Apps Like Ingo Money: Financial Apps are very much important for today’s generation. Without financial apps, life can get a little risky and difficult.

Many different apps are very essential for survival which are financing apps, investment apps, payment apps, check cashing apps, ingo money apps, and much more. Not everyone chooses each app as the best and part of a necessity but has a lot of variable options to count as a necessity.

Now you may be thinking that what is a check-cashing app? Is that even a term? Let us explain to you in easy and simple terms.

Check Cashing service simply means getting access to the money without opening or having an active bank account. This service comes in handy for the people who are unbanked or underbanked.

Many people mistakenly think banks provide Check-Cashing but usually, there is a financial service provider outside the banking world who provides you finance on the verification of you having a valid and authentic paycheck, government check, or any other check issued to you by charging you some fees for same.

Check Cashing is a part of getting instant or urgent money without having bank accounts or having issues regarding the opening of a traditional bank account. People nowadays are obsessed with the check cashing app which doesn’t use ingo money but wants many alternatives of same.

Hence in this article, we are going to talk about what Ingo money is and what it offers and the best 5 alternatives of the same. Here selected the closest 5 alternatives to Ingo Money are Venmo, LodeFast, Ace Flare, Netspend, and PayPal.

By the end of the article, you will get a detailed idea about how these 5 apps work and the fees charged for their services offered.

What is INGO Money?

Ingo Money is the most used app for payroll check cashing. Ingo money promises to get to money instantly in a few minutes.

To get money instant with Ingo Money, they will ask to make an account with them and link the debit cards, credit cards, or Paypal account to receive money in. Ingo money offers you to pay credit card bills, you can also buy an Amazon gift card or even split the check and fund it in more than one linked account.

Once your check is approved, the money they deposit in your account is as good as money to be used directly to shop online, payments, and also for the Android Pay feature.

How Does INGO Money Work?

- First, you need to install the application from Apple App Store and Google Play Store.

- Once you get signup and made your Ingo Money account you will be asked to link your Paypal account, debit cards, or credit cards for getting money stored.

- Once you complete the above procedure, it will ask you to upload a photo of the front and back of the cheque for verification and approval.

- Once your check gets approved, they will directly fund your account within minutes.

- With that money, you can make payments and clear your bills, purchases, and much more.

- Ingo Money promises the money guaranteed, no check-cashing lines and no deposit holds with no worries and no take-backs. What is paid is paid.

Venmo

When we talk about Venmo, usually the first thought that comes to mind is it is not a check cashing app but a peer-to-peer payment app but very few know the magical aspects of Venmo.

Venmo allows checking cashing only when you have applied for Venmo Debit Card or even the Direct Deposit then you can use the application to get the cash against the checks.

Venmo is the most preferred application when it comes to ATM Access or Virtual Payment options. Venmo offers 10 day no fee approval option and also free of charge ATM Withdrawals at over 30,000 MoneyPass locations.

Venmo also offers to check cashing and rewards like cash back offer if you use Venmo’s, Debit Card.

How Does Venmo Work?

- You can download the Venmo application from Google Play Store and Apple App Store easily.

- Once you have installed the application then you can open your Venmo account and apply for the direct deposit or Venmo’s Debit Card.

- Once your application is approved and your Debit Card is activated, you can then apply for a check-cashing facility.

- Once the application is approved then you are now eligible for getting instant cash for the checks.

- All you have to do is tap on the Manage Balance and launch a Cash a Check feature.

- Then select the photo of your check and submit it.

- Once it is verified and the details are reviewed correctly, you can choose to receive cash instantly with a fee or in 10 days without fees in your Venmo account like Ingo Money.

Fees of Venmo

- Venmo charges fees the same as PayPal and Ingo Money charges which are 1% for the government and payroll checks whereas 5% for the other checks.

- Venmo gives the no-fee option for payment in 10 days selection.

- If the check doesn’t get cashed then no fees are charged by Venmo.

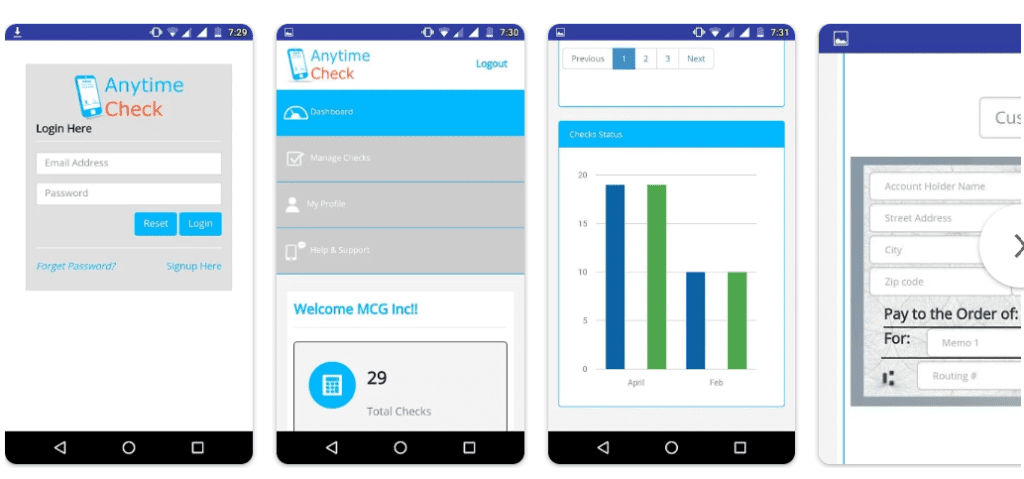

Anytime Check

Anytime Check is the best alternative option for Ingo Money users. Anytime Check works for the subscriptions and allows users to send and receive check payments on mobile applications, the web, etc.

Anytime Check allows its users to check funds directly by depositing into a linked U.S Bank Account and also International Check processing services. The fees charged by AnytimeCheck are decided upon how many check cashing you do in a month and then they bill you monthly on the same basis.

Anytime Check also allows upgrade and downgrade of the sus cri[ptionsd if not used well compare to the plan selected.

How Does Anytime Check work?

- Download the Anytime Check application from Google Play Store and Apple App Store.

- Signup to make a virtual account with Anytime Check.

- Once the account is created then you need to link your bank account or any debit card details to get cash linked.

- Once all this procedure is completed, all you have to do is upload the photo of your check and wait for it to get approved for encashing like Ingo Money.

- Anytime Check will take 1-5 days to get clear and credited to your account.

Fees of Anytime Check

- The fees are charged as subscriptions and packages.

- For 10 checks in a month, the package is available for $20.

- For 75 checks in a month, the package is available for $100, etc.

- On the monthly subscription, the fee starts from $19.99 per month to $99.99 per month.

Ace Flare

Ace Flare is introduced by Metabank and provides similar services as a traditional bank does which includes an addition to the check cashing is ATM Access, a VISA Debit Card feature, and also the option of Direct Deposit.

Hence Ace Flare provides similar options to Ingo Money making it one of the closest alternatives of the same. In one word, Ace Flare is a popular Check Cashing Service for its users.

If you are looking for the same service provider from Ingo Money then you will not get disappointed with Ace Flare since it is featured by First Century Bank which is also used for Ingo Money as the service provider.

How Do Ace Flare Work?

- Ace Flare has fee-free cash withdrawals from ACE Locations.

- Ace Flare Mobile App is available from App Store and Google Play Store for downloading.

- Once the app is downloaded it will ask you to open a virtual account with Ace Flare.

- Once your account is open you can apply and get its debit card and set up a direct deposit option.

- Once all this is set up then for check cashing you can select the option of Mobile Check Capture to get it verified and approve like Ingo Money.

- Once you select the option it will ask you to capture your paycheck from front and back and upload it for verification.

- Once the paycheck is verified then it will take 3 to 4 business days for encashing it in your account.

- Then you can utilize the funds or withdraw them using a debit card etc.

Fees of Ace Flare

- The fee charged by Ace Flare is up to 2 to 5% which is quite similar to other apps like Netspend, PayPal, Ingo Money, etc.

- Fee-Free ATM facilities.

- It has zero charges for the standard check cashing.

Netspend

Netspend is best for employees' paychecks and hence is a great alternative to Ingo Money. Netspend is actively used by employees for their paychecks, tax refunds, pensions, benefits in railroad retirement, government, worker’s compensation, etc.

The Netspend application also allows one to deposit personal checks and small business customer checks in your Netspend prepaid card with your mobile phone. The time duration for direct deposit of check-cashing takes up to 2 days earlier than the expected date given.

Once the money is encashed in your Netspend account, then you can monitor your transactions and transfer funds to others through Netspend accounts.

How Does Netspend work?

- Firstly you have to download the application in your tab, mobile through the app store or web.

- Once it is installed, you can open your online account and add a wallet through Netspend Visa or MasterCard Prepaid Card.

- Once you have added a wallet you can choose you to want cash at the reloading location or mobile check load feature.

- Then upload your check pictures and verifies details to get approved.

- Once you select the feature as per your wish, the money will be funded to your Netspend account by which then you can pay bills, go shopping and also withdraw cash at ATMs.

Fees of Netspend

- The minimum fee charged by Netspend is up to $5 for check deposit or eventually 2-5% of the check’s face value.

PayPal

PayPal is also famous for the peer-to-peer payment and then we forget about every other facility it has to offer. So yes, PayPal also offers a check cashing service which is very underrated in PayPal’s description.

PayPal also offers to snap a go feature same as what Ingo Money has to offer and for security reasons PayPal always wins alone and also when it comes to the closest alternatives for the payment and financial apps.

PayPal offers services for both- personal reasons as well as pure business financial outlets. You can use it for what you need PayPal to accompany you.

How Does PayPal work?

- The simplest way for an easy check cashing feature is PayPal.

- PayPal is available everywhere, web, Apple Store, and Google Play Store so easily download the application and install it.

- Once the application is downloaded, open your account, provide some personal details, and get verified.

- Once all these procedures are done, you will see a feature called Cash a check simply click the option.

- Once you click on the option it will ask you to snap a picture on your phone of the check and asks you to access the cash within 10 days with no fee and instantly with fee.

Fees of PayPal

- PayPal charges a fee of up to 1% expedited check cashing fee for government and payroll checks.

- PayPal charges a 5% expedited fee for other types of check-cashing fees.

Conclusion

Hence as you have seen the alternatives of apps for those who don’t use ingo money is a longlist to look forward to. But here we bring you the best and the closest alternatives of the same.

The selection among these best alternatives is tough to do but we hope our information and research will save some of your time and make your selection process the same easy.

FAQs

Is there another app like Ingo Money?

In these articles, we have provided the apps like Ingo money namely

PayPal

Venmo

Ace Flare

Anytime Check

Netspend and many more.

How can I instantly cash a check online?

The applications which are reviewed in this article will help you instant cash checks online with a traditional bank facility or without traditional bank interfering.

![5 Best Apps like INGO Money You Should Try [2024]](https://viraltalky.com/wp-content/uploads/2022/05/investing-apps.jpg)