With the apps like Deferit, you can have the flexibility of purchasing or paying for bills now and pay overtime in the form of four fortnightly installments.

In this article, we’ll be discussing Deferit alternatives that let pay for your bills upfront and provide you the flexibility to pay later.

But, before going any further, first, let’s understand what Deferit is, and how does Deferit works.

What is Deferit?

Deferit is a budgeting and billing service that lets you pay bills in installments, with no late fees or no interest. All you need to do is simply upload a bill, select how much to pay, and Deferit will pay it for you easily.

While you can pay for your payment in 4 installments every two weeks, Deferit will pay the full amount upfront. One of the interesting features about Deferit is that it offers discounts which you can use after paying bills on time.

How Does Deferit Work?

Firstly, you’ll need to download the app and make an account by providing your personal information. Then, take a photo, add a file, or take a screenshot of the bill and upload it.

Now, choose the total amount that you’ve to pay your biller. Once it is done, choose the payment option that suits you and Deferit will pay the full amount upfront, while you can pay it in installments.

So, this is your all-in-one budgeting tool which keeps records of all your bills and sends reminders so that you never miss the due date.

Apps Like Deferit

Here is the list of the buy now pay later services that pay your bills.

Willow Pays

Firstly, we have Willow Pays on our list of the best apps like Deferit. Willow Pays is a customer-first financial service that easily regulates your monthly expenses. Its main aim is to help you prevent expensive payment options with compounding interest.

It pays your bill upfront, and then it divides your monthly bills into 4 smaller payments starting today. Although it doesn’t charge any interest, it does charge a small flat service fee.

This service fee is $4 for bills up to $100, $8 for bills up to $200, $12 for bills up to $300, and likewise. Sometimes, transaction fees might also apply.

How Do Willow Pays Work?

All you need to do is to download the app and sign up easily. Then, upload your bills by taking a photo and Willow Pays will evaluate and approve your request within 24 hours.

Once you are approved, it will pay your bills, and you can pay them back in fortnightly installments without any interest.

It covers almost all bills, including water, cell phone, car payment, heat, internet, childcare, electricity, insurance, TV/cable, and more. However, it currently doesn’t cover mortgages, rent, student loans, past due payments, or other debt payments.

Features

- Pay your bill upfront

- No late fees and no interest

- Flexible payment options

- You can pay back in four installments

- Avoid late fees and pay every single bill on time

- Help you build your credit score when you pay on time

- Smooth out your monthly cash flow and budget

- It charges a small flat service fee

How to Signup: You can sign up for Willow Pays by using your email ID or through Facebook. Then, enter your detail, upload your first bill, and simply connect a debit card!

Since Willow Pays is the only app that works almost like Deferit, we have mentioned other buy now pay later services that let you pay for your purchase over time.

What is Buy Now Pay Later?

BNPL or Buy Now Pay Later is short-term financing that let customers make purchases and pay for them later, generally interest-free. However, depending on the retailer, some of these plans can come with late fees and interest.

How Does Buy Now Pay Later Work?

Once you are done shopping and ready to checkout, you may see an option to split your total purchase into smaller amounts. This means it divide your purchase into multiple equal payments.

You might have to provide your personal information like name, address, phone number, date of birth, social security number, etc. And you should also have to give your payment method.

PayPal Pay in 4

PayPal offers a buy now pay later payment service – Pay in 4, which allows you to split your online purchase into four interest-free installments with the first payment at checkout.

It only appears as a choice at the point of sale for those people, whose PayPal account is in a better position. So, there is a probability that it might not appear if you have a negative balance in your account.

How does PayPal Pay in 4 Work?

PayPal Pay in 4 will only be visible in the PayPal wallet if you are at least 18 years old, have a valid PayPal account, and have completed a transaction value between $30 and $600.

When you make a purchase, you just need to click on the standard PayPal button as the payment method, and if you are eligible, then the Pay in 4 option will be visible.

It lets you divide your purchase between $30 and $1500 into four equal interest-free installments. And the first payment should be made during the time of purchase.

The remaining payments are automatically deducted from your PayPal account depending on the payment option you’ve selected.

One of the major drawbacks of Pay in 4 is that its availability depends on your state of residence. This means it is not available in all states in the United States.

Features

- Doesn’t charge any late fee for missed payments

- There is no prepayment fee

- Might run a soft credit check to check your eligibility

- There is no impact on your credit score

- No fees for choosing to pay with Pay in 4

- Offers purchase protection

- Only available for online shopping

- Make four interest-free payments

- Charges conversion fee for international purchases

- Three subsequent payments will be taken every 15 days

- No interest

Cost: PayPal Pay in 4 charges no interest. So, as long as you see PayPal’s Pay in 4 option at the checkout, you can simultaneously have multiple Pay in 4 plans.

However, you should keep in mind that if you don’t pay on time, there might be a penalty and that amount may vary based on the state you live in.

How to Signup: Download the PayPal app and create an account with it. Then, enter your personal information like name, home address and card information. Or you can decide to connect your bank account directly.

Once it is done, choose Pay in 4 at the checkout, get a decision within seconds and complete your purchase by making the first payment.

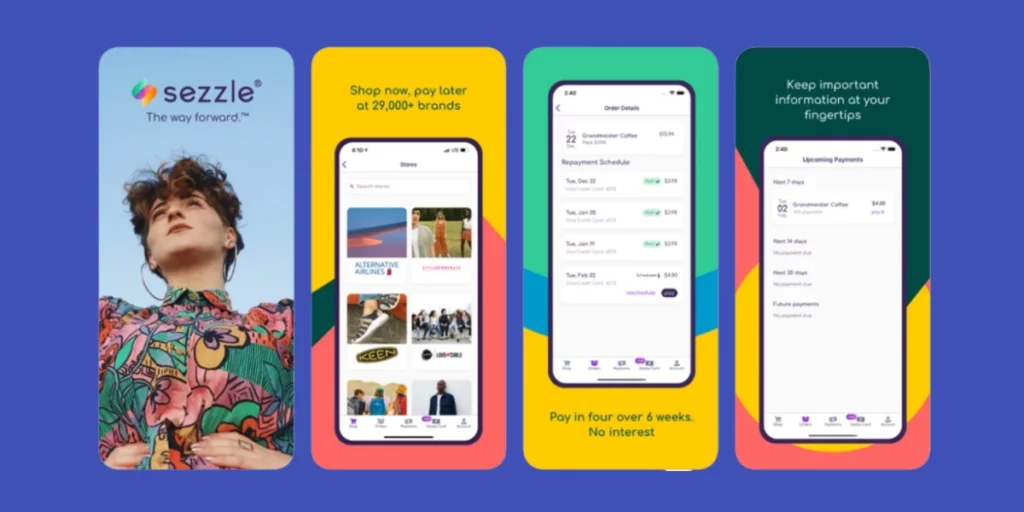

Sezzle

Sezzle is a publicly traded fintech that provides an alternative payment platform offering interest-free installment plans at certain online stores.

You can shop with thousands of stores, receive your order right away, and pay for it over 6 weeks, completely interest-free.

Rather than relying only on the FICO score, it assesses each order personally and considers multiple factors like soft credit score check, the customer’s order history, and the total purchase amount.

How does Sezzle Work?

It lets customers of participating online stores split the payment for their purchases into four installments. And when you place an order, their unique approval process reviews your account and decides what type of plan should be offered to you.

Once they approve you, you’ll need to make the necessary down payment and then three equal payments are scheduled in six months timeframe.

When your order is placed, Sezzle will instantly pay the seller in full, so the seller has their funds and can process your order easily.

The first installment is paid at the time of purchase while the other three are due at regular intervals over the following six weeks.

Features

- Alternate payment option during the checkout process

- No fees when you pay on time

- Free payment reschedules

- Zero impact on your credit

- Wide range of products, including jewelry, footwear, clothes, and more

- Allow you to reschedule your payment

- Credit score is not impacted

- Discover new stores, reschedule future payments, get notified, regulate existing orders, and change your payment methods

Cost: Sezzle is completely free to download and use. It doesn’t charge any interest, but the only fees you might be charged is the failed payments or reschedule payment fees that are $10 and $5 respectively.

How to Signup: To create an account with Sezzle, you’ll need to provide your mobile number, name, date of birth.

You should be at least 18 years old, have a valid email address, and must have a US or Canadian bank account, credit card, or debit card.

Affirm

Next on our list of the Deferit alternatives, we have Affirm. Affirm is a financial technology that functions as a financial lender of installment loans for customers to use at the point of sale to finance a purchase.

It is the smartest way to pay overtime. So, shop anything anywhere and pay at your own pace without any additional fee.

How does Affirm Work?

All you need to do is to select Affirm at checkout while shopping at your favorite stores to view your payment options. You’ll get a maximum spending limit that usually differs from consumer to consumer.

However, the maximum amount one can use s approximately $17,500. So, whenever you wish to purchase something through Affirm, it examines your account to approve that transaction.

Then, it will present you with different payment options which you can choose based on your limit. Moreover, you can also choose the payment schedule and then confirm your loan.

Features

- No interest or hidden fees

- Set up easy automatic payments

- No impact on your credit score

- Shop your favorite stores online or in-store

- Select the payment option that works best for you

- Four interest-free payments every two weeks to monthly installments

- Doesn’t affect your credit score

Cost: Affirm’s interest rates depends on which retailer you are shopping. Besides, it doesn’t have any late fees, service fees, prepayment fees, or any other hidden fees.

How to Signup: First, you’ll have to download the Affirm app on your device and enter your personal details to create an account. Once it is done, you can request the amount.

To signup, you’ll need to be at least 18 years old, have a valid U.S. home address, mobile number, and give the last four digits of your social security number to authenticate your identity.

Viabill

Viabill is another buy now pay later service that let you pay for your purchase over time, interest-free.

It effortlessly integrates into your website’s checkout flow and allows higher conversion, larger AOV, and revenue.

How does Viabill Work?

Once you fill your basket and finish your shopping, you can choose ViaBill as your payment option at checkout. If you are approved, you can enjoy the order now, pay overtime in four installments.

What you need to keep in mind is that you’ll have to pay the first installment at checkout and the remaining later, without any interest.

Features

- Track orders, receipts, transaction history, payment schedule, and other information

- Manage payments and create a contact or individual information along with payment approaches

- Access electronics, sports, automotive, fashion, toy stores, and much more

- Seamlessly integrates with several third-party applications

- Track the expenses and view late payments with their due dates

- Users receive updates regarding processing additional payments, and orders

- Purchase now and pay overtime in four separate interest-free installments

How to Signup: To sign for ViaBill, you’ll need to be at least 18 years old, have a valid email address and mobile number, and even have enough funds to cover your first installment during the time of purchase.

So, if you meet the above requirements, visit this page and create an account by providing your mobile number and link your bank account.

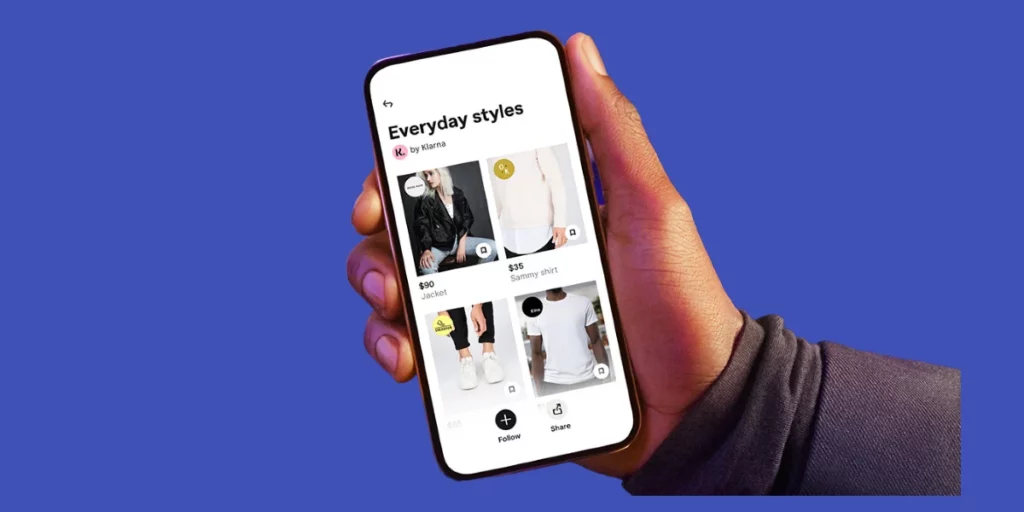

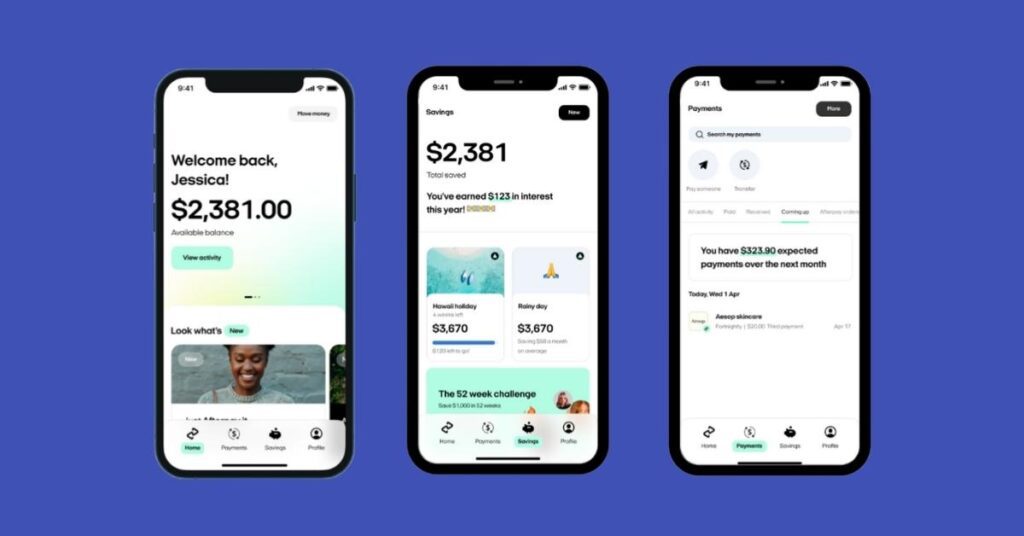

Klarna

Klarna is a multi-payment solution that offers online financial services like direct payments along with post-purchase payments and payments for online storefronts.

With its post-purchase payments, shoppers can pay for their purchase in four installments, interest-free. Its main aim is to provide payment solutions for the e-commerce industry and make safe & secure payments for everyone.

Moreover, users can purchase from any online retailer and take advantage of the interest-free installment plan.

How does Klarna Work?

You can choose Klarna as a payment method at the checkout. But it’ll perform a soft credit check to determine your spending limit. Note that it won’t affect your credit score.

While making a purchase, you get to decide from three payment options – Pay in 4, Pay in 30 days or pay in 6 to 36 months, with interest rates starting from 0%.

Note that the pay in four is a zero-interest payment option which requires a 25% down payment at the time of purchase.

Features

- Track your shipments

- View your process returns and purchase history

- Create a wish list of items for future purchases

- Enjoy the flexibility to get what you want

- Instant approval process has zero impact on your credit score

- Make early payments or extend your due date

- Get a complete overview of all your purchases and finances

Cost: Although all installments are interest-free, the company charges a late fee, which is $7. And the longer-term loans have a $25 late fee assessment.

However, there will be no penalty for early payment or paying off your balance in full before the final due date.

How to Signup: You can sign up for Klarna if you are at least 18 years old, have positive credit history and have a valid email address and mobile number. So, all you need to do is to download the app and create an account.

Afterpay

Finally, we have Afterpay on our list of the apps like Deferit. It is partnered with over 50,000 in-store and online retailers to provide you with an easy and simple buy now pay later experience.

You can divide your installments and pay back every fortnight. Since all these installments are interest-free, you don’t have to worry about paying anything extra. However, if you don’t pay on time, there will be a late fee.

How does Afterpay Work?

It let eligible shoppers use this service with no interest, no credit checks, and any additional fees. When you make a purchase, your payments are divided into four installments.

Remember that you’ll need to pay the initial down payment during the time of purchase, and the remaining payments should be paid over a six-week period.

But before that, it considers different factors to approve your order, including how much time you have been an Afterpay shopper and whether you have successfully repaid all your orders.

Features

- Stay top of your shopping budget and manage your budget

- Manage your payment plan easily

- Browse retailers and brands

- Need to pay the first installment at the checkout

- No interest

- Keep track of all your orders and your payment plan

Cost: All the Afterpay loans are interest-free with a 25% upfront. The only fee it charges is the late payment fee, which will be capped at 25% of the initial purchase and doesn’t accumulate over time.

How to Signup: You can create an Afterpay account instantly to make your first payment and complete the checkout process. You can easily create an account without giving your social security number.

In order to create an account, you’ll need to be at least 18 years old or 19 in Alabama and Nebraska, have a valid mobile number, address, and should enter a legally binding contract.

Final Words: Best apps like Deferit!

Most of the apps listed in this article are easy to use and are interest-free. These services let you buy something now and pay off the amount overtime.

Hopefully, the above article has helped you know everything about apps that pay for your bills or other purchases.

7 Apps like Sezzle to Buy Now Pay Later Top 7 Apps Like Zip to “Buy Now Pay Later”

![Must-Try “Apps Like Deferit” to Check Out [2024]](https://viraltalky.com/wp-content/uploads/2022/04/Apps-Like-Deferit-.jpg)