Apps Like Credit Genie: Credit Genie is a personal finance app that assists you get a cash advance with no credit check, mandatory repayment time, no interest, or any other fee.

However, many people have issues with the credit genie app, such as their bank account getting disconnected, poor customer service, not getting advance, and more. Thus, they are looking for alternatives.

If you are also someone who is having issues with the Credit Genie app, look no more. In this article, we’ve mentioned a curated list of the apps like Credit Genie that offers cash advance and several other features.

List of Apps Like Credit Genie

Below is a curated list of the best apps like Credit Genie that you can use for cash advances and overdraft protection.

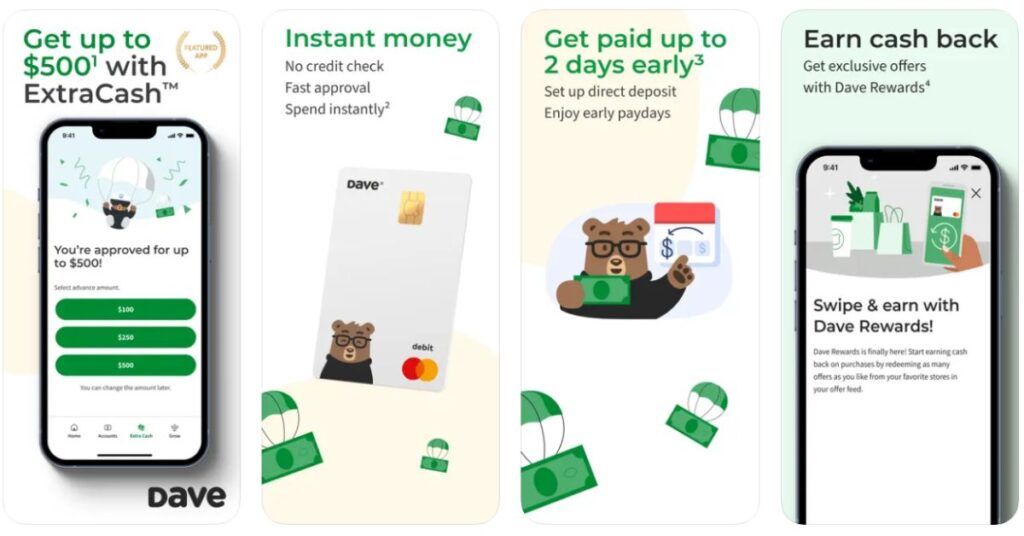

1. Dave

Dave is one of the finest mobile banking apps like Credit Genie that assist users avoid overdraft fees and enhance their financial well-being.

Your cash advance option is determined by examining various data points, including three recurring deposits, a total deposit of $1,000 per month, income history, and sending patterns, and your bank account should have a minimum 60-day history and a positive balance.

So, based on these factors, the ExtraCash amount you are eligible for updates each day, and the limit may vary. However, remember that you won’t be able to take an advance if you have any outstanding balances.

| Advance Amount | Up to $500 |

| Fees | · Subscription Fee: It costs $1 per month to access account monitoring, budgeting, notification services, and other services.· Express Fees: $1.99-$9.99 for Dave Spending transfers and $2.99-$13.99 for external transfers. |

| Repayment | Automatically deducted on your next payday from your bank account |

| Time to Fund Without Fast-funding Fee | 1-3 business days |

| Time to Fund With Fast-funding Fee | Under an hour |

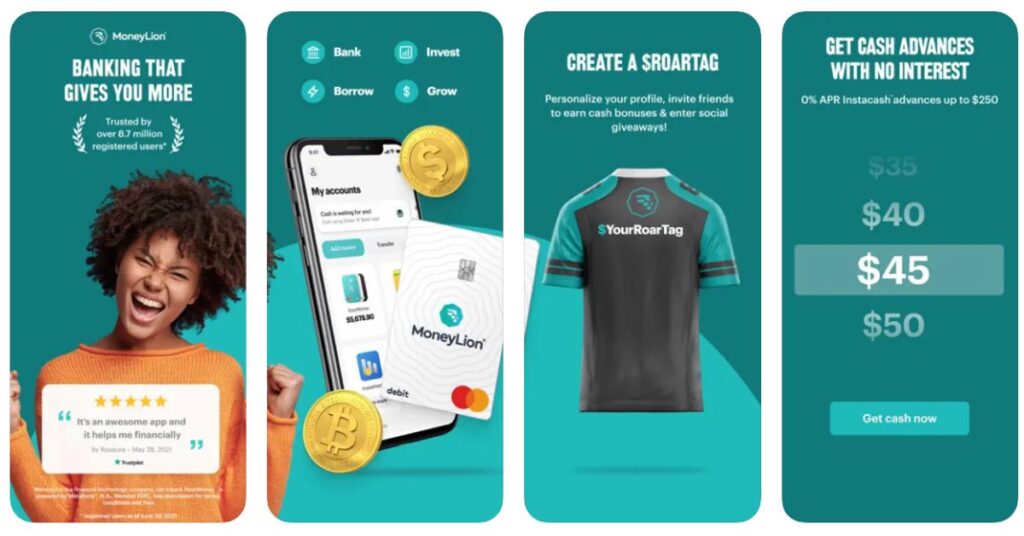

2. Moneylion

MoneyLion is another finance app that offers mobile banking and personal finance resources. With MoneyLion, you can get cash advances, access online banking, compare personal loan offers, and auto-invest to reach your goals.

All you need is to have a consistent income and link a checking account that has been open for at least two months. So, take control of your wallet with this smart money app and manage money with this all-in-one finance app.

| Advance Amount | · Up to $500· You can increase the limit up to $1,000 with a qualifying recurring direct deposit into a RoarMoney account. |

| Fees | $0.49-$8.99 for $5-$100 advance |

| Repayment | The money is automatically deducted from your account on the due date determined by your recurring direct deposit cycle. |

| Time to Fund Without Fast-funding Fee | 12-24 hours for checking accounts and 2-5 business days for those without a MoneyLion checking account. |

| Time to Fund With Fast-funding Fee | Within a few minutes |

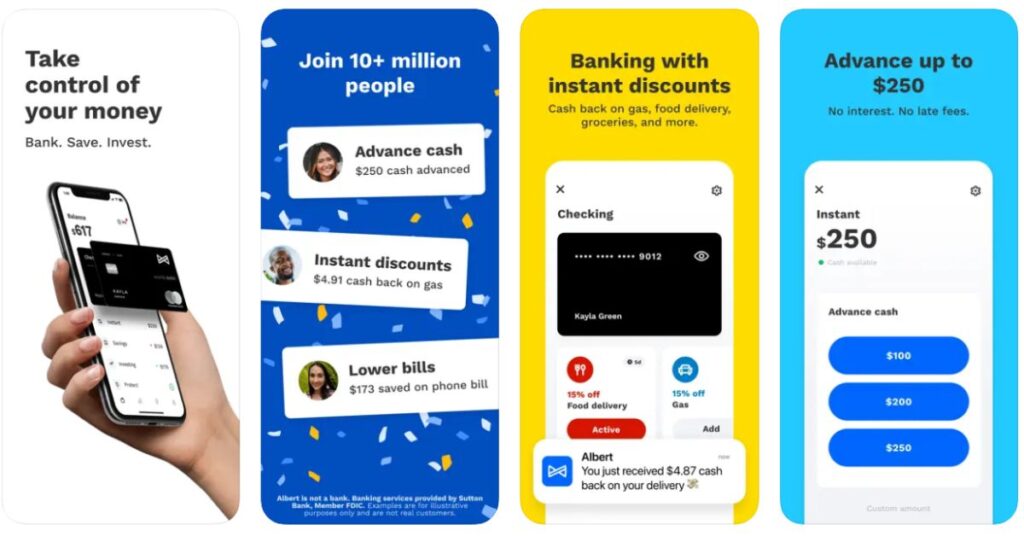

3. Albert

With the Albert banking app, you can bank, save, invest, and budget. Get paid up to two days earlier and earn cash back with your debit card, invest automatically, and protect your money.

As long as you have a paycheck and have repaid your previous advances, you can request up to three cash advances per pay period.

Furthermore, it offers several features, including budgeting, smart alters, savings, investment advice, and many more. Budgeting can examine your income, expenses, and spending habits to create a personalized budget.

| Advance Amount | Up to $250 |

| Fees | · Subscription fee: $9.99· $3.99 to your Albert debit card without direct deposit· $6.99 per advance to a non-Albert debit card |

| Repayment | No mandatory minimum or maximum repayment time. You can pay when you get paid or when you can afford it. |

| Time to Fund Without Fast-funding Fee | 2-3 business days |

| Time to Fund With Fast-funding Fee | Within a few minutes |

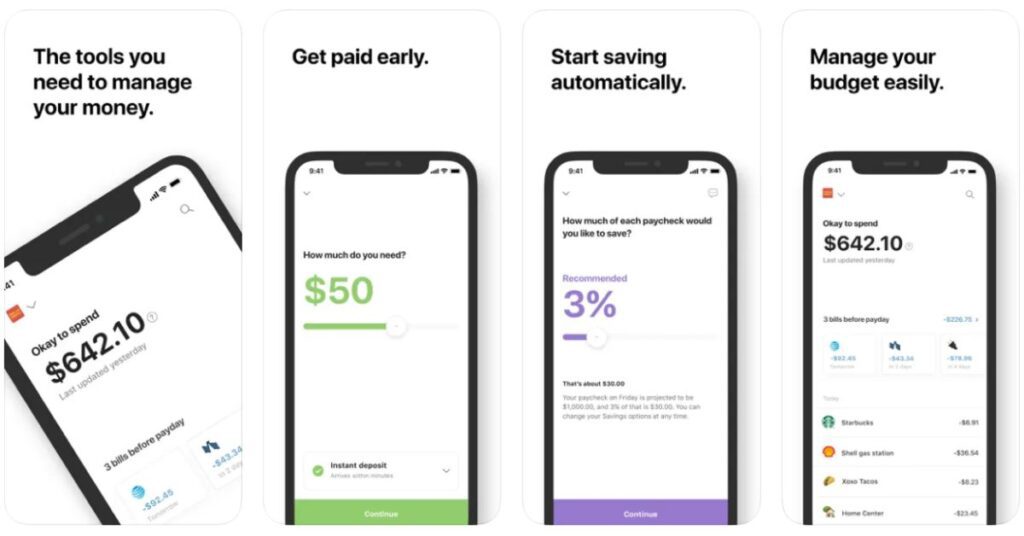

4. Cleo

Cleo is a budgeting and cash-advancing app that provides up to $250 cash advance in low-balance moments and also helps you budget, save, and build credit.

Your eligibility for a cash advance is based on various factors like connecting the bank account you’re paid into and paying your Plus subscription on time.

Though you can request many cash advances, you’ll need to repay the previous one first. And there is also a cool-off period that lasts a full 24 hours from when you last repaid your advance.

| Advance Amount | Up to $250 |

| Fees | · Subscription Fee: Cleo Plus costs $5.99 a month or $72 annually.· Fast-Funding Fee: $3.99 |

| Repayment | Repayment is on the date that is agreed upon at the time of requesting the cash advance, which is typically up to 14 days from the date of request. |

| Time to Fund Without Fast-funding Fee | 1-3 business days |

| Time to Fund With Fast-funding Fee | On the same day |

5. Empower

Empower is a finance app that is developed to help you manage your personal finances more effectively. It offers a wide range of features and tools to help you in saving, tracking your expenses, budgeting, and investing.

You can easily register an account, access insightful resources, manage your money to build your financial confidence and many more.

Your eligibility for a cash advance is based on the review of the transaction history in your primary checking account. And once your repayment is done, it’ll take up to 3 business days to see when your next cash advance is available.

| Advance Amount | Up to $250 |

| Fees | · Subscription Fee: $8 per month with a 14-day free trial.· Fast-Funding Fee: $1-$8 |

| Repayment | Automatically deducted from your bank account on your predetermined due date. |

| Time to Fund Without Fast-funding Fee | 1 business day |

| Time to Fund With Fast-funding Fee | Within a few minutes to two hours |

6. Even

With Even, get paid early and save automatically. It is partnered with various leading employers to offer tools that you require to manage your money.

It also helps you manage your budget by detecting your monthly expenses and giving you daily, personalized information on what is fine to spend.

Furthermore, the number of times you can use Instapay is based on your employer. And its use is limited to ensure your paycheck is big enough to support larger expenses.

| Advance Amount | · You can request up to 50% of your next paycheck. |

| Fees | The only fee it charges is a subscription fee for Even Plus which costs $8 a month |

| Repayment | Your employer will process the repayment as a deduction on your paycheck. |

| Time to Fund Without Fast-funding Fee | One business day or you can pick up your Instapay at a Walmart MoneyCenter |

| Time to Fund With Fast-funding Fee | There is no Express fee option |

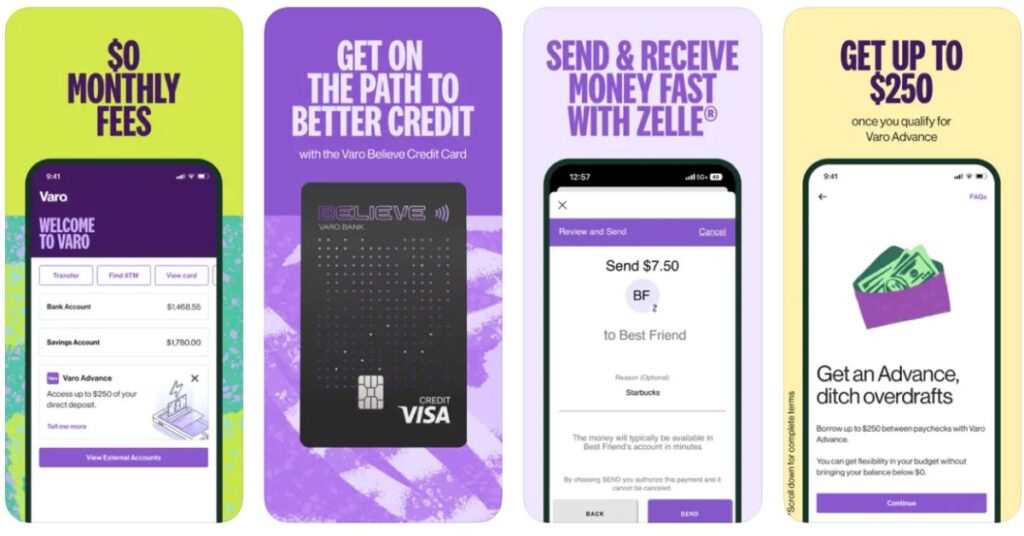

7. Varo

When you are running low on cash or need a little extra money when bills are due, get financial assistance from Varo’s cash advance.

In order to get a quick cash advance, all you need to do is select an amount of cash within your current advance limit and get money within minutes directly to your Varo bank account.

Your cash advance limit can vary depending on your Advance repayment history, your account activity, account balances, and many other factors.

| Advance Amount | Up to $250 |

| Fees | There is no fee up to $20, but advances over $20 have a fee between $4 to $15, based on the Advance amount. |

| Repayment | You can repay your cash advance on your next payday or any day you choose between 15-30 days from your cash advance |

| Time to Fund Without Fast-funding Fee | Instantly |

| Time to Fund With Fast-funding Fee | There is no fee for instant access |

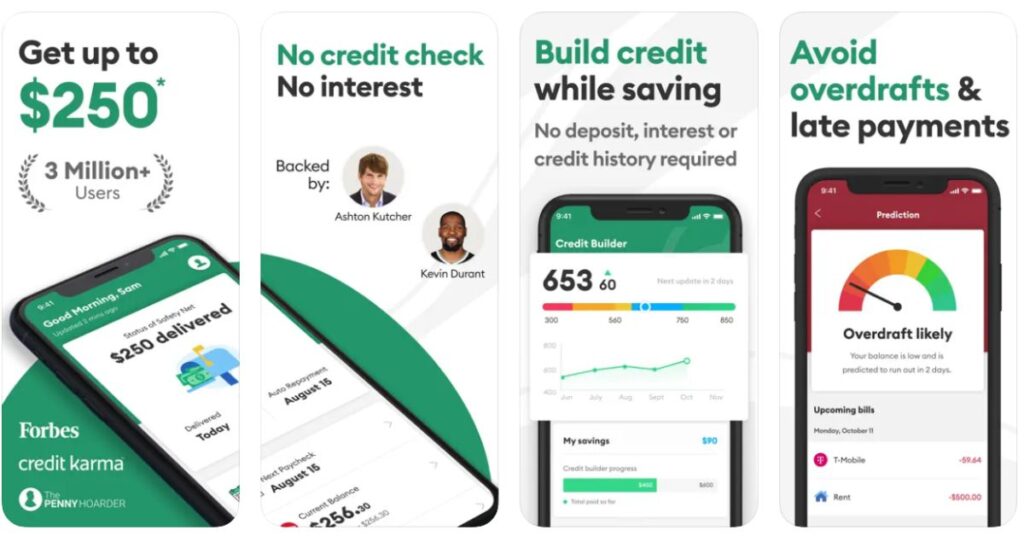

8. Brigit

Brigit is another finest financial health and budgeting apps like Credit Genie that helps you get your finances on track with budgeting tips, instant cash advances, gig work, and more.

All you need to do is download the Brigit app, connect your primary bank account that has three recurring deposits from the same source and is active for at least 60 days, and then request an advance and set a repayment date.

Furthermore, it lets you build credit, save money, monitor your finances, and track your budget, all from the app directly.

| Advance Amount | Up to $250 |

| Fees | · Subscription Fee: Brigit Plus costs $9.99 a month· Fast-Funding Fee: $0.99 |

| Repayment | Directly deducted from your bank account on the date Brigit analyzes to be your next payday. |

| Time to Fund Without Fast-funding Fee | 2-3 business days |

| Time to Fund With Fast-funding Fee | Instantly |

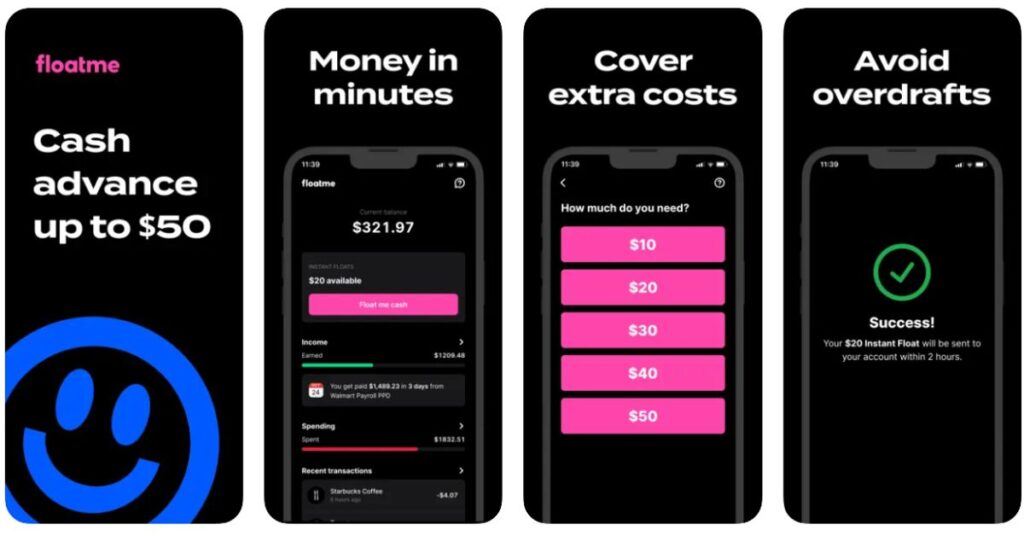

9. Float Me

Float Me is a cash-advancing app that offers innovative tools to help you get ahead of your finances and make better decisions. And once you are a FloatMe member, you can use its personal articles, see your overdraft risk, manage your finances, and access your earned wages.

Get started with FloatMe by connecting your bank account to the app. Then, you can request the cash advance, which will be deposited into your bank account within minutes.

And based on various factors like transaction history, your anticipated income, information about your linked accounts and more, the maximum amount you can access is determined.

| Advance Amount | Up to $50 |

| Fees | · Subscription Fee: $1.99 a month· Fast-funding Fee: $4 |

| Repayment | Repayment is done in one installment and the repayment period is based on the date you choose or confirm. |

| Time to Fund Without Fast-funding Fee | 1-3 business days |

| Time to Fund With Fast-funding Fee | Within minutes |

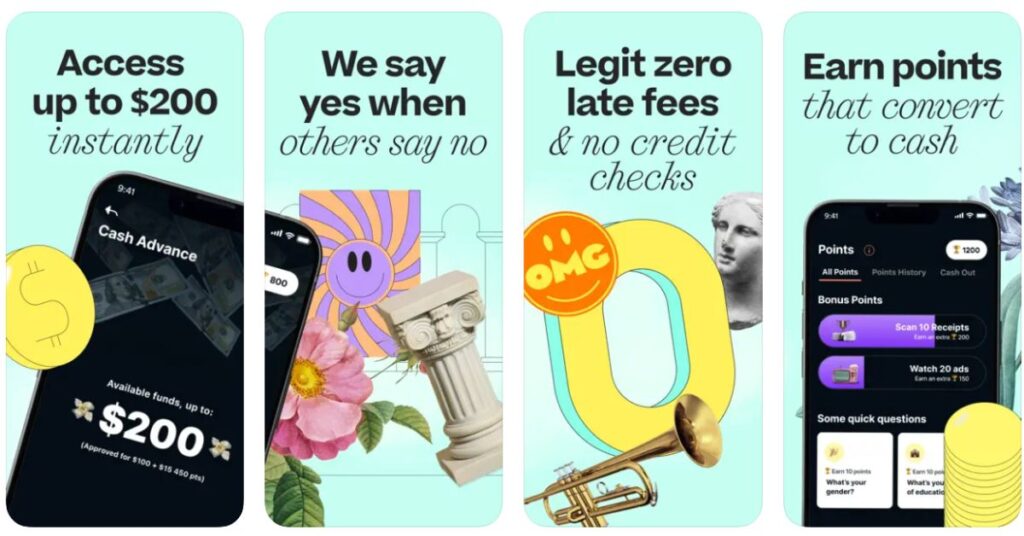

10. Klover

Klover provides you with access to budgeting tools, cash advances, and other financial services. The budgeting tool also includes features like a budget planner, a spending tracker, and a bill reminder.

All you need to do is sign up in seconds by entering your name, phone number, and email address, link your bank account, and then access your cash with no credit check.

Further, you can earn points for taking surveys and watching ads, which you can further use for a bigger advance or to enter the daily sweepstakes.

| Advance Amount | Up to $200 |

| Fees | · Subscription Fee: $3.99 a month· Fast-funding Fee: $2.99-$2078. |

| Repayment | Money is automatically deducted on your next payday |

| Time to Fund Without Fast-funding Fee | 3 business days |

| Time to Fund With Fast-funding Fee | Immediately |

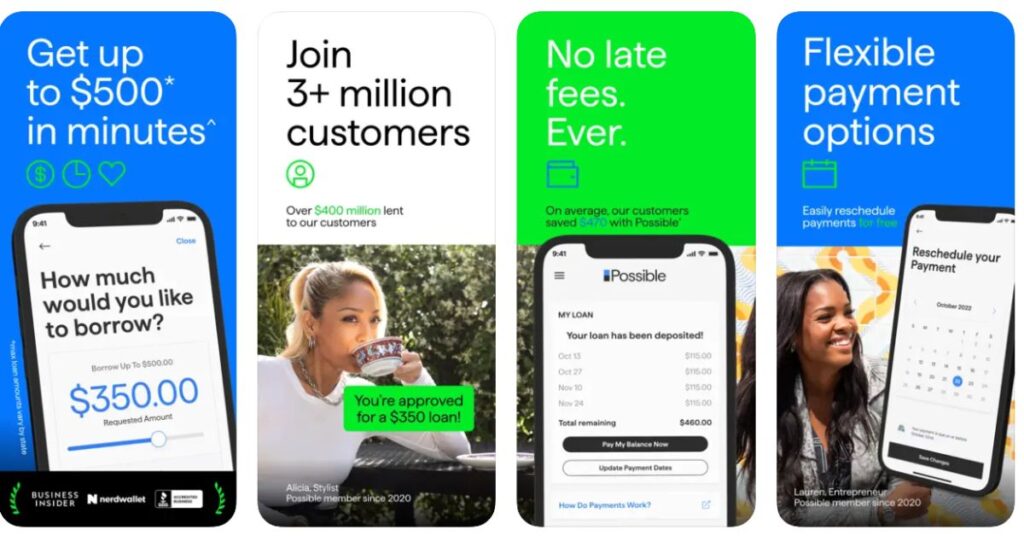

11. Possible

With the Possible finance app, receive money quickly, improve your financial health, and attain peace of mind. It doesn’t charge any fee even though you repay your loan on time.

However, your on-time payments are reported to the credit bureaus, thus helping you to improve your credit score over time. So, simply get started with the Possible app by downloading the app and creating an account.

And to be eligible for the cash advance, you’ll need to have a valid ID, a monthly income of $750, compatible checking or savings account, a Social Security number, and a smartphone to install the Possible app.

| Advance Amount | Up to $500 |

| Fees | · Charges a monthly fee of $8 or $16.· Origination Fee: $15 to $20 for every $100 borrowed |

| Repayment | You can pay overtime in 4 installments |

| Time to Fund | Within minutes to up to 5 days |

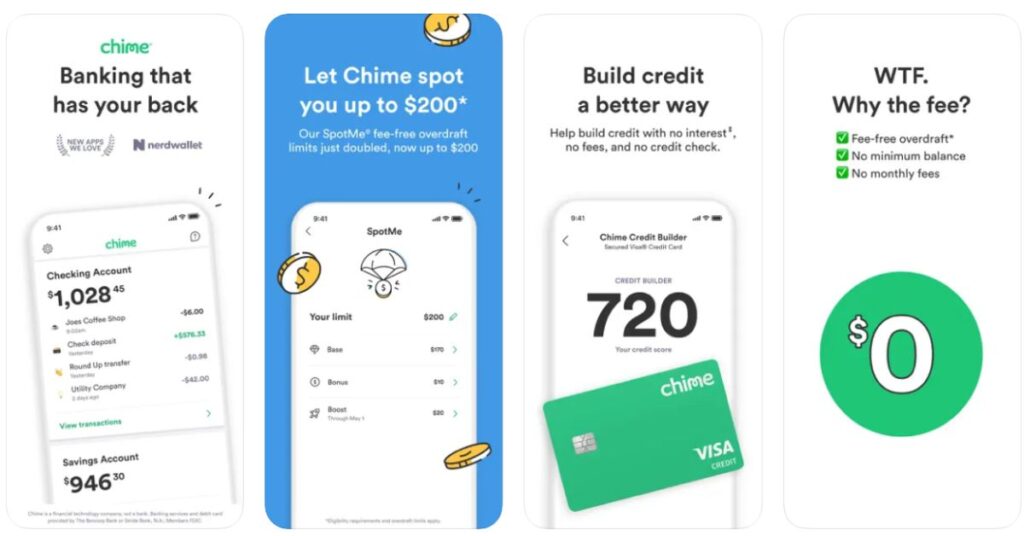

12. Chime

Chime is a banking app that keeps your money safe with security features and lets you get paid early with direct deposit and no monthly fees.

You can get paid up to two days early with direct deposit and stay in control of your money with instant transactions and daily balance alerts.

Further, Chime doesn’t have monthly maintenance fees, minimum balance fees, or foreign transaction fees. So, access Chime’s SpotMe and get support for overdrafts up to $200 without fees.

| Advance Amount | Initially up to $20 and later it is increased to $200 |

| Fees | There are no fees associated with Chime SpotMe |

| Repayment | It automatically deducts the amount from the future deposits |

| Time to Fund | Instantly |

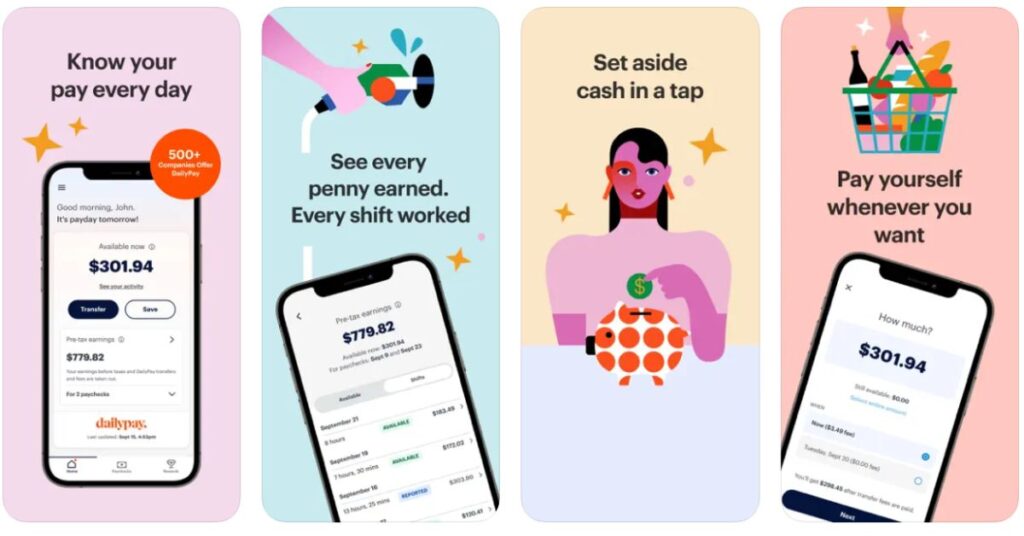

13. DailyPay

Lastly, we have DailyPay on our list of the best apps like Credit Genie. With DailyPay, access your earned pay and have it sent to any account instantly for a small fee.

All you need to do is download the DailyPay app, check what’s available now to see how much money you have available for early transfer and choose the amount you’d like to transfer and submit your request.

Besides, it also offers savings tools, financial education, lets you track your earnings in real-time, access your payment history, and even referral programs.

| Advance Amount | Up to $1,000 |

| Fees | Cost $2.99 flat fee for every transfer and instant transfer costs $1.99 |

| Repayment | You can either pay off your entire cash advance balance in full or you can choose to pay it off in installments |

| Time to Fund Without Fast-funding Fee | Next business day |

| Time to Fund With Fast-funding Fee | Instantly |

![13 Top Apps Like Credit Genie to Get Cash Quickly [2024]](https://viraltalky.com/wp-content/uploads/2023/06/Apps-Like-Credit-Genie.jpg)