In this article, we have compiled a list of the best apps like Even that offer early pay as well as a wide range of financial planning tools.

Even and Even alternatives have been helping people to get the money they’ve already earned before their payday without any overdraft fees.

Although most of the apps don’t charge any interest, there are few apps that charge a monthly subscription. Check out the below article to know about the best Even alternatives.

Before going any further, first, let’s understand what is Even, and how does Even app work.

What is Even?

Even is one of the popular fintech that offers cash advances of as much as 50% of the money that you’ve already earned.

It also notifies you of the ‘Okay to Spend’ amount for your bills. Moreover, it allocates a specific amount from your bank account so that you don’t face any financial trouble at the month-end.

How Does Even App Work?

Even helps both employers and employees to enjoy financial wellness. For employees, it can provide on-demand pay to access earned wages instantly.

You can get these funds against the wages you’ve earned but are yet to get paid through a feature called Instapay.

To regulate your borrowings, Even track how much you’ve made. That means if you get paid frequently, weekly or bi-weekly, or daily, it makes it easy to check how much you’ve already earned from the total amount due.

You can access a maximum of 50% of your earnings. You can access the funds you want through a cash pick-up or a bank deposit.

Cash pick-up instant and to get the cash pick-up, you just need to visit a Walmart store. However, if you choose the bank deposit option, Even will let you know how soon you can get the money in your account.

But the only catch is that you can only use Even if your employer signs up. So, keep on reading to know about the best apps like Even!

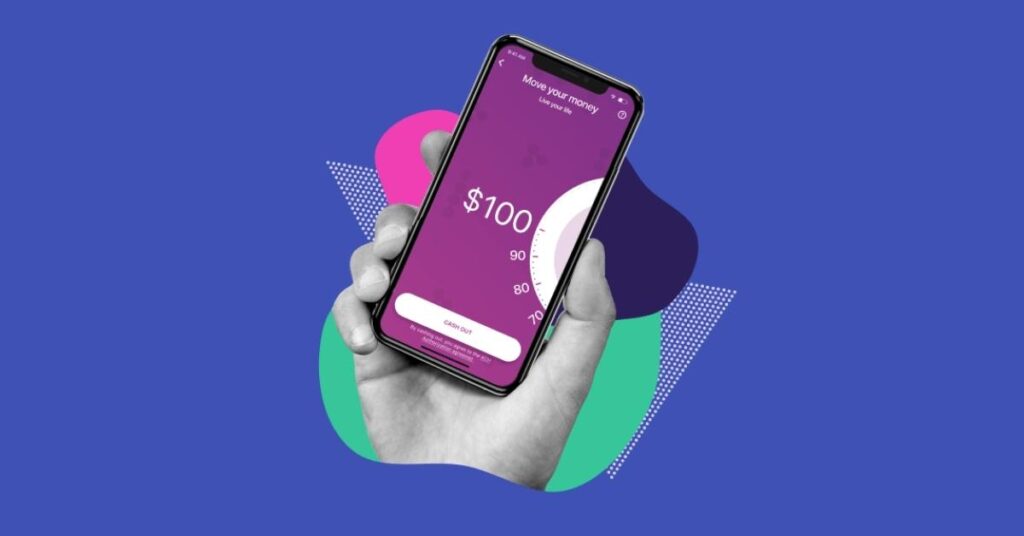

Earnin

In the first position, we have Earnin in the list of apps like Even. Earnin is a financial services company that offers earned wage access services.

Its main service – Cash Out, lets users access earned wages that they have not yet been. For instance, you can borrow up to $500 a day if you have worked enough hours.

What makes it more interesting is that you don’t have to go anywhere to collect your funds. You can simply use its ‘Lightning Speed Program’ to get instant access.

Within one day, this will deposit the amount into your bank account. Moreover, its Balance Shield program will prevent you from overdraft fees.

Yet, you’ll need to work regularly, enable your local services and even upload your work schedule to qualify for an advance withdrawal.

Features:

- Access the money you’ve already earned with the Earnin app.

- No hidden fees, no interest, and no credit check.

- Connect your debit card to Earnin and get your money in an instant.

- Balance Shield Alerts notify you when your bank balance is getting low.

- Earnin Financial Calendar lets you know in advance when you have recurring payments coming up.

- It does not require a minimum or maximum repayment time frame.

How Does Earnin Work?

To get started with Earnin, all you need to do is to create an Earnin account and connect your bank account where you get paid, and add a debit card.

Then, you’ll need to add the employer you get your paycheck from and verify your work email. If you don’t have a work email, you can turn on the ‘Location permission’ for Earnin.

It will then automatically add earnings to your Earnin account once it verifies your work address. With its Balance Shield feature, it helps you prevent overdraft fees.

If you are a freelancer, remote worker, or someone who does various jobs, you cannot be eligible for the payday advances in Earnin.

Eligibility Criteria:

- Have consistent pay schedule–weekly, biweekly, semi-monthly, or monthly

- Over 50% of your direct deposit sent to a checking account

- Your salary must be at least $4 an hour

- A fixed work location and electronic timekeeping system at work

Cash Advance: The maximum amount you can borrow through Earnin is $100 per day and up to $500 per pay period.

It does offer $500 for everyone. However, if you continue to use the app and pay all your advances successfully, you might be eligible for an advance of up to $500.

Repaying Advance: The repayment period depends on the total amount of money you can receive during each pay period.

And it will automatically deduct the amount you’ve borrowed from your checking account on your next payday.

Fees: Earnin doesn’t charge compulsory fees, interest, or have any hidden costs. It also doesn’t charge any monthly fee and is completely free to download.

Customer Service: If you need any help with Earnin, you can contact their customer support by sending an email to them at support@earnin.com.

Dave

Dave is a digital banking service that offers users an advance on their paycheck to cover small expenses and offers a spending account that charge no overdraft or low-balance fees.

It uses an algorithm to predict users’ ability to repay loans depending on their checking account and income history.

It’ll help you improve your financial health with their incredible financial tools and even monitors your budget and predicts your forthcoming expenses.

Moreover, when you don’t have enough money or your account balance is getting low, you’ll get a notification to pay the bill.

And its budgeting tool will analyze your bank account transactions to automatically create a budget for you and assist you to plan for upcoming expenses.

Features:

- It has fully-trained professionals standing by to help you out.

- No overdraft fees, no minimum balance fees, and ATM-fees.

- Every account is protected by banking-level security and FDIC-insured up to $250,000.

- Deposit paychecks, unemployment benefits, stimulus payments, and tax returns directly into Dave Banking.

- It helps you build your credit just by paying rent and utilities on time.

- Planning tools helps you organize upcoming and recurring expenses.

How Does Dave Work?

Provide your email address, mobile phone number, low balance alert amount, and other personal information to create a Dave account.

Dave will then examine your income, spending habits, as well as the regular balance of your bank account and use predictive analysis to know how much money is coming and going out of your account.

Once they approve you for a cash advance, you can choose from standard funding or express funding options. However, standard funding might take up to three business days.

It let you build your credit score by making on-time payments. These payments are automatically deducted from your bank account.

Eligibility Criteria:

- Should be 18 years old

- Have a steady paycheck that your direct deposit into your checking account

- Show that your bills don’t consume your entire paycheck

Cash Advance: The maximum payday advance you can receive through Dave is $250.

Repaying Advance: Users can pay the advance back manually or set up automatic payments from a bank account. And the automatic payment date is set to your next payday.

Fees: It charges a monthly fee of $1 and it will automatically deduct your fee from your connected bank account.

Also, it asks for optional “tips” and it also charges a monthly fee of $1 which will be deducted from your connected bank account.

Customer Service: If you need any help with Dave, you can call them at 1-844-857-3283 between 4 Am to 10 Pm from Monday to Friday and between 5 AM to 5 Pm on Saturday and Sunday or visit here.

You can also try contacting Dave by sending an email to their support team at support@dave.com.

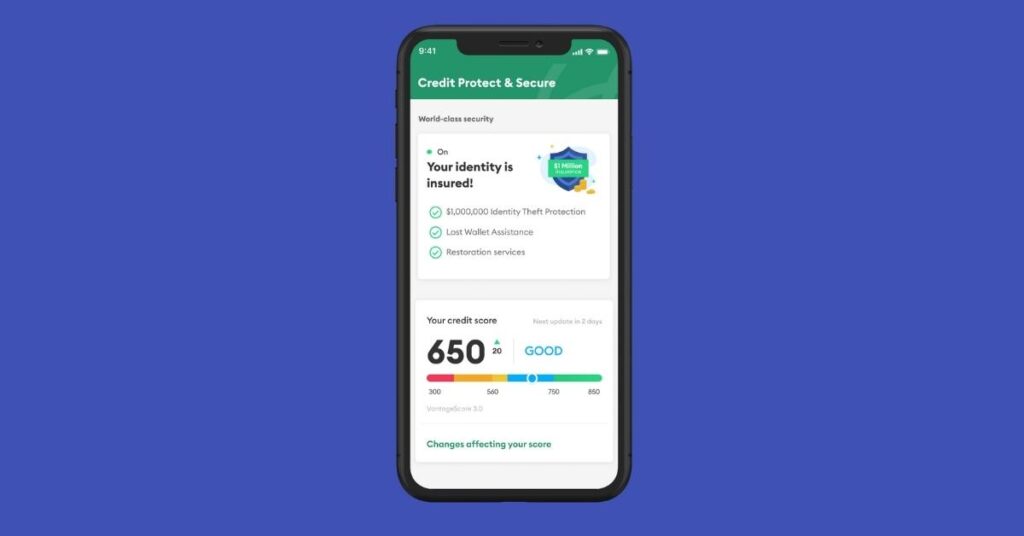

Brigit

Next, in the apps like Even, we have Brigit. Brigit is a payday advance or cash advance platform that permits you to get up to $250 without a credit check and without any interest.

It can be the perfect choice for anyone who wants an occasional emergency loan. Moreover, it analyses your account and predicts your spending habits to prevent overdraft.

With the Brigit Plus Membership, you’ll automatically get advance money if they think you’re at risk of overdrawing.

Also, you’ll need a Brigit score of at least 70 to get qualified for Brigit Plus to have an early payment. And the amount you can borrow is only based on your bank activity.

Features:

- No credit check, no interest, no transfer fees, no processing fees, no late payment fees, and no hidden fees.

- No compulsory minimum or maximum repayment time frame.

- Get tools and full credit reports to help you understand and better your credit.

- Discover new opportunities to increase your income with full- or part-time jobs.

- Build your score up to 60 points with Brigit’s credit-builder account.

- Access your full credit report.

How Does Brigit Work?

Once you’re qualified for the credit, it makes sure that you can have access to $250 as long as your credit card balance hits zero.

It doesn’t charge any overdraft fees, and you are completely free to choose the free or paid version of the app.

When you request your advances, the repayment date will be given. If you wish to repay the Brigit advance before your due date, you can select the “repay now” button.

As soon as you’ve repaid your loan, you can access another payday advance, and this is all included in your monthly fee.

Moreover, it uses an algorithm that helps you to avoid overdraft fees by automatically analyzing your checking account

Eligibility Criteria:

- Must be 18 years old

- Average paycheck should be greater than $400

- Must have an active checking account

- Have bank account balance greater than $0

- Money should be left in your bank account two days after you get paid

- Must have at least three recurring direct deposits from your employer

Cash Advance: You can get a cash advance up to $250 if your credit card balance hits zero.

Repaying Advance: The repayment date will be given to you when you request your advances, and it can be accessible in the app. It’ll automatically withdraw the advance on your repayment date.

Fees: Brigit has both free and paid membership. Its paid membership – Brigit Plus, costs $9.99 per month.

Its paid version offers instant deposits, auto advances, and credit protection & security. And its free version has very limited features when compared to the paid plan.

Customer Service: If you need any help with Brigit, you can chat with the Brigit support expert between 9 Am to 6 PM by submitting a request or simply sending an email to info@hellobrigit.com.

It usually takes two business days to respond to your email or request, and they currently don’t support phone calls.

You can also visit here and explain your problem by providing your email address, phone number, bank name, and other required information.

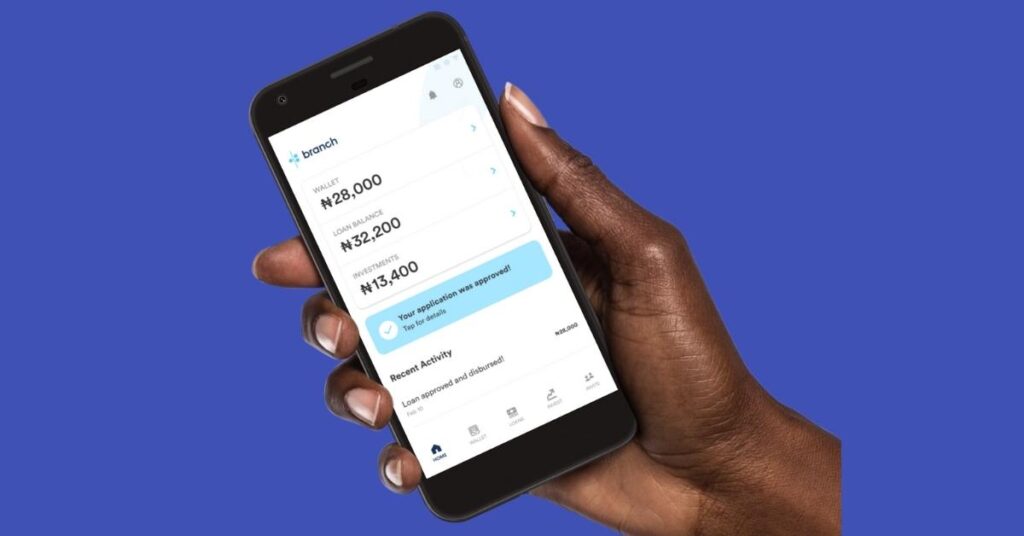

Branch

Branch is one of the similar apps like Even that offers budgeting, wage advances and a checking account. It states itself as “Banking for Working Americans.”

You can get access up to $100 as an early payment and get you to pay two days prior than usual as long as your pay goes to your Branch checking account through direct deposit.

Although there are no membership fees or any hidden fees, there is a $3.99 transaction fee for an instant advance, or else, you’ll have to wait up to three business days to get the funds.

It will automatically withdraw the advanced amount from your checking account on your next scheduled payday.

Features:

- Offers the simplest and most secure way to borrow, save, and improve your financial health.

- Access your credit report at no cost.

- Choose repayment terms depending on your loan amount.

- No paperwork, salary slips, collateral, or office visits needed.

- Lower fees, and flexible payment terms as you repay.

- No late charges or rollover fees on loans.

How Does Branch Work?

Download the Branch app on your device and then, create an account, add your work location, payroll card or debit card, employer name, and bank account information (optional).

Once your bank account has been verified and your Branch account is activated, you can be able to request your first paycheck advance.

It analyses data to decide whether to lend money or not. Besides, it doesn’t need any credit check and the provider will provide you a repayment date that will coincide with your next paycheck.

Eligibility Criteria:

- Be at least 18 years old

- Must have a payroll card or debit card

- Provide bank account information

Cash Advance: The maximum amount you can through Branch is $150 and the maximum you can get per pay period is $500.

The amount you are eligible is usually depended on the number of hours you work and the wages due.

Repaying Advance: Branch will automatically withdraw the advance money from your checking account on your next payday.

Fees: It doesn’t charge any interest or late fee or membership, however, you may ask to leave a tip for the service.

And depending on the amount you transfer; it charges $2.99 to $4.99 for an instant advance to your linked debit card or bank account.

Customer Service: If you need any help with Branch, you can contact their customer support by sending an email to support@branchapp.com or call them at 866-547-2413. You can also visit here and submit your request.

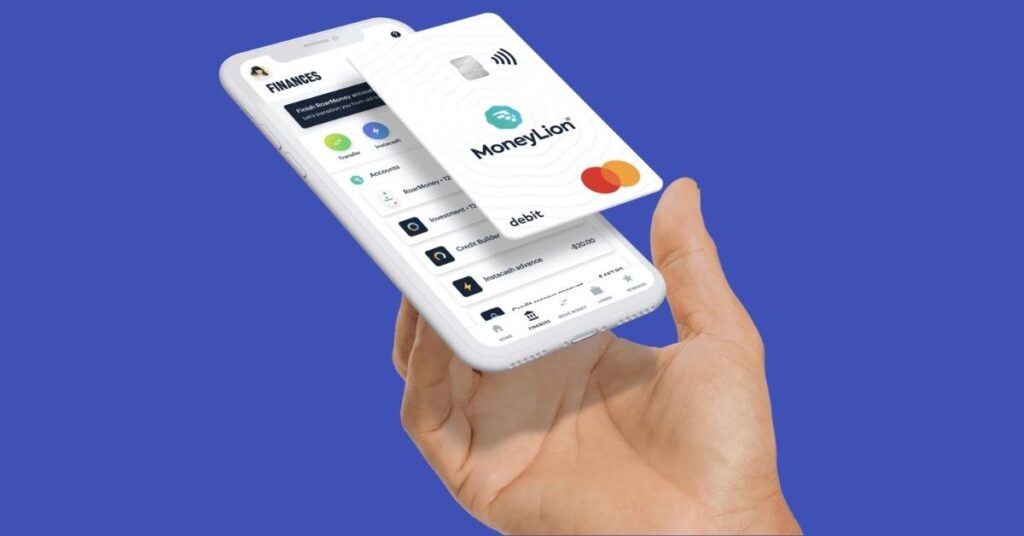

Moneylion

Moneylion is another Even alternative that offers a large range of financial products and services such as credit builder loans, personal loans, cash advances, checking accounts, credit score tracking, and more.

It boasts itself as an “All-in-one mobile banking membership” as they offer a lot of products and services as mentioned above.

Moreover, its machine learning technology provides personalized advice to users based on their spending habits.

Not only that, but it also offers access to small loans to help users handle their monthly income and expenses and even automatically invest the spare change into your MoneyLion investment account from your purchases.

Features:

- Offers finance, mobile banking, cash advance, investing, and more.

- Automatically invest the spare change from purchases into a MoneyLion Crypto or Investment account.

- No interest, no monthly fee, and no credit check.

- Access investment account and a zero-fee checking account for completely free.

- Analyzes your primary checking account which should meet a few measures to get approved.

How Does Moneylion Work?

You can easily create a Moneylion account and access its services. To apply for its loan, all you need to do is to provide your residential address, social security number, phone number, full name, and bank account.

Once they approve you, it’ll advance a portion of your loan into your bank account and the remaining money is deposited into a Credit Reserve Account to build your savings.

Each Credit Builder Plus loan has a 12-month term and the payments are deducted from your bank account each month on your pay date.

Your repayment can be higher based on the amount you borrow and the APR you’re provided. Moreover, you can also pay early and even have the ability to change your payment due date and reschedule it.

Eligibility Criteria:

- Must be at least 18 years old

- Should be a permanent resident or citizen of the United States

- Have valid Social Security Number

- Have a bank account, prepaid card, or debit card

Cash Advance: You can access up to $250 with Moneylion. And depending on the amount you borrow, credit history, finances, and the APR you’re provided, your payment can be higher.

Repaying Advance: The payments are deducted from your bank account each month on your pay date.

Fees: It doesn’t charge any interest or monthly fee; you can create a MoneyLion account for completely free. However, to get a Credit Builder Plus loan, you’ll have to pay a monthly fee of $19.99.

Customer Service: If you need any help with MoneyLion, you can contact their customer support by calling them at 888-659-8244 or +1 (888) 704-6970 or visit here.

16 Best Apps Like MoneyLion to Manage Your Money [2022]

Chime

Last in our list of the best apps like Even, we have Chime. Chime is an American fintech service that offers fee-free mobile banking services.

You get Visa debit cards and have access to an online banking system, which you can access through the Chime mobile application or through its website.

Since it doesn’t charge any overdraft fees or monthly fees, it earns the majority of its income from the collection of interchange fees.

If you open a Chime account, you will automatically get a spending and personal savings account. And if you have a balance on your savings account, it will automatically put interest on it at 0.5% APY.

Features:

- No monthly maintenance fees, minimum balance fees, or foreign transaction fees.

- No interest, no annual fees, no credit check.

- Enable instant transaction alerts and daily balance updates, and block your card with a single tap.

- Stay in control of your money with two-factor authentication, Touch ID, or Face ID.

- Automatic Savings features help you save money any time you spend or get paid.

- Send money to friends, family, or roommates as fast as a text.

How Does Chime Work?

Chime offers a direct deposit program, which gives the ability to combine direct deposit with the app and makes them available up to two days early.

Once you create a direct deposit into your spending account, you’ll be eligible and can choose to get your payment up to two days early.

You can be able to enroll in Chime’s SpotMe service if you get a direct deposit of at least $200 each month.

Through the SpotMe service, you can overdraw your account by up to $20 on debit card purchases without any fee.

Your SpotMe allowance can be improved up to $200 or more based on your account history, direct deposit amounts & frequency, spending habits, and other factors

Eligibility Criteria:

- Must be at least 18 years old

- Should be a citizen of the US

- Your first and last name

- Social security number (SSN)

- Email and a password

Cash Advance: The cash advance limit through Chime is up to $200.

Repaying Advance: It’ll automatically withdraw your loan amount on your payday.

Fees: It doesn’t charge any monthly fee, overdraft fee, or service fees. And Chime’s spending account is completely free. However, it charges a fee of $2.50 for every transaction at an out-of-network ATM.

Customer Service: If you need any help with Chime, you can contact their customer support by sending an email at support@chime.com or calling them at 1-844-244-6363.

Must Try these 7 Apps like Chime for Mobile Banking!

Final Words: Apps Like Even!

So, these are the best apps like Even that you might want to try. You can try these services and figure out which one offers the best features or the one that meets your requirements.

Don’t overlook the app’s overdraft fee or other fees. Thus, choose the app that has no overdraft fees, offers free or inexpensive transfers, cash back, or other rewards, and the one with free ATM withdrawals.

Finally, we hope you have selected the perfect Even alternative based on your preferences.

![6 Similar Apps Like Even to Check Out! [2024]](https://viraltalky.com/wp-content/uploads/2022/01/Apps-Like-Even-alternatives.jpg)