Nerdwallet vs Credit Karma: Building a career is a heavy task to do. In the 20s of life, you have to legitimately do 20 tasks together ina one go. Of course, all this helps you make a career, but with a career, you need to settle down with great future backups too.

Of course, now for materialistic security and gain, you can just end up making your savings balance zero and buy everything at once. For this, you need loans to be taken up, paid one by one, and proper financial planning.

And for taking up loans, credit score and credit report are now as important as your professional resumes for the job. But with work and 20 more things, you just can roam for the bank and their paperwork.

Hence, for your rescue, some apps provide you with transaction history, tips, and tricks to manage your finances well, with bill payments, and importantly a good credit score checker and report maker.

In this article, we are going to compare the two best apps which are well known in finance and budgeting with great credit scores and report builders. The two apps namely are- Nerdwallet vs Credit Karma.

By the end of the article, you will get all the detailed comparisons of Nerdwallet vs Credit Karma with their pros and cons, prices, perk highlights, and much more.

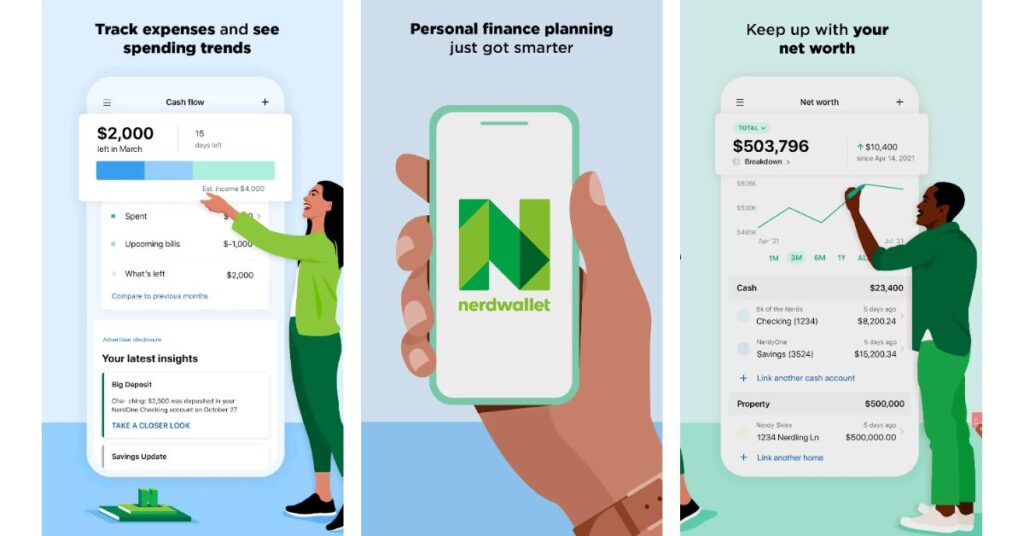

What is Nerdwallet?

Nerdwallet is a great app for those who are searching for a good income and expense tracker. It is a great alternative for small businesses and customers to track their purchase history, income, expense flow, and much more.

Nerdwallet isn’t limited to one feature but has many features like money tracking tools, personal finance tips and tricks, mobile apps, and much more. It offers its users ample tools in education as well as beginner-level terms of credit making.

It provides detailed information on financial decisions, insights, tools, and products to make it easy for users to make financial decisions without worrying too much about their credit score, savings ad losses.

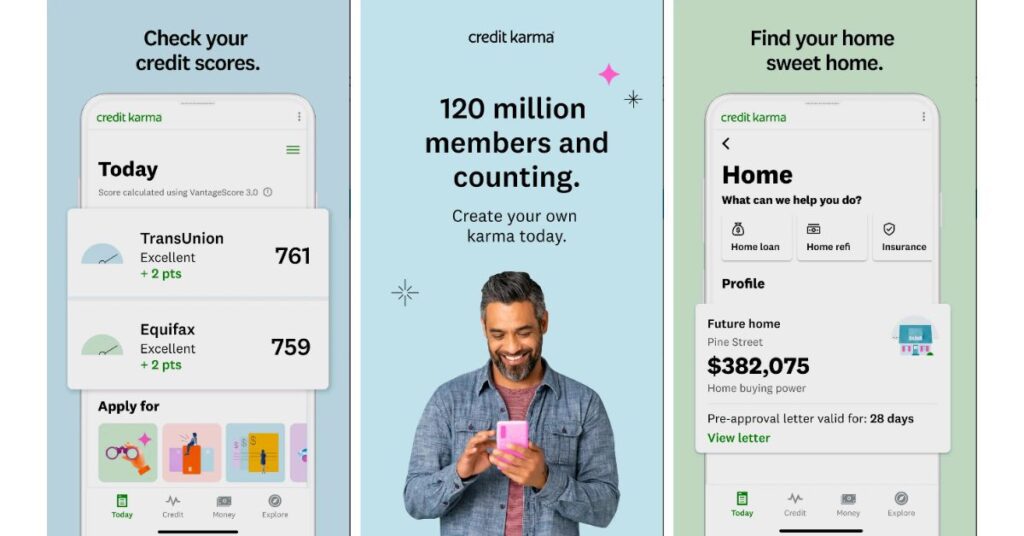

What is Credit Karma?

Credit Karma is a great app for personal financing services with maintaining a good credit score and overall reports. Credit Karma has great features and basic requirements to earn a good credit score.

Credit Karma has kept the app very minimal and it asks its users to pay bills regularly, use Credit Karma to note down their regular payments, bills paid, etc, and get a good score of credit from the app experts.

The app also provides you with the potential credit options to help you make a good score if you are not perfect with budgeting and finance matters.

How Do Nerdwallet works?

Nerdwallet has a very easy usage login procedure to start with. Nerdwallet needs an account opening for using its finance management tools.

To open an account with Nerdwallet, you will need some personal details like email address, credit cards, bank details, debit card details, current work profile, and much more.

To create an account with Nerdwallet you need to sign up with your email address and phone number. After that write down your details and name correctly. Then, link your bank account with Nerdwallet.

Once you have linked your bank account with Nerdwallet, also add your cards and ink them too. Now since you have linked all your bank details and cards, Nerdwallet will start collecting data and transaction history for the same.

Once it has checked down your history of bank accounts and cards ad payments, it will evaluate and track all your income and expenses to give you a detailed report of savings and credit score and credit reports as well.

Then, they will eve provide you with current progress in credit score and report and tips and tricks for the newbie to maintain their positive credit score for future benefits of increasing credit score higher to the max possible.

How Does Credit Karma work?

Credit Karma works very easily. It is a great deal for those who don’t open and close accounts instantly or in a short duration, who maintains all the savings balance, who stay active and current on the loan payments, and who avoid all the negatives of banking history.

If you are one of the people, who maintains a good account and is good with paying loans then Credit Karma will give you rewards in the form of improving your credit score higher ad easily by just maintaining good books with banks.

It is also a good option for people who don’t have much knowledge about how to make a good credit score since it also provides educational tips and tricks to improve credit score with also giving you all the important notes and alerts of same.

To start your journey with Credit Karma is very much simple and easy to follow. You will need an email address, name, few financial-related information like personal details, social security number, and much more.

After that, it will give you some security options for the sensitive data you provided and also gives you the option to choose the credit alerts and the way you need them to receive as in via email, text et.

Once all these are completed, you can easily get access to the main job work of Credit Karma. It will ask you to choose the reported plan that offers two or three reports from different bureaus in free and paid versions respectively.

After choosing which report is good for you, it will ask you to link your bank accounts and credit and debit cards to monitor your creditability and generate the report and score.

Perk Highlights: Nerdwallet vs Credit Karma

Nerdwallet

- It is available in the web versions and desktop versions.

- The app is available on Google Play Store as well as Apple App Store.

- It offers an income and expense tracking feature.

- It offers free credit reports and scores for the users.

- Nerdwallet also is said to be completely free cost.

Credit Karma

- It is easily available on desktop and mobile applications.

- It offers a free version of Credit Karma.

- The app has a free Credit Report and Score available.

- It also has a web interface for the users. ‘

- The app also is available on Apple Store and Google Play Store.

Pricing and Plans: Nerdwallet vs Credit Karma

Nerdwallet

- Nerdwallet is said to be free of cost.

- The app may charge up fees for some exclusive features somehow.

Credit Karma

- The current paid version of Credit Karma is said to be $19.95 a month.

- The paid version of the app offers exclusive features.

- Credit Karma usually has limited access and tools for the free version of the app.

Pros & Cons: Nerdwallet vs Credit Karma

Pros of Nerdwallet

- It tracks all the income and expenses done through your bank accounts and cards/

- Nerdwallet also helps you handle financial crisis and credit score issues with ease.

- The app offers a huge collection of editorial and educational content so no one can go wrong with the credit system and tools.

- It has a sharp and very profound search bar feature that navigates your required product and content easily.

- Nerdwallet also has a very stable user0interface mobile application available for its users.

Cons of Nerdwallet

- The home page design may be a bit confusing for the users.

- The user interface is quite tough to navigate and work out for the new users as well.

- The Nerdwallet app offers a few transaction categories.

- The app shows the partnered app content more which can be misleading for the customers.

Pros of Credit Karma

- It has a free version with limited tools to be used by its users.

- Credit Karma offers excellent user experience and customer support.

- The app also explains all the rationale credit reports as well as scores and hence also gives you tips to improve the same.

- It also suggests solutions to the financial probe areas of users.

- Credit Karma is now updated with a no-fee checking account.

- The mobile application offered by Credit Karma is a great tool to start with.

Cons of Credit Karma

- It doesn’t offer any income or expense tracking facility yet.

- The app has many ads which can distract people from the main job work of Credit Karma.

- It supports and shows recommendations of financial products of the third party which are usually of no use to the users.

Final Verdict: Which is Better Nerdwallet or Credit Karma?

Hence here we have seen what Nerdwallet vs Credit Karma looks like. They both in a general sense offer the same services and may end up being each other's alternatives but ahs some unique content to look for.

If you are looking for hefty finance management with a friendly user interface then Credit Karma is a great option, but if you are looking for a budget-friendly option then Nerdwallet wins.

Yet, if you are looking for a pure income and expense tracking feature then Credit Karma will disappoint you a bit since it doesn’t offer to track expenses and incomes whereas Nerdwallet is free and offers income and expenses tracking.

Hence, there are many similarities as well as the difference between Nerdwallet vs Credit Karma and yet choose wisely with help of the information provided in this article.

Nerdwallet vs Mint: Which Is Better For You? [2022] YNAB vs Truebill: Which Is Better For You? [2022]

FAQs

Who owns Nerdwallet?

Tim Chen is the owner of Nerdwallet.

Who owns Credit Karma?

Intuit acquired Credit Karma in the year 2020.

![Nerdwallet vs Credit Karma: Which Is Better For You? [2024]](https://viraltalky.com/wp-content/uploads/2022/06/Nerdwallet-vs-Credit-Karma.jpg)