Loans like Cigno: One of the most well-known direct money loans in Australia is Cingo. When you need money right away, it makes it easier for you to get up to $1,000 in your pocket.

But the issue with Cingo is that the loans are only available in the $100 to $1,000 range. What happens if your needs exceed $1,000? Are you seeking a substitute for Cigno loans, which offer more than $1,000?

You're in luck if so! We've compiled a list of loans like Cigno that function similarly. You can use this list to locate the best financial option for your needs. Continue reading to find out more about these loan websites and how they may be of use to you.

List of Loans like Cigno

1. Fundo

Fundo is an Australian-owned company that provides a short-term loan that lets you borrow between $300 and $2000. Unlike certain traditional lenders, Fundo does not automatically presume that a borrower with a poor credit rating poses a high risk.

Before making a choice, they consider your circumstances to determine your capacity to repay a loan. Also, frequently on the same day, approved lenders get their money. Through your personalized dashboard, which enables you to update your account, make payments, and check your credit score, you may manage your loan and your Fundo account.

Feature

- The straightforward application process at Fundo is one of the best.

- When your application is accepted, the money will be transferred practically instantly.

- Your monthly account fees will decrease the faster you repay your loan.

- Your ability to make timely payments will reflect favorably on future loan applications.

Maximum loan amount

$2000

Interest rate

0%

Loan term

Up to 6 months

Eligibility

- A minimum age of eighteen is required to apply.

- An Australian citizen or tax-paying resident.

- Earn a steady salary of at least $1000 each week, excluding government assistance.

- Be able to adhere to due dates for payments.

- You won't run the chance of running into money issues when borrowing from Fundo.

Monthly fee

20% establishment fee

Flat 4% per month

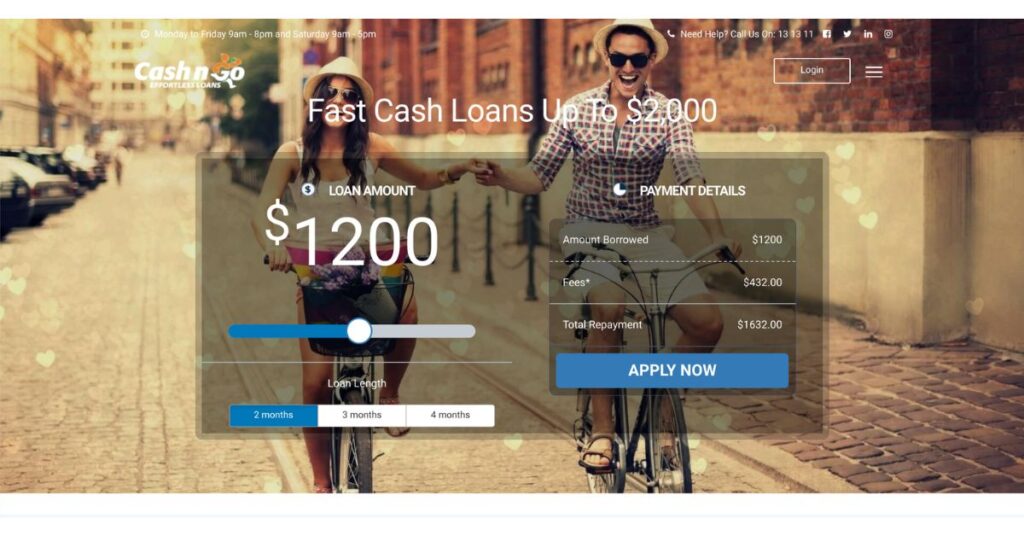

2. CashnGo

CashnGo is an online short-term money lending loan that offers quick loans if you need extra cash. Its loans are mostly intended for borrowers who need a small sum of money for a brief period. Anyone with a steady source of income can apply for a CashnGo loan.

Any day of the week, you can submit an online loan application with CashnGo, or you can go to one of their Self Service Kiosks, which are strategically placed all around Australia. Once your application is approved, you’re likely to receive your funds within 30 minutes or less, depending on when you’ve applied.

Feature

- CashnGo boasts one of the simple and most transparent applications available.

- CashnGo has a loan calculator which does an excellent job of displaying the borrowed amount, associated fees, and total repayment.

- Its application process is as fast and confidential as it can be.

Maximum loan amount

$2000

Interest rate

0%

Loan term

2, 3 or 4 months

Eligibility

- It is necessary to be at least 18 years old.

- Earn a regular, stable income.

- Possess the ability to pay back their loans

Monthly fee

Establishment fee of 20%

Monthly fees of 4%

3. Cash Train

Australian short-term lender Cash Train offers cash advances up to $2,000 and personal loans up to $10,000. Although it isn't as well-known as some of the other lending companies on the list, it is just as trustworthy. It processes funds very quickly and takes all purposes into account.

They also take into account Centrelink recipients and borrowers with poor credit. You can apply for a Cash Train loan online in just a few minutes by filling out a brief application, or you can apply in person by going to one of their nearby branches.

Feature

- Cash Train specializes in offering loans to those in need of cash immediately.

- Its prices are reasonable and affordable.

- Its online application is quick and simple to complete; the entire process usually takes 5 to 10 minutes.

- It provides small cash loans to people with bad credit as well.

- Once accepted, your money will be transferred to your bank account.

Maximum loan amount

$2000

Interest rate

0%

Loan term

3 months to 12 months

Eligibility

- Be more than 18 years old.

- Be employed (part-time and seasonal employment are OK; self-employment is forbidden).

- Earn more than $1,200 every month and be paid regularly—weekly, fortnightly, or monthly—into your bank account instead of in cash.

- To evaluate eligibility, it considers your existing financial condition, repayment capacity, and the goal of the loan.

- To qualify, if you receive Centrelink you must make more than $1,200.

- No more than 50% of your income may come from Centrelink.

Monthly fee

The establishment fee is 20%, and the monthly fee is 4%

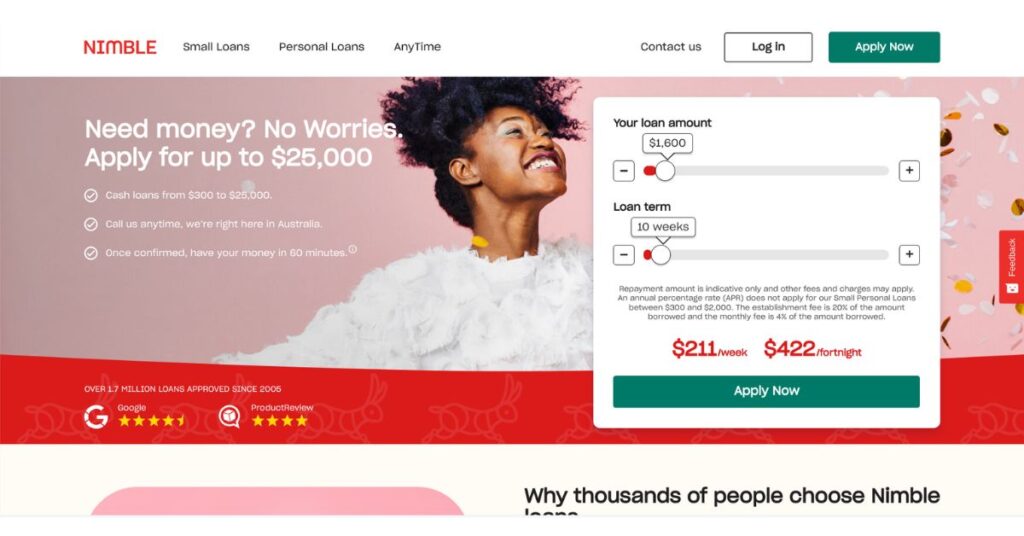

4. Nimble

There are no lending companies in Australia that are more well-liked than Nimble. Although it may not be as quick as Perfect Payday or Fundo, they are undoubtedly competitive in terms of adaptability. It's intended to provide you with financial control.

It will consider your circumstances, confirm your information, and always take additional care to lend you money that you can afford to pay back. It provides small cash loans, medium cash loans, personal loans, and even auto loans. Small cash loans fall into the $300 to $2,000 range.

Feature

- Online applications are easy to complete.

- No paperwork or in-person interviews are required.

- You may apply whenever you choose from the comfort of your couch.

- After you apply, it will check your information and make a quick judgment.

- Quick payment terms.

- Within 60 minutes of your loan being approved, the funds are wired directly into your bank account.

Maximum loan amount

$2000

Interest rate

0%

Loan term

62 days to 9 months

Eligibility

- Over the age of 18.

- A permanent resident or citizen of Australia.

- You are working and receive no more than 50% of your income through Centrelink.

- Its team investigates your financial history after receiving your application to determine whether you can afford the repayments.

Monthly fee

Establishment fee 20% and loan fees 4%

5. Perfect Payday

If you want access to a range of lenders to find the loan that will suit your financial needs and situation, Perfect Payday is best. It is a small, short-term loan which is best for acquiring direct money. It is not a lender, but rather a service that connects you to a certain range of payday lenders.

You might be able to save time by using this service instead of looking for a loan online because Perfect Payday will review your application and locate a lender for you. With this, you can apply for a loan amount ranging from $300 to $2000.

Feature

- The application procedure is straightforward.

- You must complete a brief application that shouldn't take you longer than a few minutes.

- The service is hassle-free.

- It is helpful whenever you need it if you need any assistance.

Maximum loan amount

$2,000

Interest rate

0%

Loan term

16 days to 1 year

Eligibility

- Be an Australian resident

- Be aged over 18 years

- Have an active bank account

- Being able to show identification

- Have a regular source of income paid into your bank account (not in cash)

Monthly fee

4% of the principal amount

Final Words

We have concluded this article regarding Cigno loans. With these, we've done our best to inform you about the instant loan-offering platforms. We hope that our advice will be helpful to you while you look for the finest loan.

FAQs

Does Cigno affect credit?

Simply said, a payday loan does not affect your credit score because lenders normally do not perform a credit check as part of the application process.

What is the maximum loan amount in Cigno?

Cigno offers a maximum of up to $1000 loan.

Try Alternatives-

![5 Top Loans like Cigno & Cigno Alternatives [2024]](https://viraltalky.com/wp-content/uploads/2023/07/Loans-like-Cigno.jpg)