offers up to 10 free non-US transfers per month for every user.

It also offers access to cryptocurrencies, such as Ethereum, Bitcoin Cash, Bitcoin, Litecoin, and XRP by exchanging with 25 fiat currencies. And with its trading facility, you can access different US stocks and fractional share purchases/sales.

Features

- From payments to transfers and everything in between, unlock amazing features.

- Make hassle-free payments to your Revolut friends in 30+ countries.

- Ability to split & settle bills in one place, request money with a tap, and more.

- Send and exchange money fee-free in over 30 currencies.

- Take control of your money with smart budgeting and analytics tools.

- Reach your financial goals faster with Vaults.

Requirements:

- Must 18 years old or over to open a Revolut account

- Have a valid mobile number, email address, and resident address

- Provide information about where the money you will put in your account comes from.

How Does Revolut Work?

Unlike other banks, Revolut doesn’t need any paperwork, and it completely operated on a digital basis via an app. So, quickly register for an account by providing your personal information and start transferring funds.

You can transfer money to someone in other countries, pay bills, and even load your account with a balance in a foreign currency.

If you sign up for a Premium account, you’ll get a Mastercard in the mail within three business days. It will even provide you with updates on your card, such as when it is being created and shipped.

Fees: Based on your Revolut plan, you can make set types of payments or a set number of them for free. And offers up to 5 ATM withdrawals, then a fee applies. This fee is 2% of the withdrawal, to a minimum of £1 withdrawal.

It offers three different accounts – Standard, Premium, and Metal that cost $0, $9.99, $16.99 a month respectively.

To replace a Revolut Cards, it charges £5 or currency equivalent per replacement except for a delivery fee.

Customer Service: If you need any help with Revolut, you can contact their customer support through the In-App Chat or email them to feedback@revolut.com.

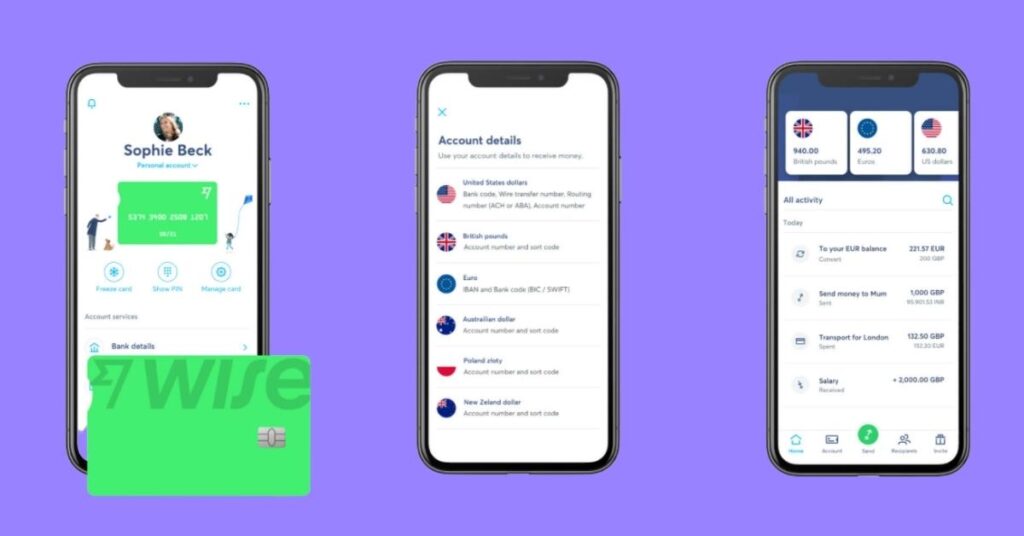

Wise

Wise is the best money transfer app that lets you send and receive money in multiple currencies. It offers an inexpensive way to send money from the US to around 80 countries.

You can fund a Wise money transfer in different ways, such as with a credit card, or bank account, but people to who you are sending money should have a bank account.

To send money in local currency, all you need to do is simply deposit funds in your Wise balance through the Wise account or any other bank account.

And unlike most of the similar services, it offers very low-interest rates. Additionally, it provides three transfer types that charge different fees based on the mode of transfer that you select – Easy, Low cost, or Fast.

Features

- Send money to over 80 countries or spend or withdraw money in over 200 countries.

- Secure your transfers with two-factor authentication.

- It’ll auto-convert what you have with the lowest possible price by using your account details.

- Pay invoices and bills faster, at a better exchange rate.

- Ability to connect to supported platforms like Amazon, Stripe, Xero, and many more.

- Freeze and unfreeze your debit card, and update your virtual card whenever you like.

Requirements:

- Provide your personal information like name and date of birth

- Should be a resident of the United States

- Valid contact information, residential address, and email address

- Proof of ID, such as SSN or any government-issued document

- Complete details of the linked account or card that you’ll use to fund your account’s opening balance

How Does Wise Work?

All you need to do is to create an account and sign up as an individual. If you have a business, you can add your business to your Wise account.

Your recipient doesn’t have to use Wise for you to send money. You just need to provide their local bank details, and you can easily send money to them.

Pay by debit or credit card or make a local bank transfer. That means you don’t need to link your bank account to Wise and based on the country you’re sending money from; you may have other payment options.

And there are limits for how much you can send using Wise. That is based on which currencies you send to and from, and how you pay. Visit this page to check the limits for each currency.

Fees: To see exactly how much your transfer could cost, you can visit here. However, the transfer costs depend on the amount you’re sending, the exchange rate, and how you pay.

Customer Service: If you need any help with Wise, you can contact their customer support by sending an email to support@wise.com or send a direct message through Twitter at @Wise, or visit here.

Popmoney

Popmoney is a person-to-person payment app like Zelle that lets individuals to send and receive payments electronically in a manner that is developed to replace the traditional check payments.

It was primarily created for payments between friends and family, and Popmoney for small businesses lets businesses to use this service as well.

Its transactions execute from the sender’s checking account to the receiver’s checking account directly and there is no need for a stored-value account for either participant.

Since it uses ACH (Automated Clearing House network) to deliver the funds, it might take 2-3 days to receive the funds, which is why it isn’t that of a great option.

Features

- Paying someone and getting paid is as easy as sending a text or email.

- Popmoney is offered by 1400 financial institutions, making it easy for your friends and family.

- It’s a simple, secure, and smarter way to pay and get paid.

- Request payment from a single person or a group of people, including setting up reminders to pay.

Requirements: You’ll need to sign up with Popmoney to send money, but you don’t need to sign up in order to receive funds from a Popmoeny user.

Popmoney vs Zelle: Complete Comparison [2022]

How Does Popmoney Work?

To use Popmoney, you’ll need to download the mobile app on your device, or you can sign up at popmoney.com. Similar to Zelle, Popmoney lets you send and receive money to and from friends or family or anyone.

Your recipients don’t necessarily have to sign up for Popmoney and when they receive payments, they’ll get notified by either a text message or email.

However, if your recipients are not Popmoney users already, it will ask for the recipient’s bank account information so that they can direct funds into their bank account.

Once you enter your eligible transaction account, you can receive money. Moreover, if your financial institution offers Popmoney, you can just log onto their online banking site to use Popmoney there.

Fees: There is no fee assessed by Popmoney to receive and deposit a payment into your Eligible Transaction Account. However, sending money through Popmoney costs $0.95.

Note that some credit unions and banks integrate Popmoney into their service, it comes with extra fees on the bank’s end.

Customer Support: If you need any help with Popmoney, you can contact their customer support by sending an email to support@popmoney.com or by calling them at (877) 675-6378 from 9 am to 9 pm.

Final Words: 6 Best Apps Like Zelle!

These are the Zelle alternatives that are the best apps to transfer money to other debit cards or bank accounts.

So, check out these apps and figure out which one offers the best features or meets your requirements!

If you find it difficult to select one, you can choose an app that has less transfer fee, and offers free ATM withdrawals. Needless to say, don’t overlook security!

You may also check for additional features that the app offers. Hopefully, you may choose the best app like Zelle based on your needs and requirements!

![6 Must-Try Apps Like Zelle for Safe Transfers [2024]](https://viraltalky.com/wp-content/uploads/2022/01/apps-like-zelle-alternatives.jpg)