Prism vs Mint: Technology surely moves rapidly, from debit and credit cards to automatic bill payments, it has modernized personal finance and simplifies transactions.

So, if you want to take your bill-payment to the next level with Prism and Mint and are wondering which is the best budgeting app and which service offers the best features, don’t worry.

In this post, we’ll give you a detailed Prism and Mint comparison, including how they work, pricing, key features, and key differences, which will help you pick the best budgeting app.

Both Mint and Prism are amazing services that let you track your bills and budget for them. However, they are so much different. So, keep on reading the article to find out more about the Mint vs Prism comparison.

Prism vs Mint: Overview

Prism:

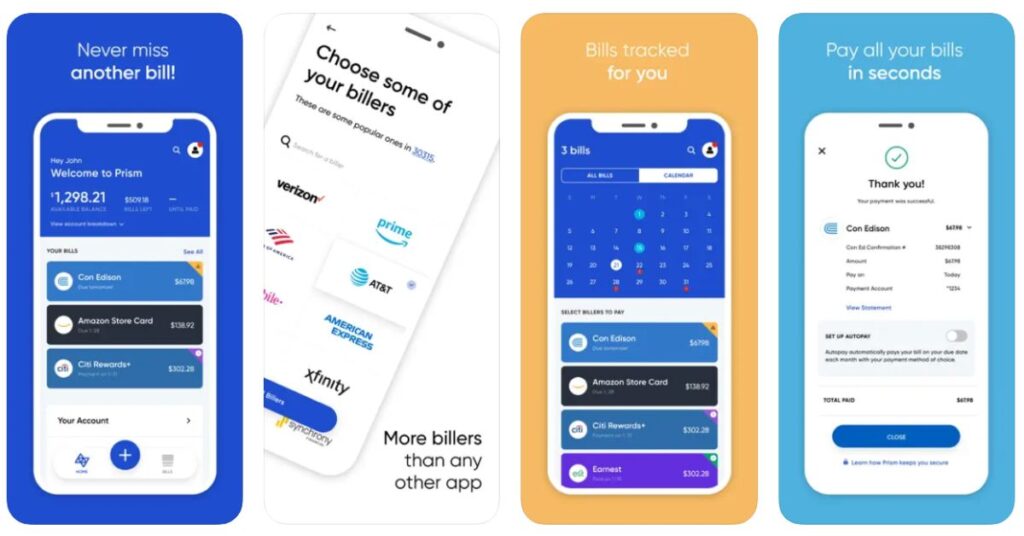

With Prism, get a complete picture of your finances by keeping all your bills updated. It is a free personal finance and bill organizer tool that automatically tracks bills and sends bill pay reminders.

You can schedule payments to be made on the same day or several days in advance. Moreover, you don’t need to log in to multiple accounts to pay your bills because it gives you an easy-to-use interface.

However, unlike Mint, it only aggregates income and expenses instead of bank and investment accounts.

When it comes to security, it is crucial for any financial account app to be secure. But with Prism, you don’t have to worry about your information because it uses 256-bit AES encryption and biometric/PIN authentication security.

Mint:

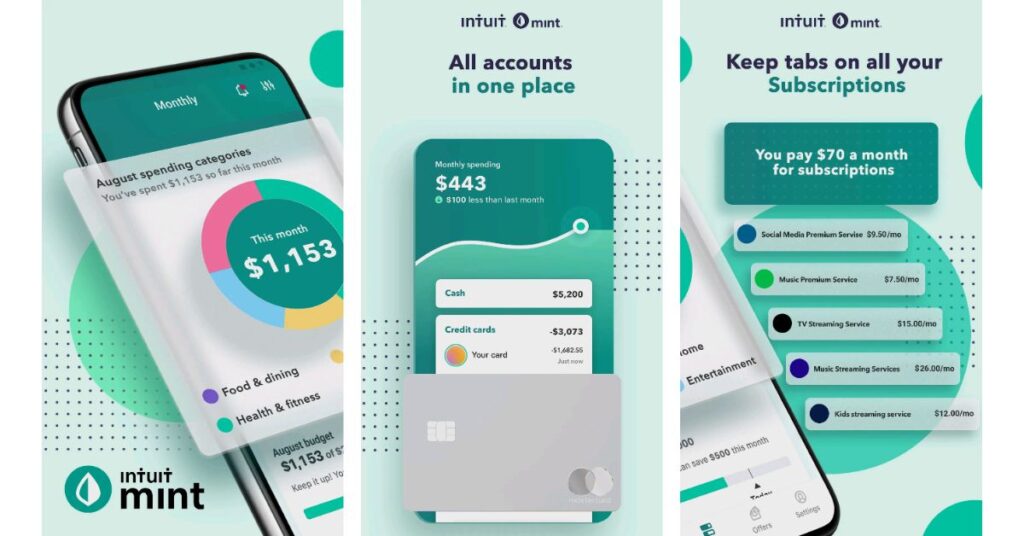

Like Prism, Mint lets you connect all your financial accounts in one place. It enables users to track spendings and savings and set and track budget goals.

You can sync up money management accounts, credit cards, bank accounts, retirement and investment accounts, and other financial accounts.

Then easily place your expenses in budget categories such as bills, shopping, and transportation. Or else personalize these categories and set limits. If you’re approaching those limits, Mint will remind you.

It carefully guards user information with the latest security measures, including Touch ID and 4-digit code, which let only you to view your account.

How Do They Work?

Prism:

To create an account with Prism, you’ll need to be at least 18 years old and then create a personal ID number and a password to activate your account.

Once you sign up, sync your bank accounts, debit card, or credit card, and the biller that you wish to include in your Prism account. You can then decide how much you want to pay towards your bill, either the full amount or the minimum payment, or a custom amount.

Remember that some billers may charge a fee if you pay using a credit card or other payment methods. So, it’ll warn you prior if you use a payment method that has a fee.

Finally, when you are ready to pay your bill, simply tap on the pay button to schedule your payment, and you’ll be notified that your bill payment has been scheduled.

Mint:

Get started with Mint by simply downloading the app on your device and creating an account using your email address or mobile number and providing your personal information.

After you sign up, connect your bank account, credit card, or debit card so that Mint can monitor your income and spendings. Then, it’ll split your income into categories that you can customize if you want.

You can set limits for every category and then manage your spendings and transactions for a better budgeting experience. Moreover, it’ll monitor how you pay with credit card payments, bills, etc., and will provide you with a detailed credit report completely free.

Pricing

Prism:

Prism is a free service. Although many billers offer free payment options, only free offer free payments when using certain options like your bank account and others charge a fee for all options.

Mint:

Like Prism, Mint is completely free and there is no premium version for an added cost. However, if you are an iOS user, you can be able to access Mint Premium which costs $4.99 a month.

Mint Premium includes the following features:

- Ads: It’ll remove all ads and third-party offers outside the Marketplace tab

- Advanced data visualization: Get access to specialized analytics like spending projections and breakdowns for each spending category, and visual indicators that alert you to projected overspending

- Advanced spending graph capabilities: Download your Mint data as a CSV file, share a snapshot of your spending graph, and compare your spending habits to other Minters

- Mint Premium Arcade: Play two exclusive games that offer up saving and spending tips

Key Features

Prism

- Automatic bill reminders: It’ll automatically track bills and end due date bill reminders and save money by never paying a bill late fee again

- Bill trackers: It combines all your financial accounts together at once and send you reminders about due dates

- Manage debt, bills, expense tracker & money: Track bills, account balances, income, and monthly expenses with an easy-to-read graph

- Take back your time: No more logging into several websites to check due dates or pay your bills

- Account syncing: Syncs account every day, and you can manually refresh a biller

- Choose your bill payment source and date: You can choose to pay your bills from your bank account and make an immediate payment, or you can choose a future date

- Payment cancellation: When you make a payment through Prism, you’ll get ten minutes to cancel that payment

Mint

- Monitor your cash flow: Helps you track expenses, transactions, account balance, expenses, monthly budget, subscriptions, and taxes

- Manage bills: Track bills and your financial goals along with your account balances and get monthly bill reminders to avoid late fees

- Set financial goals: set personalized financial goals and get actionable tips customized for you

- Spend Smarter: Discover new ways to use this app and reach your financial goals

- Budget Alert: Get alerts when your balances are low, or bill payments are due to avoid fees and penalties

- Investment tracker: Offers the right tools for your investment needs and help you stay on top of your investments

- Free credit score: Get a free credit score directly in the app with no credit card required

- Categorize bank transactions: Set budget categories to helps you track your spendings

- Add tags: You can add tags, and organize your transaction as you choose

Key Differences

| Prism | Mint | |

| Cost | Free | Free and Mint Premium at $4.99 for iOS users |

| Supported Billers | Credit unionsMortgage lendersStudent loan lendersPhone servicesCable companies Insurance providers Water and waste utilitiesElectric utilities Numerous subscription services | Phone servicesCredit unionsWater and waste utilitiesMortgage lendersStudent loan lendersCable companies Insurance providers Electric utilities Numerous subscription services |

| Platform | Android, iOS, Windows Phone, Windows | Android, iOS, Windows Phone, Windows |

| Late Fee Reimbursement | Up to $1,000 lifetime maximum per user | No |

| Budgeting | Yes | Yes |

| Payment Methods | Debit cardCredit cardACH Bank Transfer | Debit cardCredit cardACH Bank Transfer |

| Payment cancellation period | 10 minutes | N/A |

| Investment Tracking | No | Yes |

| Two-Factor Authentication | Yes | Yes |

| Data Encryption | Yes | Yes |

| Phone Support | No | Yes at 1-800-226-8848 |

| Message Support | Yes | Yes |

| Email Support | At [email protected] | At [email protected] |

| Customer Service Hours | 24/7 availability | 5 AM to 9 PM seven days a week |

Prism vs Mint: Which is Better?

Both Prism and Mint are great apps that help you get control of your monthly budget. They are free to use, track your bills, and budget, and even notify you of upcoming bills.

Without any doubt, Prism is a great fintech app that can help you organize your bill-paying activities and even help you improve your credit by helping you to pay your credit cards and other loan accounts on time.

And you also get a choice of payment options like bank or debit card. Since it is free it displays a lot of ads, which a lot of people find annoying.

Moreover, there is no paper statement available and there is no phone support. This means you can only connect with customer support through email only.

On the other hand, Mint is also a free app, which offers a premium version for only iOS users. So, if you don’t mind getting bothered with the annoying ads, it can be a good fit for you as you can access a lot of features.

Lastly, if you are interested in Prism and want to begin investing, you can use Prism along with Mint. Nonetheless, before deciding on any service, kindly do your research and pick the one that suits your needs.

Hopefully, this article on Mint vs Prism comparison has helped you understand everything about each service clearly.

FAQs

Does Prism cost money?

Prism is a free service that allows you to track and pay your bills in one place.

Is Mint the best budgeting app?

Mint is a popular financial service that lets users track spendings and savings and set and track budget goals.

Is Prism a trustworthy app?

As it is crucial for any financial account app to be secure, Prism uses 256-bit AES encryption and biometric/PIN authentication security.

How much is Mint a month?

Mint Premium costs $4.99 a month, and it is only available for iOS users.

What fees do Prism charge?

Even though many billers offer free payment options, there are some billers that charge a fee for all options.

Pocketguard vs Mint: Which Is Better? [2022] GoodBudget vs Mint: Which Is Better? [2022] Nerdwallet vs Mint: Which Is Better For You? [2022]

![Prism vs Mint: Which Is Better? [2024]](https://viraltalky.com/wp-content/uploads/2022/08/Prism-vs-Mint.jpg)