Pocketguard vs Mint – If you are looking for the best comparison on two popular budgeting apps – Pocketguard and Mind, your search is over.

In this article, we’ll have a detailed mint app and pocketguard app comparison which will help you decide on a perfect service that meets your needs. But before that, let’s understand what budgeting apps are.

Budgeting apps let you connect with your financial accounts, categorize expenses, and track spendings so that you can analyze where your money is going.

Even though both these apps help you track your expenses and assess how much and where it is going, you’ll understand that both are different in many ways.

So, keep on reading to find out more about the Mint vs Pocketguard comparison.

Pocketguard vs Mint: Overview

Pocketguard:

Pocketguard is a free tool that makes it easy for you to take control of your money, optimize your spending and grow your savings automatically.

You can connect your credit cards, loans & investments, bank accounts, and track bills. And by using the algorithm, it’ll let you know how much you have left to spend after separating funds for bills, necessities, and goals.

Besides, it also tracks your net worth and gives you the option to not link your accounts and rather track your finances manually. However, once you connect your bank account, Pocketguard will start working as a finance tracker.

Mint:

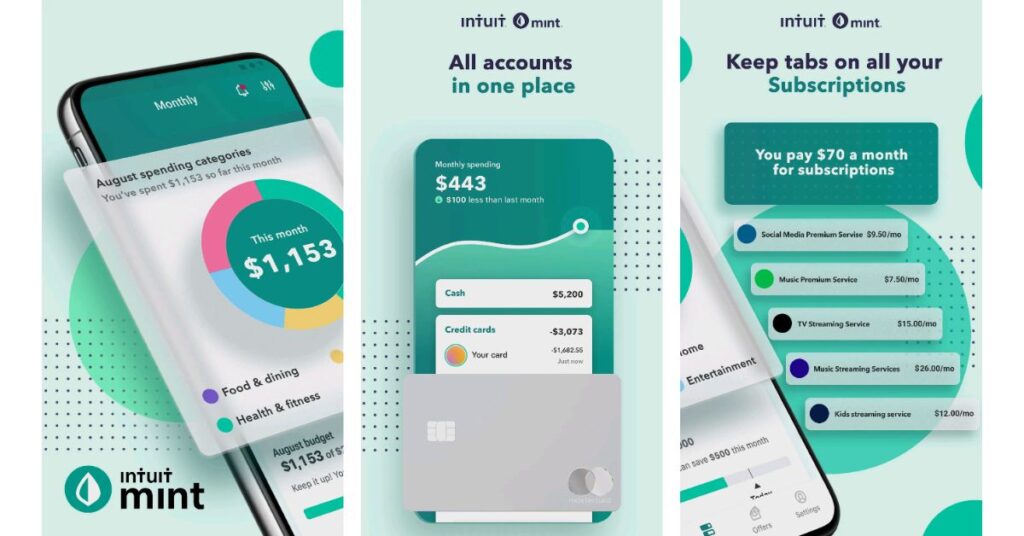

Mint is a popular budgeting app that let you connect all your financial accounts in one place. It enables users to track spendings and savings and set and track budget goals.

You can sync up money management accounts, credit cards, bank accounts, retirement and investment accounts, and other financial accounts.

Then easily place your expenses in budget categories such as bills, shopping, and transportation. Or else personalize these categories and set limits. If you’re approaching those limits, Mint will remind you.

You can easily download the app on your device and simply log in to get started with Mint.

How do They Work?

Pocketguard:

To get started with Pocketguard and to make your budgeting smarter, you’ll have to connect your credit, checking, and savings account.

But before that, you’ll need to create an account. To create an account with Pocketguard, you’ll have to be 18 years old, and you’ll have to provide your personal and contact details.

Once it is done, they’ll tell you what you’re spending, and where to save, and will send you a reminder when your bills are due. And the ‘In Pocket’ feature will let you know how much money is left after you’ve paid all your bills and set some savings aside.

Then, it’ll work to save you money through the processes like finding high-interest savings accounts and negotiating lower bills.

Mint:

First, download the app on your device and create an account using your email address or mobile number and provide your personal information.

Once you sign up, you’ll need to connect your bank account, credit card, or debit card so that Mint can monitor your income and spendings. Then, it’ll split your income into categories that you can customize if you want.

Like Pocketguard, you can set limits for every category with Mint and then manage your spendings and transactions for a budgeting experience.

Besides, it’ll also monitor how you pay with credit card payments, bills, etc., and will provide you with a detailed credit report for entirely free.

Key Features

Pocketguard

- Keep tabs: Keep tabs on your spendings and personalize your reports with custom categories

- All accounts in one place: Link your credit cards, banks, loans, and investment in one place to keep track of your account balances

- Bill tracker and subscription manager: Stay on top of your bills and negotiate better rates on your cell phone, cable, and other bills. All your bills will be automatically included in your monthly budget

- Reach your goals: Grow your savings automatically with Autosave

- Comprehensive Analytics: It provides you with various reports to let you view personal finances from different angles

- Learn your spending habits, make required adjustments, and optimize your monthly budget

- Custom categories: Create your own custom category if the current numbers are not enough

- Export and Import transactions: Create personalized spending trends, and transform data into graphs and charts using Google Sheets or MS Excel tools

- Transactions: Automatically pulls out transactions from your accounts when you link them to the app

Mint

- Monitor your cash flow: Helps you track expenses, transactions, account balance, expenses, monthly budget, subscriptions, and taxes

- Manage bills: Track bills and your financial goals along with your account balances and get monthly bill reminders to avoid late fees

- Set financial goals: set personalized financial goals and get actionable tips customized for you

- Spend Smarter: Discover new ways to use this app and reach your financial goals

- Budget Alert: Get alerts when your balances are low, or bill payments are due to avoid fees and penalties

- Investment tracker: Offers the right tools for your investment needs and helps you stay on top of your investments

- Free credit score: Get a free credit score directly in the app with no credit card required

- Categorize bank transactions: Set budget categories to help you track your spendings

- Add tags: You can add tags, and organize your transaction as you choose

Pocketguard vs Mint: Pricing

Pocketguard:

It offers two plans – the free version and a paid version, which is called PocketGuard Plus. Although you can use most of its features for free, you’ll need to subscribe to the paid plan to access advanced features.

Pocketguard Plus has three pricing options – $7.99 a month, $79.99 a year, and $99.99 for a lifetime membership.

With Pocketguard Plus, you’ll get the following features

- Create your own categories

- Import transaction history

- Unlimited savings goals and category budget

- Extended transaction history

- Multiple cash accounts

- cash transfers

- Change the date of external transactions

- Set a debt payoff plan

- Split transactions into different categories

- Attach receipt

- Auto-repeat bills and income

Mint:

Unlike Pocketguard, Mint is completely free and there is no premium version for an added cost. Once you sign up, you can access all its features and benefits for free.

However, if you are on iOS, you can be able to access Mint Premium which costs $4.99 a month. Your subscription includes ad removal, advanced data visualization, advanced spending graph capabilities, mint Premium arcade, and more.

And if you are wondering how Mint makes money, well, it makes money on partnerships with other companies, which is the reason that the app features ads and offers for other financial services.

Security

Since you provide your sensitive financial information, it is essential to ensure that you are using the budgeting app that is properly secured.

Pocketguard:

With Pocketguard, your data is secured with 256-bit SSL encryption, which is the same level of security as major banks.

And the app uses biometrics and PIN code, as an extra security layer in case your phone is lost or stolen.

Mint:

Security is the utmost priority for Mint. It carefully guards user information with the latest security measures. These include Touch ID and a 4-digit code, which let only you to view your account.

Moreover, you don’t have to worry about getting your mobile device stolen or losing your mobile because you can delete all your account information remotely.

It also uses multi-factor authentication, which will verify your account with a code sent through SMS or email.

Pros and Cons of Pocketguard and Mint

Pocketguard

| Pros | Cons |

| Ability to connect bank accounts from a wide range of financial institutions | Some features are limited to the premium subscribers |

| Track how much you can spend with the In Pocket feature | Free version has customization limits |

| Help users reach their financial goals | |

| Personalized budget to make an accurate financial picture |

Mint

| Pros | Cons |

| Connect all your financial accounts in place | A lot of ads and no way to get rid of these ads |

| Free credit score access | No joint account |

| Personalized alters when over budget, ATM fees and for large transactions | Categories may assign incorrectly |

| Offers blog and education tools | |

| Ability to create savings goals and track investments | |

| Credit monitoring service |

Pocketguard vs Mint: Which is Better?

Both the apps are incredible budgeting services as they both dive into your finances and help you track your spendings and save a few extra bucks. Furthermore, they also let you customize categories, set financial goals, and send reminders to prevent you from spending extra.

Pocketguard is particularly developed for customers who aim to control their spendings, save money every month, and want routine reminders of how much they can spend every day.

On the other hand, Mint can be a perfect choice for someone who doesn’t get bothered by ads. Since there is no premium version of Mint for Android users, you get to see a lot of ads here and there.

So, if you don’t mind paying a few extra bucks, go for Pocketguard. Moreover, you can also access advanced features with Pocketguard Plus, such as the ability to customize your budget using custom labels for multiple categories.

Before deciding on any service, don’t forget to do your research and pick the one that meets your requirements and works best for you. Hopefully, this article on Pocketguard vs Mint comparison has helped you understand everything about each service clearly.

FAQs

Yes, you can share the same Pocketguard profile with your spouse on different devices. You just need to sign in with the same login credentials or use the same Google or Apple account.

How do I get a free Mint subscription?

Mint is completely free for everyone and there is no premium version for an added cost

Does Pocketguard cost money?

It offers two plans – the free version and a paid version, which is called PocketGuard Plus, which costs $7.99 a month.

Can you make a budget with Mint?

Yes. It is largely customizable, so you can create your budget to fit your financial goals.

Which budget app is best?

The best budget app makes budgeting easy, and it should have an easy-to-use interface and should seamlessly connect to your accounts so that you don’t have to enter transactions manually.

GoodBudget vs Mint: Which Is Better? [2022] Nerdwallet vs Mint: Which Is Better For You? [2022] Prism vs Mint: Which Is Better? [2022]

![Pocketguard vs Mint: Which Is Better? [2024]](https://viraltalky.com/wp-content/uploads/2022/08/Pocketguard-vs-Mint.jpg)