GoodBudget vs Mint: A budget is a must. Even if you earn more than yous pent, still budget is very much necessary to go through your finances every month, bi-weekly, quarterly, or every year. Without a budget, we will never know how much we spent and on what.

Budget becomes vital if you are looking forward to savings options as well unless you crack a good budget and how to ace the same. Now no one has enough time to sit down and find a person who will help you meet the best budget for yourself.

Hence the apps come in handy when there are plenty of apps in personal finance options. The apps in this field offer tips, finance monitoring, and many more useful tools to ace your finance game up.

In this article, we are going to talk about the two popular apps in the field finance industry which helps you manage a budget and progress in savings techniques. The two popular apps we are going to discuss are GoodBudget and Mint.

By the end of the article, you will get comparison details about GoodBudget vs Mint with their key features, pros, cons, prices, and much more.

What is GoodBudget?

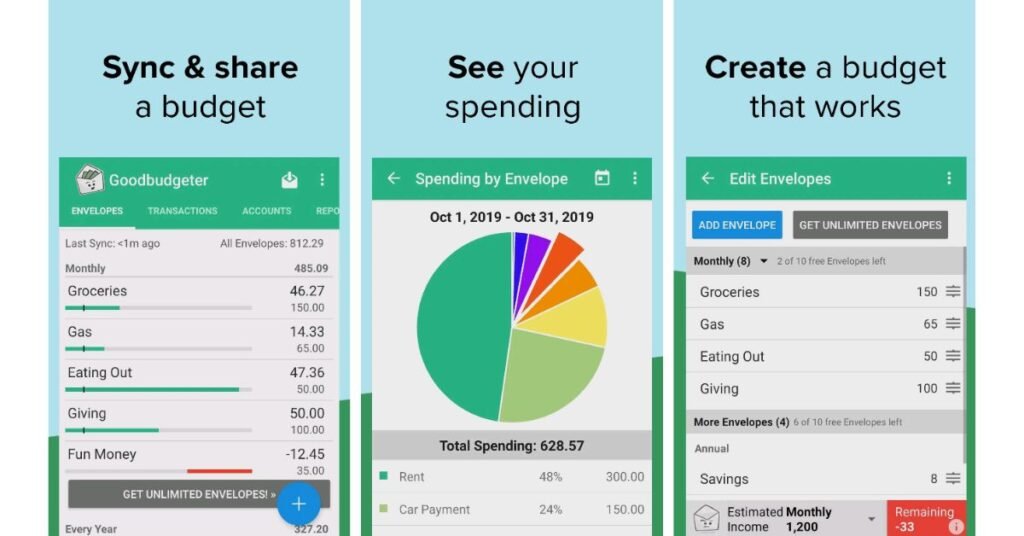

GoodBudget is a simple app for budgeting that works as a digital envelope system to keep your money accountable in income and expenses. The envelope system divides your income into specific categories like rent, groceries, dining expenses, etc.

The app is said to be very simple so that even the non-commercial people can easily crack down on what budget-making seems to be and how it is aced up. The app ensures that you don’t overspend the with the limits yous et for each category.

GoodBudget is a great alternative for the people who are beginners in finance management and budget making. The app is useful for people who need to track their spending and improve it with a less complicated app.

What is Mint?

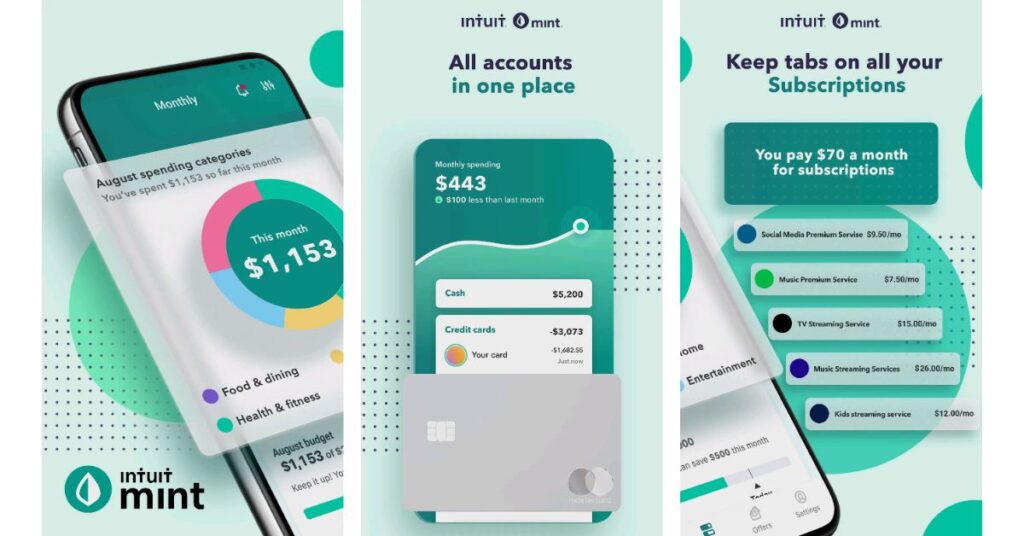

Mint app is a free finance app that makes it easy to manage all your expenses and incomes in one go. The app also promotes savings benefits and exciting tips and tricks to do so. The app is developed by Intuit, Inc and is specially curated for budgeting.

The app is free to download and is completely free to use, it doesn’t need any subscription or paid premium packages for users to log in. The Mint app offers its facility free of cost.

The app lets users manage and track their spending and income ratio and also gives category-specific budgets and savings goals to look up for. The app connects with your financial accounts and then checks for your spending habits and patterns to customize your budget.

How does GoodBudget work?

The app works very simply. You don’t need to link your bank accounts or credit cards, etc. You just need to open your account with the app with your email address and mobile number.

Once you have opened an account with Goodbudget, you have to enter everything manually whether it be income flow or expense flow. The app doesn’t provide any automatic updates regarding income and expenses.

You can make envelopes for each payment like groceries, savings, property taxes, dining expenses, etc, and then it will show your spending in digital and colorful graphs with notifying when you are over-spending or here you have forgotten to pay.

How does Mint work?

The mint app is great for people who want to use an automatic budgeting app rather than enterings spending and incomes manually. This app is a great alternative for people who agrees with linking financial accounts with apps.

To start your journey with the Mint app, you first have to install the the app from web store, apple app store, or google play store. The app is free to download and then you have to create an account using your mobile number or email address.

Once you have signup with your email address, then you will need to link your bank account and with credit and debit cards so the app can monitor your income as well as spending. Once you have allocated all that, it will divide your income into categories that you can choose to do so and customize.

After diving into categories, you can set limits for each and then monitor your spending and transactions for a budgeting experience with the Mint app. Once you have entered all these details and the app is all set to monitor your incomes and spending, you can just sit back.

The app also provides credit monitoring for free, it will monitor how you pay bills, credit card payments, etc and will give you detailed credit report and credit score features for free without cost.

Perk Highlights: GoodBudget vs Mint

GoodBudget

- The free plan of the app offers 10 regular envelopes with 10 extra envelopes to divide incomes in.

- The financial account is managed by one user in a free plan.

- Devices supported by the free plan of the app are 2.

- The support managed in the free plan is kept limited up to community support.

- With paid plans, you will get unlimited envelopes and categories to divide your income.

- The financial accounts opened under the paid plan are unlimited.

- The accounts history kept by the app in the free version is 1 and for the paid version is 7 years.

- The devices allocated for the paid version are unlimited and support given to paid users is by email support.

Mint

- The app is free to use and download.

- Mint is a great alternative that updates the categories and entries of income and spending automatically.

- No manual hassles to look for.

- The app directly connects to your all financial accounts and monitors the income and expenses flow intensely.

- The app gives you a free credit score and details credit reports for making a good credit reputation.

- The app promises to give you a monthly budget, categorize expenses, track down your spending, monitor credit scores, and much more.

Pricing and Plans: GoodBudget vs Mint

GoodBudget

- The app has a free plan with limited features to go through.

- The paid plan of GoodBudget for monthly will cost you around $6 per month.

- The paid plan of GoodBudget for yearly will cost you around $60 per year.

Mint

- The app is said to be free to download.

- Overall the app is free to use and users don’t need to pay for any of its features.

- The Mint app does not have any paid subscriptions or plans.

Pros and Cons: GoodBudget vs Mint

Pros of GoodBudget

- The GoodBudget is affordable and intuitive.

- The app supports multiple devices and web extensions.

- The GoodBudget app also provides reports.

- The app also supports multiple users.

- It also can import bank transaction files to store them safely.

Cons of GoodBudget

- It has a limited free plan.

- The app requires manual logging

- It is quite slow compared to other apps.

- The features listed under the app are very limited.

Pros of Mint

- The Mint app is free to use.

- It is the secure and safest app.

- The app syncs every data with the set of financial accounts.

- It has great alerts and reminder tools.

- The app also offers free credit monitoring facilities.

- Mint also helps calculates net worth.

Cons of Mint

- The apps take a lot of time to set up.

- The categories offered by Mint may be assigned incorrectly sometimes.

- It gets technical glitches with occasional connection issues.

Final Verdict: Which is Better GoodBudget vs Mint?

Here, we come to an end with the comparison article of GoodBudget vs Mint. In this article, we came across the benefits, pros-cons, ket features, and prices of Goodbudget and Mint.

Hence the conclusions we observed that the Mint app is a great option for the people who need to have free apps and are not interested to pay for subscriptions or plans for monthly budgets. The mint app is said to be also a good option who want s automatically categorize expenses by tracking the spending.

But if you are looking for a simple application with manual categories and entries then GoodBugdte makes a great deal. The app does provide you with many other financial tools and gives you the exact envelope technique experience for budgeting.

Nerdwallet vs Mint: Which Is Better For You? [2022] Pocketguard vs Mint: Which Is Better? [2022] Prism vs Mint: Which Is Better? [2022]

FAQs

Who owns the GoodBudget app?

GoodBudget is owned by Dayspring Technologies.

Who wons the Mint app?

Mint app is owned by Intuit.

Is Mint free?

Yes. Mint app is free to download and free to sue. It doesn’t charge you a penny to use any features of the app.

![GoodBudget vs Mint: Which Is Better? [2024]](https://viraltalky.com/wp-content/uploads/2022/07/GoodBudget-vs-Mint.jpg)