MoneyGram and Money Order are both financial services that let you transfer money. While both let you transfer money to another person, what is the difference between them?

If you want to know what the difference between MoneyGram and money order is, and which is better, then you’ve landed at the right place.

In this article, we’ll give you a detailed MoneyGram vs money order comparison which will help you understand how they differ, and which is better between them.

MoneyGram vs Money Order: Overview

What is MoneyGram?

MoneyGram is a peer-to-peer payment and money transfer service which provides its services to individuals and businesses through a network of agents and financial institutions.

It provides an easier way to send money from the United States, pay bills, and much more. All you need to do is to register or log in, then mention to whom you are sending the money and how much you want to send. Once it is done, you can pay by card or pay directly from your bank account.

You can either send payments to your recipient’s mobile wallet or bank account. Since there are over 400,000 MoneyGram agents across the world, sending money and cash collection has become a safe and convenient service.

What is Money Order?

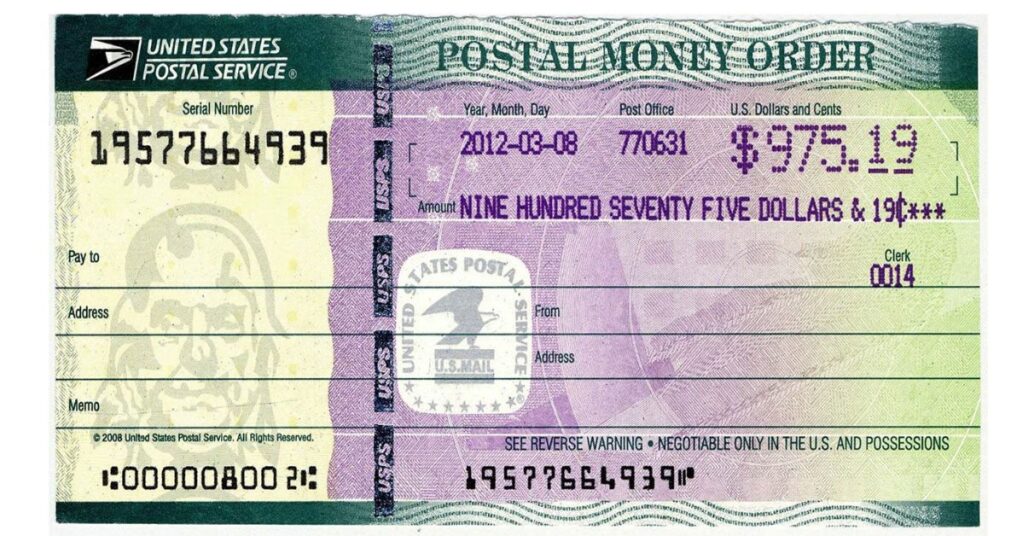

A money Order is a certified way to pay a pre-specified amount of money from prepaid funds thus making it a trusted method of payment. It lets the stated payee get cash on demand.

Typically, Money order function much like a certified cheque, but the major difference is that money orders are limited in maximum face value to some specified figure. For instance, the United States Post Service limits the domestic postal money order to $1,000.

However, money orders are easily accepted and converted to cash and are mostly used by people as you don’t need to have access to a standard checking account.

Furthermore, to make a money order to an official, you’ll require the recipient’s name and address along with your name, address, and sign.

What Is The Difference Between MoneyGram and Money Order?

Both MoneyGram and Money Order are financial services that allow you to transfer money from one person to another. However, they differ in a few ways.

MoneyGram offers several ways to send and receive money, such as through its mobile app, online, or directly from one of its physical locations. Whereas a money order is a paper document that you can buy from a post office, bank, or other financial institution.

One of the major differences between MoneyGram and money order is that the former one is an international service, and the latter is typically used for domestic transactions.

Furthermore, money orders are limited in the amount of money that you can send (usually up to $1,000). While MoneyGram lets you transfer a large amount of money, typically up to $15000.

Another difference is the service they both charge. MoneyGram’s service fees depend on the amount of money you want to send and the destination whereas, money order’s service fee varies depending on the issuer.

And when it comes to the sender and receiver, with MoneyGram, the sender, and receiver can be anyone who has funds to transfer and can receive the funds respectively.

On the other hand, with a money order, the sender is the person who bought the money order, and the receiver is the person whose name is on the order.

Cost & Convenience

MoneyGram

As mentioned above, MoneyGram’s fee is based on where you wish to send money, how you’d like to pay, and the location you want to send it to.

Its fee typically includes exchange rate makeup, transfer fee, and other third-party charges. These fees usually increase between $500 and $1,000. From here, you can get an estimate of transfer costs.

Money Order

On the other hand, the money order’s fee is typically a flat rate fee that can depend on where you buy the money order, a small fraction of the value of the order. For instance, USPS charges $1.65 for money orders up to $500 and $2.20 for orders up to $1,000.

So, we can say that MoneyGram can be a better option if you want to transfer a large amount or wish to have international transactions.

MoneyGram vs Money Order: Which is Better?

MoneyGram is a service that lets you send and receive money across the globe. It offers various payment methods including debit cards, credit cards, and bank transfers, and charges a fee for its services.

On the other hand, a money order is a payment order for a predetermined amount of money that you can purchase from a post office or a bank. And it is typically used for paying bills and transferring money to someone who doesn’t have a bank account.

Overall, both services serve different purposes. MoneyGram can be ideal for transferring larger amounts of money internationally and money order is ideal for sending or making smaller payments within the same country.

Furthermore, transferring money through MoneyGram is usually considered more secure as they are done electronically and need identification verification. Nonetheless, money orders are also safe as they can only be cashed by the person whose name is on the order.

Is a MoneyGram the same as a Money Order?

Though both are methods of sending money, they are different. A money order is a payment order for a pre-specified amount of money and MoneyGram is a money transfer service that lets you send and receive money across the world.

MoneyGram works like a money order, but it is much faster as the funds you send are available to the receiver within 10 minutes.

How does MoneyGram money order work?

All you need to do is to deposit the amount you want to send into your bank or credit union account or simply cash them at many cashing locations.

FAQs:

What is the disadvantage of MoneyGram?

One of the main disadvantages of MoneyGram is the transfer fee it charges.

Is MoneyGram safe to send money?

Yes. MoneyGram offers a safe and secure way to send money.

![MoneyGram vs Money Order: Difference, Better? [2024]](https://viraltalky.com/wp-content/uploads/2023/04/MoneyGram-vs-Money-Order.jpg)