Cash App for Business vs Personal: This article will show you a simple Cash App for business and personal comparison to help you decide which one is the best for you.

In today's world, selling and buying products or services has become pretty routine.

Secure, easy and reliable internet connection has allowed a vast number of customers to get the best quality products and services seamlessly.

In contrast, payment solutions that are hassle-free such as Cash App, permit merchants to accept money from their customers.

Cash App for Business vs Personal: What's the difference?

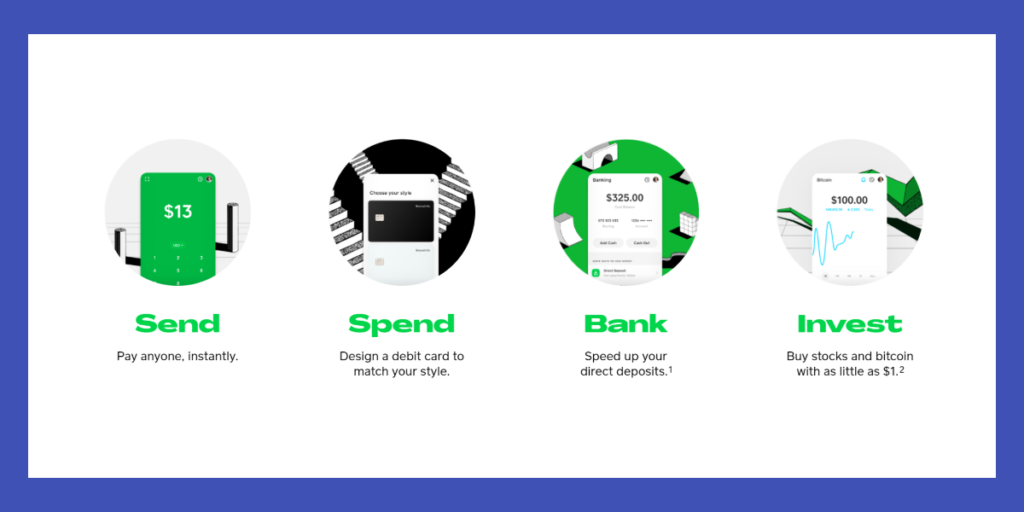

Cash App is one of the most popular peer-to-peer payment app. All you need to do is to download the app and send money quickly to family back and forth, and the money goes through almost instantly.

Then, users can choose to withdraw the money with their cash card or debit Visa card in ATMs or transfer it to any local bank account.

Check out the guide below for further detailed information on Cash App for Business vs Personal comparison.

Whether you use Cash App for a personal or business account, one thing is sure that seamless payments are guaranteed for both types of users.

Also, both business and personal account holders can associate their bank accounts through credit and debit cards and spend money efficiently.

If you get to a basic level, you'll se that there are more similarities than differences between Cash App for business and personal accounts. Nevertheless, few differences ultimately let you choose between personal or business account.

One of the most prominent differences is that Cash App business account holders who accept $20,000 in a month can get 1099-k form to file taxes. On the other hand, this feature is not available for personal account holders.

Another difference is that Cash App for business account holders are permitted to create cash.me payment links a share it through email, SMS, and WhatsApp or link to their website and utilize it as a payment gateway.

Features: Cash App for Business vs Personal

Charges

Cash App for business accounts allows traders to get unlimited money from their clients. Remember that, the best interest of the small business owner, Cash App charges only 2.75% per transaction for being paid via the business account.

Whereas Cash App's personal account holders don't need to pay anything to receive money from contacts.

Creating link

One of the best things about Cash App for business accounts is that retailers can create their own payment link and share it with their consumers. It also allows non-Cash App users to make payments through the link without actually downloading the app and creating a new account.

Not only that, if you have a website, you can be able to attach your payment link to your website and obtain money automatically. Cash App Personal account users don't have this option.

Deposit fee

A standard bank deposit is fee cash app business account users are free. Nevertheless, immediate deposit on Cash App is chargeable for both personal and business account users. The instant deposit fee is $0.25 or 1.5% at minimum.

Useful links: Cash App for Business Terms

Weekly and monthly limits

With a personal account, the limits that you can send and receive each will be much lower. But if you set up your account as a business account when you're enrolling, your limits are going 7 to be much larger, so you can handle much more transactions through the cash app system.

Get Cash App :

Cash App for Business vs Personal: How to Switch from Business to Personal?

During the time of sign-up, you can choose the type of account you would like to create. Many people choose ‘Personal’ whereas some people opt for ‘Business’ account.

If you have created a business account and wondering how to switch from business to personal or vice versa on a cash app, keep on reading to know how to switch from a Business account to a personal account.

- Open Square Cash App on your device.

- Click on the profile button on your home screen and scroll down to choose the personal tab.

- Click on ‘Change Account Type’ ad scan your finger to confirm the changes.

Now, you can see that your Cash App for business is changed to Cash App for personal.

The Bottom Line

If you intend to create a personal account and use it as a business account, it is possible that they can close down your account permanently, which would be inconvenient.

Still, they also might review your account and automatically switch it over into a business account.

So, I'm hoping that the above article on the Cash App for Personal vs Business comparison has made it easier to choose between the Cash App for Personal and Business depending on your requirements and personal preferences.

Apple Pay vs Cash App: Comparison [2022] Webull vs Cash App: Which is better? [2022]

What’s the difference between personal and business cash app?

For a business account, Cash App charges a 2.75% fee for receiving. Whereas, a personal account is entirely free to receive money from contacts. Nonetheless, an instant deposit on Cash App has a fee of 1.5% or $0.25 for both personal and business account holders.

Can I have a personal and business cash app?

If you are thinking about whether you can have a personal and business cash app, it can be only possible if you have two different phone numbers. However, you have the ability to switch from business to personal account in the cash app.

What is the cash app business account fee?

Cash app Business account fee is 2.75% for every payment you get. Meanwhile, sending money from a business account to a connected bank account also charges a fee of 1.5% for instant transfer with a standard bank deposit fee.

How to switch cash app from business to personal account?

Open cash app -> profile icon -> personal tab -> change account type -> confirm.

Guide:

![Cash App for Business vs Personal: What’s the Difference? [2024]](https://viraltalky.com/wp-content/uploads/2021/07/cash-app-for-business-vs-personal.webp)