Need some extra cash before payday? No problem, apps like Empower will help you with that. So, stop asking friends and family to borrow money, simply use these Empower alternatives!

Before that, let’s understand what are payday loans? Basically, a payday is a short-term loan that is usually repaid in a single payment on your next payday.

However, some of the apps listed in this article have no mandatory repayment time frames and let you pay whenever you have money.

Apps Like Empower: Empower Alternatives!

Empower is one of the popular apps that offer cash advances of up to $250 for completely interest-free.

It is not only a cash advance app; it is more than that! It also helps you limit your spending depending on your income. And if it predicts that you are spending over your limit, it sends you an alert.

Moreover, there are no overdraft fees, no account minimums, and no insufficient funds fees. Yet, the only fee it charges is its membership fee which costs $8 a month.

So, keep on reading to know more about the best apps like Empower!

Dave

Firstly, we have Dave on our list of the best apps like Empower. It offers loans and uses an algorithm to predict users’ ability to repay loans based on their checking account and income history.

It is partnered with LevelCredit to let you report rent payments to major credit bureaus thus giving you a credit building opportunity.

Moreover, it strives to improve your financial health with their automatic budgeting financial tools and even monitors your budget and predict your forthcoming expenses.

And if it feels that your expenditure is more than you have in your bank account, it’ll alert you concerning your extreme usage.

Features

- Improve your financial health

- Get paid up to two days early

- Build your credit

- No interest, no credit checks

- Intuitive budgeting tools and predictive alerts

Eligibility Criteria:

- Be 18 years old

- Have a steady paycheck that you direct deposit into your checking account

- Show that your bills don’t consume your entire paycheck

How Does Dave Work?

Easily get started with Dave by giving your email address, mobile phone number, low balance alert amount, and other personal information.

Once you’ve set up your account, it’ll examine your income and spending habits, as well as the regular balance of your bank account. And use predictive analysis to know how much money is coming and going out of your account.

If you are approved for a cash advance, you get to choose from standard funding or express funding options. Furthermore, it offers two funding options – Standard and Express funding.

With the standard funding, it might take up to three business days to get your money. And with the express funding, you can receive your money on the same day.

Cash Advance: You can get a cash advance of up to $250 to cover daily expenses, search for local side hustles, and access our easy-to-use automatic budgeting tool right from the app.

Repaying Advance: Users can pay the advance back manually or set up automatic payments from a bank account. And the automatic payment date is set to your next payday.

Fees: With Dave Banking, there are no overdraft fees, no minimum balance fees, and no ATM fees from over 32,000 ATMs.

Customer Support: You can call them at 1-844-857-3283 between 4 Am to 10 Pm from Monday to Friday and between 5 AM to 5 Pm on Saturday and Sunday. Or email to their support team at [email protected]. You can also visit here for more information.

Brigit

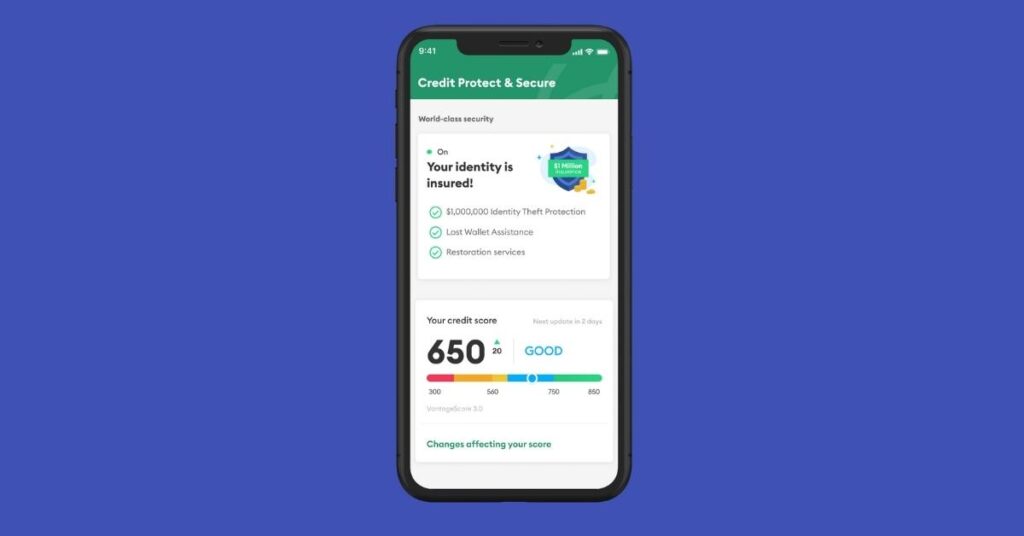

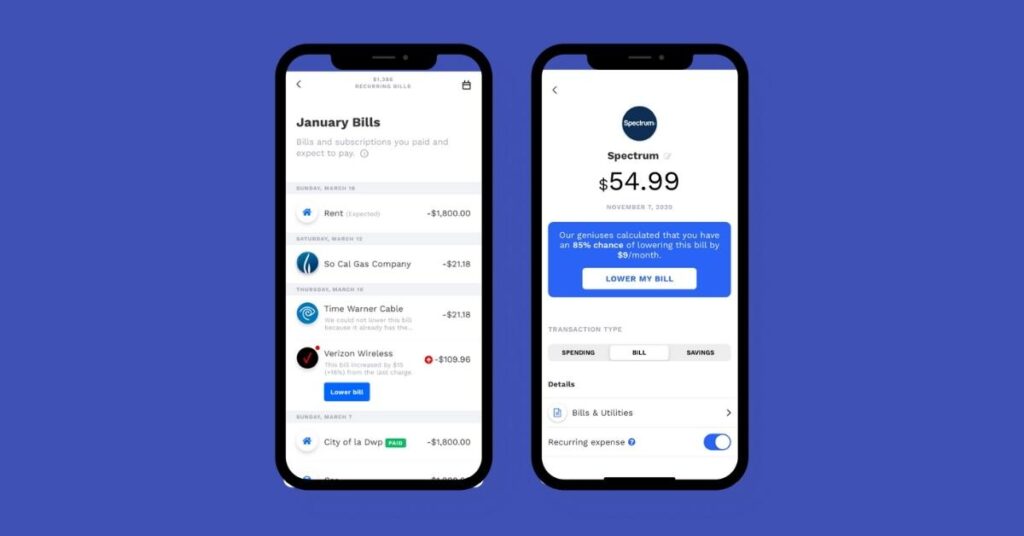

With Brigit, get a deep dive into your spending habits, keep tabs on bills before their due date arrives, and moreover, you even find better ways to budget.

And if it predicts that your current balance can’t cover your upcoming expenses, it’ll send you cash immediately through its Auto Advances feature to prevent you from getting any overdraft fees.

You also can get tools and full credit reposts to help you understand and better your credit. What makes it more interesting is that it sponsors side gigs for its partners in the form of employment.

Furthermore, if you have a Brigit Plus membership, you can access a lot of features that are not available with the free Brigit account.

These features include credit builder, credit protection & security, instant deposit, auto advances, flexible repayment, personalized content, identity theft protection, and more.

Features

- Help you save money and spend wisely

- No transfer fees, no interest, no processing fees, no late payment fees, no tips

- No compulsory minimum or maximum repayment time frame

- Build your credit score with Brigit Credit Builder account

- No security deposit & no credit check needed

Eligibility Criteria:

- Be 18 years old

- Average paycheck should be greater than $400

- Have an active checking account

- Bank account balance greater than $0

- Money should be left in your bank account two days after you get paid

- Have at least three recurring direct deposits from your employer

How Does Brigit Work?

All you need to do is to create an account by providing your basic information and once you’re qualified for the credit, it makes sure that you can have access to $250 as long as your credit card balance hits zero.

After you get your advances, the repayment date will also be given to you. You don’t have to worry about missing your repayment date because it’ll notify you 24 hours before the due date.

However, if you wish to repay the Brigit advance before your due date, you can select the “repay now” button.

Moreover, it helps you avoid overdraft fees by automatically analyzing your checking account and if it predicts you’ll run out of money, it’ll advance your cash to prevent you from going to overdraft your account.

Cash Advance: Once you are qualified for the credit, you can get a cash advance up to $250 as long as your credit card balance hits zero.

Repaying Advance: The repayment date will be given to you when you request your advances, and it can be accessible in the app. It’ll automatically withdraw the advance on your repayment date.

Fees: Brigit doesn’t charge any interest, late fees, processing fees, or overdraft fees. However, it has a premium plan that lets you access a lot of features that the free plan doesn’t offer.

Brigit Plus Plan costs $9.99 a month, this includes getting advances immediately, helping you to build your credit, and more. You can visit here for more information on Brigit Pricing.

Customer Support: You can chat with a Brigit support expert between 9 AM to 6 PM by submitting a request or email [email protected]. You can also visit here and explain your problem.

Klover

Klover boasts that it is the fits app to give you access to your earnings early. It offers zero-interest cash advances or paycheck advances to users that are significantly small loans that provided you to access cash and pay it back as soon as your paycheck arrives.

In order to use the app, you’ll have to provide your personal financial information like your balance information and account transaction history.

It uses the data you’ve provided and associate you with financial products and services. You can be able to earn reward points to get some extra cash, which you can easily achieve by answering a few questions, scanning receipts, or by watching videos.

Besides, it also offers advanced budgeting tools to help you stay financially stable and protect you from expensive lending, loans, and overdraft fees.

Features

- Access a salary advance before you get paid

- No credit check, no interest, no hidden fees, and no payback period.

- Offers automated budgeting and saving tools

Eligibility Criteria:

- All deposits should be from the same employer

- Bank statement’s paycheck description must match previously deposited paychecks

- A minimum of three consecutive direct deposits over the past 2 months

- Have a regular paycheck – weekly or bi-weekly. No semi-monthly or monthly deposits are accepted.

- Your account must have a positive balance

- Checking account should be active for the last 90 days.

How Does Klover Work?

Once you create an account, you’ll need to wait for 1 to 2 days to get your account verified. As soon as you are verified, you can request a cash advance that usually takes 1 to 2 business days to be deposited in your account.

You also get to choose the same-day deposits for which you’ll have to pay a small fee, whereas the standard direct deposit is completely free.

So, similar to Dave, it also offers standard and express funding options. However, the immediate debit option charges a fee ranging from $1.99 to $14.99.

Even though you can borrow up to $100, you can increase your limit through its point system, which can be improved by the regular use of the app and can be redeemed for a Boost or extra cash deposited directly into your account.

Cash Advance: The maximum cash advance you can borrow with Klover is up to $100. This limit can be increased by the regular use of the app.

Repaying Advance: Your cash advance money will automatically deduct from your bank account on your next payday.

Fees: Klover doesn’t charge hidden fees or interest. Yet, there is a $2.49 per month membership fee. And for the immediate debit option, it charges a fee ranging from $1.99 to $14.99.

Customer Support: You can contact Klover’s customer support by submitting your request here. You’ll probably get the response within 3-4 business days!

10 Cash Advance Apps Like Klover to Check out [2022]

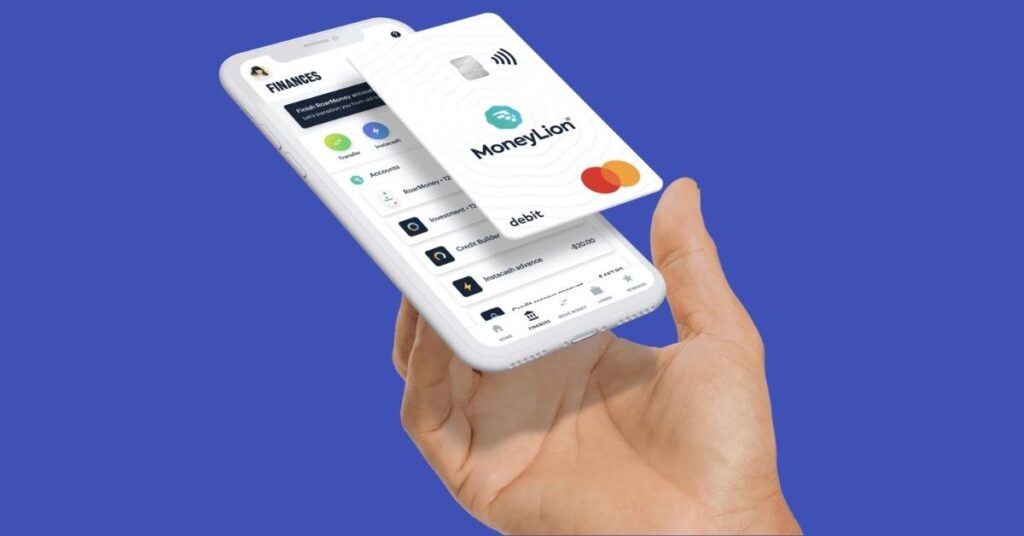

MoneyLion

MoneyLion is another Empower alternative. It can be your destination for mobile banking, finance, investing, cash advance, and more.

It gives you an easy way to earn, invest, save and borrow. And the amount of Instacash you are entitled to get will be based on your creditworthiness and other conditions that are determined by MoneyLion.

Furthermore, it sends weekly reports to see where your cash is going and helps you get your spendings under control.

With Credit Builder Plus, you can access other features to help build your credit. And allows you to take out a loan of up to $1,000 with 12 months repayment term.

Features

- All-in-one banking: mobile banking, cash advance, investing, and more.

- No interest, no monthly fee, no credit check.

- Automatically invest the spare change from purchases

- Earn up to 5% cash back3 on everyday purchases

Eligibility Criteria:

- Be at least 18 years old

- Bee a permanent resident or citizen of the United States

- Valid Social Security Number

- A bank account, prepaid card, or debit card

How Does MoneyLion Work?

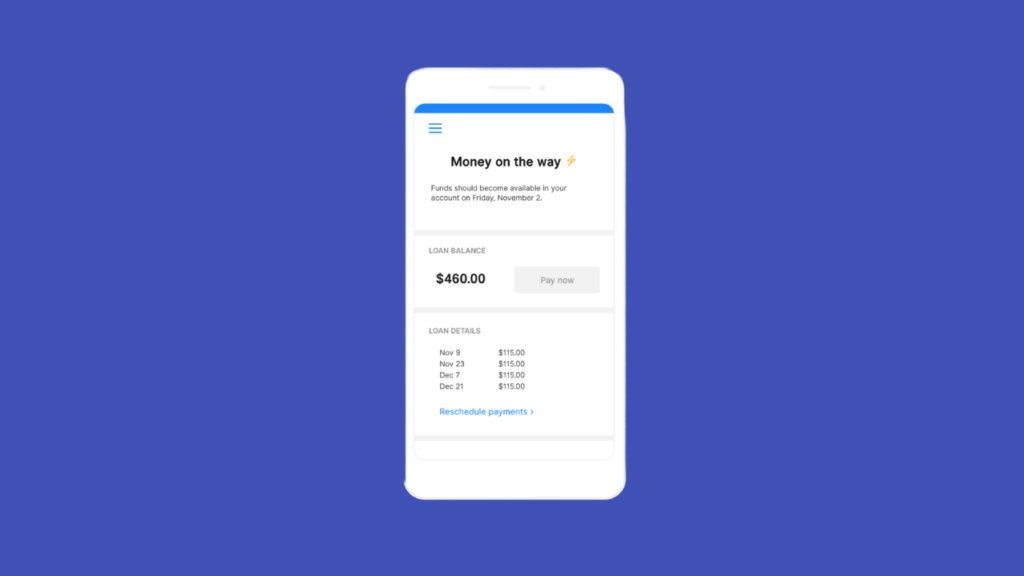

After you create an account with MoneyLion, you can choose its free services like Instacash advances or paid services like Credit Builder Plus which costs $!9.99 a month.

You can apply for its loan by giving your address, social security number, phone number, full name, and bank account. And once you’re approved, it’ll advance a portion of your loan into your bank account.

Although every Credit Builder plus loan has a 12-month repayment term, you can repay your loan sooner if you want.

And by using the ‘Monthly Repayment Calculator’, you can predict the possible cost of your loan and your monthly repayment.

Moreover, you can also change your payment due date and reschedule it by contacting MoneyLion.

Cash Advance: You can get cash advances of up to $250. And with recurring direct deposits, get paid up to two days early1 and unlock up to $1,000 0% APR cash advances.

Repaying Advance: Each Credit Builder Plus loan has a 12-month term and the payments are deducted from your bank account each month on your pay date.

And with the Credit Reserve Account, you can repay your loan sooner.

Fees: MoneyLion’s Credit Builder Plus charges $19.99 per month. And Credit Builder Plus loans have an annual percentage rate ranging from 5.99% APR to 29.99% APR.

The amount you can borrow and your APR is based on your previous loans, credit history, and finances.

Customer Support: You can contact MoneyLion’s customer support by calling them at 888-659-8244 or +1 (888) 704-6970 or visit here.

16 Best Apps Like MoneyLion to Manage Your Money [2022]

Albert

Next on our list of the apps like Empower, we have Albert. Albert is a new kind of fintech that uses powerful technology to automate your finances.

It offers better banking, saving, investing, and budgeting solution by giving you access to live human financial advisors through ‘Albert Genius’ who provide expert financial guidance.

These real financial advisors regularly work to review your bank fees, bills, unusual charges and send you alerts. And you can easily get paycheck up to e days early.

Similarly, you will be provided useful financial topics, everything including from managing to paying off debt. Albert boasts that it is offering you new ways to bank, save, and invest!

Features

- An improved banking, saving, investing, and budgeting solution

- Save, manage, and invest

- No late fees, no interest, no credit check.

- No mandatory minimum or maximum repayment timeframe

- Tracks your income and spending to find dollars you can save

- Uses cutting-edge security technology to protect your sensitive information

Eligibility Criteria:

- Be a U.S. resident or citizen

- Be 18 years old or older

- Hold a bank account with a U.S. financial institution

- A mobile phone that supports the Albert app

- Make a qualifying direct deposit

How Does Albert Work?

Once you create an account with Albert, you’ll need to connect your credit card, checking account, or any other financial account.

Then, you can access a lot of features, including Albert Genius, Albert Instant, Albert Savings, Albert Investments, Albert Planning, and various other tools and insights.

You can request for cash advance once you’re approved and since there is no compulsory mandatory period, you can repay whenever you want.

Moreover, through its Albert Savings feature, it analyses your income and spending habits to find additional money for automatic savings.

You also get to view your bills, income, and the remaining funds through the Albert app.

Cash Advance: The maximum cash advance you can access through Albert is up to $250.

Repaying Advance: There is no mandatory repayment timeframe. You can repay when you get your next paycheck or whenever you can afford it.

Fees: It doesn’t charge any interest or late fees.

Customer Support: If you need any help with Albert, you can email their customer service at [email protected].

Or send a text message at (639-37) to connect with someone who can help you. You can also easily connect with them within the app: Profile tab -> Help -> Contact Support.

7 Bank Apps like Albert to Smartly Manage Your Money [2022]

Possible

Lastly, we have Possible Finance. With Possible Finance, you can make small installment loans and even build your credit history to get better financial tools.

It states itself as an alternative to traditional payday loans, that are short-term, high-cost which are supposed to be repaid in the next payment.

You need to keep in mind that although it helps you build credit, it doesn’t perform any credit check, so people with no credit or bad credit history can easily borrow.

Moreover, if you have a Visa debit card, there is a possibility that you can get your loan funds on the same day you’re approved.

Features

- Improve your financial health

- Ability to change your payment dates & receive reminders notifications

- Build credit history

- Make payments or add a new payment method

Eligibility Criteria:

- Have an online checking account with a minimum monthly income of $750

- Your bank account information to check whether your checking account is compatible

- A driver's license or state-issued ID.

- Your Social Security Number

- Three months of transaction history

- Positive checking account balance

How Does Possible Work?

To get started with Possible, all you need to do is to download the app on your device and create an account. Once you’ve done that, you can easily access its loan.

However, to get approved, you’ll need to meet the requirements that are listed above and before applying for a loan, you might have to check if it works with your current bank or your credit union since it doesn’t work with all banks.

And within 24 hours, you’ll get a notification regarding the status of your application from Possible. If you are qualified, then you’ll have up to 3 days to accept your loan otherwise you’ll need to re-apply for a new loan.

Cash Advance: People with no credit history or bad credit can get up to $500, but the loans are available only in limited states.

Repaying Advance: You can be able to repay your loan in two-week intervals for eight weeks or two months, instead of asking for the full repayment on your next pay date.

Moreover, you can change your repayment date up to 29 days past your due date with no extra fees or interest charges, and it doesn’t affect your credit scores.

Fees: Possible Finance might charge a fee or a monthly fee along with some interest depending on the state you live.

Customer Support: You can email Possible’s customer support at [email protected] or call them at +1 (206) 202-5115. You can also visit here for more information.

Must Try these 12 Apps like Possible Finance for Instant Loans! [2022]

Final Words: Best Apps Like Empower!

So, if you need money urgently to cover an expense, these apps can be a great choice. However, it can be difficult for you to decide on a particular app as they all are amazing.

Nonetheless, before picking up any service, don’t forget to consider which service offers lower interest or no interest and has a quick & easy application process.

Most of them also help you stay on top of your bills and even avoid the overdraft or late fees. Hopefully, the above article has helped you to choose the best app like Empower that meets your requirements.

Try these 5 Apps Like Lenme to Borrow & Lend Money Easily! [2022]

Empower App Not Working? Try These Steps to Fix! [2022]

![6 Must-Try Apps Like Empower to Check out [2024]](https://viraltalky.com/wp-content/uploads/2022/02/Apps-Like-Empower-alternatives.jpg)