Looking for similar investing apps like Stash? Look no further! In this article, we’ll see what is Stash, how does Stash work, and what are Stash alternatives.

Until recently, investing has been confusing, time-consuming, and not to mention it was quite intimidating for beginners. But not anymore!

Fortunately, there are a lot of micro-investing apps that are designed to provide personalized investment advice as well as to let you trade and manage stocks on your own.

Moreover, you can get a tailored portfolio, trade your own stocks, check your portfolio performance and even shift money seamlessly.

What is Stash?

Stash is an American financial service that operates on both mobile apps and a web platform, allowing users to invest small amounts. It simplifies investing, thus making it easy to build wealth.

You can invest as low as $0.01 additions into small shares of thousands of stocks and over 80 exchange-traded funds. It offers retirement, individual, banking investment, and custodial account via a subscription model.

Also, users can invest in retirement accounts, traditional IRAs, brokerage accounts, Roth IRAs, or custodial accounts. It also offers financial education and automatic investing.

How Does Stash Work?

Stash offers different ways to make money, such as opening a taxable account so that you can start investing your money in the market.

Different programs have various features and fees, so it is essential to understand every way through which you could grow your wealth by using Stash products.

If you have a Stash banking account, you get a Stash debit card. And you can start investing with just $1 and build a portfolio of individual stocks.

Now, you might be wondering why Stash alternatives? Well, despite being an incredible investing service, it doesn’t offer automated management for IRAs, no tax-loss harvesting, and no personalized investing advice.

Apps like Stash: Best Alternatives

Therefore, check out the below guide for more information on the 5 best apps like Stash that can help you with your investing journey!

Acorns

We have Acorns in the first place on our list of the best apps like Stash. Acorns is an American fintech and financial service that mainly specializes in Robo-investing and micro-investing.

It offers a simplified, low-cost investing approach that suits several types of investors. Acorns provide five different products – Invest, Found Money, Later, Spend, and Early.

Besides, it targets a much younger, more tech-savvy generation as the whole investment experience can be created and managed directly from a smartphone.

Acorns is the first app that started ‘Round-Ups’, which works by rounding the nearest dollar of the purchases that you’ve made on a debit card or credit card that is linked to your Acorns account.

Features

- Invest automatically into a diversified ETF portfolio, built by experts.

- Invest spare change with automatic Round-Ups, set it & forget it with Recurring Investments.

- Shop 12,000+ brands that invest in you, search MILLIONS of jobs in our Job Finder, & earn exciting referral bonuses.

- You can invest in one of five portfolios, ranging from conservative to aggressive, depending on the amount of risk.

How Does Acorns Work?

Once you’ve created an account, you can select one of many pre-built portfolios to invest in and link credit or debit cards to your account.

It reads your spending habits on your credit card or debit card and rounds every transaction up to the nearest whole number.

Then, it will automatically invest your spare change and allow you to invest as little as $5 any time on a repeated basis into a portfolio of ETFs.

You can also invest for retirement, set up a custodial investment account for your kids, or set up a checking account.

And with Acorns Checking, you can save, invest and earn while you spend. It has no minimum balance or overdraft fees, plus free Allpoint ATM access across the country.

Account Minimum: It doesn’t require a minimum amount to open an account but the service to requires a $5 balance to start investing.

Fees: It offers two membership tiers with a monthly management fee of;

- Acorns Personal ($3/month) – Acorns Invest, Acorns Later, and Acorns Checking.

- Acorns Family ($5/month) – Acorns Invest, Acorns Later, Acorns Spend, and Acorns Early.

You’ll need to pay a steep fee if you decide to move your investments out of Acorns to another provider. Also, it charges $50 per ETF to transfer investments.

Customer Service: If you need any help with Acorns, you connect to their customer service by emailing to [email protected] or call to (855) 739-2859. You can also visit here for more information.

| Pros | Cons |

| Round up your purchases | High fees on small balances |

| Low investment portfolio option | No cryptocurrency trading |

| Offer cash back at over 350 retailers | |

| Access a lot of educational content |

8 Best Apps like Acorns & Acorns Alternatives [2022]

Robinhood

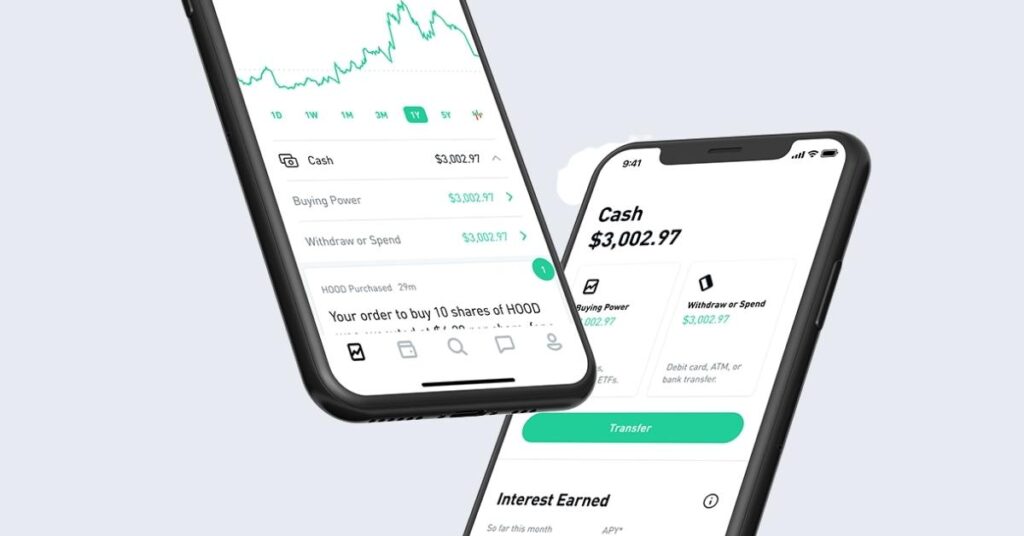

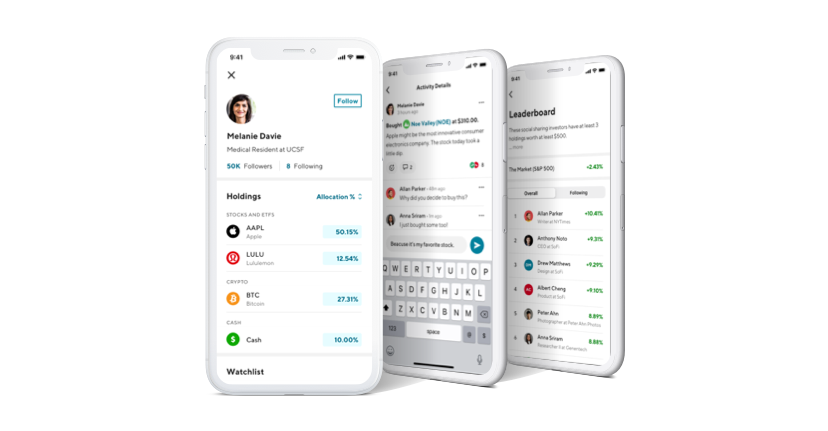

Robinhood is another American financial service that is widely known for offering commission-free trades of exchange-traded funds and stocks through a mobile application.

It helps you better understand financial markets, so you can invest in stocks, funds, and options, all commission-free. You can invest as little as you want without incurring a fee.

Not only that, but it also introduced instant deposits, crediting users immediately for deposits up to $1,000.

However, its capabilities are limited. That means you can’t open a retirement account or invest in mutual funds. It has a simple and easy-to-navigate design as well as offers the ability to trade fractional shares.

Features

- Invest in stocks, options, and ETFs with Robinhood Financial.

- From commission-free trading to intuitive design, investing is now more approachable & affordable.

- Access real-time market data, see analyst ratings, read relevant news articles, & get notified about important events.

- You can also buy & sell cryptocurrencies like Bitcoin (BTC), Bitcoin Cash (BCH), and Dogecoin (DOGE) with Robinhood Crypto.

- Get your paycheck, pay bills, send checks, and more.

How Does Robinhood Work?

Firstly, you’ll need to create an account with Robinhood by providing your name, email address, phone number, residence address, social security number, and country of citizenship.

You’ll then need to answer a few questions and link your bank account to your Robinhood account. Then, you can start investing in stocks, gold, cryptocurrency, options, and Exchange Traded Funds.

Thanks to its fractional shares, you can start investing with just a few dollars. And with its ‘Practice Portfolio’ you can learn how the market fluctuates over time, and how to make healthy investment habits.

The only downside is that you cannot invest in futures, mutual funds, bonds, or stocks that trade on non-US exchanges.

Account Minimum: It doesn’t have an account minimum, which means investors can instantly get started. However, you’ll need enough to buy the investment that you want.

Fees: Investing with Robinhood is commission-free, it doesn’t charge any fees to open and maintain your account or transfer funds to your account.

However, the biggest fee that Robinhood charges is the $75 outgoing ACAT transfer fee. This ACAT transfer is when you wish to transfer your investment to another broker.

Customer Service: Robinhood has limited customer service. That means it doesn’t have any official phone number or email address to contact their customer support.

Nevertheless, it has live phone support and suggests you to ‘Request Call’ through the app.

| Pros | Cons |

| Low trading costs | Limited research and educational content |

| You can access fractional shares | Limited investment offerings |

| Easy to use interface | Limited customer support |

| Free cryptocurrency trading |

SoFi Invest

SoFi is another similar app like Stash that offers a suite of financial products, including refinancing, personal loans, credit cards, home loans, student loans, investing, and banking through their desktop and mobile app interfaces.

It competes with Stash and its alternatives in the personal finance space and also has a presence in investing by offering free trades on ETFs, stocks, crypto, and more.

This micro-investing app also lets you trade in fractional share investing – Stock bits, which are small portions of a share of stock worth less than the complete value of one share.

This can be a great choice to invest your spare change or add more to the market at once by simply tapping into savings accounts to make a larger deposit on a regular basis.

Features

- SoFi is a one-stop shop for your finances.

- Manage your money, invest and trade, check your rates and apply for loans.

- Earn high interest on all your cash when you save and spend money with SoFi Money.

- You can trade crypto, invest in stocks, ETFs, retirement funds, and more.

- Pay zero account fees, including no annual, overdraft, or other account fees.

How Does SoFi Invest Work?

SoFi Invest offers a few different services like retirement savings, active trading, cryptocurrency trading, and automated investing.

You can choose the automated investing account and select a taxable investment account or tax-advantaged individual retirement account.

Then, you’ll need to answer a few basic questions to examine your risk tolerance and then recommends a portfolio that is tailored to your particulars.

And just like any other Robo-advisors, SoFi Invest puts your cash into an expanded portfolio of ETFs after determining your risk tolerance and investing limit.

If you are investing for retirement, it offers a choice of a Roth IRA, a traditional IRA, or a SEP IRA, which can be a good option for small business owners.

Account Minimum: Usually, some Robo-advisors have a steep account minimum but with SoFi Invest, you can access its Automated Investing Robo-advisor with a $1 account minimum.

Fees: SoFi is a fee-free investment platform, which means there are no management and administrative fees. Yet, it charges a fee of 1.25% for cryptocurrency transactions.

Customer Service: If you need any help with SoFi Invest, you can contact their customer support by calling them at (855) 456-SOFI (7634), which will be available from Monday-Thursday between 5 am-7 pm.

| Pros | Cons |

| Automatic investing | Small selection of investment products |

| Access to certified financial planners for free | Limited track record |

| Cryptocurrency trading | No tax-loss harvesting |

| Automatic rebalancing |

Investment Apps like SoFi to Check Out !

Webull

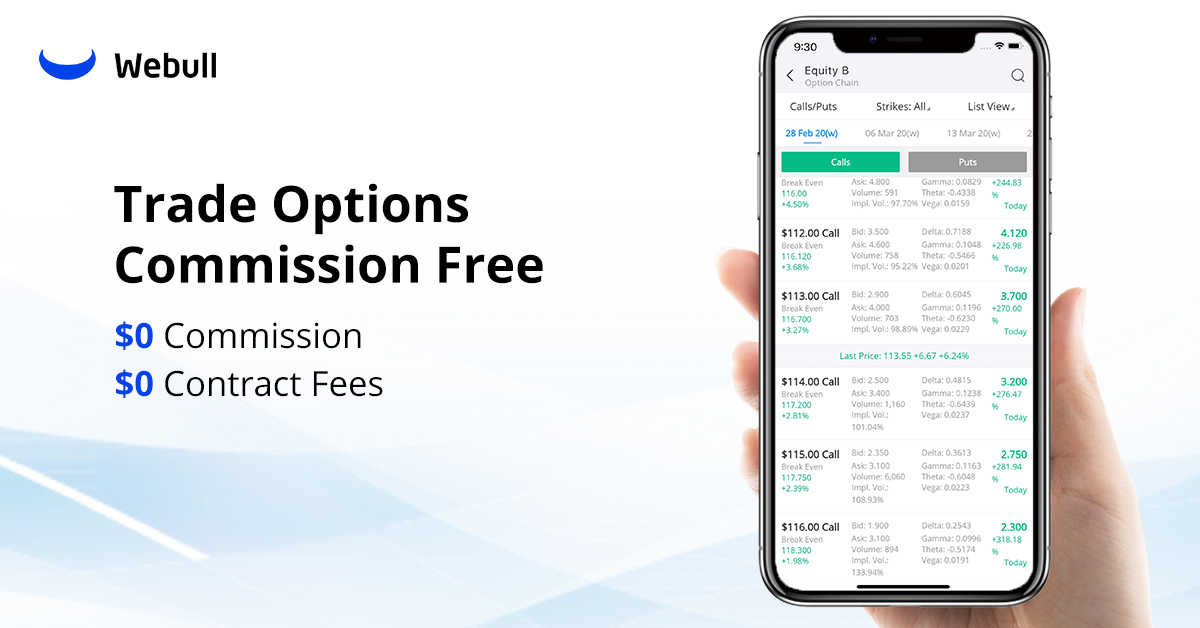

Webull offers an electronic trading platform that you can access through desktop and mobile app, for the commission-free trading of exchange traded-funds, cryptocurrencies, stocks, options, and margins.

Invest in thousands of companies and fractional shares with as little as $5 using our trading tools and analytics to create your own financial portfolio.

Besides, it has recently added the ability to trade fractional shares from morning to evening. Thus, investors can enjoy the full extended-hours trading.

Since it doesn’t charge any commission for the trades, it makes money on other services you take, such as PFOF (Payment for Order Flow), interest on cash, margin loans, and service fees.

Features

- Get live stocks market quotes, charts, financials, key statistics, and more.

- Add holdings, create alerts and save notes to keep track of your portfolios.

- It has over 50 technical indicators and 12 charting tools.

- Set personal alerts to get informed of live stock price movements and invest fast.

- Test out your trading skills with the free Paper Trading feature.

- Follow key global events from major media sources.

How Does Webull Work?

Once they verify your information, you can open a trading account. And while signing up, you can decide if you want a retirement, cash, or a margin account.

It is completely a free trading platform, and it doesn’t charge any hidden fees. And if you are new to investing, you can start work with its trading simulator or ‘Paper Trading.’

Although there is no minimum balance you require holding in your cash account, you might need a minimum balance of $200 to open a margin account.

As soon as you are ready for trading, you can send in a request to Webull, which will give you access to certain options based on your history with trading and account size.

Account Minimum: It doesn’t have an account minimum, which means investors can instantly get started. But for a margin account, it requires an account minimum of $200.

Fees: Webull doesn’t charge any commission for ETFs, trading stocks, and options listed on U.S. exchanges.

Nevertheless, certain regulatory agencies might still charge some fees, some of which are passed from the broker-dealer to clients as a pass-through transaction.

Also, if you want to transfer all your Webull assets to another brokerage, you’ll be charged a $75 transfer fee.

Customer Service: If you need any help with Webull, you contact their customer support by calling them at 1-888-828-0618 or email them to [email protected].

| Pros | Cons |

| Easy approval process and no fees | Limited tools for portfolio management |

| Access to extend hours and pre-market trading | No mutual funds |

| Access to 11 different cryptocurrencies | Limited educational content |

| Paper trading availability |

Investment Apps Like Webull & Webull Alternatives

M1 Finance

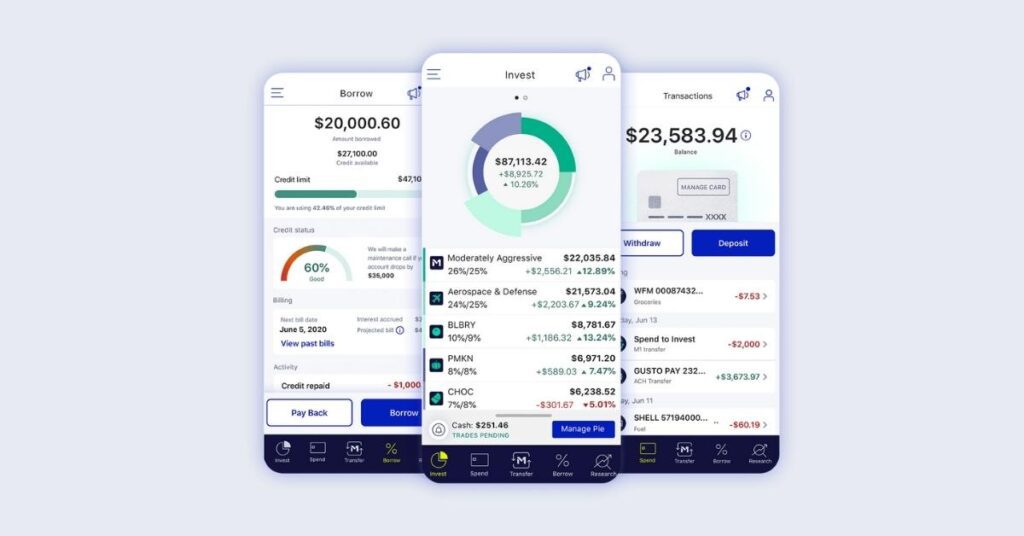

Last, we have M1 Finance in our list of apps like Stash. M1 Finance offers a rob-advisory investment service with commission-free investing, automatic deposits, the ability to invest in fractional shares, and more.

It provides automatic rebalancing services, reinvestment services, margin lending, automatic dividend reinvestment services, and cash management services as well.

Furthermore, investing money with M1 Finance is as easy as depositing money. All you need to do is to set your index fund and stock selections and let it automate your investments on your behalf.

So, if you are looking for a way to create and maintain a free, diversified portfolio of ETFs and stocks, then M1 Finance can be a perfect option.

Features

- Build and manage your wealth from the intuitive mobile platform.

- Automate your finances with Smart Transfers: custom rules that move your money how you want.

- Buy stocks, ETFs, bonds, and mutual funds with an intuitive Pies interface.

- Fractional shares let you invest as little as one dollar, so invest with more power and flexibility.

How Does M1 Finance Work?

Just like any other app listed in this article, getting started with M1 Finance is quite simple. Before that, you need to understand what ‘Pie’ is, which makes M1 Finance unique.

Pie is nothing but an investor’s portfolio that offers investors certain exclusive benefits. So, you should have the ability to customize your own Pies or simply choose from over 80 pre-built pies.

Once you start to buy and sell, your money will be automatically allocated to this pie. So, after you create an account with M1 Finance, you can open a brokerage account by providing your personal information.

Then, link your bank account and your money will automatically get invested across your portfolio depending on your target allocations. You can easily turn off this automatic investment feature at any time!

Account Minimum: It requires a minimum deposit of $100 and $500 for retirement accounts to start investing.

Fees: M1 Finance doesn’t charge any portfolio management or trading fees. To build a portfolio from an extensive list of ETFs and stocks with low expense ratios which average between 0.6% and 0.20%.

Rather, M1 makes money through interest, lending securities, the Plus membership, and payment for order flow.

Its premium version – M1 Plus costs $125 per year with high checking & savings interest, lower lending rates, and cashback on debit card purchases. Also, accounts with less than $20 and those which are inactive for 90 days are charged a maintenance fee.

Customer Service: If you need any help with M1 Finance, the easiest way to contact their customer support is to submit a ticket. Or, you can call them at 312-600-2883 from Monday to Friday between 9 am to 4 pm.

| Pros | Cons |

| Choose from over 6,000+ stocks and ETFs | Limited financial tools and calculators |

| Competitive rates on margin accounts | No tax loss harvesting available |

| Extensive portfolio management customization options | No cryptocurrency |

| Access fractional share trading |

Comparison

| App Name | Acorn | Robinhood | SoFi Invest | Webull | M1 Fianance |

| Fees | Personal – $3/month and Family – $5 per month | No annual, inactivity, or ACH transfer fees. $75 ACAT outgoing transfer fee | $0 but charges 1.25% for cryptocurrency transactions | No annual or inactivity fees but charges $75 for full or partial transfer | M1 Finance Plus – $125 per year |

| Account Minimum | $0 to open an account and $5 to start investing | $0 for brokerage account and for Robinhood Gold account | $1 to access Automated Investing Robo-advisor | No account minimum | Requires a minimum deposit of $100 and $500 for retirement accounts |

| Crypto Offering | No | Yes | Yes | Yes | No |

| Security | 256-bit encryption, SIPC protected account, SSL encryption, multifactor authentication, ID verification | Fingerprint, Custom pin, 2F authentication, 6-digit code, SIPC insurance | Biometric, 2F authentication, | Biometric, 2F authentication, 6-digit code, SIPC insurance | Military-grade 4096-bit encryption, 2F authentication, SIPC insurance for investments, FDIC insurance for deposits |

| Portfolio | Well-diversified portfolio with domestic and international stocks, REITs, and bonds | Offers very little portfolio analysis, you can only view real-time balances, margin, and buying power | Choice of 10 strategies with allocations and ETFs from 13 asset classes | No broad suite of portfolio analysis tools but offers metrics, account statements, and confirmations | Rebalance your new funds |

| Best For | Build financial habits, offers unique perks, automated investing for as little as $3 per month | Basic stick, ETF and crypto investing | Fee-free active trading and automated investing | Self-directed investors and intermediate traders | Fee-free active trading and automated investing |

| Ratings | iOS: 4.7/5 Android: 4.3/5 | iOS: 4.2/5 Android: 3.8/5 | iOS: 4.8/5 Android: 4.3/5 | iOS: 4.7/5 Android: 4.5/5 | iOS: 4.6/5 Android: 4.5/5 |

Final Words: Apps Like Stash!

That’s it, these are some of the top apps for getting your finances organized and invested! We know investing can be risky, but with these apps, you can invest for free!

Hopefully, the above article has helped you to select the best micro-investing app like Stash. Because these are ideal for beginning investors who wish to invest their money but don’t have many savings yet.

![Must-Try these 5 Apps Like Stash for Micro-Investing [2024]](https://viraltalky.com/wp-content/uploads/2021/12/apps-like-stash-alternatives.jpg)