Best Apps Like Klover – Are you finding the fastest way to get money? Wondering which platform will offer you the best features? In this article, We have mentioned a few best alternatives to Klover, so you can decide which one is right for cash advance and managing your money.

Klover is a service that gives you access to your wages early. It also provides various innovative tools to help you stay financially stable and protect you from expensive loans. Even though it offers incredible features, this might not be right for you. You can check Klover article in the below guide.

Apps Like Klover: Best Alternatives!

Payday loans offer you to get access to quick cash. Check out the guide below on the finest alternatives to Klover that will help you get access to cash loans.

Dave

Dave is first Cash advance app in our list of similar apps like Klover that puts your financial mind at rest.

It is aligned with LevelCredit to let you report rent payments to major credit bureaus and give you a credit building chance. With Dave’s automatic budgeting feature, you can always know how much you can spend while still covering all your bills.

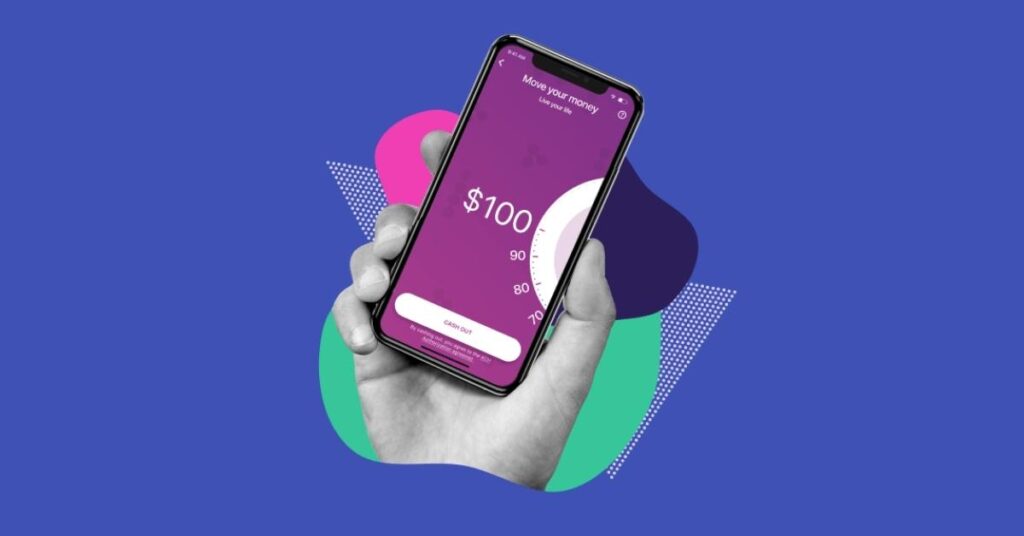

Cash advances

The payday advance that you can receive through Dave is $100. Once you’re approved for the cash advance, you will have the ability to choose from the standard or express funding options.

The standard funding option is entirely free; however, it might take up to three business days to get the money you requested. The express funding option permits you to receive your money on the same day by paying a small fee.

Repaying Advance

Once you’ve received a cash advance, you’ll not get more money until you repay it entirely. It doesn’t review your credit history or report your payments to credit bureaus.

How does Dave work?

In order to use Dave, you should have a regular paycheck and a checking account, and you should be able to show that your bills don’t consume your paycheck.

Now, download the Dave app, create an account, and provide your basic information like mobile number, email address, low balance alert amount, and bank information.

Once you’ve created your Dave account, it’ll examine your income and spending habits, as well as the regular balance of your bank account and use predictive analysis to know how much money is coming and going out of your account.

Pricing

Although it doesn’t charge any interest, it might ask for optional “tips.” These tips represent a large percentage of the app’s income.

It only charges a monthly membership fee of $1, which will be deducted directly from your linked bank account every month.

Customer Support

If you need any help with Dave, you can call them at 1-844-857-3283 between 4 AM to 10 PM from Monday to Friday and between 5 AM to 5 PM on Saturday and Sunday or visit https://support.dave.com.

You can also try contacting Dave by emailing their support team to support@dave.com.

| Pros | Cons |

| Access to cash advance at no extra cost | Low maximum advance limit |

| Doesn’t charge any interest | Charges a membership fee |

| In-built budgeting tools | |

| Check payments possible without overdraft | |

| Automated system for preventing account overdrafts |

SpotMe by Chime

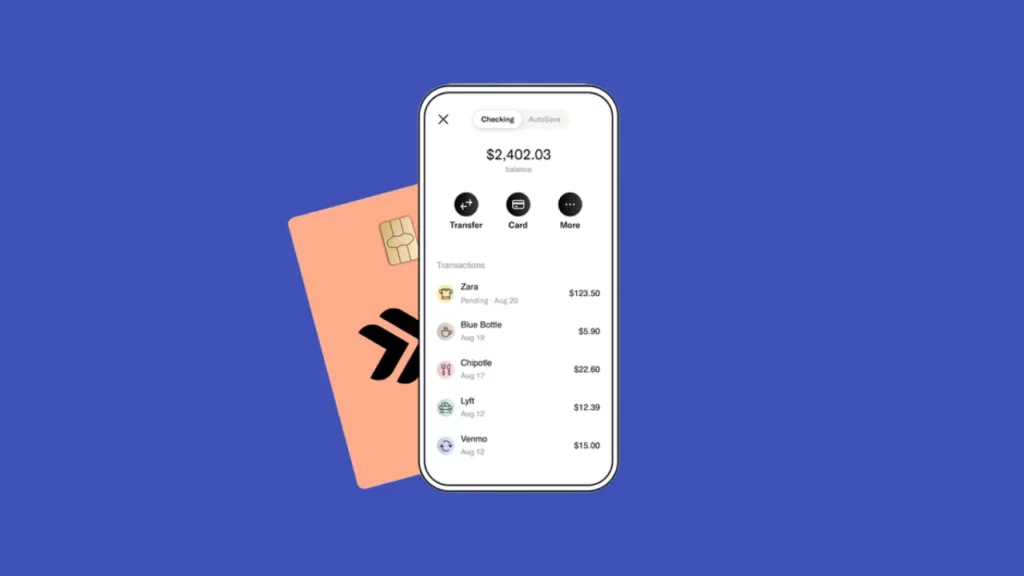

Chime is an American financial company that offers free mobile banking services. Chime account holders are issued Visa debit cards and can have access to an online banking system which you can access via chime.com or through the mobile app for iOS and Android. It earns the majority of its returns from the collection of transactions.

Cash advances

Chime’s cash advances start with only $20 and maximum up to $200. You’ll have the ability to withdraw your advances two days prior to your normal payday. As soon as your employee deposit your paycheck, it’ll deposit it into your account.

Repaying Advance

On your payday, it’ll automatically withdraw your loan amount.

How does it work?

As soon as you create a direct deposit into your spending account, you’ll be eligible and can choose to get your payment up to two days early.

You can be able to enroll in Chime’s SpotMe service if you get a direct deposit of at least $200 each month. This lets you overdraw your account by up to $20 on debit card purchases without any fee.

Depending on your account history, direct deposit amounts & frequency, spending habits, and other factors, it can improve your SpotMe allowance to up to $200 or more. With its ‘Credit Builder Card’, you can improve your credit score.

Pricing

Chime’s spending account is entirely free, and it charges a fee of $2.50 for every transaction at an out-of-network ATM. Also, it might charge a fee when you deposit cash at Green Dot Location.

Fortunately, it doesn’t charge any monthly fee, overdraft fee or service fees and doesn’t need any minimum balance to get started.

Customer Support

If you need any help with Chime, you can contact their customer support by emailing support@chime.com or calling them at 1-844-244-6363.

| Pros | Cons |

| No monthly fees or overdraft fees | Only accessible to US residents |

| No minimum balance is needed | There is no ability of joint account |

| Get paid early through direct deposit | |

| Automatic savings by using spending round-ups |

Must Try these 7 Apps like Chime for Mobile Banking!

Earnin

Earnin is another Klover alternative that provide you access to the pay you’ve earned. Unlike any other payday service that charges fees every time you use one, with Earnin, you can make any transaction without being charged.

It is available for both iOS and Android devices. The main thing is that you can only use Earnin if you’re a salaried or an on-demand employee.

Cash advances

You can receive up to $100 through Earnin. Based on other factors like if you continue to use the app and pay all your advances successfully, you might even be accessible for an advance up to $500.

Once you’ve borrowed the maximum eligible amount, you will not be accessible to get more money until your next pay cycle starts.

Repaying Advance

The repayment time on Earnin entirely depends on the sum of money you receive during every pay period.

It’ll automatically deduct the amount you’ve borrowed from your checking account on your next payday.

When you click on “Max Info” on your home screen, you can be able to check your current daily and pay period Max amounts and know more about the factors that are utilized to examine them.

How does it work?

You should have a stable payday, a mobile phone, and an active checking account to use Earnin. You’ll also have to provide your personal information like email address, paycheck information, and employer information.

Then, link your bank account and provide your employment information to assist them in authorizing your pay schedule.

Once it is done, add your salary by sending them your electronic timesheet or just link your earnings automatically through its “Automagic Earnings” feature.

With its “Balance Shield” feature, it’ll help you to prevent overdraft fees. You’ll have to remember that the remote workers, freelancers and those with different jobs are not eligible for the payday advances in Earnin.

As it needs your banking and other personal information, Earnin uses bank-grade security like 256-bit encryption to protect your information.

Pricing

Even though it doesn’t charge any interest hidden or monthly fees, it might ask for optional “tips” during the checkout.

Customer Support

If you need any help with Earnin, you can contact their customer support by emailing them at support@earnin.com.

| Pros | Cons |

| It doesn’t charge any interest or late fee | Low maximum advance limit |

| Overdraft protection | Maximum loan amount depends on your financial condition |

| No credit check is needed | |

| Additional tools and resources | |

| Tips are completely optional |

Empower

Cash advances with Empower are interest-free, and it doesn’t perform any credit check. When you tell them your weekly savings target, it will examine your income and expenses daily to figure out when and how much you can afford to save.

Then, it’ll automatically move that money from your spending account to your Empower AutoSave Account. It works as a financial aggregator, which allows you to link all your financial accounts on your smartphone.

Cash advances

Empower can advance you up to $250 with zero interest, and it doesn’t charge any late fees or perform a credit check.

You should have a minimum $500 average monthly income and three recurring deposits of $200 in order to access payday advance through Empower.

Repaying Advance

Once you’re approved and got your cash advance, you can pay back it on your next paycheck.

How does it work?

To create an account, you must have a bank account at a U.S. financial institution, Social Security Number, and a valid U.S. residential address.

Then, link your active spending accounts, and the app will show you various pre-loaded financial institutions for you to choose from.

You can be able to set weekly savings goals, and they’ll be able to determine when you have extra cash and when you’re running low.

Use the budgeting feature to personalize your budget categories and track your spending every time.

Pricing

There are no hidden fees, no overdraft fees, no maintenance fees and no insufficient fund fees with the Empower Card account. It charges a monthly membership fee that costs $8 a month, which gives you access to all the features like banking and budgeting tools.

You’ll also have the ability to try its 14-day free trial period, and when your trial period is over, you’ll be charged $8 every month. It also sets a 1% foreign exchange fee of the total transaction amount.

Customer Support

If you need any help with Empower, you can connect with their customer support by sending an email to help@empower.me or call them at (888) 943-8967 between 9 am to 6 pm, Monday to Friday.

You can also chat with their team through the app between 9 am to 6 pm, Monday to Friday.

| Pros | Cons |

| Overdraft alerts and automatic savings | Users must have to pay a membership fee |

| No interest or tips | No due date extensions |

| No credit check |

Brigit

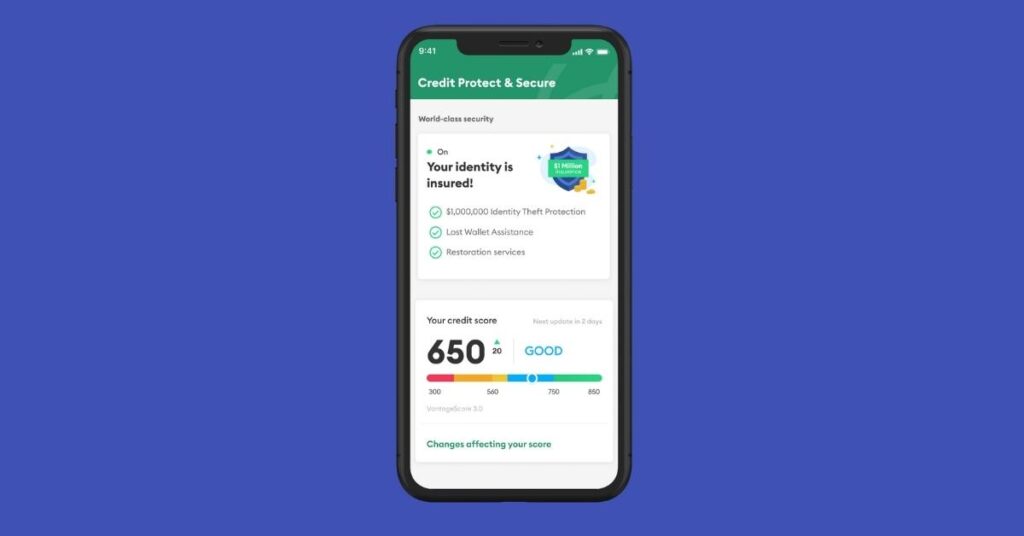

Brigit is one of the payday loan app, which is essentially known for its payday advanced. Nevertheless, it is more than just a paycheck advance app, and it also offers many other features like overdraft fees, budgeting protection, and more.

It analyzes your activity across spending, bank account, and earnings to give you a Brigit score, which will determine whether you are eligible for immediate loans.

Cash advances

Through Brigit, you can have access up to $250 as long as your credit card balance hits zero. It doesn’t charge any overdraft fees, and you are completely free to choose the free or paid version of the app.

Repaying Advance

When you request your advances, the repayment date will be given to you, which can be accessible at any time in the app.

On your repayment date, it’ll automatically withdraw the advance. You can select the “repay now” button if you wish to repay the Brigit advance prior to your due date.

How does it work?

To have an account in Brigit, you must be older than 18 years and should have some identification. Your average paycheck must be over $400 and should have three or more recurring deposits from your company.

By automatically analyzing your checking account, it helps you to avoid overdraft fees. If it predicts you’ll run out of money, it’ll be advancing you the cash to prevent you from going to overdraft your account.

Pricing

Unlike other payday loan apps like Dave and Earnin, it’ll not prompt you to “tip,” and it doesn’t charge any interest on payday advances.

Brigit offers both free and paid membership. Its paid membership – Brigit Plus, costs $9.99 per month, and its free version has very limited features when compared to the paid plan.

Customer Support

If you need any help with Brigit, you can chat with the Brigit support expert between 9 am to 6 pm by submitting a request or simply sending an email to info@hellobrigit.com.

It usually takes two business days to respond to your email or request, and they currently don’t support phone calls.

You can also visit https://help.hellobrigit.com and explain your problem by providing your email address, phone number, bank name, and other required information.

| Pros | Cons |

| If Brigit thinks you might overdraw your account, it provides auto advances | Charges a membership fee for early payment |

| Offers budget tracking tools | Not available for joint checking accounts |

| It’ll alert you if it finds there is a risk of being over-drafted | |

| It offers to extend the due date up to three times |

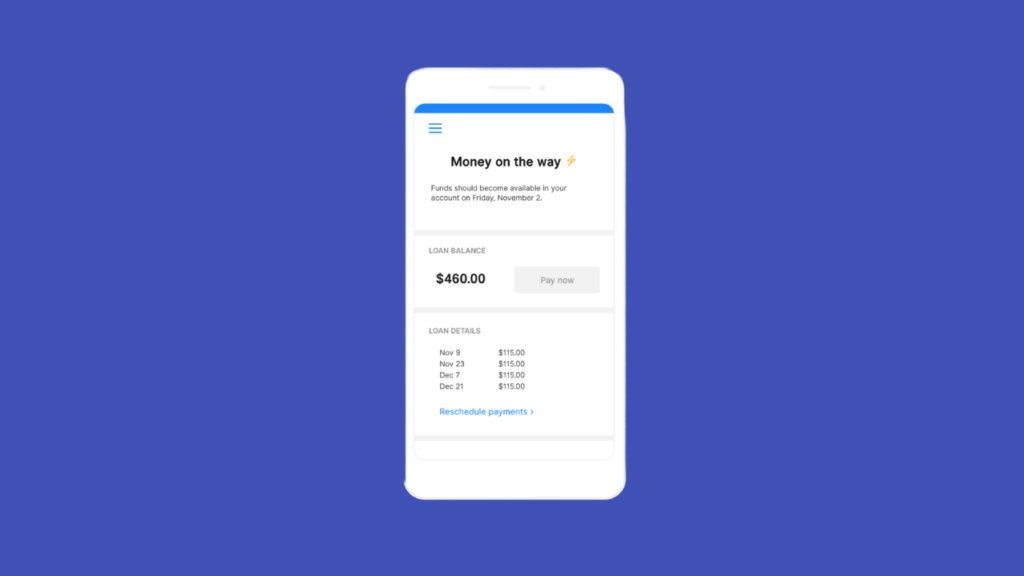

Possible Finance

Possible Finance is a payday loans service that offer small personal loans. Possible Finance states itself as an alternative to usual short-term loans, which are pretty costly and are supposed to be repaid entirely on your next payday.

As it doesn’t perform any credit check, those with bad credits or no credit history can borrow. However, many people will not be able to access Possible Finance loans since it is only available in a limited number of states.

Unlike other payday loans, Possible Finance reports loan payments to the three major credit bureaus – Experian, Equifax, and TransUnion. Thus, it would be better to make on-time payments which can help you to build your credit.

If you have a Visa debit card, there is a possibility that you can get your loan funds on the same day you’re approved.

Cash advances

People with no credit history or bad credit can get up to $500, but the loans are available only in seven states. It won’t check your FICO score; you can just apply and get approved within minutes.

Repaying Advance

You can be able to repay your loan in two-week intervals for eight weeks or two months instead of asking for the full repayment on your next pay date.

You’ll have the ability to change your repayment date up to 29 days past your due date with no extra fees or interest charges. It doesn’t affect your credit scores.

Remember that you can pay off your loan before the due date without any prepayment penalty.

Also, you don’t have to worry about missing your due date, as it’ll send you a push notification or a text from the app before your payment is due.

How does it work?

Firstly, you have to download the Possible Finance app on your device and create an account. Once you have created a Possible Finance account, you’ll have to meet some requirements in order to access the loan.

You should have an online checking account with a minimum monthly income of $750, a Social Security Number, a valid Driver’s license or State-issued ID, and your bank account information to know whether your checking account is compatible or not.

Keep in mind that before applying for a Possible Finance loan, you may have to check if it works with your current bank or your credit union because it doesn’t work with all banks.

Within 24 hours, you’ll get a notification regarding the status of your application from the Possible Finance app. If you are approved, you’ll have up to three days to accept your loan otherwise, you’ll have to re-apply after three days.

Pricing

Based on the state you live in, Possible Finance might charge a fee or a monthly fee along with some interest. Although its APRs may be lower than another payday loan, keep in mind that its interest rates are still high.

Customer Support

If you need any help with Possible Finance, you can email their customer support at help@possiblefinance.com or call them at +1 (206) 202-5115. You can also visit its support page – https://support.possiblefinance.com for more information.

Must Try these 12 Apps like Possible Finance for Instant Loans! [2021]

| Pros | Cons |

| Can help you build credit as it reports your repayments to all major credit bureaus. | Not available in most states |

| You can be able to delay your payment | Short repayment terms |

| Offers loans for people with low or poor credit | High interest rates |

| Repayments are aligned with your payday | Not available in most states |

PayPal Working Capital

PayPal Working Capital provides you with a faster and safer way to send money, receive money, make an online payment, or set up a merchant account.

It also serves as an electronic alternative to traditional paper methods like money orders and checks. Furthermore, it operates as a payment processor for auction sites, online vendors, and many other commercial users for which it charges a fee.

Cash advances

Your maximum cash advance amount is based on your PayPal sales, account history, and any prior usage of PayPal Working Capital.

Repaying Advance

When you have sales, repayments are automatically deducted from your PayPal account based on the repayment percentage you choose.

When you don’t have sales, you won’t make any repayments. Nevertheless, regardless of your sales, you’ll have to meet a minimum level of repayments for every 90 days.

You’ll be informed about your specific amount in your terms during the application process. You can also be able to make additional payments to repay your cash advance sooner.

How does it work?

To use PayPal, you just have to provide your basic information regarding yourself and your business and then choose the amount that you want to receive.

The maximum amount you receive will ultimately depend on your PayPal sales and account usage. Noe, you can select the percentage of your PayPal sales, which will go towards your loan repayment.

Once you are approved, funds are directly transferred to your PayPal account. Applying for a PayPal cash advance will have no impact on your business or personal credit score, and once you are approved, you’ll get your funds within minutes.

Pricing

It doesn’t charge any interest, fees, or early repayment penalty. Your fees will be determined by the repayment percentage you choose, your business’s PayPal sales, account history, and the amount of your cash advance.

Customer Support

If you need any help with PayPal, you can contact their customer service by calling them at 0800 368 7176 between 8:30 Am to 4:30 Pm from Monday to Friday.

| Pros | Cons |

| Easy to use and setup | Can be difficult to contact their customer service |

| Payments are more secure and easily accessible | It charges you to receive money |

| Can create invoices directly through your account | |

| Easily integrates with the website |

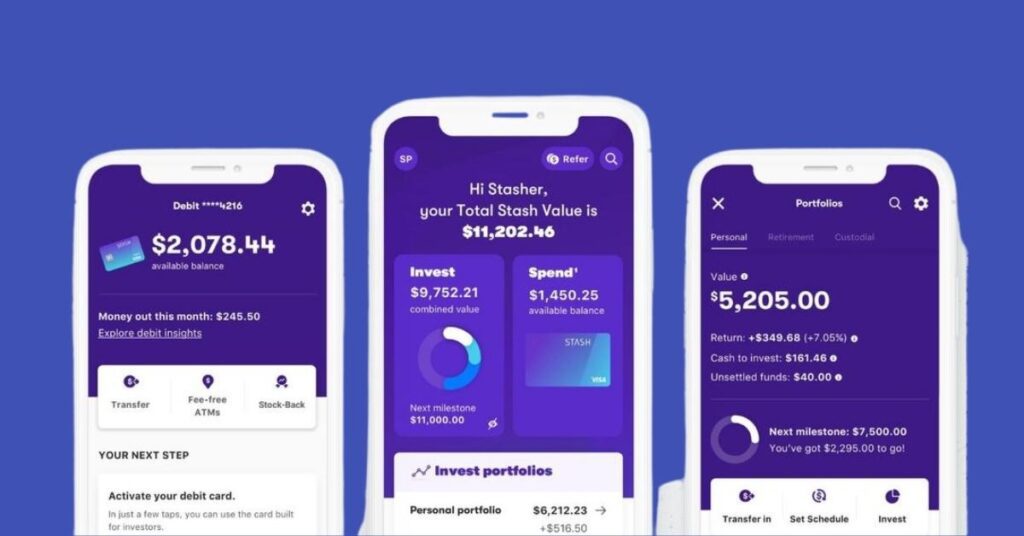

Stash

Stash simplifies investing (especially stocks and exchange-traded funds) by making it easy and affordable for everyday American’s who wish to build heath.

It offers several features such as loans, investing, banking, stock-back card, saving tools, smart portfolio, investing for children, and much more. It operates both on web platforms and as a mobile app for iOS and Android users.

Cash advances

It offers short-term loans of up to $1,250, which are tailored to fulfill your requirements and the capability to repay.

Repaying Advance

Once you are approved for the loan, you’ll get your money deposited directly into your checking account. These loans should be paid off in full within 180 days, and you can also be able to pay off your loan without any prepayment penalties.

How does it work?

Stash provides its users a wide range of various ways to make money, this includes a taxable account, payday loan, and more. To get started with the Stash account, you’ll have to have a bank account with a U.S. bank, Social Security Number, and you should be a U.S. citizen.

Once you have created the Stash account and applied for the loan, it’ll usually take as little as 60 seconds for your loan to get approved. It gives you access to your money up to two days earlier than normal.

You can be able to apply for the payday loan online, and they’ll deposit the money directly into your bank account on the next business day. For the people who don’t have a direct deposit account, they can offer the loan as a check.

Pricing

Stash’s monthly subscription starts at $1 for a brokerage account along with access to its online account and debit card. It also offers other account options.

For $3 every month, you can get the brokerage and bank account along with access to a retirement account.

For $9 every month, it offers all the features listed above along with the access to two custodial accounts for those who are below 18 years and also provides extra bonuses through the rewards program and a monthly investment research report.

Customer Support

If you need any help with Stash, you can try contacting their customer support at (800) 205-5164 or visit https://ask.stash.com.

| Pros | Cons |

| Automatic savings and investing tools | Charges monthly fees |

| No trade fees or commissions | High ETF expense ratios |

| Several educational content and support | |

| Makes investing easy to understand | |

| It uses 256-bit bank-grade encryption |

Must-Try these 5 Apps Like Stash for Micro-Investing [2022]

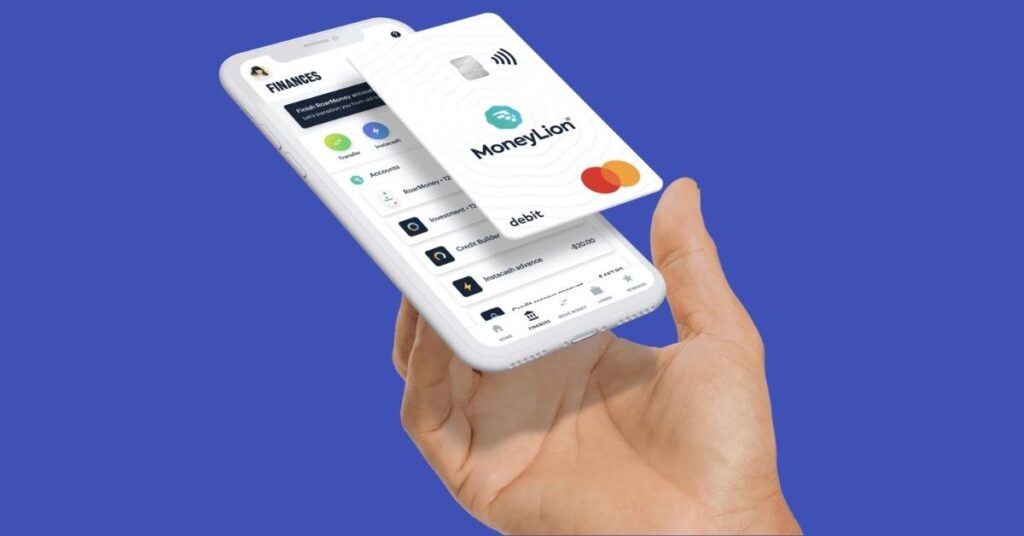

MoneyLion

MoneyLion offers financial advisory, lending, and investment service to users. Its machine learning technology provides personalized advice to users based on their spending habits.

Likewise, it also offers access to small loans to help users handle their monthly income and expenses.

As a part of its Credit Builder Plus membership, it offers credit-builder loans up to $1,000. Although these loans are of low-interest rate, you’ll have to pay a membership fee.

Cash advances

It offers loans up to $1,000. The APR ranges from 5.99% to 29.99 and comprises your MoneyLion Plus membership fee.

Based on the amount you borrow and the APR you’re provided, remember that your payment can be higher.

You can also predict the possible cost of your loan and your monthly repayment by using the ‘Monthly Repayment Calculator.’

Repaying Advance

Every Credit Builder Plus loan has a 12-month term and the payments are deducted from your bank account each month on your pay date.

You can have access to any funds in your “Credit Reserve Account”, if you wish to repay your loan sooner. You’ll also have the ability to change your payment due date and reschedule it by contacting MoneyLion.

How does MoneyLion work?

You must have a MoneyLion account to get a payday advance through MoneyLion. To create a MoneyLion account, you must be 18 years old and have a bank account. After you’re done creating an account, you can log in and access its services.

You can choose to add free services like Instacash advances or paid services like Credit Builder Plus. If you want a credit builder loan, you can apply for a Credit Builder Plus membership.

Once you are approved, it’ll advance a portion of your loan into your bank account, and the remaining money is deposited into a Credit Reserve Account to build your savings.

Pricing

MoneyLion’s Credit Builder Plus charges $19.99 per month. The amount you can borrow and your APR is based on your previous loans, credit history, and finances.

Customer Support

If you need any help with MoneyLion, you can contact their customer support by calling them at 888-659-8244 or +1 (888) 704-6970 or visit https://moneylion.zendesk.com.

16 Best Apps Like MoneyLion to Manage Your Money [2021]

| Pros | Cons |

| It doesn’t charge a monthly fee | It doesn’t have any physical locations |

| Integrated digital personal finance | Only provides low advance amounts |

| Personalized investment portfolios | |

| No hard credit inquiry required |

16 Best Apps Like MoneyLion to Manage Your Money [2021]

Coming Soon

Cash App

Cash App is a mobile payment application that permits users to transfer money to one another using a mobile phone app. The service is available in the U.K., and the U.S. Users can select the money with its debit Visa card known as Cash Card, in ATMs or transfer it to any local bank account.

It was formerly known as Squash Cash which was introduced for businesses, this includes the capability for organizations, businesses, individuals to use a unique username.

Customer Support

If you need any help with Cash App by contacting them to 1-800969-1940 or visit their support page https://cash.app/support.

| Pros | Cons |

| Doesn’t charge any fee to send and receive money | Cannot be used globally and you’ll have to pay a 3% fee if you use a credit card |

| You can buy and sell Bitcoin | Doesn’t have FDIC coverage |

| Invest in stocks with no commission fees | |

| Simplifies reimbursements |

Robinhood

Robinhood is one of the best Klover alternatives. It is an American financial service that is widely known for offering commission-free trades of exchange-traded funds and stocks through a mobile application.

Likewise, it is a FINRA regulated broker-dealer which is registered with the U.S. Securities and Exchange Commission and is a participant of the Security investor Protection Corporation.

Customer Support

If you need any help with Robinhood, you can visit https://robinhood.com/contact or https://robinhood.com/support.

Currently, Cash App and Robinhood are working on their cash advances service. So, you might have to wait for a while till they officially release this feature!

| Pros | Cons |

| No account minimum is required | Can be difficult to contact their customer service |

| Charges 0% fees for trades | No retirement accounts, mutual funds or bonds |

| Easy to use and simple user interface | |

| Can buy and sell cryptocurrency |

Final Words:

What did you choose? As long as you have a stable paycheck, you can be able to access these apps. I hope the above article on 10 best apps like Klover has helped you choose the best quick cash app that suits your needs and requirements.

![10 Cash Advance Apps Like Klover to Check out [2024]](https://viraltalky.com/wp-content/uploads/2021/07/Apps-Like-Klover-alternatives-9.jpg)