Apps Like Zilch – With several retailers partnering with buy now, pay later services, it became easier for people to make purchases now and pay overtime.

Zilch is such a BNPL service in the UK that let you buy now, and pay later, with the first payment at the checkout and the remaining payments due every two weeks over 6 weeks.

It doesn’t charge any interest and even if you miss a payment, you’ll get emails to remind you of any overdue amounts. However, if you’re still not able to settle your payments after 14 days, they might end your eligibility.

Even though Zilch is an amazing BNPL site, you might want to look for its alternatives. So, here is a list of the Zilch alternatives!

6 Apps like Zilch & Zilch Alternatives:

With sites like Zilch, you get what you want today and split your payments over time. To prevent you from downloading any random sites or apps, we have curated a list of the top sites like Zilch.

Klarna

Klarna is one of the top apps like Zilch that offers different point-of-sale installment loans for customers. It is partnered with over 200,000 sellers and merchants.

Klarna’s main aim is to provide an easy payment solution for the eCommerce industry and to make safe and secure payments for both sellers as well as buyers.

Requirements for Eligibility

- At least 18 years old

- Have positive credit history

- Permanent resident of the UK

- Have a valid mobile number and email address

- Don’t have a lot of debt

How Does Klarna Work?

When you choose Klarna at the checkout, you can choose from different financing options – Pay in 3 and Pay in 30 days. Pay in 30 let you divide your purchase into 3 payments and Pay in 30 let you to receive your order before and get up to 30 days to pay, interest-free.

Besides, it offers a traditional loan option at selected retailers with an APR of 18.9% maximum. Moreover, you can track your shipments, view your purchase history, and process returns through the app.

Spend Limit: Although there isn’t any specific spending limit, your spending limit, and the ability to shop is generally determined by its soft credit check, the information you provide, and your buying history.

Repayment Terms: While making a purchase, you can choose from one of the three financing options – Pay in 3 or pay in 30 days or a 6 to 36-month loan.

Interest & Fees: Here is a clear breakdown of Klarna’s loan types and terms.

| Loan Type | Terms | Interest | Late Fee |

| Pay in 3 | Pay four equal installments due every two weeks | Interest-free | No late fee |

| Pay in 30 | Pay nothing for 30 days and then pay the balance in full | Interest-free | No late fee but if you don’t make the full payment, you might be considered in default |

| Longer Term Loans | Pay with a loan up to 36 months | Highest APR rate is 18.9% | No late fee |

My Argos Card

With the My Argos Card, you can shop at Argos and Habitat with flexible payment plans that give you extra time to pay entirely interest-free.

From the app, you can view your statements, personalize your credit plans, keep track of your recent transactions, set up payment reminders, and most importantly you can securely log in.

Requirements for Eligibility

- Be over 18 years

- Have your bank details

- Mention where you’ve lived for the last two years

- Have been a permanent UK resident for over a year

How Does My Argos Card Work?

Before you apply for an Argos Card online or in-store, its online application will let you see where you’ll be accepted or not.

If you are eligible, then you can shop where Argos Card is accepted. After you add what you want to your trolley, you’ll see your credit plan options and application details at the checkout.

Spend Limit: Your Argos Card limit is reviewed regularly and increased or decreased by the people at Argos Card. But if you want to increase your credit limit, you’ll have to navigate to your Argos Card account on your app or on the website.

Repayment Terms: It has standard 3–6-month credit plans along with special offer plans on certain products. However, based on what you buy, your repayment terms differ.

Interest & Fees: If you pay in full within your credit plan period, there will be no interest. But if you fail to pay in full, you’ll be charged interest on any balance remaining at the end of the plan.

Clearpay

Sister to the popular Australian BNPL service, Clearpay is one of the best Zilch alternatives. Clearpay helps you stay on top of your spending and keep track of your budget.

Clearpay offers only one type of payment plan that divides your total purchase into four equal amounts. You easily can view your payment schedule and manage your payment plan from the app.

Requirements for Eligibility

- Be at least 18 years old

- Have a valid email address and phone number

- Use a UK bank payment card

- Be capable of entering a legally binding contract

- Have a verifiable and valid ID

- Be living in the UK

How Does Clearpay Work?

All you need to do is to download the app on your device, shop your favorite brands or explore thousands of brands and choose Clearpay as your payment method.

For online shopping, goods will be shipped to you by the seller after checkout and for in-store shopping, download the Clearpay mobile and follow the in-app instructions. Then, you’ll need to make the first payment upfront and the remaining over six weeks.

Spend Limit: You can access your estimated spending limit on the Clearpay website or in the Clearpay app. Nonetheless, your order value including shipping should be between £0 to £1500.

Repayment Terms: You can pay over 6 weeks. It’ll automatically take the payments from your bank account at 2-week intervals for over 6 weeks. You can also reschedule your payment date by shifting them up to five days.

Interest & Fees: It doesn’t charge interest or any other fees. However, if you miss a payment, you’ll be charged a late fee. For orders under £24, late fees are capped at £6 and for orders over £24, you’ll get time until 11 pm the following day time to make the payment.

4 Apps & Sites Like Clearpay To BNPL! [2022]

Laybuy

Laybuy is one of the best companies like Zilch in the UK that let you buy now and pay over six weekly installments, entirely interest-free.

You can use Laybuy both in-store and online. Choose Laybuy as your payment method for online purchase and to pay in-store, simply take your items to checkout and pay with Laybuy.

Requirements for Eligibility

- At least 18 years old

- A valid ID

- A valid and verifiable phone number and email address

- Have a valid credit or debit card

- A permanent resident of the UK

How Does Laybuy Work?

With Laybuy, you can get your purchase now and split the total cost. All you need to do is to download the Laybuy app, sign in to create an account and shop at your favorite stores.

You just have to select Laybuy as the payment method after your shopping and select the payment day, with the first payment paid now and the rest later.

Spend Limit: You can find ‘You Limit’ on your dashboard on the website or app, which means that it is the current limit you are accessible to spend. Typically, depending on your credit score, a credit limit of between £60 to £600 can be agreed.

Repayment Terms: The first installment will be due at the time of your purchase and the remaining five subsequent installments will be due on the same day in the 6 weeks following.

Interest & Fees: It doesn’t charge any interest and there is no fee for early payments. However, if you fail to make payment on its due date, you’ll get a further 24 hours to pay.

Yet, if you fail to pay within 24 hours of the due date, you’ll be charged a default fee of £6.

Openpay

Openpay is a top buy now pay later app that let you pay in installments. With Openapy, you can shop online and choose it as a payment method at the checkout.

It is an interest-free BNPL apps in the United Kingdom, which is also available in the United States and Australia.

Requirements for Eligibility

- At least 18 years of age

- A valid email address and phone number

- Provide a valid photo ID

- Valid UK passport information

- A valid Visa or Mastercard – both debit and credit cards are accepted

- Other valid government issued photographic information

How Does Openpay Work?

All you need to do is to sign up for an Openpay account and provide your details. If you are approved, you can shop at your favorite and choose Openpay as your payment method.

Then, pick up among different repayment options during your purchase, with the first instalment paid during your purchase and the rest over 2-6 monthly instalments based on your purchase.

Spend Limit: Typically, it offers a credit limit of up to $20,000. However, the amount you can spend differs by merchant, and it also depends on your financial circumstances.

Repayment Terms: Repayments are due every two weeks, and are automatically deducted from your linked credit or debit card. However, these will vary by merchant with few offering longer plan lengths than others.

Interest & Fees: It doesn’t charge any interest. But, if your Nominated Card is a credit card, and you fail to pay your credit card statement on time, they may charge interest.

Also, if you miss a payment, you’ll be charged a late fee which will be capped at a maximum of £15 per plan.

Payl8r

Lastly, we have Payl8r in our list of the top sites like Zilch, which is partnered with over 1,000 retailers both online and in-store. You just need to proceed to the checkout and select Payl8r as your payment method.

All the payments are interest free, and you can also pay off your repayment early for completely free.

Requirements for Eligibility

- Should be a UK citizen

- Have a UK bank account with a credit or debit card and online banking

- Be at least 18 years old

How Does Payl8r Work?

All you need to do is to select Payl8r at the checkout and choose deposit, installment plant, and complete the application process within 60 seconds.

Some customers might need to submit extra information, which can take a little longer. Once it is done, you’ll products will be shipped.

Repayment Terms: It offers different payment options to pick up from – 30-day repayment and another option is dividing the cost over 3, 6, 9, or 12 monthly payments. Your monthly repayments are deducted from your debit card.

Interest & Fees: It doesn’t charge any interest but if you fail to miss a payment, extra charges may be applied. And you can view the total cost of the loan on y our application.

Generally, the total amount you must pay is the total of the amount of deposit, the credit, and the application fee of £4.95.

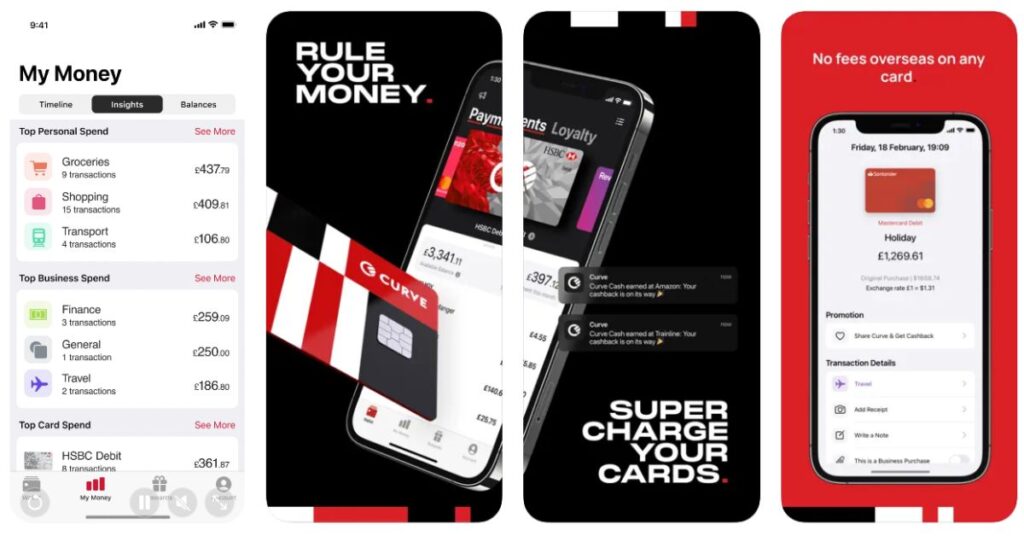

Curve Flex

Curve Flex is one of the top Zilch alternatives that let you have control of your financial life. Once you add your cards to Curve, your money is immediately boosted with more rewards, security, insights, and control.

Most of us lose control over our spendings and wonder where our money goes. With Curve Flex, you don’t have to worry about it anymore as it gives you 20/20 vision with all your balances in one place.

Moreover, any cash back that you receive from hotels, takeaways, supermarket, etc., will go into a separate Curve Cash card which you have to use within 6 months as it expires after that.

Requirements for Eligibility

- UK Curve Card holders can use Curve Flex

- You must meet credit risk and affordability checks

How Does Curve Flex work?

You can swipe on any payment you’ve made in the last 12 months and split them into 3,6,9 or 11 monthly installment plans so you don’t have to pay for everything at once.

All you need to do is to choose an eligible payment from your transaction history and tap ‘Swipe to Flex’. Once it is done, you’ll need to choose the payment card that you’d like to make repayments on. And then choose which day of the month you’d like repayments to be taken.

You may get the loan funds instantly but sometimes depending on your account provider, it takes 3-5 days to appear in your account.

Spend Limit: You can view your current spending limits from your Curve Flex app. Follow the steps: Open your Curve app – > Account tab -> Card limits and tap on See Details for the detailed breakdown of your Curve spending limits.

You can visit this page for more information on spending limits.

Repayment Terms: After you take out a loan and choose your repayment day, your first repayment will be no less than 30 days and then, it’ll be monthly.

Interest & Fees: If you are not able to pay on your repayment date for whatsoever reason, you’ll get 7 extra days to pay. However, if you fail to make payment within these 7 extra days, they’ll charge you £6 late payment fee.

PayPal

PayPal is an American multinational financial technology company that operates an online payment system in the majority of countries like the United States, United Kingdom, Australia, etc.

It offers a Buy Now, Pay Later service called PayPal Pay in 3 for UK customers where it lets you divide your purchase into three payments with no interest and no set up fees.

Requirements for Eligibility

- You’ll need to provide your name, phone number, address, date of birth, and payment details

How Does Paypal work?

When you choose PayPal Pay in 3 as your payment method, you’ll be automatically taken through the application process for which you’ll get a decision instantly. However, note that not everyone is approved.

Your application is assessed based on your financial position using a combination of the information you’ve mentioned in your application and information about your history and usage with PayPal.

If they need more information in order to approve your PayPal Pay in 3 application, they may run a credit check with an external credit reference agency. However, note that it’ll not affect your credit score.

Spend Limit: Your spending limit for PayPal Pay in 3 varies from merchant to merchant. But typically, it ranges between £30 to £2,000.

Repayment Terms: Generally, PayPal Pay in 3 will last 2 months in total with the first payment due at the time of purchase. After that, your 2nd and 3rd payments will be charged in two subsequent months on the same day of each month.

You don’t have to worry about missing a payment because it’ll send you a reminder by email or SMS 10 days before your due date.

Interest & Fees: There are no fees associated with PayPal Pay in 3.

Affirm

Affirm is another BNPL service that let you shop stress-free at your favorite stores and pay overtime without any late fees or hidden fees.

So, purchase goods and services from Affirm and pay off for these purchases in fixed monthly payments.

Requirements for Eligibility

- Be a resident of the US.

- Have a Social Security Number.

- Be at least 18 years old.

- Have a valid phone number that received SMS and is registered to the United States or its territories.

- Provide your name, date of birth, and email address.

How Does Affirm Work?

All you need to do is to download the app on your device and see if you are prequalified. This means that you get an estimate of how much you can spend with Affirm. And then, shop from your favorite store and choose Affirm at the checkpoint under payment options.

Then, they’ll check your eligibility, if you are eligible, you can complete your purchase with a small down payment and then the rest of the amount in installments over a few weeks.

Spend Limit: After you open an account with Affirm, you’ll get a prequalification and an estimate of how much you can spend with Affirm.

Repayment Terms: It offers flexible repayment plans ranging from 3, 6, 9, or 12 months.

Interest & Fees: It doesn’t charge any kind of fee, including annual fees, prepayment fees, late fees, and fees to open or close your account.

As for the interest, based on the size of your purchase, your payment plan might include interest. But remember that you’ll never have to pay more interest than you agreed to.

5 Best Buy Now Pay Later Apps in UK [2022]

Summing Up: Apps Like Zilch!

As there are a lot of apps available out there, it can be difficult for you to select one of them. However, all the BNPL apps listed in this article are easy to site, interest-free and have low fees.

Moreover, several sellers accept these payment solutions, so we can say that your favorite retailers might accept at least one of these BNPL options.

Hopefully, this article may help you find the best BNPL service in the United Kingdom that can meet your current needs and help you stick to your budget.

![6 Best Apps Like Zilch & Zilch Alternatives [UK 2024]](https://viraltalky.com/wp-content/uploads/2022/06/Buynowpaylater-apps.jpg)