Apps like Webull: Fintech is currently growing in the economic market of today’s world. Saving money, trading money, and investing money – all these tasks can become brain-draining processes.

Money is a ruler, without money you are close to invisible, and with money, you are close to risking it. Hence, money-managing can become a mindful task where we need security and as well a guarantee that our money is safe.

We all are currently living in the digital world. We are earning money, saving money, investing money all via the online world. While investing we do check the sites are certified and safe or not.

In this article, we are going to talk about Webull’s alternatives and their key features. Webull in one sentence is an app that provides you the platform to invest your money for your good.

By the end of the article, you will get all the knowledge about Webull and its best alternatives with their key features and much more.

Apps like Webull: Best Similar Apps!

Before directly jumping on the best alternatives of Webull, we will have a quick recap of what Webull is what it has in the store to offer its users.

What Is Webull?

History

Webull offers financial services for gifting knowledge to its users regarding the stock market and their economic trends. It was founded approximately 4 years ago.

Webull offers real-time information regarding current global market quotations, economic trends, real-time market scenarios, they also provide you with some useful tools to help you make selective and accurate financial decisions in the stock market.

About Webull

The parent of Webull is Wang Anquan and the headquarters of Webull is situated geographically in New York, USA. The key person who has designated the position of the Chief Executive Officer of Webull is Anthony Denier.

The ownership of Webull is divided with Wang Anquan, Xiaomi, Shunwei Capital, Bojiang Capital, Gopher Asset Management, and Hongdao Capital at different proportions.

Key Features

- The main key feature of Webull is the real-time data providence where it let their customers know about live stocks, profit earnings, economic cycles, profiles of companies, statistics, and much more.

- Webull also provides users with useful tools namely 50+ technical indicators and also 12 different types of charting tools for financial acknowledgment.

- It offers exclusive access to supreme class tools namely IPO Earnings Calendar, Press Releases, Advanced Quotations and Capital Flows.

- It offers 24×7 live market news updates for the companies to make accurate financial analyses.

- It also allows its users to follow Bloomberg, Google Finance, Yahoo! Finance, Wall Street Journal, and many more.

- Webull also offers mobile personalized widgets to add on the home screen to get an idea about the latest movements in prices and also allows alerts to be made on favorite stocks.

- It also offers a practicing feature that allows users to test their stock market skills with paper trading.

- It also offers an advanced level of access to their users to go in-depth with the idea of the stock market and much more.

Fees of Webull:

- Webull is completely free in terms of account minimum, stock trading costs, and options trading.

- Webull only charges fees regarding the transfer as full or partial transfer fees up to $75.

- Webull also is free in terms of annual and inactivity fees.

Now let’s jump into the best alternatives of the Webull app.

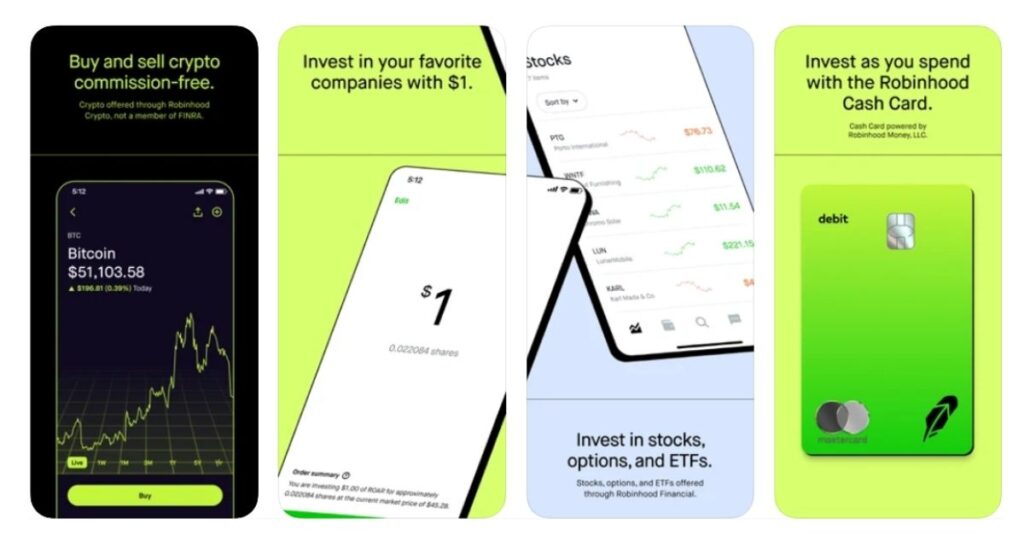

Robinhood

Robinhood app provides low trading costs and zero balance requirements for opening an account to trade. Robinhood app also has a simple and easy user interface for the easy understanding of the customers.

Robinhood offers its services for trade stocks, ETFs, options, and cryptocurrencies. It provides its platform to trade and invest in cryptocurrencies namely Bitcoin, Ethereum, and many more.

Robinhood also allows its customer to purchase fractional shares with a minimal range from $1. The cash management feature of the app is a worthy money-making feature. The cash management feature lets its customer wins .30% APY.

About Robinhood

Robinhood currently has more than 500 million users which are currently investing and selling cryptocurrency with a commission-free facility.

Robinhood started initially as a brokerage company where it wins against many competitors by giving the special feature. The special feature given to the customers of Robinhood was not charging any commission or fees for stocks, options, and cryptocurrency trading.

Robinhood gained many customers because of running out of this special feature and made its name to the top few companies providing the best financial services around the boundaries of the United States.

Robinhood currently attracts many customers for investing, saving money, and also for the stock exchange and brokerage services offered so far.

Key Features of Robinhood

- It offers to buying and selling of cryptocurrencies namely Bitcoin, Dogecoin, and Ethereum.

- It has removed all the barriers of keeping account minimums.

- It also has a category to make the customer understand the financial market situations at ease.

- It also offers a category of trading tools that gives access to real-time data with a news feed to keep users updated with current market scenes like Webull offers.

- It also offers security protection against users’ holdings and offers security tools to keep the user’s account safe.

- It also provides a customer helpline that works 24×7 to solve all the queries users have against Robinhood.

- It offers to invest and buying facilities of cryptos in Bitcoin, Bitcoin Cash, Bitcoin SV, Litecoin, Ethereum Classic, and Ethereum and Dogecoin mainly.

Fees of Robinhood

- Robinhood Gold which is a premium feature offered by Robinhood charges you the monthly fees of approximately $5/ per month.

- It also charges up to $20 for overnight delivery of domestic checks.

- It also charges for outgoing account transfer services up to $75 for the procedure.

- Robinhood also charges fees for regulatory trading of $5.10 on $1 million sales.

- It also charges fees on transfer of shares: for equity sells it charges up to $0.000119 per share and for contract sales it charges $0.002 per contract.

- It charges up to $5 for paper statements on a monthly base, $2 for confirmation of papers, $20 for domestic overnight mails, and $50 for international overnight mails.

- For the depository receipts, it may charge for the custodial fees from $0.01 to $0.03 per share counted.

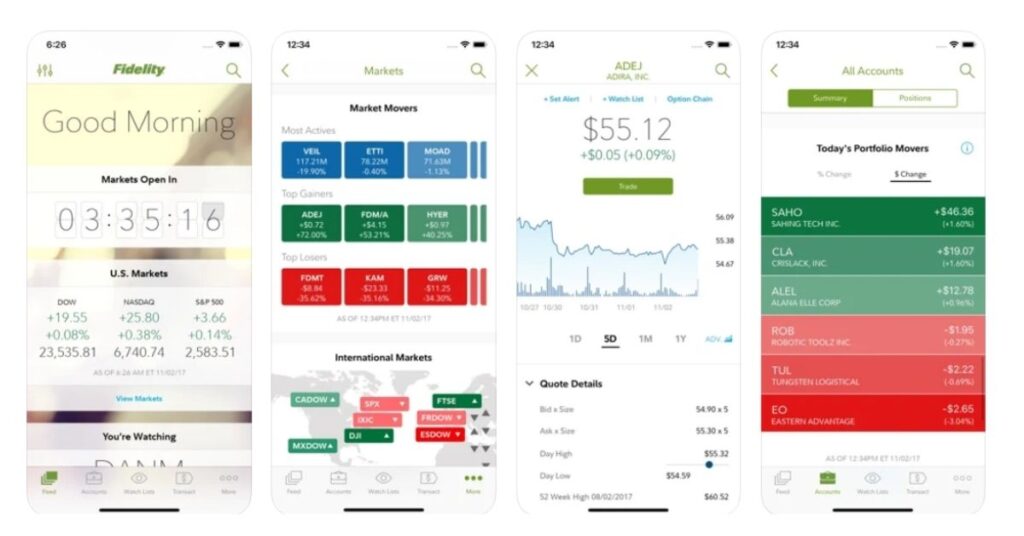

Fidelity

Fidelity Investments is for the human who wants to learn stock markets scenarios with the facility to start trading stocks, ETFs, and mutual funds at instant clicks.

Fidelity app has great research tools and the stock screening combines more than 140 criteria with 20 themes namely artificial intelligence, cloud computing, drones, and much more. It also has a huge collection of educational backgrounds for trading and investing.

Fidelity also has live sessions and interactive sessions namely the Trading Strategy Desk where any of its users can ask professionals for trading-related queries and doubts to get a perfect idea regarding the same.

About Fidelity

Fidelity stands for Fidelity Investment and is in the industry of personal finance and stockbroking since the year 1946. Fidelity is a well-known company and stands among the largest brokers in the United States.

Fidelity Investments not only just entertain the investors of the long run, but also as educational tools for the new beginners in the field of stock broking and investments.

Fidelity charms the customers in offers namely low costs transactions, best trade executions, asset screeners and robust research, and also rich educational offerings.

Key Features of Fidelity

- It offers a learning platform to learn regarding the stock market and cryptocurrencies while listening to the webinars, podcasts like Webull does.

- It also offers Bloomberg content similar to Webull and also offers access to market information.

- It also offers a cash management category where you can manage your purchase and sell histories regarding the transactions made by users.

- It also offers trading tools namely real-time market quotations same as Webull offers its users.

- It also offers facilities like transferring stocks and currencies, trading them, depositing them, and also allows paying bills.

- It also offers the facility of linking external accounts to its users.

- This app also has a voiceover service with dynamic type.

- This app offers customized notification of your favorite stocks same as Webull.

- This app also offers customer service 24×7 with a professional guide for financial concepts.

Fees of Fidelity

- It charges $0.65 per contract.

- It also charges up to $32.50 per 50 optional contracts.

- It also charges for the combo of 500 shares + 5 contracts at $3.25.

- It may charge up to $49.95 for mutual funds outside the no transaction fee feature.

- It charges $75 on the purchase of CGM, Vanguard, Sequoia funds, and more.

- It charges $32.95 per trade as a live broker fee.

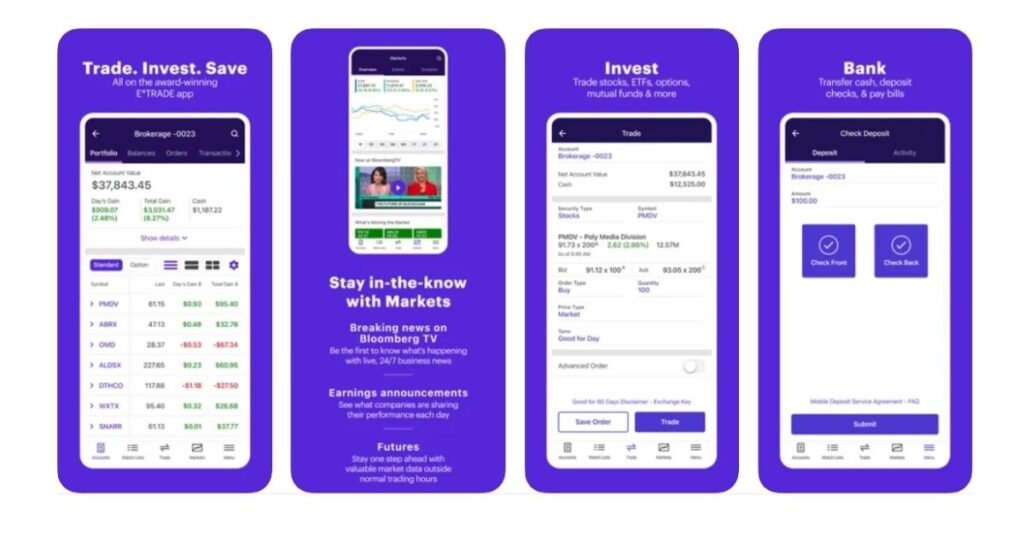

Etrade

Etrade is a great application for beginners to start trading and investing. Etrade helps beginners to get knowledge about the stock market, investing, and trading on a simpler basis.

Etrade specialty is in its app, whereas other competitors have only one application, ETrade offers 2 different mobile applications for investors with different specifications and requirements.

Etrade also offers 100 technical studies and also 30 drawing tools with streamlined trade tickets and customization options to its users. Etrade also provides real-time data and places, portfolios, and every information you need for investing and trading.

About Etrade

Etrade has made the name in the first online brokers listed for the United States. Etrade also offers commission-free trading on stocks, options, and ETFs too.

Etrade provides immensely huge investment selections and also gives the best user interface to its audience. ETrade also offers a huge selection of educational resources and offerings.

Key Features of Etrade

- It provides real-time listed stocks with trading options just as Webull does.

- It provides companies portfolios which are done by professionals which gives security and accuracy of stocks and prices similar to Webull.

- Same as Webull it also offers quotations and charts for the companies and their profit-making stocks and market trends.

- It also offers the option to trade mutual funds like Webull.

- It also gives access to the trading tools like education related to financial concepts and much more in detail.

- This app also streams Bloomberg content same as Webull.

- It also offers customer service which is in-built in the application.

- It also has a unique feature of transferring funds, paying bills, depositing a check, and also access to the ATM facilities within the app.

Fees of Etrade

- Etrade charges $0.50 as an optional contract fee for 30+ trades.

- It charges $0.65 as an optional contract fee for less than 30 trades.

- It also charges $25 for broker assistance trades to its customers.

- It also charges for the over-the-counter stocks up to $6.95 as commission fees.

- It also charges up to $10 to $250 for online secondary trades of bond worthy $1 per one bond.

- It also charges $2.50 per contract for future products.

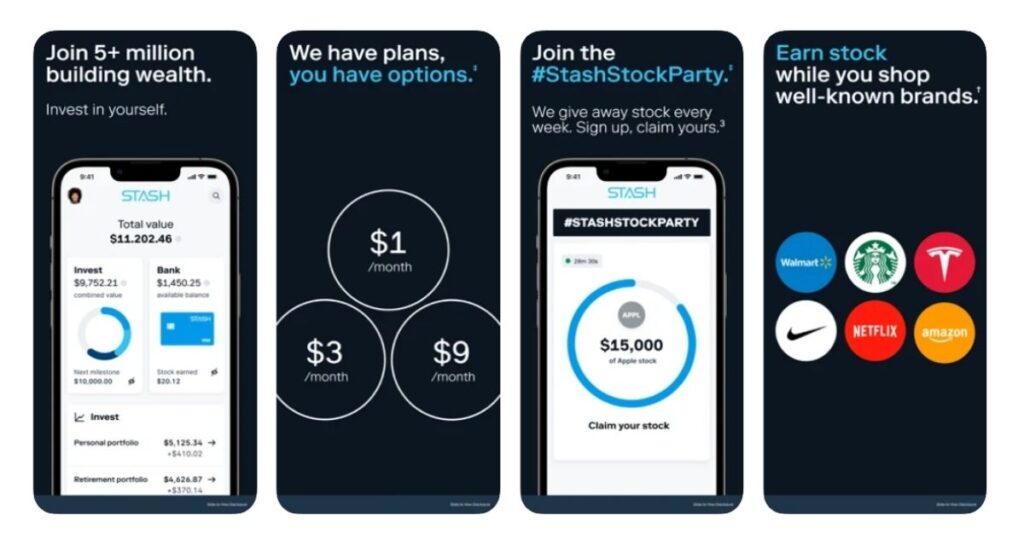

Stash

Stash offers its services in the personal financing category. It has made investing and trading just one way to maximize users’ wealth and benefit them in economic terms.

Stash makes the best alternative for Webull because it has many features like Webull and is tagged to be the perfect fit for beginners in trading.

Stash also provides its users with three different subscriptions and education content to stream and understand in detail any queries and doubts regarding cryptocurrencies and trading.

About Stash

Stash firmly stands for Stash Financial, Inc which a private company founded 7 years ago in year 2015. The current revenue earned by Stash is up to $2 billion as of the year 2020.

The hands behind making Stash Financial, Inc successful are Bradon Krieg, David Ronick, and Ed Robinson. The headquarters are geographically located in New York City, United States.

The products offered by Stash are investment management, investment portfolios, stock portfolios, and also stock trading. It offers services in the category of retirement, banking, investments for families and individuals, and much more.

Key Features of Stash

- It has a customizable limit for you to choose how much you want to save and invest.

- It also offers a professional portfolio of companies and their share market situations like Webull to give you the true market scenarios.

- It also offers safety and protection against money without cutting any fees.

- It also offers a card facility namely Stock Back card which offers stock in well-known brands.

- It also offers different plan investments namely retirement plans and family plans.

- It offers personalized quotations and news like Webull for its users.

- It also offers paid subscriptions with more exclusive features and the facility of personalized advice by professionals with a deposit account and much more.

Fees of Stash

- It charges you up to $5 for beginning the investing journey.

- It charges $1 per month for the stash beginner program.

- It charges $3 per month for the stash growth program.

- It charges $9 per month for the stash plus program.

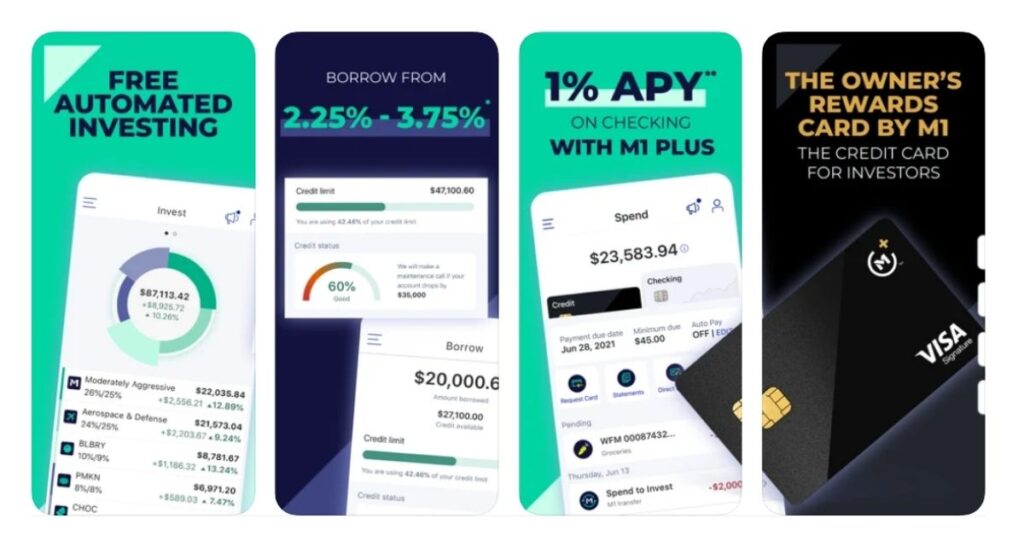

M1 Finance

M1 Finance offers commission-free investing which currently has thousands of investors who trust M1 Finance with options like saving, trading, and investing their wealth for a better future.

M1 Finance has a zero fees feature for the trading experience and account management of its users. It also provides full-fledged portfolio reports regarding cryptocurrencies and stocks to make people understand the same trends and much more.

The account minimum for the retirement accounts is kept to be $500 and the regular users need to maintain at least $100. It also pays 1% interest for the cash balances maintained in the user’s account.

About M1 Finance

M1 Finance is popular with its short-form M1. It is an American-based private company that offers financial services in the fintech industry.

M1 Finance was founded 6 years ago in the year 2015. The hands behind M1 Finance are Brian Barnes the founder and the chief executive officer of M1 Finance. Currently, more than 300 employees work under the roof of this fintech company.

Like M1 Finance, they have more products namely M1 Borrow, M1 Invest, M1 Spend, and much more. They offer its services for commercial banking, stock brokerage, wealth management, and also an electronic trading platform.

Key Features of M1 Finance

- This app features an opening category of accounts namely individual, joint, custodial, or trust account.

- It also has the facility of openings of SEP, Roth IRA, Traditional, or rollover.

- It also offers to borrow against user’s assets and hold from 2% to 5% of rates.

- It also provides account protection up to $5000000 for the securities in the user’s account.

- It also offers news and quotations of market scenarios and the history of different companies like Webull.

Fees of M1 Finance

- It charges from $0.06 to $0.20% as an investment fund fee.

- It also charges the same range of $0.06 to $0.20% for banking fees too.

- It charges an annual fee of $125 per year.

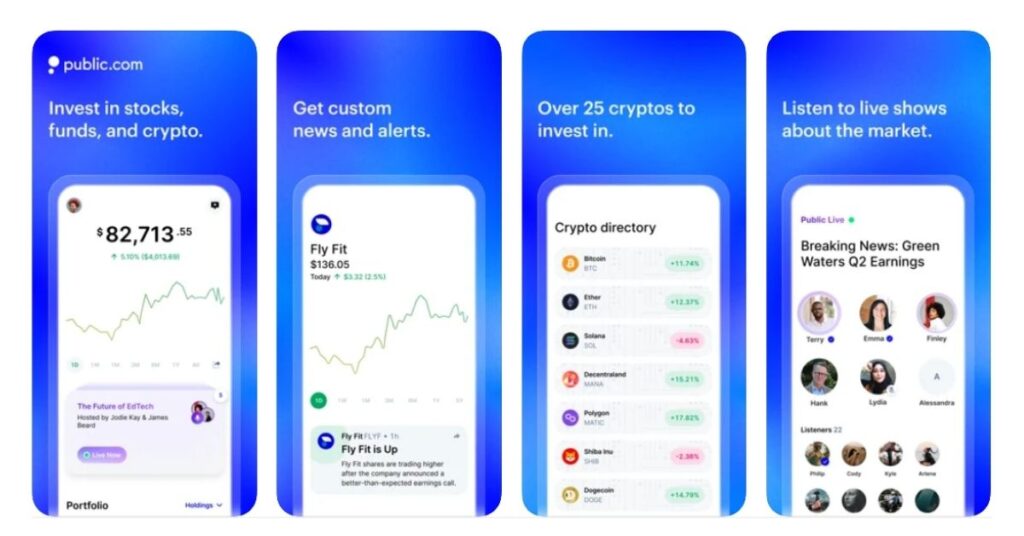

Public.com

It has an easy and sleek interface to astonish its users and provide similar services like Webull to its users.

The public has a huge portfolio regarding ETFs, mutual funds, crypto, and stocks to look out for. The public also has a unique feature of the referrer and referee to win free stocks.

In detail, Public offers its users a free stock when they refer any stocks or crypto to their friends or in the social community. It also has a facility to chat with friends, to made groups with family, and many more features to stay in touch with trends as well as humans.

About Public

The public is known for the commission-free stock trading app which provides its services in the fintech industry. Public also allows its customers to buy fractional shares and also has a key appearance of social media.

The only drawback of Public is it does not accept payments related to the order flow but still it has a great user-interface application. The public also offers investment plans for financial products, stable future finance, and also educational backgrounds.

The public is a great fit for beginners to try investing as it offers educational tools and learnings about the stocks and investments and how to earn profit out of it.

Key Features of Public

- It offers listening to podcasts and audio shows to get a grasp of financial concepts like Webull.

- It offers to build a professional portfolio for companies and their history of trading, investing, and making crypto similar to Webull.

- It offers no account minimums compulsions.

- It also features updated and new IPOs and SPACs.

- It doesn’t sell your investments or your holding to a third party like Webull.

- The available cryptocurrencies here are Bitcoin, Ether, Shiba Inu, dogecoin, Solana, Shushi, Uniswap, Polygon, and much more.

- It also has live customer support via call and email which helps out every user with their financial queries.

Fees of Public

- It charges $35 for the statements on paper.

- It also charges for the returned checks and stops payments up to $30.

- It also charges for outgoing account transfer services up to $75.

- It charges up to $35 for the overnight checks in the areas of the United States.

- It charges $30 for the domestic wire transfers.

- It charges $30 for phone transactions with the facility of brokers.

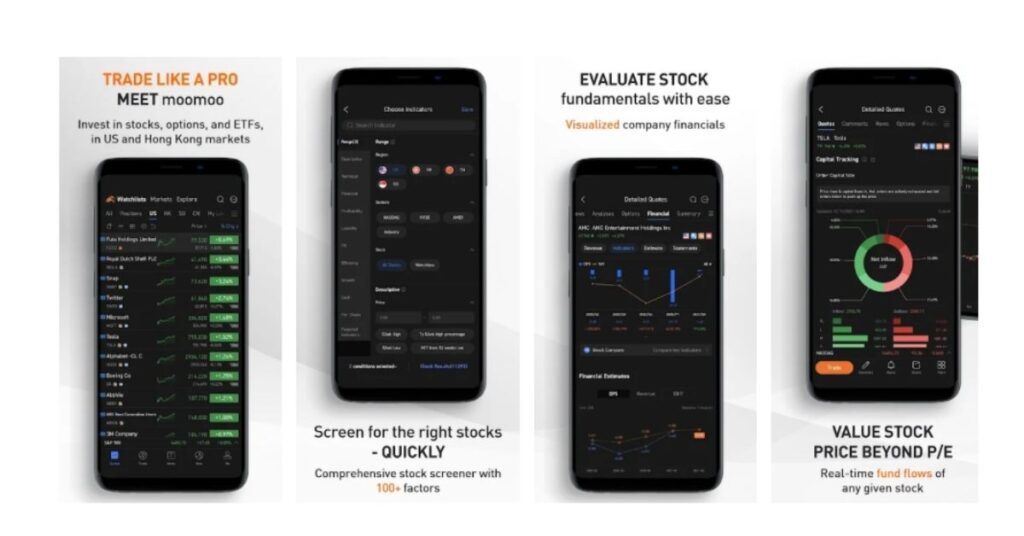

Moomoo

Moomoo teaches its audience to trade like a pro which offers a learning platform similar to Webull.

MooMoo offers free stocks, options, and ETFs also. It is known for the easy and fast service regarding opening an account. It also has many statistical quality tools to analyze market situations and get a transparent and accurate report of stocks.

Currently, Moomoo only offers account openings for individuals. Moomoo is not available for families, joint accounts, corporate accounts, and many more of the same category.

About MooMoo

Moomoo is meant for the smart trading services in the category of fintech. Moomoo also offers low costs for commissions or fees so people can find it easy for investments and much more.

The best feature of Moomoo is it has more than 8000 different categories of stocks to invest, buy and sell in. It also has a great real-time feature to look out for. It also offers zero minimal account management for pocket-friendly users.

Key Features of Moomoo

- It offers 62 free technical indicators snd 37 charting tools like Webull to get easy market insights of the different stocks and companies.

- It also has personalized alerts for the favorite companies’ stocks like Webull.

- It also offers live support for the audience to solve every query they have.

- It also offers free market information and real-time data quotations similar to what Webull offers.

- Just like Webull, it also shows market information that is accurate and shows the history of companies and their losses and gains.

- It also offers Bloomberg content to follow and hear like Webull.

- It also gives the latest news regarding market trends and policies and cycles and much more.

Fees of MooMoo

- Commission Fees: It charges for US stocks up to $0.0049 per share and $0.99 per order. It charges 0.03% of investments for Hongkong stocks or $3 minimum. It charges 0.03% for Singapore stocks.

- Platform Fees: For US stocks up to $0.005 per share and $1 minimum per order. For Hong Kong, it charges up to $15 per order, and for Singapore, it charges $1.50 minimum or 0.03% of the transaction amount.

Which is the Perfect Fit for you?

The perfect fit to find from the above best alternatives of Webull is a tough thing to accomplish. Hence you should look out in detail for every app and experience its user interface and facilities to choose as per your requirements.

We can’t just give away one app that is a perfect fit for you. Hence we offered you the best 7 alternatives which work like Webull.

FAQs: Apps like Webull

Can Webull be trusted?

Yes. It is well power-backed with safety measurements and security protocols to build their trust with the audience.

Is Webull owned by China?

No. The ownership may be divided among Chinese key people but the company is based in the United States and is registered at the place of New York City.

Is Webull fake money?

Kind of. Webull offers the learning platform with paper money namely virtual money where you can learn how trading works and how you invest your real money. The fake money is for the trials to get an idea of the real stock market and crypto world.

![7 Investment Apps Like Webull & Webull Alternatives [2024]](https://viraltalky.com/wp-content/uploads/2021/11/best-apps-like-chime-alternatives.jpg)