Apps to Pay Bills In 4 Payments: Financial flexibility is important, especially in today's economy. When unexpected expenses arise, it can be difficult to cover them all at once. This is where apps that allow you to pay bills in 4 payments can be helpful.

The app splits the payment into four equal installments, which you can pay over a period of time. There are a number of benefits to using apps to pay bills in 4 payments. It can help you to avoid late fees and interest charges.

It can also help you to budget your money more effectively. And gives you peace of mind knowing that you have a way to pay your bills, even if you have unexpected expenses.

In this article, we will introduce you to some of the best apps to pay bills in 4 payments. We will also discuss the features of these apps and how to choose the right app for you.

List fo Apps to Pay Bills In 4 Payments

1. Deferit

Deferit is a bill payment and budgeting tool that allows you to pay any bill in 4 interest-free installments. It is a flexible and convenient way to manage your bills, especially if you have unexpected expenses or want to spread out your payments over time.

To use Deferit, simply upload a photo of your bill, choose how much to pay, and select the payment option that works best for you. It will then pay the full amount upfront to your biller. You can then pay Deferit back in 4 equal installments.

Key Highlights

- It makes it easy to pay all of your bills in one place.

- There are no additional costs or interest charges.

- It automatically splits your bill into 4 equal installments, which are due every two weeks.

- Deferit does not charge any late fees.

- Making on-time payments with Deferit can help you to build your credit score.

- You can choose how much to pay and when to pay it.

2. Zip

Zip is a buy now, pay later service that allows you to purchase items and pay for them in four installments, over a period of six weeks. It is a popular BNPL service because it is easy to use and convenient.

It is also a good option for people who want to budget their money more effectively or who want to avoid late fees and interest charges.

To use Zip, simply select Zip as your payment method at checkout when shopping online or in-store. You will then need to create a Zip account and provide some basic information. Once your account is created, you will be able to complete your purchase and receive your items immediately.

Key Highlights

- Zip makes it easy to pay for purchases online and in-store.

- It does not charge interest on purchases made with the service.

- There is a late fee of $10 for each installment that is missed.

- Purchases made with Zip are repaid in four equal installments, over a period of six weeks.

- There is no effect on your credit score at all.

3. PayPal Pay in 4

PayPal Pay in 4 is a buy now, pay later service that allows you to split your online purchase into four equal installments. To use it, you must be at least 18 years old, have a valid PayPal account, and make a purchase between $30 and $1500.

At checkout, select PayPal as your payment method and then choose Pay in 4 if it is available. You will need to make your first payment at checkout and then three more payments every two weeks. PayPal will automatically deduct the payments from your PayPal account.

Key Highlights

- There are no interest or late fees associated with using PayPal Pay in 4.

- You will need to make your first payment at checkout and then three more payments every two weeks.

- No impact on credit score.

- No fees for choosing Pay in 4.

- It offers a number of discounts to you if shop at participating retailers.

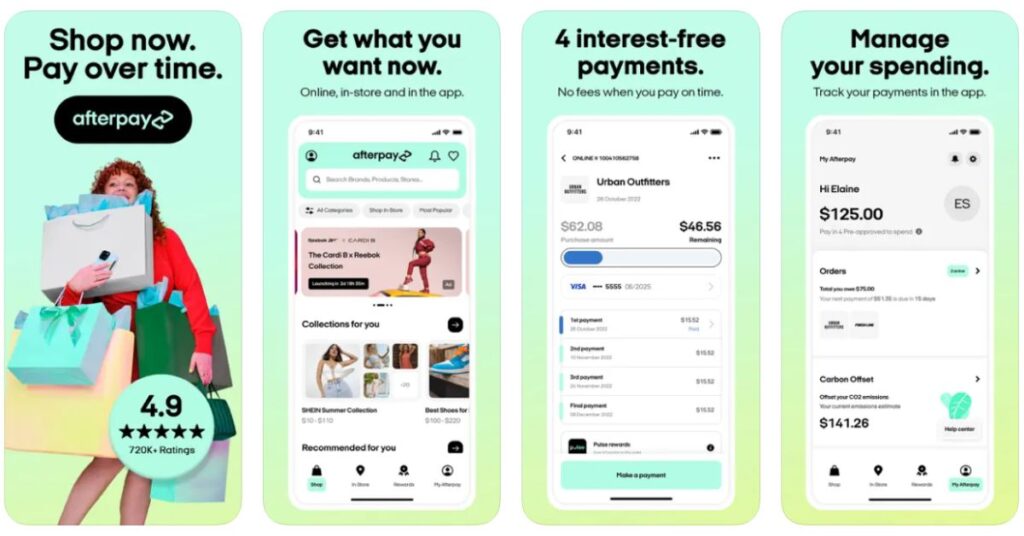

4. Afterpay

Afterpay is an app that allows users to split their purchases into four interest-free installments. It is available in Australia, New Zealand, the United States, the United Kingdom, and Canada.

You must first register an account in order to utilize Afterpay. Once you have an account, you can shop at any of Afterpay's partner retailers, online or in-store. At the checkout, select Afterpay as your payment option.

Key Highlights

- Online and in-store, browse thousands of brands and millions of goods.

- To help you get back on track, it'll send you reminders and cap late payments.

- You will need to make a down payment of 25% of the purchase price, and the remaining payments will be spread out over six weeks.

- It does not charge any interest on the installments.

- It does not impact your credit score.

5. Willow

Willow is a financial service app that helps users manage their monthly expenses by paying their bills upfront and dividing the remaining amount into four easy-to-cover installments. Willow is available in the United States and Canada.

You must first make an account before you can use it. Once you have an account, you can upload your bills by taking a photo or by connecting your bank account. Willow will then review your bills and approve them within 24 hours. Once your bills are approved, Willow will pay them upfront.

Key Highlights

- Willow charges a small flat service fee but no interest on late payments.

- Not any hidden fees.

- You can build up your credit score.

- Using the app will not impact your credit score.

- Easy to use app.

- It covers almost all bills like water, cell phone, car payment, heat, internet, etc.

6. Neon

Neon is a bill payment and management app. Its objective is to provide a simple solution for a specific need that is, paying for monthly household bills. Simply put, Neon does three things consolidate all your essential household bills — electricity, telecom, internet, water, gas, and rent on its dashboard.

It provides a credit line to cover these bill payments. And it makes all payments as you become due. You can then pay back in 4 equal installments beginning at the end of the month for which it cover all payments.

Key Highlights

- Get a zero-interest credit line to cover all of your monthly expenses.

- Make on-time payments to improve your credit score.

- No more missed payments or late fees.

- Track your payment history and bills.

- Get reminders when your bills are due.

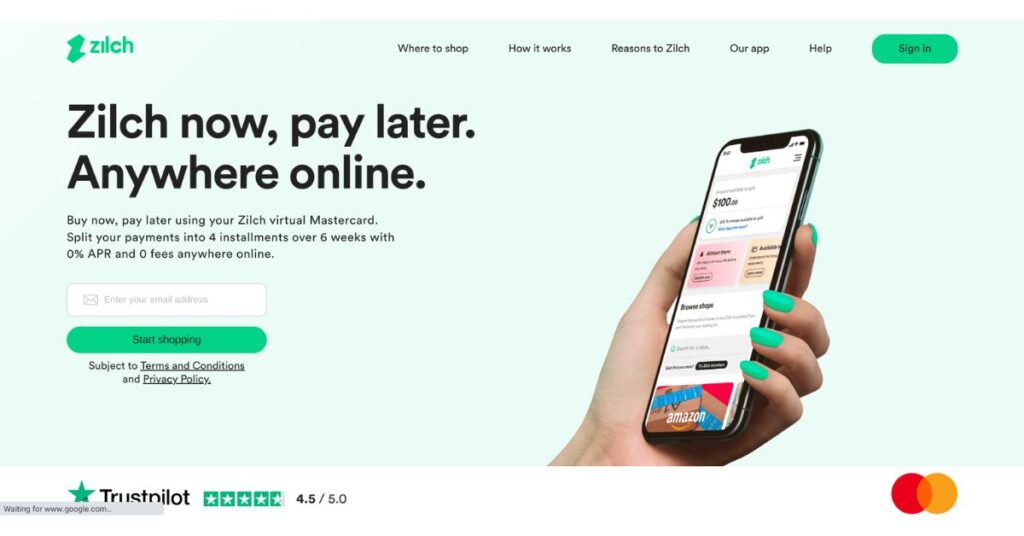

7. Zilch

Zilch is an app designed to simplify your payments and financial management. It offers a buy-now-pay-later service, which means you can divide your purchases into four equal parts without incurring any interest charges.

Zilch is similar to Deferit in that both apps offer installment payments. However, Zilch provides users with greater flexibility by working with a virtual Mastercard, which is widely accepted by online retailers.

Key Highlights

- Improve your credit score by using Zilch regularly and repaying on time.

- Enable your Zilch card before you shop.

- Pay your bills in four installments over 6 weeks.

- Pay a fee of up to $3 for purchases over $10 when shopping online anywhere else.

- Get interest-free installment payments.

- No credit check is required.

- Track your payments in the Zilch app.

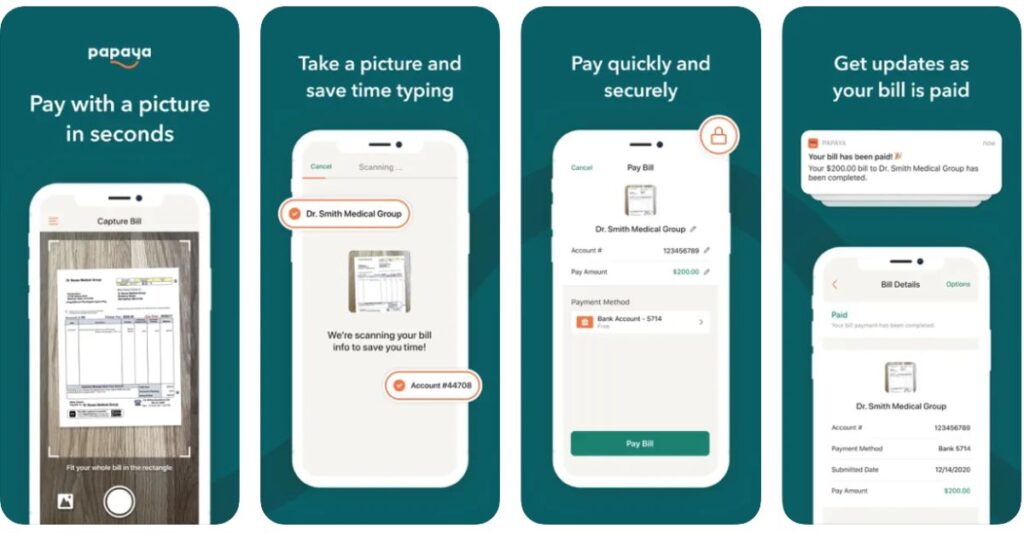

8. Papaya

Papaya is a bill pay app that allows you to pay your bills quickly and easily, with no fees. It is a convenient and affordable way to pay your bills, and it is especially helpful for people who are busy or who have difficulty remembering to pay their bills on time.

You can simply take a photo of their bill and Papaya will pay it for them. It works by using the same game-changing technology as mobile banking apps. Take a picture of your bill and Papaya will send your payment.

Key Highlights

- Papaya is a simple and free app that helps you pay your bills quickly and easily.

- It keeps your payment information safe.

- It doesn't affect your credit score.

- It doesn't charge any fees or interest to you or the merchants you pay.

- It's an easy method to keep track of your bills.

9. Klarna

Klarna is a flexible payment app that allows you to shop now and pay later, with a variety of options to choose from. You can use Klarna to pay for purchases in four interest-free installments, or you can choose to pay later, with interest. It also offers instant financing for larger purchases.

It is unique in that it allows you to make purchases at any US or Europe-based retailer that accepts debit and credit cards. It is accepted by a wide range of retailers, both online and in-store.

Key Highlights

- Pay in four installments of two weeks each.

- It doesn’t charge any interest.

- Klarna does charge a late fee.

- Does not affect your credit score.

FAQs

Is there an app to pay bills in 4 installments?

Yes, there are several apps that allow you to pay your bills in 4 installments. Some popular options include: Afterpay, Deferit, Klarna, PayPal Pay in 4, Zilch, Papaya, Neon, Willow, Zip, etc.

Can papaya pay any bill?

Yes, Papaya can pay any bill. It is a mobile bill pay app that allows you to pay any bill, including rent, utilities, insurance, and more. You simply take a photo of their bill and Papaya pays it for them.

How does Deferit work?

Deferit is a buy now, pay later app that allows you to split your bills into four interest-free installments. To use Deferit, simply upload a photo of your bill and choose how much to pay. It will then pay your bill upfront and you can pay Deferit back in four equal installments, every two weeks.

![9 Top Apps to Pay Bills In 4 Payments [2024]](https://viraltalky.com/wp-content/uploads/2023/09/Apps-to-Pay-Bills-In-4-Payments.jpg)